USDCAD analysis: chances of US dollar strengthening are gradually decreasing

Employment growth and changes in US crude oil inventories may significantly impact the USDCAD price. Read details in our USDCAD forecast for today, 2 October 2024.

USDCAD forecast: key trading points

- ADP change in US nonfarm employment: previous reading 99,000; forecast 124,000

- US Federal Open Market Committee (FOMC) member Michelle Bowman’s speech

- US crude oil inventories: the previous reading showed a decrease of 4,471 million barrels; the forecasted reduction is an additional 1,500 million barrels

- USDCAD forecast for 2 October 2024: 1.3490 and 1.3311

Fundamental analysis

The ADP Nonfarm Payrolls report is based on data from more than 400,000 companies. It provides an estimate of nonfarm employment in the US and is published two days before the release of national employment statistics. The forecast for 2 October 2024 assumes an increase in employment to 124,000, up from 99,000 in the previous period. Employment growth may positively affect the USDCAD rate and could signal the strengthening of the US dollar.

Michelle Bowman, a member of the US Federal Open Market Committee (FOMC) and the Fed’s Board of Governors, is expected to deliver a speech that may provide insights into future US monetary policy.

Today, on 2 October 2024, data on US crude oil inventories will be released. Fundamental analysis for 2 October 2024 shows that the indicator may change from the previous value to -1,500 million, which would favour the US dollar. However, at this stage, it is only a forecast; the actual value, based on the previous data, may differ significantly from the expected values and could impact the dollar, potentially leading to a correction in the USDCAD rate and strengthening it against the Canadian dollar, triggering further growth of the pair.

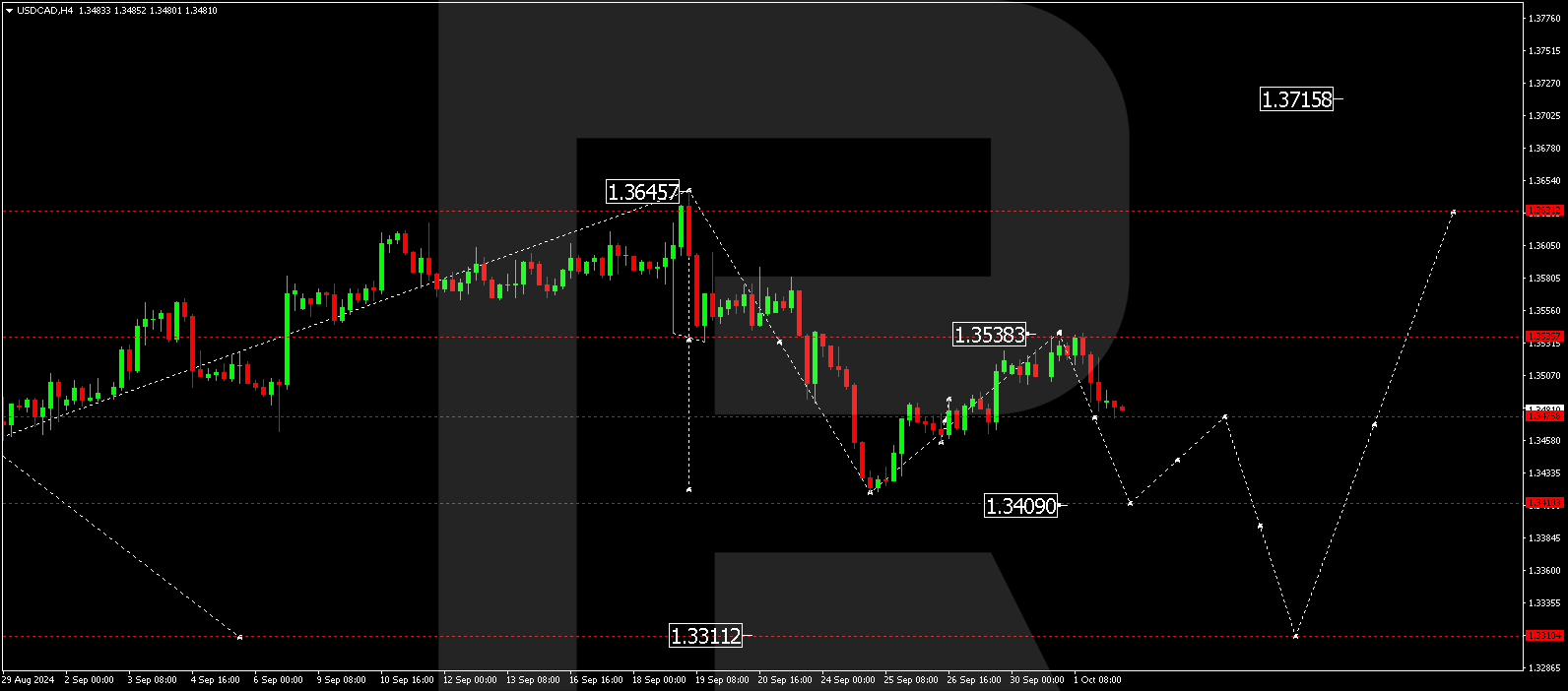

USDCAD technical analysis

On the H4 chart of the USDCAD currency pair, the market experienced a downward impulse to 1.3419, followed by a correction to 1.3538. Today, on 2 October 2024, we anticipate a decline to 1.3470. After reaching this level, the market may enter a narrow consolidation range. A break below this range could signal an extension of the downward movement towards 1.3409, which may serve as a critical signal for USDCAD traders. A further breakdown could lead to a continuation of the downtrend to 1.3311.

Summary

While the fundamentals may support the US dollar, the technical analysis for today’s USDCAD forecast suggests a possible downward movement towards 1.3490 and 1.3311. Traders should monitor critical data releases and market signals for clearer guidance on the pair’s next move.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.