EURUSD under pressure: the Fed holds off on rate cuts

The EURUSD rate is poised for another test of the EMA-200. Find out more in our analysis for 14 October 2024.

EURUSD forecast: key trading points

- In August 2024, Germany recorded its lowest current account surplus of 14.4 billion EUR since May 2023

- The US Consumer Sentiment Index fell to 68.9 points in October, according to preliminary data

- Markets estimate an 86.8% likelihood of a 25-basis-point Federal Reserve interest cut in November

- EURUSD forecast for 14 October 2024: 1.0890 and 1.0850

Fundamental analysis

The EURUSD rate is falling after rebounding from the 1.0990 resistance level. The euro remains under pressure as markets expect the Federal Reserve to hold off on further substantial rate cuts this year. The odds of a 25-basis-point rate cut in November are estimated at 86.8%, while the likelihood of a more severe 50-basis-point cut is almost ruled out.

In August 2024, Germany recorded a current account surplus of 14.4 billion EUR, the lowest level since May 2023. For comparison, the revised surplus was 17.7 billion EUR in July. Analysts had expected it to be 19.9 billion EUR, with the surplus in the goods segment contracting most markedly. In today’s EURUSD forecast, such data may exert pressure on the euro.

The US Consumer Sentiment Index (according to a preliminary report by the University of Michigan) fell to 68.9 points in October from a five-month peak of 70.1 in September, while analysts had expected the index to rise to 71.9 points. The reading was 63.8 in October 2023. Consumers remain concerned about high prices.

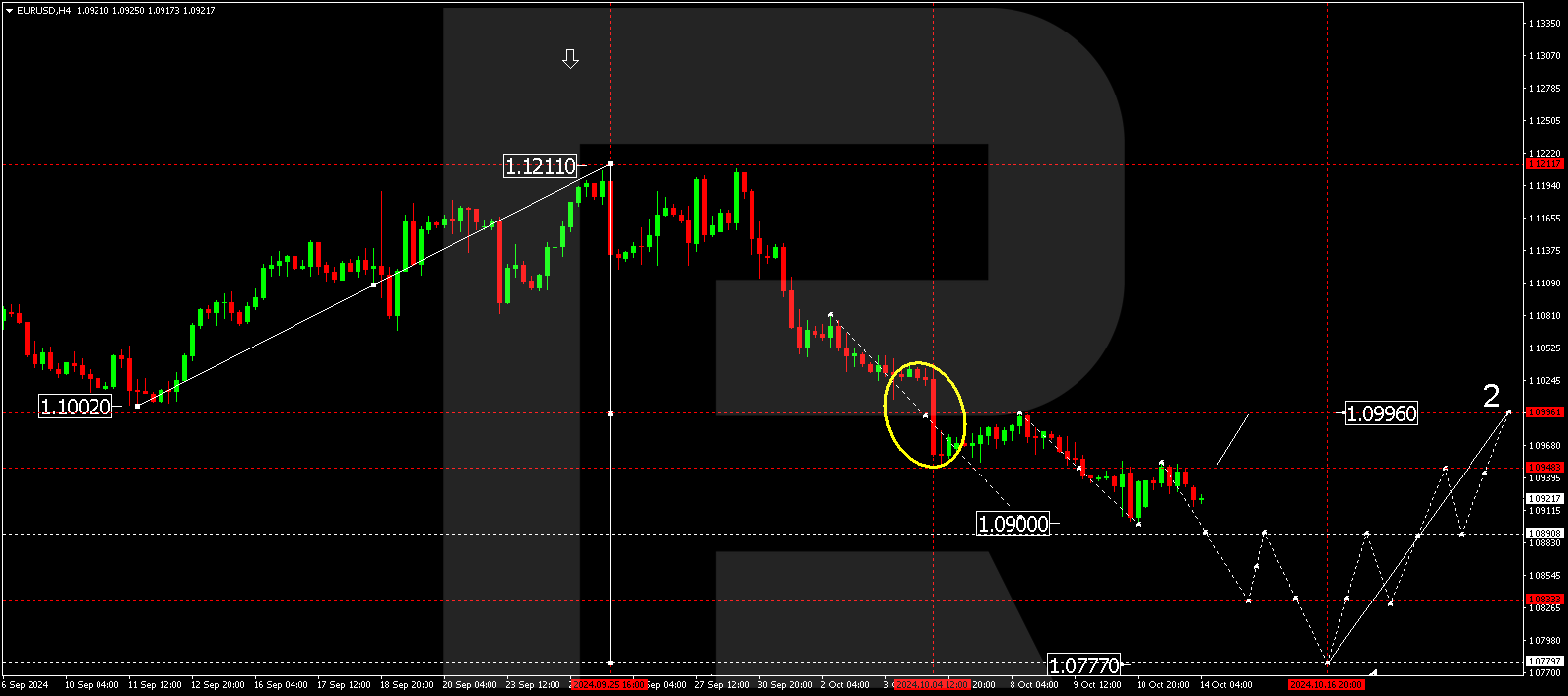

EURUSD technical analysis

The EURUSD H4 chart shows that the market has completed a growth wave, reaching 1.0953, and corrected towards 1.0926, forming the boundaries of a consolidation range around 1.0926. The market has broken below the 1.0926 level. The range could extend towards 1.0898 today, 14 October 2024. After reaching this level, the price might rise to 1.0926 (testing from below). A decline and a breakout below the 1.0890 level will open the potential for continuing the trend to 1.0850. Conversely, a rise and a breakout above the 1.0955 level could extend the correction towards 1.0995. Subsequently, the downward wave might continue towards 1.0850.

Summary

The EURUSD rate declines further amid expectations that the Federal Reserve will hold back from substantial interest rate cuts this year. Weak economic data from Germany provides additional support for the US dollar. Technical indicators in today’s EURUSD forecast suggest a potential decline to the 1.0890 and 1.0850 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.