USDJPY forecast: correction before the fall

A possible decline in new home sales in the US and Japanese indices remaining flat may impact the current USDJPY trend - read more in our analysis for today - 25 September 2024.

USDJPY forecast: key trading points

- Japan Corporate Services Price Index (CSPI) YoY: previous 2.7%, actual 2.7%

- Japan Core CPI (Consumer Price Index) YoY: previous 1.8%, actual 1.8%

- US New Home Sales: previous value - 739K, forecast - 699K

- USDJPY forecast for 25 September 2024: 144.55 and 145.77

Fundamental analysis

The Corporate Services Price Index (CSPI) is a crucial indicator of inflation within Japan’s corporate services sector. It reflects the dynamics of supply and demand in the corporate services market.

The index reflects the change in the value of domestic services produced in the previous month compared to the corresponging month of the last year. It serves as an indicator of inflationary processes in the economy and the development of the services sector. The previous value was 2.7%, and the actual value for the current period remained at the same level, while the forecast for 25 September 2024 suggested a decrease in the index to 2.6%. Based on the actual data, the CSPI remained unchanged, providing support to the Japanese yen.

The Consumer Price Index reflects the dynamics of the cost of goods and services from the consumer’s perspective. It is the primary tool for assessing changes in consumer preferences and inflation. Due to seasonal fluctuations in these categories, the CPI is calculated without including energy and food products.

The CPI’s impact on exchange rates can be ambiguous: an increase in the index supports a rise in interest rates and the strengthening of the national currency. However, during an economic crisis, CPI growth can aggravate the situation, which may cause a weakening of the national currency. The analysis for 25 September 2024 shows that while the previous value was 1.8%, the actual value remained at the same level, which slightly aided the US dollar’s recovery from its fall.

US New Home Sales data shows the number of residential buildings sold in the previous reporting period. The forecasted value of 699 thousand indicates a possible decline in citizens’ purchasing power. Rising food and energy prices limit consumers’ ability to purchase new homes. Nevertheless, the USDJPY rate may continue to rise within the correction wave.

USDJPY technical analysis

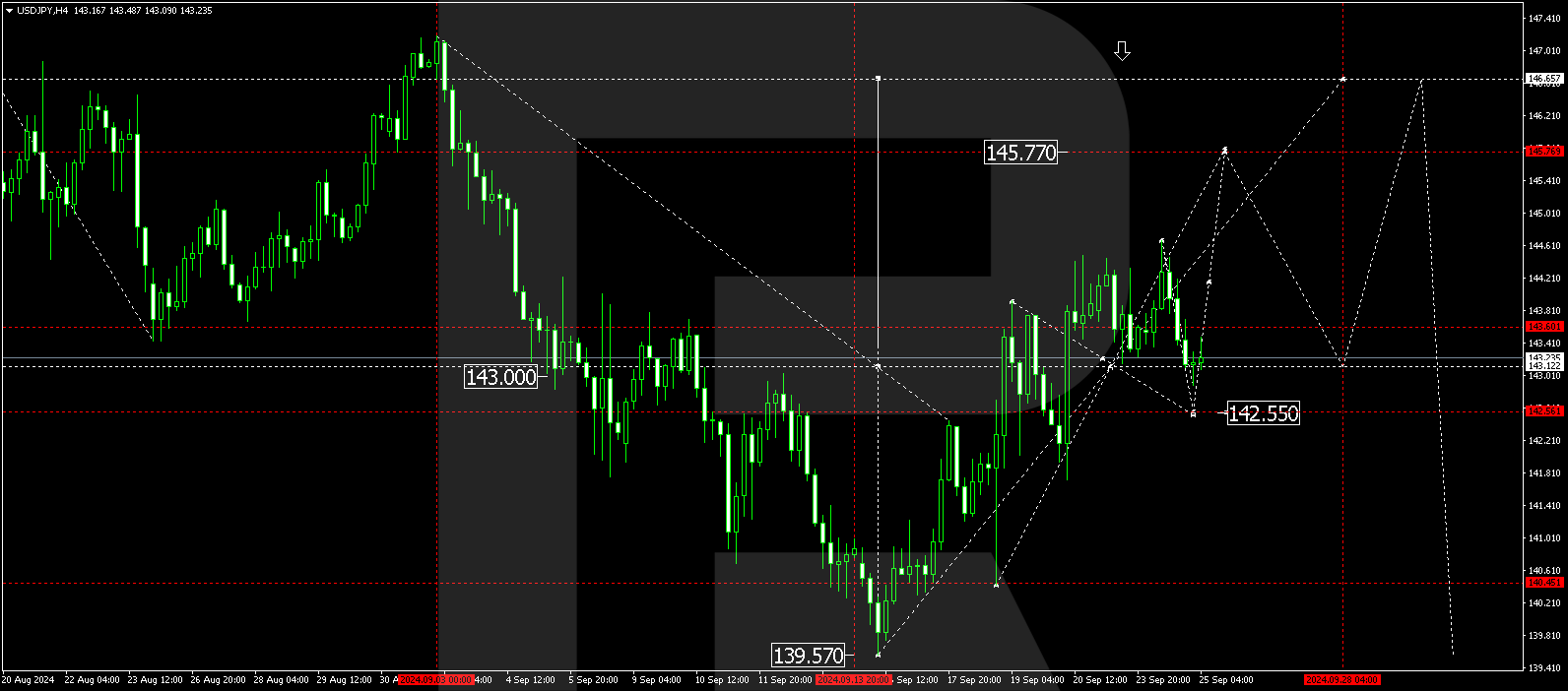

The USDJPY technical analysis reveals that the pair is in a corrective phase, with an initial downside wave structure targeting 143.12, followed by consolidation around 143.43. Today, 25 September 2024, signals suggest a possible extension down to 142.55. Subsequently, we expect growth to the 144.55 level. If this level is breached upwards, it will open the potential for a wave of USDJPY growth to 145.77. The target is local.

After this level is tested, we will consider the probability of the beginning of a correction decline to 143.43 (test from above). Further, we expect another growth wave to 146.66. This growth is considered a correction to the previous wave of decline. Alternatively, a decline and breakthrough of the 142.00 level downwards will open the potential for a trend wave towards the 137.77 level.

Summary

The outlook suggests that today’s USDJPY forecast could continue its growth wave towards 144.55 and 145.77 but with a high probability of an eventual decline post-correction.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.