GBPUSD analysis: growth continues amid uncertain prospects

GBPUSD continues to grow, with the pound needing to break out of the sideways channel. Read more in our GBPUSD analysis and forecast for today, 30 September 2024.

GBPUSD forecast: key trading points

- GBPUSD is poised for further growth

- GBPUSD outlook remains subdued due to uncertainty surrounding the Bank of England’s next monetary moves

- GBPUSD forecast for 30 September 2024: 1.3455 and 1.3520

Fundamental analysis

GBPUSD is approaching 1.3380 on Monday.

The market believes the pound will remain subdued in the short term. The Bank of England is expected to cut the interest rate gradually. This will be especially noticeable compared to the ECB and Fed positions, although sentiment may change. Investor expectations are growing that the ECB may implement more significant rate cuts than the Bank of England. This divergence in monetary policy is a key factor shaping the GBPUSD outlook and may limit the potential for GBP gains. At the same time, it is worth considering that the BoE’s stance may be underestimated, and the rate cut might occur faster than average expectations.

The UK will see significant macroeconomic activity this week. On Monday, Q2 GDP estimates and Nationwide’s housing market report for September will be released. On Wednesday, the minutes from the Bank of England’s previous meeting are scheduled for publication, along with several speeches by monetary policymakers. On Thursday, the PMI report will offer further insights into the economic conditions influencing the GBPUSD forecast.

GBPUSD technical analysis

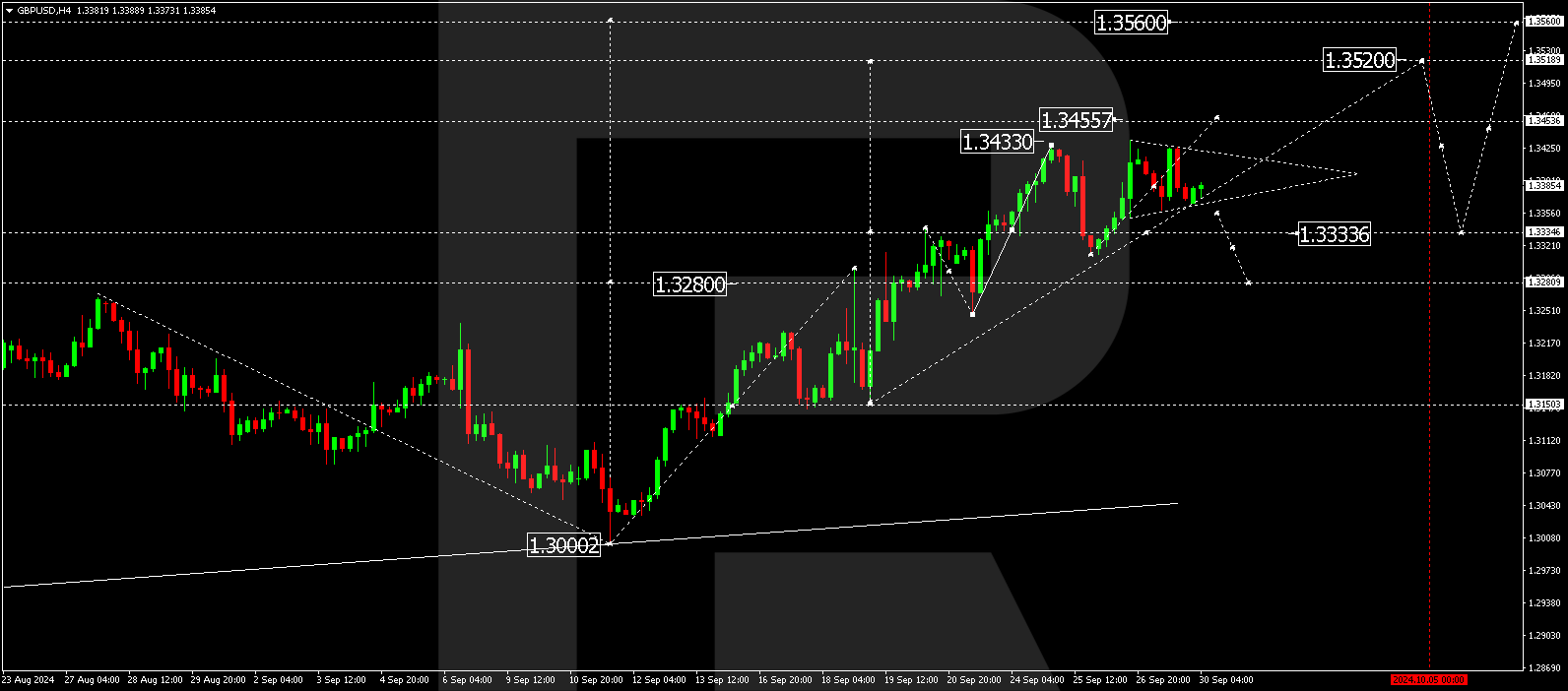

On the H4 chart, GBPUSD continues to develop its growth structure within the ascending channel. GBPUSD has found support near the channel’s lower boundary at 1.3366, and the pair is now moving towards 1.3455. Today’s GBPUSD forecast suggests that this level should be reached, followed by a decline to 1.3380 (at minimum). Further growth is expected, targeting 1.3520. This is a local target. After reaching this level, there is potential for a corrective move to 1.3333 (test from above). Subsequently, a further growth wave towards 1.3560 is possible.

Summary

GBPUSD is in an upward trend, though the rise is expected to be cautious. Technical indicators for today’s GBPUSD forecast suggest considering the likelihood of growth towards 1.3455 and 1.3520.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.