USDCHF declines: the US dollar is in a disadvantageous position

The USDCHF pair continues to fall, with the Swiss franc benefiting from the weakness of the US dollar. Find out more in our analysis for 17 September 2024.

USDCHF forecast: key trading points

- The USDCHF pair is still going down

- The US dollar falls amid concerns about the Federal Reserve's decision

- USDCHF forecast for 17 September 2024: 0.8460, 0.8490, and 0.8550

Fundamental analysis

The USDCHF rate dropped to 0.8445 on Tuesday.

The US dollar’s decline comes as the Federal Reserve meeting approaches. It starts today and closes on Wednesday evening with an interest rate decision and comments from the regulator. The baseline scenario suggests that the Fed could decide to lower interest rates by 50 basis points at once.

The likelihood of such a decisive move exerts pressure on the USD position, allowing other currencies, including the CHF, to rise.

While the currency market volatility will be low on Tuesday, it will increase significantly on Wednesday evening. The USDCHF forecast expects the current movement to remain in force.

USDCHF technical analysis

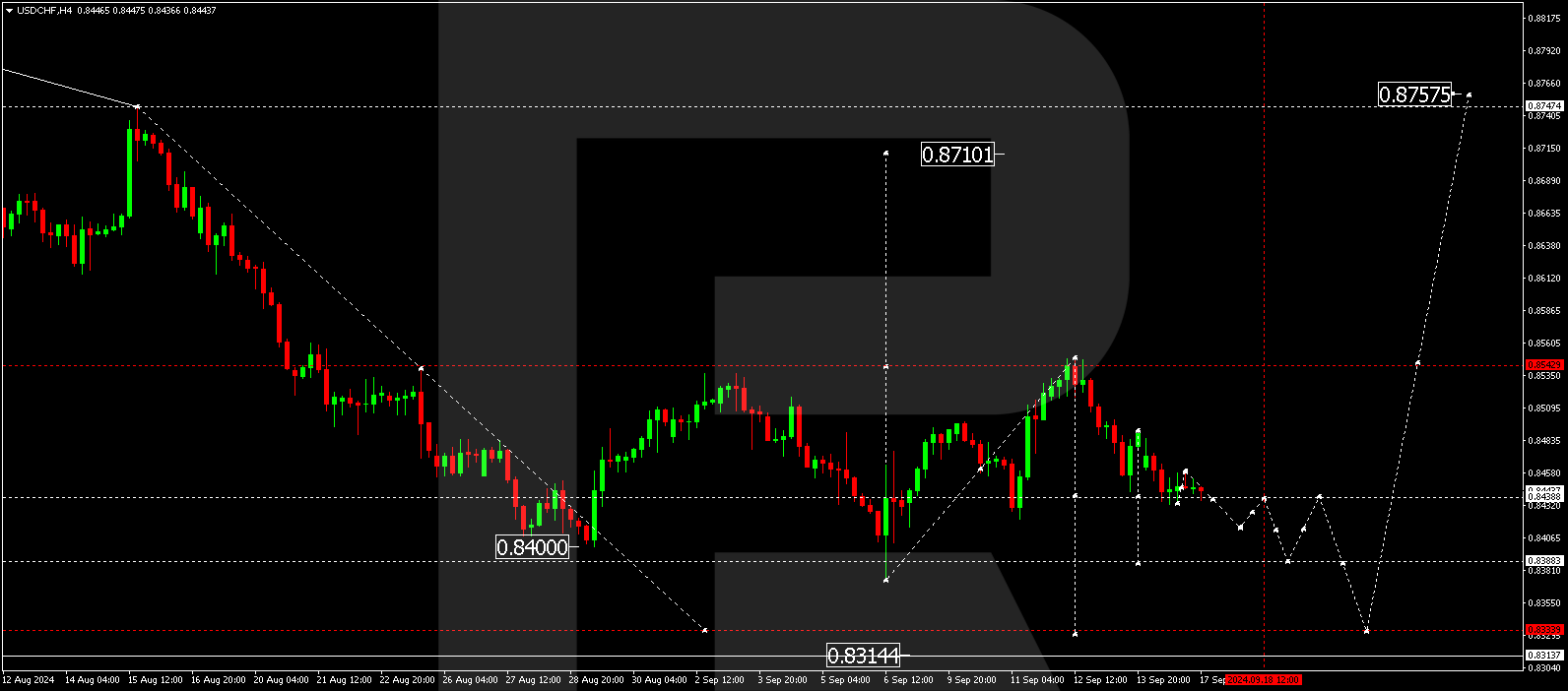

The USDCHF H4 chart shows that the market has completed a growth wave, reaching 0.8549. A corrective structure has fully formed today, 17 September 2024, aiming for 0.8434. A consolidation range is currently developing above this level. Breaking above the 0.8460 level will open the potential for a growth wave towards 0.8550 and potentially further towards the local target of 0.8710. A breakout of the 0.8460 level may be considered a signal for a new growth wave. Alternatively, the price could break below the range, aiming for 0.8388 and potentially extending the wave towards 0.8333. Once the price reaches this level, a new growth wave might begin, targeting 0.8757, the uptrend’s first target.

Summary

The USDCHF pair remains under pressure until the end of the US Federal Reserve meeting. Technical indicators in today’s USDCHF forecast suggest that the downward wave could stop at current levels. It will be relevant to consider growth to the 0.8460, 0.8490, and 0.8550 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.