EURUSD: the pair edges further down amid the US dollar’s growth

The euro remains under pressure after the US election. Find out more in our analysis for 11 November 2024.

EURUSD forecast: key trading points

- Today is a public holiday in the US – Veterans Day

- No crucial economic statistics are scheduled for today

- EURUSD forecast for 11 November 2024: 1.0680

Fundamental analysis

The euro continues to decline against the US dollar, bolstered by the recent US presidential election. Donald Trump’s confident victory positively impacted the US dollar, driving it higher against other currencies.

Last week, the Eurogroup held a meeting in Brussels, where it agreed on a value-added tax (VAT) law package tailored for the digital age. No crucial statistics are expected today due to the public holiday in the US.

In the absence of significant news from the eurozone and the US financial markets observing a day off, the pair’s gradual decline may continue.

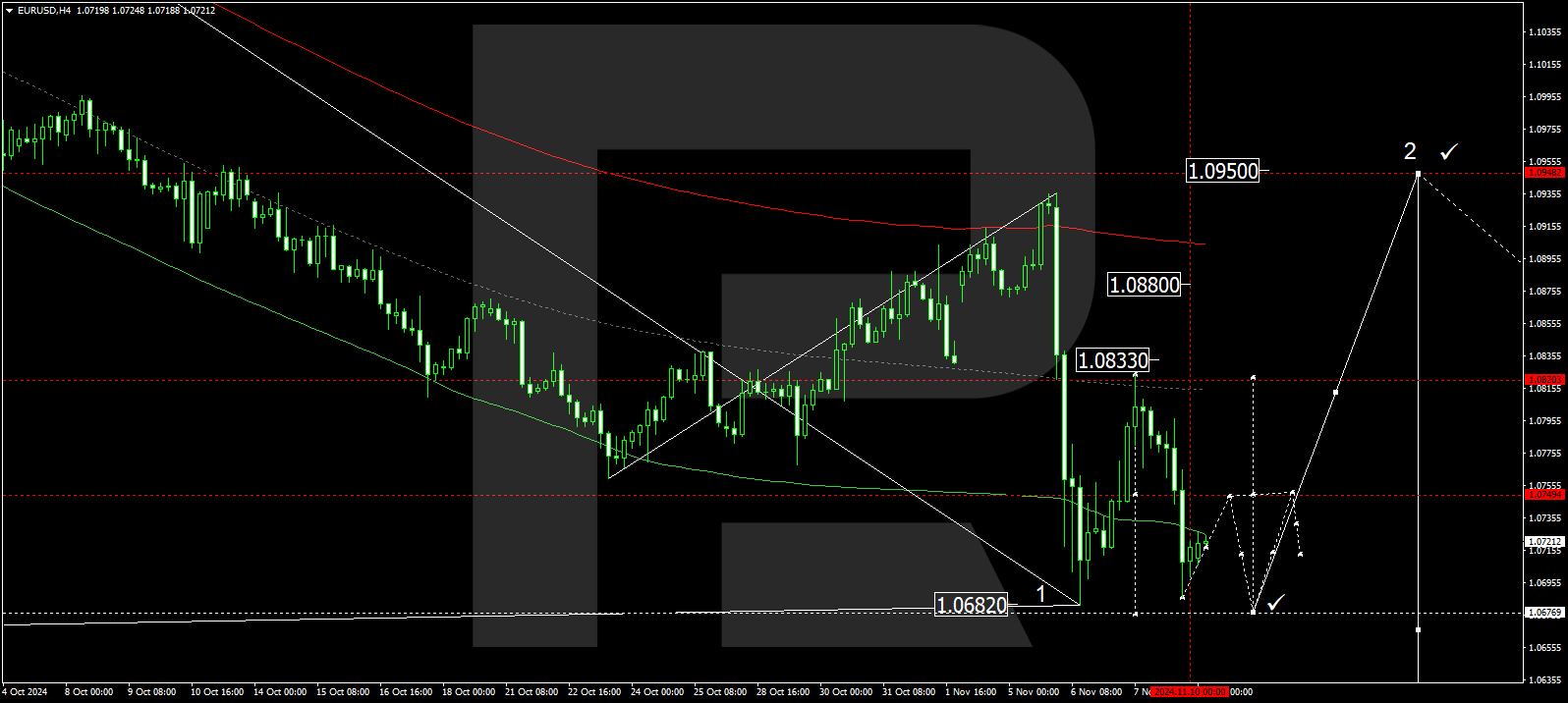

EURUSD technical analysis

The EURUSD H4 chart shows that the market followed a downward trend to 1.0750. A consolidation range has formed around this level, and with a downward breakout, the local target of the next downward wave, 1.0686, was reached. A correction towards 1.0727 has been completed today, 11 November 2024. Further decline towards the 1.0680 level is to be considered. A new growth wave could begin after the price reaches this level, aiming for 1.0950, with the first target at 1.0820.

The Elliott Wave structure and corrective matrix, with a pivot point at 1.0750, technically confirm this scenario. This level is considered crucial within the consolidation range for the EURUSD rate. The market has reached the lower boundary of a price envelope, and there is a possibility of extending the range to 1.0680. Subsequently, the price is expected to rise and expand the range towards 1.0820 before technically returning to the 1.0750 level (testing from above). The price could break above the range, aiming for 1.0880, with the potential for the growth wave to continue towards the upper boundary of the price envelope at 1.0950.

Summary

The euro remains under pressure following the US election. Technical indicators in today’s EURUSD forecast suggest that the downward wave could continue towards the 1.0680 level.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.