USDCAD: the US dollar continues to strengthen

The US consumer price index at last year’s level and the rest of the fundamental data package may further drive the USDCAD pair. Discover more in our analysis for 11 September 2024.

USDCAD forecast: key trading points

- The Thomson Reuters/Ipsos primary consumer sentiment index in Canada (PCSI): previously at 50.06

- The US consumer price index (m/m) for August: previously at 0.2%, projected at 0.2%

- The US consumer price index (y/y) for August: previously at 2.9%, projected at 2.5%

- USDCAD forecast for 11 September 2024: 1.3700

Fundamental analysis

The primary consumer sentiment index is calculated by Thomson Reuters/Ipsos and measures consumer sentiment based on a target group survey. The index increased to 50.06 last month, indicating positive consumer sentiment. The forecast for 11 September 2024 may be disappointing for the Canadian dollar, with the USDCAD rate continuing its ascent after a correction.

The expected fundamental news for the USDCAD pair may be called neutral. According to analytical forecasts, almost all data may be released in line with expectations or with minor deviations.

There is a package of US news, including year-over-year and month-over-month consumer price indices for August. They reflect changes in consumer goods and services prices and are key indicators for the direction of purchases and US inflation. Readings below the forecast are considered negative for the US dollar, while those above are considered positive.

The forecast suggests that the CPI index may remain flat at 0.2% month-over-month and slightly decrease to 2.5% year-over-year. Expectations that the estimates will align with actual data are so far low. An increase in indicators may further boost the USDCAD pair.

Despite the news, the USDCAD forecast for 11 September 2024 appears positive for the US dollar as it may strengthen its position against the Canadian dollar. Actual data aligning with the forecast may also drive growth in the pair.

USDCAD technical analysis

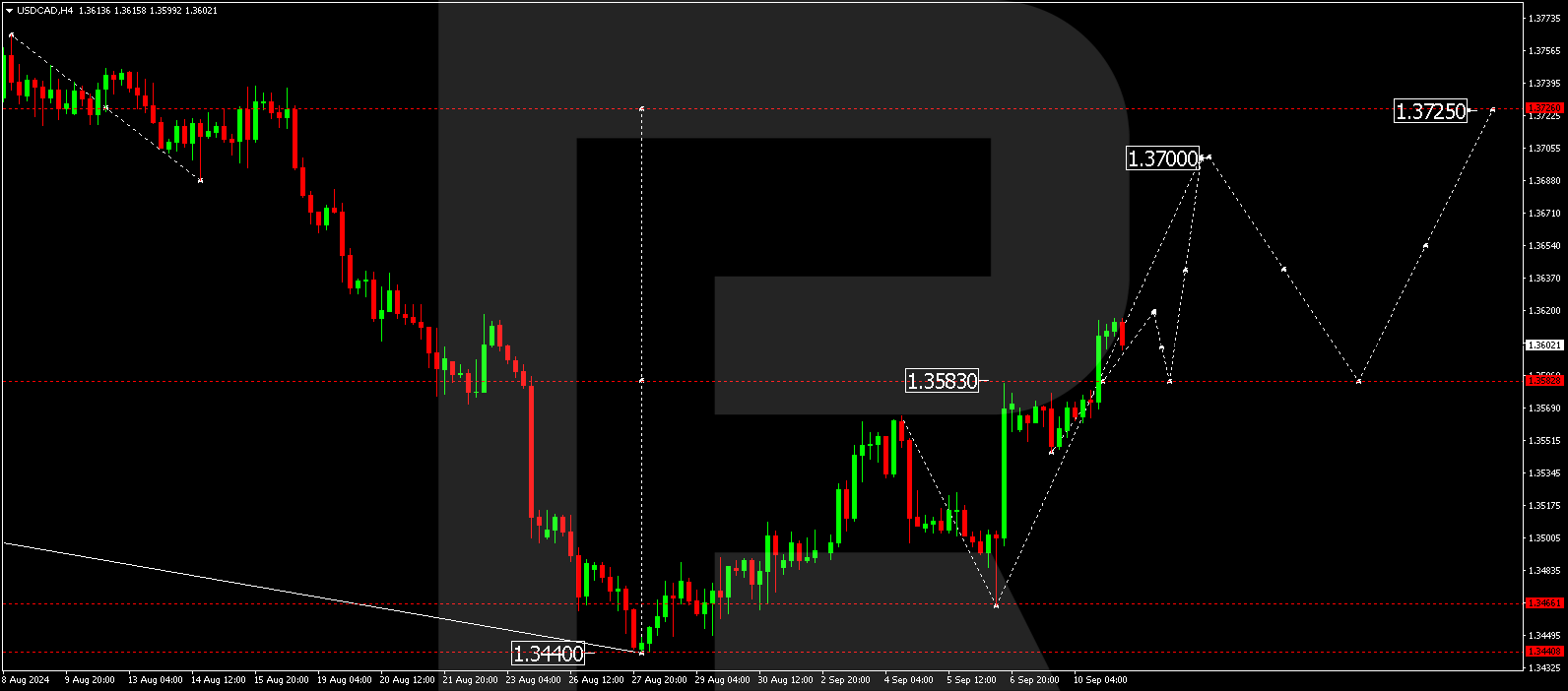

The USDCAD H4 chart shows that the market has broken above the 1.3583 level, signalling an upward movement to the local target of 1.3700. The price is expected to rise to 1.3619 today, 11 September 2024. Subsequently, it could decline to 1.3580 (testing from above) before rising to 1.3700. A corrective wave is forming. After reaching this level, the price might fall to 1.3600. Following this, a new growth wave could start, aiming for 1.3725 as the main target.

Summary

Fundamental and technical analyses in today’s USDCAD forecast suggest that a growth wave could expand to 1.3700.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.