EURUSD declines sharply: Middle East tensions make investors nervous

EURUSD is testing a four-week low. Investors are shying away from risk as tensions escalate. Read more in our detailed EURUSD forecast for 2 October 2024.

EURUSD forecast: key trading points

- EURUSD declined sharply

- The US dollar is in demand as a safe-haven asset

- EURUSD forecast for 2 October 2024: 1.0982

Fundamental analysis

The EURUSD outlook remains bearish as the pair is approaching 1.1069 on Wednesday. The escalating conflict in the Middle East, with Iran joining the confrontation, has sent waves of concern through the markets. This news has increased demand for safe-haven assets like the US dollar, putting further pressure on the euro.

Additionally, US Treasury bond yields surged last night, fuelled by ISM manufacturing data, showing easing inflationary pressures. Meanwhile, Eurozone inflation dropped below 2%, contributing further to the euro's weakness.

Today's focus will remain on developments in the Middle East and fresh US labour market data for September. As these factors continue to weigh on market sentiment, the EURUSD forecast appears increasingly uncertain.

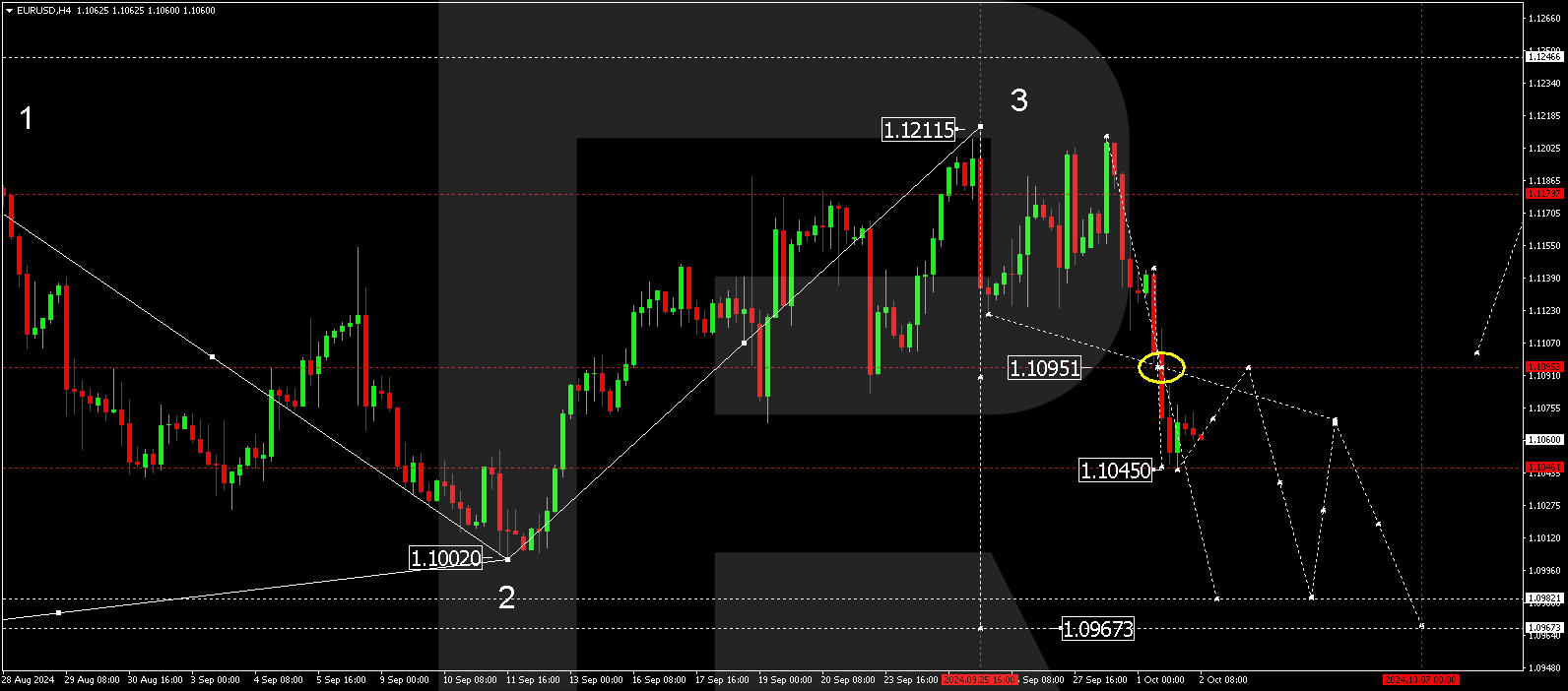

EURUSD technical analysis

On the H4 chart, the EURUSD rate has seen a strong downward impulse to the level of 1.1090. A consolidation range has formed around this level. A break below this range suggests the market could further develop a downside structure towards 1.0982. For today's EURUSD analysis on 2 October 2024, we anticipate the pair reaching this level. After a possible corrective move towards 1.1095, the downtrend may resume towards the next target at 1.0967.

Summary

The EURUSD pair has fallen to a four-week low as market sentiment turns risk-averse. Technical indicators for today's EURUSD forecast suggest considering the development of a downward wave towards 1.0982.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.