EURUSD undergoes a correction after US inflation data release

The EURUSD rate shows slight growth after rebounding from the EMA-200. Find out more in our analysis for 11 October 2024.

EURUSD forecast: key trading points

- The US Consumer Price Index decreased to 2.4%, coming in above the projected 2.3% and marking the lowest reading since February 2021

- US core inflation rose to 3.3%, exceeding market expectations of 3.2%

- US initial jobless claims unexpectedly increased to 258,000

- EURUSD forecast for 11 October 2024: 1.0944, 1.1025, and 1.1055

Fundamental analysis

Thursday’s data showed that US consumer inflation slowed less than expected in September. This raised concerns that the Federal Reserve may refrain from lowering interest rates at the upcoming meetings. Against this backdrop, the EURUSD rate began an upward correction. US consumer inflation eased to 2.4%, marking the lowest level since February 2021. However, the indicator exceeded the projected 2.3% and was only slightly down from 2.5% in August.

Conversely, core inflation, excluding food and energy, rose to 3.3% in September, exceeding analysts’ expectations. The market forecasted that core inflation would remain at 3.2%, but it has proved resilient for the third consecutive month.

Federal Reserve Bank of Atlanta President Raphael Bostic stated the Fed would consider keeping the current interest rate at its November meeting, depending on the economic situation. As part of today’s EURUSD forecast, maintaining the Federal Reserve’s current monetary policy may support a stronger US dollar. In addition, markets responded by slightly reducing the likelihood of a 25-basis-point rate cut to 84.7% from 86.7% the day before. This indicates moderate optimism about a future interest rate trajectory, which may heighten pressure on the euro in the short term.

Additionally, employment data caught traders’ attention, with initial jobless claims unexpectedly increasing to 258,000, marking a 14-month peak. The reading is 33,000 higher than last week and has significantly exceeded the projected 230,000. Investors are currently focusing on the upcoming release of the US Producer Price Index, which may help gain greater insight into the current price trends in the economy.

EURUSD technical analysis

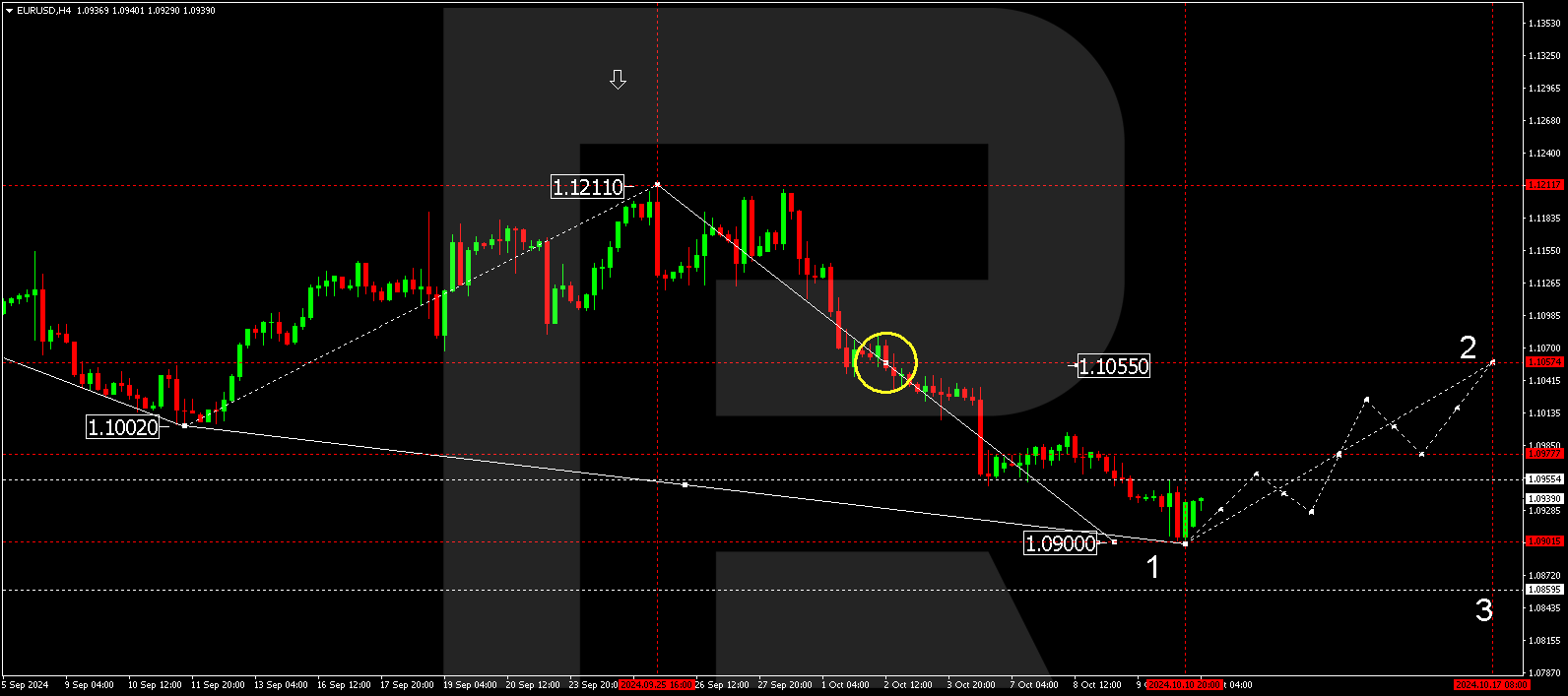

The EURUSD H4 chart shows that the market has completed a downward wave, reaching 1.0900. After receiving support at this level, the EURUSD rate underwent a correction of the entire downward wave. The first corrective wave is expected today, 11 October 2024, aiming for 1.0944. After hitting this level, the price could decline to 1.0921 (testing from above). The market is forming the boundaries of a new consolidation range around 1.0921. It is worth considering the possibility of a breakout above the range towards 1.1025, with the correction potentially continuing towards 1.1055.

Summary

The US inflation slowdown was less significant than expected, which increased the likelihood of the Fed maintaining the current monetary policy. This supports the US dollar’s position, although an upward correction in the EURUSD pair may continue in the short term. Technical indicators in today’s EURUSD forecast suggest a corrective wave towards the 1.0944, 1.1025, and 1.1055 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.