EURUSD reached a new local low as demand for the US dollar strengthens

The EURUSD pair continues to decline as the market turns towards safe-haven assets. Find out more in our analysis for 23 October 2024.

EURUSD forecast: key trading points

- The EURUSD pair continues to fall

- The US dollar is in demand, driven by expectations of Federal Reserve decisions and the upcoming US election

- EURUSD forecast for 23 October 2024: 1.0777

Fundamental analysis

The EURUSD rate fell to 1.0804 on Wednesday, with the major currency pair hitting a nine-week low.

Expectations of a modest US Federal Reserve rate cut continue to bolster the US dollar. Additionally, the market is seeking safe-haven assets before the US presidential election.

The US dollar has risen in 15 of the last 17 sessions over the past three weeks. According to the CME FedWatch Tool, the Federal Reserve is 88.9% likely to lower interest rates by 25 basis points at its November meeting. The probability of the rate remaining unchanged is estimated at 11.1%. Strong US economic data allows the Fed to avoid a more aggressive rate cut.

The EURUSD forecast favours the US dollar.

EURUSD technical analysis

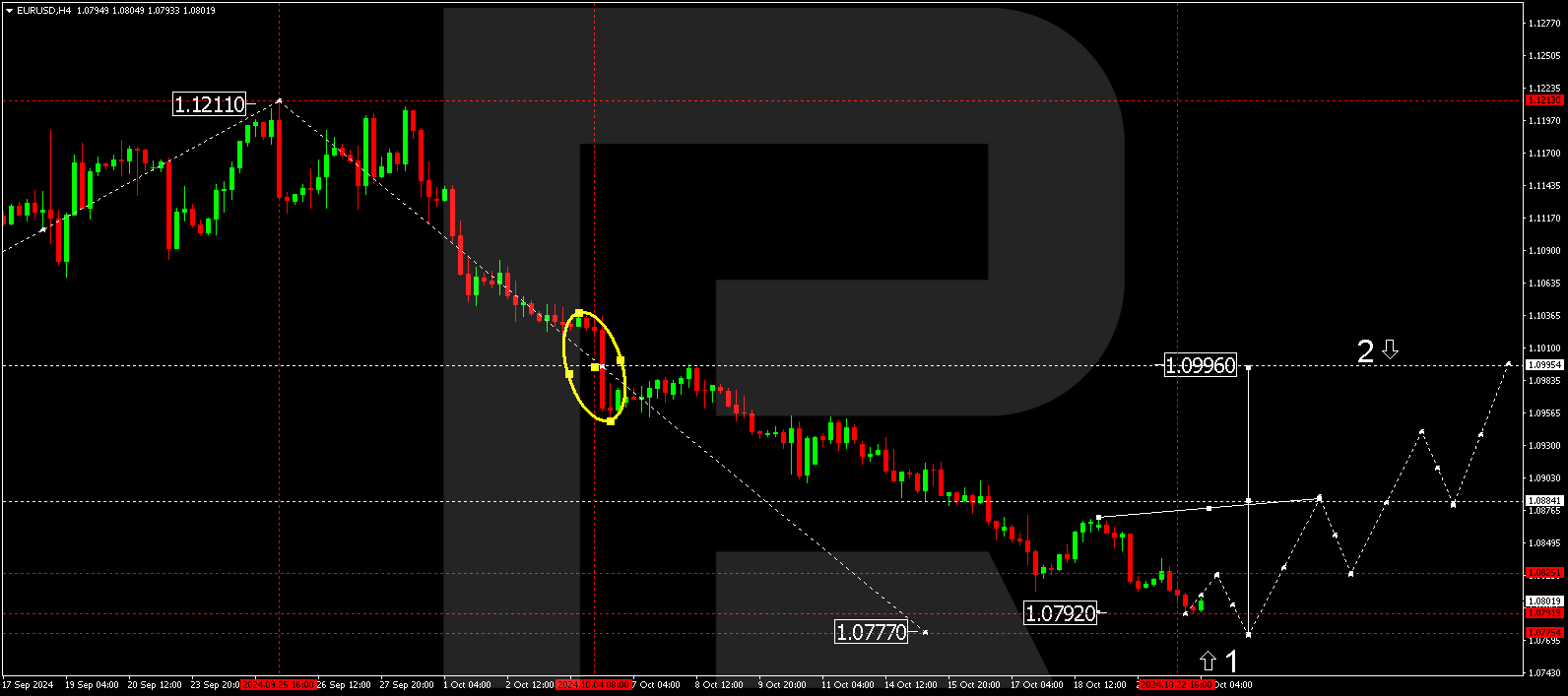

The EURUSD H4 chart shows that the market has completed a downward wave, reaching 1.0790. A correction towards 1.0825 (testing from below) could occur today, 23 October 2024. After the correction, the EURUSD rate is expected to decline to 1.0777, the first target. Subsequently, a more significant corrective structure could develop, aiming for 1.0996. The first target for this correction is expected to be at 1.0888.

Summary

The EURUSD pair has reached a 2.5-month low and remains under pressure. Technical indicators for today’s EURUSD forecast suggest that the downward wave could continue towards 1.0777.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.