USDJPY: the yen has the potential to strengthen after a correction

Japan’s PMI improved significantly, while US retail sales may decline. Find out more in our analysis for 17 September 2024.

USDJPY forecast: key trading points

- Japan’s services PMI (m/m): previously at -1.2%, currently at 1.4%

- US core retail sales index (m/m): previously at 0.4%, projected at 0.2%

- US retail sales (m/m): previously at 1.0%, projected at -0.2%

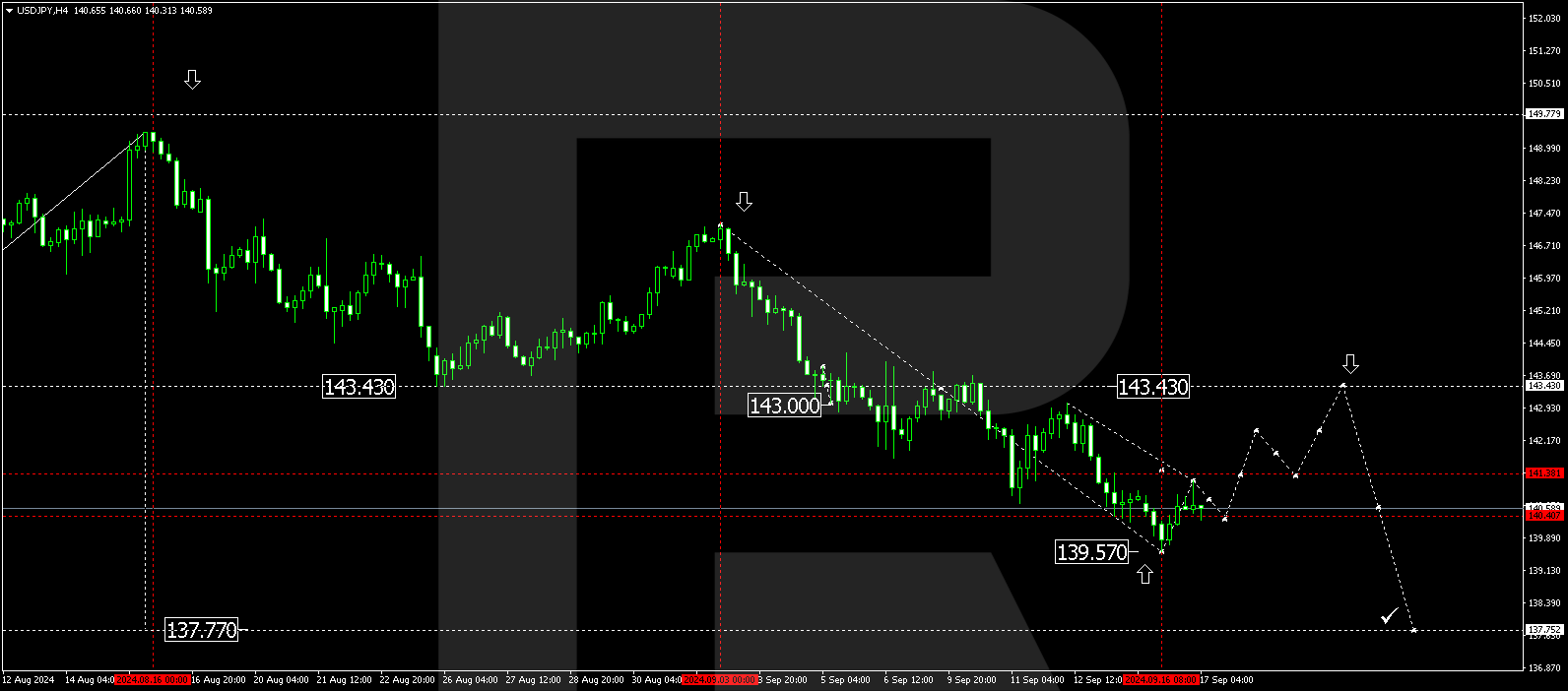

- USDJPY forecast for 17 September 2024: 141.38 and 143.43

Fundamental analysis

Japan’s services PMI shows consumer spending on all types of services other than industrial production. The index is a gauge of domestic consumer activity and financial well-being. The previous reading was -1.2%, while in the current period, the indicator shifted to positive territory, reaching 1.4%. Analysis for 17 September 2024 shows that the PMI fluctuates from negative to positive territory almost every month. This cannot have a strong impact on the USDJPY rate as the Japanese economy is export-oriented.

The US core retail sales index shows the change in retail sales over the previous month (excluding autos). The previous reading was 0.4%; according to the forecast for 17 September 2024, the index is projected to decline to 0.2%. A decrease in the indicator shows lower consumer spending and the US economic slowdown.

US retail sales show the difference in sales of all goods by retailers. The projected reading of -0.2% may indicate slowing economic growth. A slump in sales will add more negativity to the US dollar.

USDJPY technical analysis

The USDJPY H4 chart shows that the market has completed a downward wave, reaching 139.57. The price rose to 141.23 and corrected towards 140.31 today, 17 October 2024, with the market outlining the boundaries of a consolidation range. With a breakout above the range, a correction could begin, aiming for 141.38. Breaking above this level may be considered a signal for a further corrective movement towards 143.43 (testing from below). With a breakout below the range, the downward wave could continue towards 137.77.

Summary

The increase in Japan’s PMI supports the yen, with the USDJPY technical analysis in today’s USDJPY forecast suggesting a potential correction towards the 141.38 and 143.43 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.