EURUSD: the pair declines amid the US election

The EURUSD rate fell to 1.0700 due to the strengthening of the US dollar in anticipation of Trump’s victory. Find out more in our analysis for 6 November 2024.

EURUSD forecast: key trading points

- The euro declines against the US dollar amid the US presidential election

- The Eurogroup held a meeting in Brussels yesterday

- The Producer Price Index ( PPI) is scheduled for release today

- EURUSD forecast for 6 November 2024: 1.0680

Fundamental analysis

At yesterday’s meeting in Brussels, the Eurogroup agreed on a value-added tax (VAT) law package tailored for a digital economy. The package includes three proposals to fight VAT fraud, support businesses, and promote digitalisation. These measures are intended to improve the competitiveness of the EU economy.

Today, the euro is dropping sharply against the US dollar, influenced by the ongoing US presidential election. Donald Trump is confidently in the lead and is expected to become the 47th President of the United States. Trump’s anticipated victory is expected to support the US national currency rate.

EURUSD technical analysis

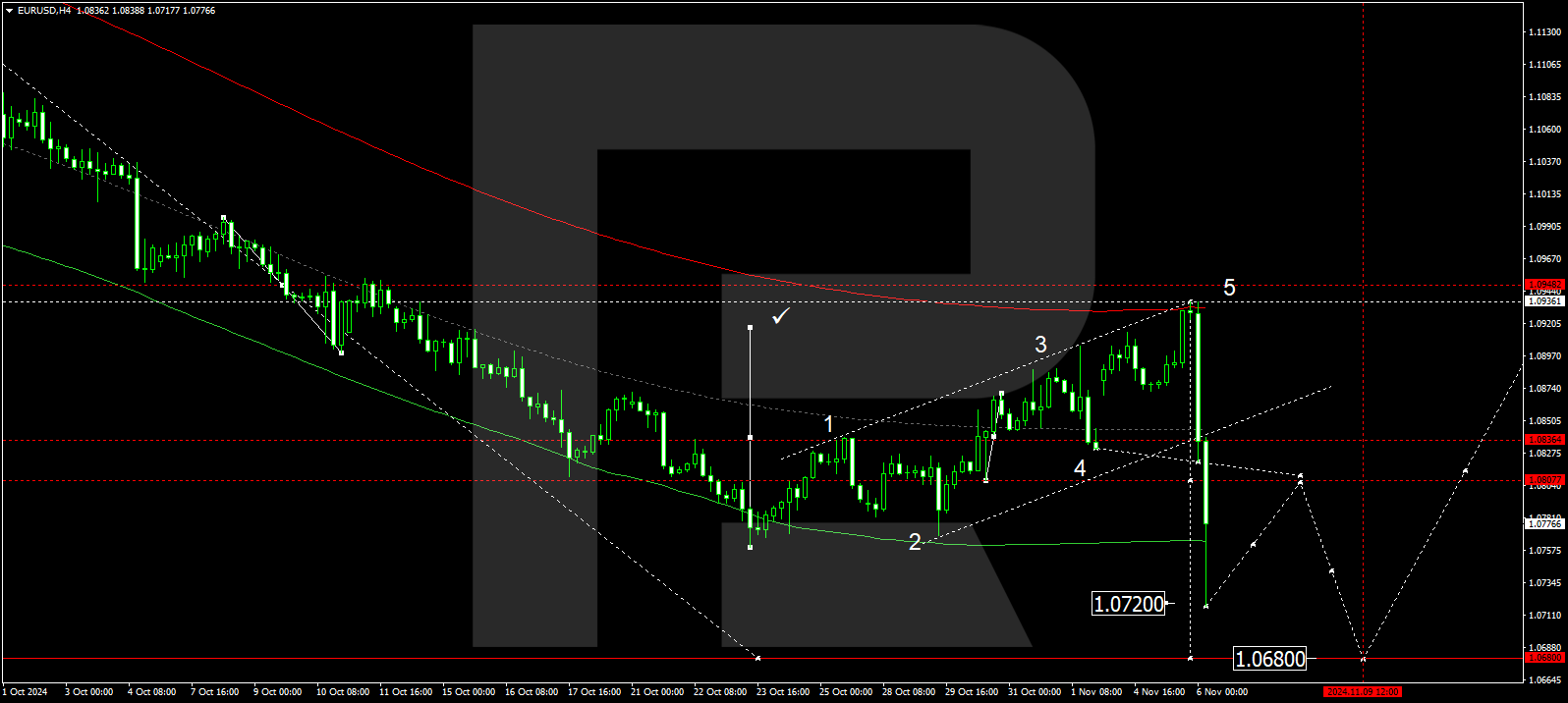

The EURUSD H4 chart shows that the market has reached the minimum target of the corrective wave at 1.0936 and has started to fall sharply in line with the trend. Today, 6 November 2024, the price broke below a corrective channel and declined to 1.0720. It may be relevant to consider the possibility of a fifth downward wave, initially targeting 1.0680. Once this level is reached, a new corrective structure is expected to develop, aiming for 1.0940.

The Elliott Wave structure and corrective matrix, centred at 1.0836, technically confirm this scenario. This level is a crucial pivot point for the EURUSD rate corrective wave. The market has rebounded downwards from the upper boundary of a price envelope and, in a sharp decline, has reached its lower boundary. The price could rebound to the envelope’s central line at 1.0880 today. Subsequently, a downward wave could begin, aiming for the lower boundary of the price envelope at 1.0680.

Summary

The EURUSD pair is declining as Trump maintains a strong lead in the US presidential election. Technical indicators for today’s EURUSD forecast suggest that the downward wave could continue towards the 1.0680 level.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.