USDJPY: uncertainty surrounding BoJ policy supports the US dollar

The USDJPY rate is rising, and buyers are poised to test the 157.85 resistance level. Find out more in our analysis for 24 December 2024.

USDJPY forecast: key trading points

- There remains a risk of Japanese authorities intervening in the currency market to support the yen in case of its further weakening

- Traders are uncertain about the timing and scale of a BoJ interest rate hike despite inflation growth

- The market expects fewer Federal Reserve rate cuts next year, which bolsters the US dollar

- USDJPY forecast for 24 December 2024: 157.85 and 158.85

Fundamental analysis

The USDJPY rate is correcting but remains above the key support level at 156.80. Traders note the risks of intervention by the Japanese authorities if the yen continues to decline. The US dollar is currently supported by uncertainty surrounding the Bank of Japan’s decisions on interest rate hikes and expectations of fewer Federal Reserve rate cuts next year.

The yen failed to strengthen despite strong inflation data. Japan’s consumer prices rose by 2.9% year-on-year in November (the most significant increase since August) from 2.3% in October. Prices excluding fresh food, a crucial gauge for the Bank of Japan, increased by 2.4%, the highest level in seven months. This indicator has been at or slightly above the Bank of Japan’s 2.0% target for over two and a half years.

USDJPY technical analysis

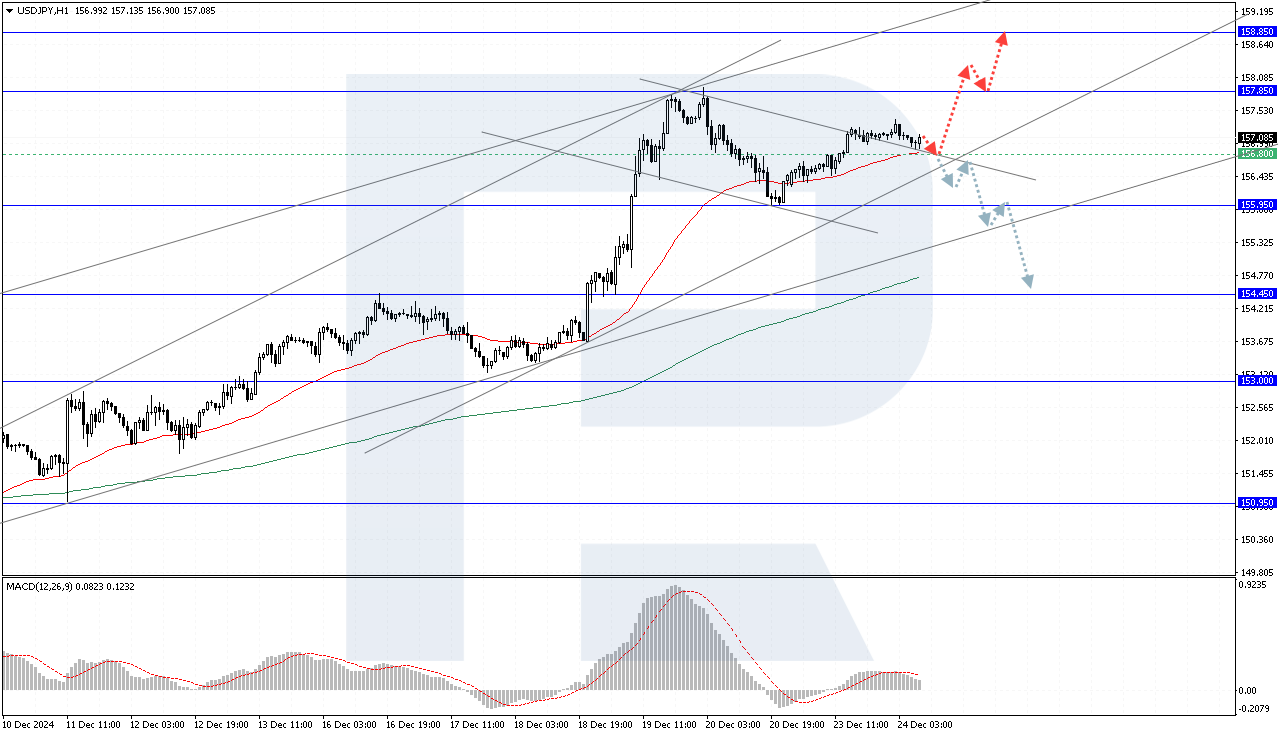

The USDJPY quotes gained a foothold above the upper boundary of a descending channel and rebounded upwards, indicating growing buyer pressure. According to today’s USDJPY forecast, there is still potential for upward movement towards the 157.85 resistance level. A breakout above this level will open the way for the next target at 158.85. The bearish scenario will be realised if the price establishes itself below the lower boundary of the ascending channel, with the decline target at the 155.95 and 154.45 levels.

Summary

Rising inflation in Japan did not help the yen strengthen as traders continued to doubt the timeliness of a Bank of Japan interest rate hike. However, there remains a risk of intervention by the Japanese authorities if the yen falls further. The USDJPY technical analysis indicates that buyers hold the advantage, and a breakout above the 157.85 resistance level will open the way for further growth towards 158.85. If the quotes fall below the lower boundary of the ascending channel, they could retreat to the 155.95 and 154.45 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.