USDJPY: the yen continues to maintain pressure on the US dollar

A decrease in the US trade balance and the JOLTS job openings data may negatively impact the US dollar and strengthen the yen. Find out more in our analysis for 4 September 2024.

USDJPY forecast: key trading points

- Japan’s services PMI: previously at 53.7, currently at 53.7

- US trade balance: previously at -73.10 billion USD, projected at -78.80 billion USD

- JOLTS job openings in the US employment market: previously at 8.184 million, projected at 8.090 million

- USDJPY forecast for 4 September 2024: 144.11

Fundamental analysis

Japan’s services PMI – the survey covers various industries, including transport and communications, financial intermediation, business and domestic services, information technology, and hotel and restaurant businesses. The responses are recorded based on the size of the company completing the questionnaire and its contribution to the overall output in the corresponding subsector of the services sector. Therefore, the opinions of large companies have a more significant influence on the final index readings than those of small businesses. The results are presented through key questions, showing the percentage of respondents who reported improvement, deterioration, or no change compared to the previous month. A reading above 50.0 points indicates that there have been no changes during the current period compared to the last month. A reading above 50.0 points has a positive impact on the yen. Analysis for 4 September 2024 shows that this month’s current reading remained flat at 53.7, indicating no changes in this economic sector, which may be an additional factor in revising interest rates.

The balance of trade shows the difference between the value of a country’s exports and imports. A trade surplus indicates that the country exports more than imports, while a negative trade balance means the opposite. The forecast for 4 September 2024 suggests a decrease in the trade balance compared to the previous period: previously at -73.10 billion, forecasted at -78.80 billion, indicating that the country continues to curtail exports.

JOLTS job openings in the US employment market have been gradually decreasing since 2022, and the current forecast also suggests a decline to 8.090 million. A decrease in job openings may negatively affect the US dollar.

USDJPY technical analysis

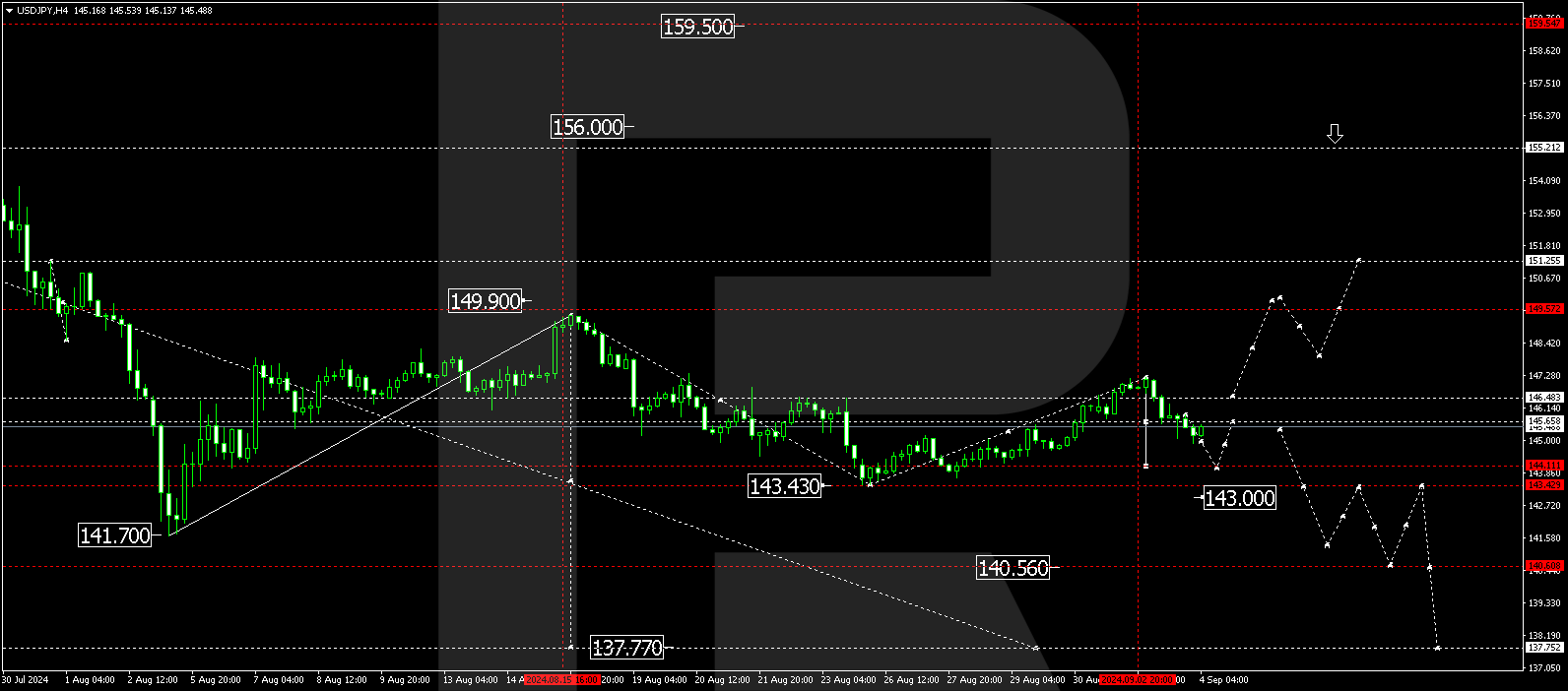

The USDJPY H4 chart shows that the market has failed to secure a position above the 146.46 level. A consolidation range is currently forming around 145.65. The price could decline to 144.11 today, 4 September 2024. A breakout below this level may signal a continuation of the trend towards the 143.00 and 140.50 levels. A breakout above the range will open the potential for a further correction in the USDJPY rate towards 149.50. Once the correction is complete, a new downward wave could start, aiming for 137.77.

Summary

Japan’s economic stabilisation, a decrease in US fundamental indicators, and the USDJPY technical analysis suggest a potential decline in the USDJPY pair to 144.11.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.