USDJPY at annual lows: this is not the end yet

The USDJPY pair continues to fall. The Japanese yen has risen to new highs. Find out more in our analysis for 13 September 2024.

USDJPY forecast: key trading points

- The USDJPY pair declines rapidly

- The yen receives support from the Bank of Japan’s hawkish statements

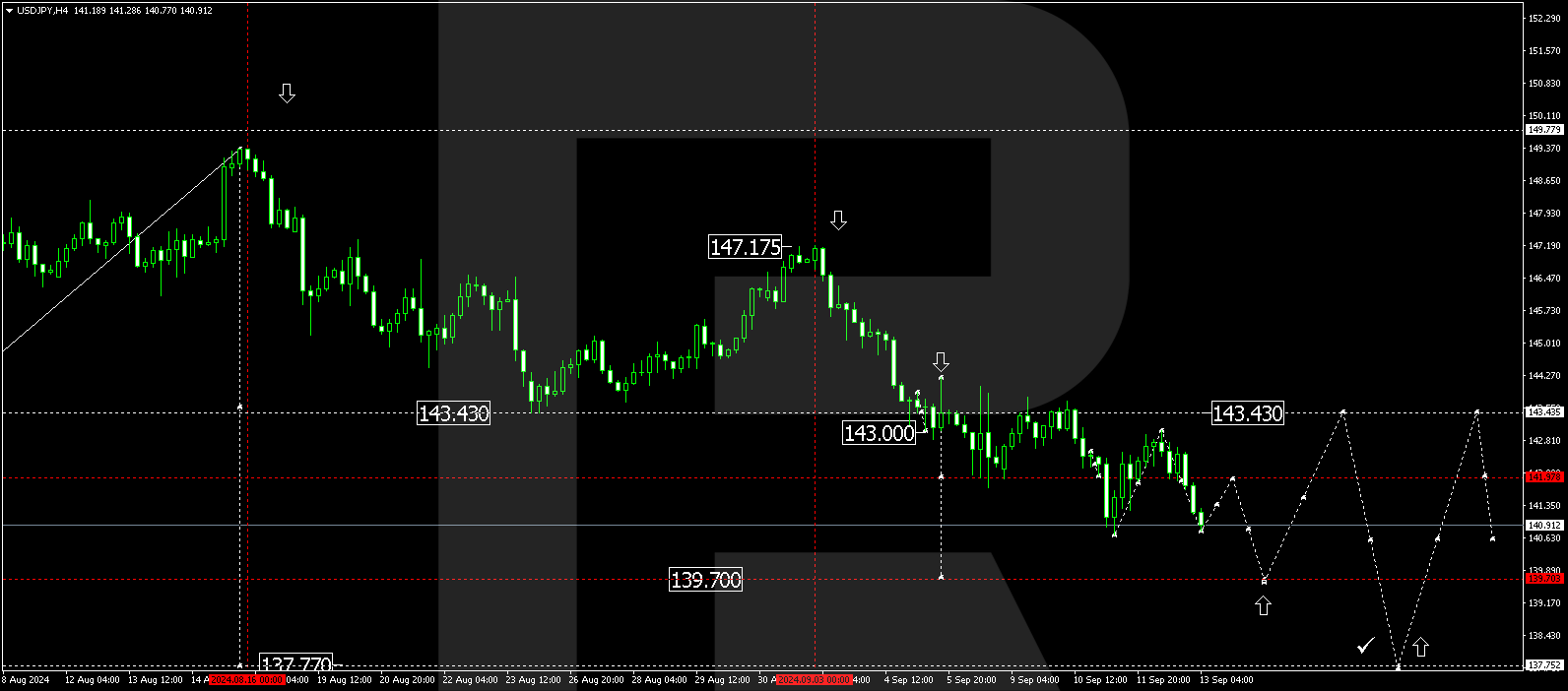

- USDJPY forecast for 13 September 2024: 139.70 and 137.77

Fundamental analysis

The USDJPY rate fell to 140.99 on Friday, marking another annual low. This became possible due to the hawkish comments from a Bank of Japan member. Yesterday, Bank of Japan Policy Board member Naoki Tamura said that the regulator should raise short-term interest rates to 1.00% by fiscal 2026 to reach the inflation target of 2.00%.

This is not the only strong statement in recent days. Junko Nakagawa has previously noted that the Bank of Japan is ready to hike interest rates further. This will be relevant if the economy and inflation align with forecasts.

Rating agency Fitch revised its interest rate expectations. The borrowing cost is now projected at 0.50% by the end of 2024, 0.75% by the end of 2025, and 1.00% by the end of 2026.

The yen has benefited from the global weakening of the US dollar. The USDJPY forecast suggests further sell-offs in the pair.

USDJPY technical analysis

The USDJPY H4 chart shows that the market has broken below the 141.95 level. A downward wave continues towards 140.64 today, 13 September 2024. A breakout below this level will open the potential for a decline to 139.70. Once the price reaches this level, a technical rise to 141.95 (testing from below) is not ruled out. Subsequently, the price could fall to 137.77, the main target.

Summary

The USDJPY pair has dropped to annual lows. There is a possibility that this is not the limit. Technical indicators in today’s USDJPY forecast suggest a potential decline to the 139.70 and 137.77 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.