USDCHF declines: a correction is necessary

The USDCHF pair is declining; the market requires a correction. Find out more in our analysis for 29 October 2024.

USDCHF forecast: key trading points

- The USDCHF pair is undergoing a correction

- The market is focused on the upcoming US presidential election

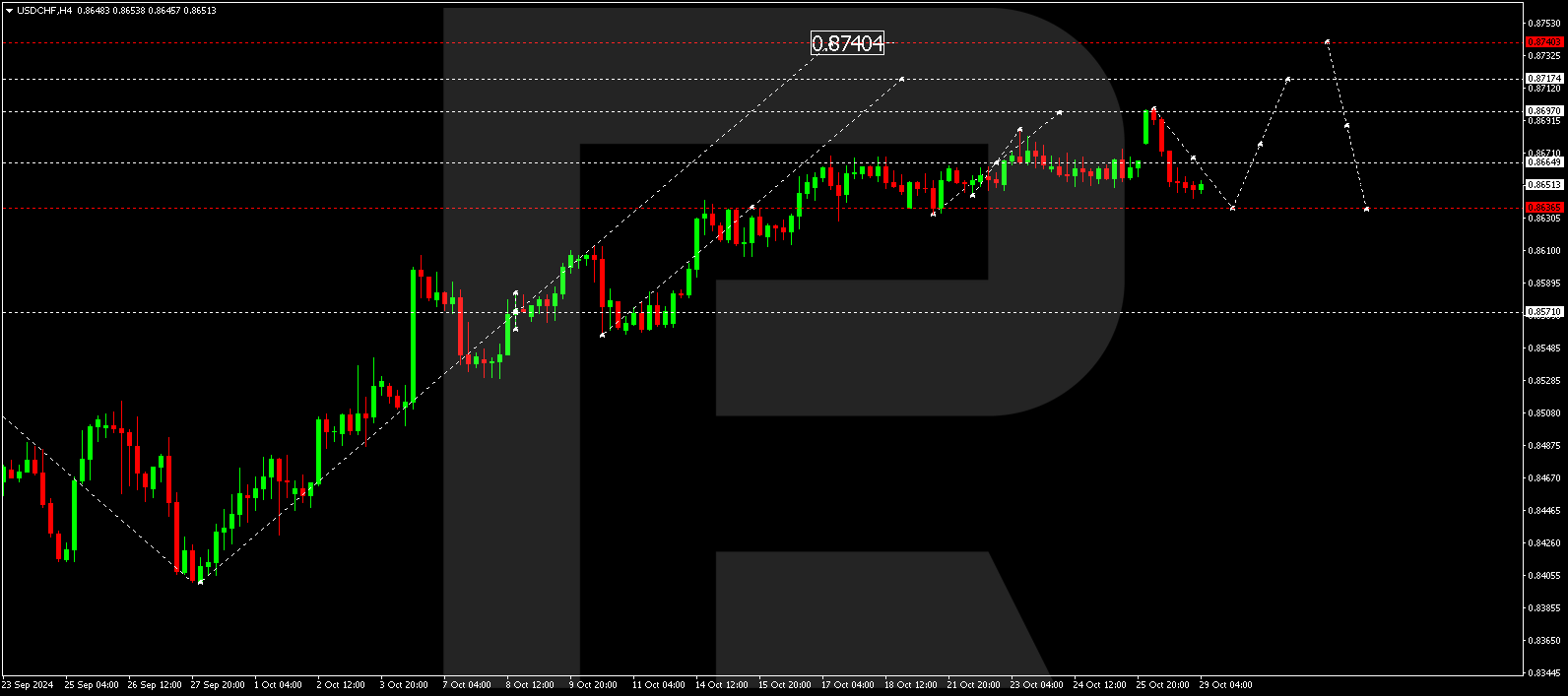

- USDCHF forecast for 29 October 2024: 0.8636 and 0.8740

Fundamental analysis

The USDCHF rate fell to 0.8649 on Tuesday.

Overall, the news cycle centres on the upcoming US presidential election. The question of who will ultimately control Congress is critical for the outcome of the US election. Following Donald Trump’s victory in 2016, the S&P 500 index surged by 31% by January 2018, while the US dollar dropped by 13%. This was mainly due to pressure from the trade dispute with China.

Current market sentiment suggests concern about a similar scenario for the USD this time. However, this could be a positive development for the stock market, especially if Republicans address the budget issue.

The USDCHF forecast does not rule out consolidation at this time.

USDCHF technical analysis

The USDCHF H4 chart shows that the market has formed a growth wave structure towards 0.8697. A correction is expected to develop, aiming for 0.8636 today, 29 October 2024. After reaching this level, the price could rise to 0.8717, potentially extending the growth wave to 0.8740. Subsequently, the USDCHF rate might enter a deeper correction towards the 0.8570 level (testing from above), with the first correction target at 0.8636. The market is forming a broad consolidation range around 0.8570.

Summary

The USDCHF pair is poised for a correction after previous steady gains. Technical indicators in today’s USDCHF forecast suggest a potential correction towards 0.8636, with the growth wave continuing to 0.8740.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.