GBPUSD: the pair reversed upwards, securing above 1.2300

The GBPUSD rate has established a local low on the price chart and is rising within an upward correction this week. Find out more in our analysis for 22 January 2025.

GBPUSD forecast: key trading points

- UK wages rose by 5.6% year-on-year

- The unemployment rate increased to 4.4% between September and November 2024

- Current trend: an upward correction

- GBPUSD forecast for 22 January 2025: 1.2300 and 1.2500

Fundamental analysis

UK earnings statistics showed a 5.6% year-on-year rise between September and November 2024, marking the highest level in the past six months. This compares to a 5.2% increase in the previous period, with the private sector driving the largest wage gains.

Meanwhile, the unemployment rate rose to 4.4% during the same period, up from the previous 4.3%. Last week’s data also pointed to easing inflation and weaker-than-expected economic growth. Against this backdrop, market participants anticipate the Bank of England will reduce the key interest rate by 25 basis points to 4.5% at next month’s meeting.

GBPUSD technical analysis

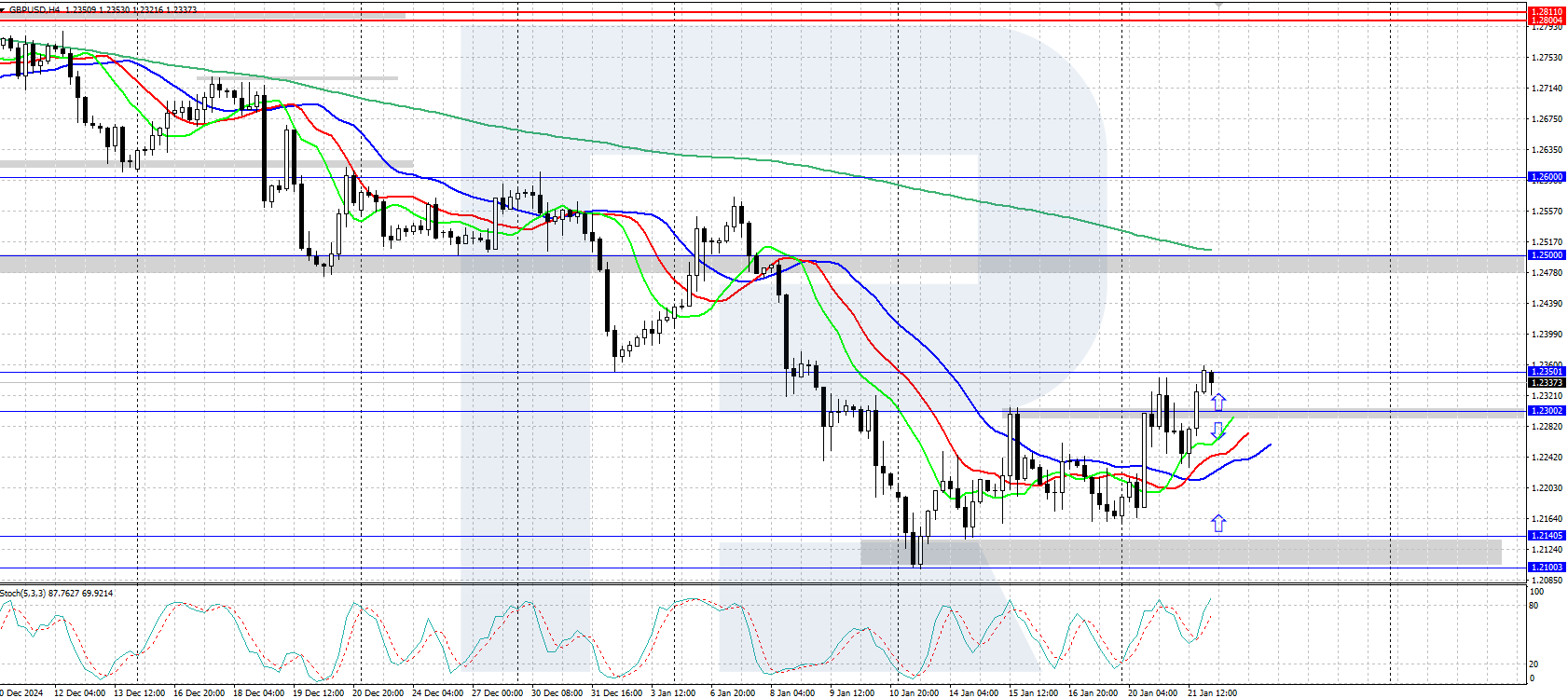

On the H4 chart, the GBPUSD pair is experiencing an upward correction after rebounding from the 1.2100-1.2140 support area, with the Alligator indicator pointing to growth. The daily trend remains downward, suggesting the price could continue to decline once the current correction is complete.

The short-term GBPUSD forecast suggests the pair could rise to the 1.2500 resistance level if the bulls hold the price above the 1.2300 support level. Conversely, a further decline is likely if the bears regain control below the 1.2300 level again, targeting the 1.2100-1.2140 support area.

Summary

The GBPUSD pair has risen above 1.2300 within the current upward correction. The bulls currently hold the initiative, and local growth will likely continue.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.