NZDUSD: expectations of an RBNZ rate cut are rising

The NZDUSD rate has gained a foothold above the support level. Discover more in our analysis for 18 October 2024.

NZDUSD forecast: key trading points

- Inflation in New Zealand eased to 2.2%, the lowest level over the past three years

- The CPI increased by 0.6%, returning to the Reserve Bank of New Zealand’s target range

- Expectations of a 50-basis-point RBNZ rate cut have increased

- NZDUSD forecast for 18 October 2024: 0.6025 and 0.5984

Fundamental analysis

The NZDUSD rate has risen for the second consecutive day, rebounding from the 0.6050 support level. The optimistic report on inflation, which returned to the Reserve Bank of New Zealand’s target range for the first time in three years, has raised expectations of further rate cuts. Traders believe the regulator will lower the interest rate once more by 50 basis points in November.

The data showed that the Consumer Price Index in New Zealand rose by 0.6% in three months, pushing annual inflation from 3.3% to 2.2%, the lowest level since March 2021. Rising housing, food, and medical services prices were the main factors behind this result. Analysts note that while prices in New Zealand continue to rise, their growth rate is slowing.

Positive US economic data has also pressured the NZDUSD rate, reinforcing expectations of a moderate reduction in the Federal Reserve rate. Within today’s NZDUSD forecast, this may trigger a breach of the 0.6050 support level.

NZDUSD technical analysis

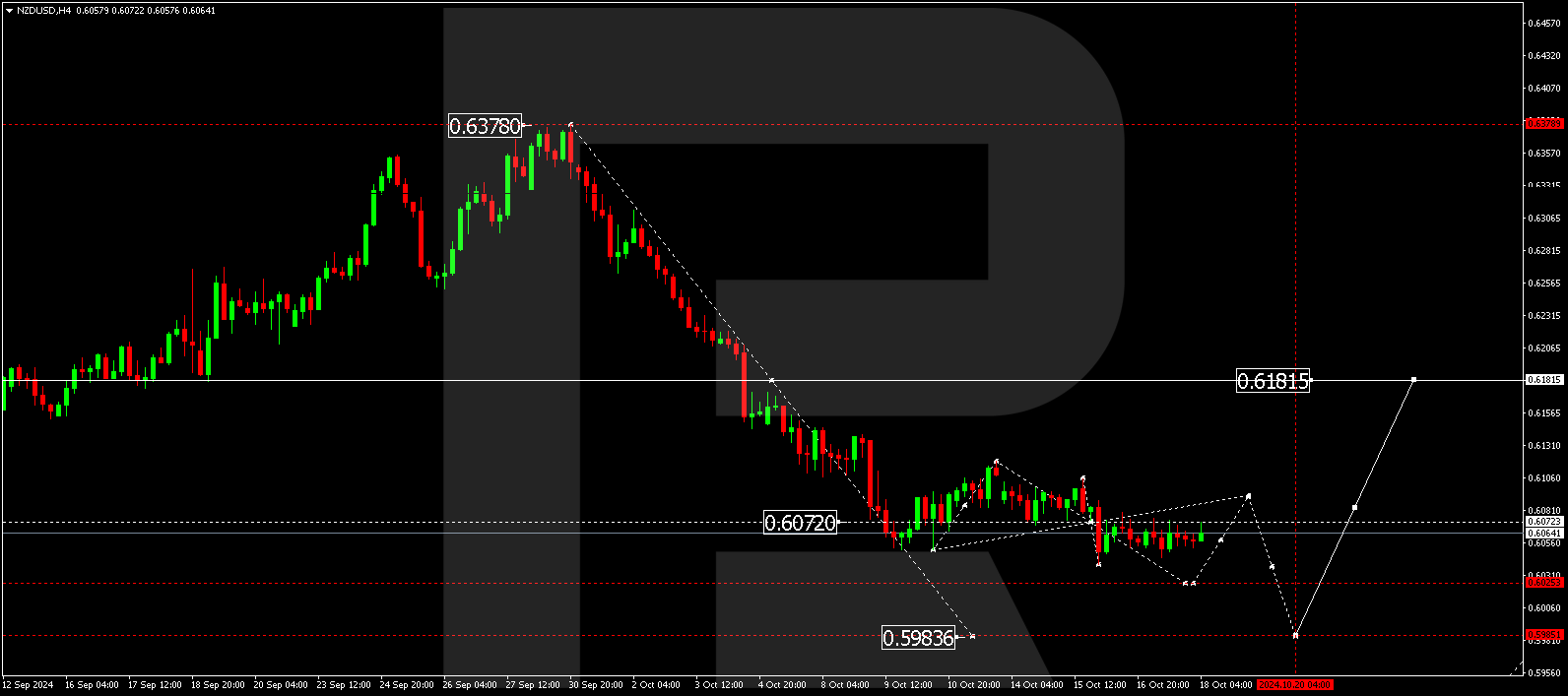

The NZDUSD H4 chart shows that the market is forming a consolidation range around 0.6072, which could extend to 0.6025 today, 18 October 2024. After reaching this level, the NZDUSD rate might rise to 0.6072 (testing from below). Subsequently, a downward wave is expected to develop, aiming for 0.5984 as the first target.

Summary

The NZDUSD rate continues to rise, bolstered by New Zealand’s optimistic inflation report. However, positive US economic data may pressure the New Zealand dollar’s rate, leading to a breach of the 0.6050 support level. Technical indicators in today’s NZDUSD forecast suggest that the wave could continue towards the 0.6025 and 0.5984 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.