USDJPY analysis: the yen may strengthen against the US dollar again

A decline in the US service sector activity index and a rise in jobless claims could be a trigger for a stronger Yen. Read more in our USDJPY analysis for today, 3 October 2024.

USDJPY forecast: key trading points

- Speech by Asahi Noguchi, BoJ Board member

- US Services PMI: previous reading 55.7, forecast 55.4

- US Initial Jobless Claims: previously 218,000, forecast 222,000

- USDJPY forecast for 3 October 2024: 143.38 and 142.42

Fundamental analysis

Asahi Noguchi is a Japanese economist appointed by the Prime Minister to the Board of Directors of the Bank of Japan. Asahi Noguchi is an advocate of large-scale monetary policy stimulus.

The US Service Sector Business Activity Index (PMI) considers various industries, including transport and communications, financial intermediation, business and personal services, information technology, and hotels and restaurants. Responses are based on the size of the company completing the questionnaire and its contribution to the total output of the respective service subsector. Thus, the opinions of large companies have a more significant impact on the index totals than the responses of smaller businesses. The results are presented by key questions and show the number of respondents who indicated an improvement, deterioration, or no change from the previous month. If the index is above the 50.0 level, it suggests no change in the current period compared to the last month. An increased value has a positive impact on the national currency. The previous value was at 55.7, while the forecast for 3 October 2024 suggests that the index may fall to 55.4. This PMI will put pressure on the US dollar against the Japanese yen.

The US Initial Jobless Claims number reflects the number of people who applied for unemployment benefits for the first time during the previous week. The indicator assesses the state of the labour market, and its increase indicates rising unemployment. The last reading was 218,000, but the fundamental analysis for 3 October 2024 does not look very optimistic, as the number of claims is expected to rise to 222,000. The change is not critical, but the actual data may impact the USDJPY exchange rate.

USDJPY technical analysis

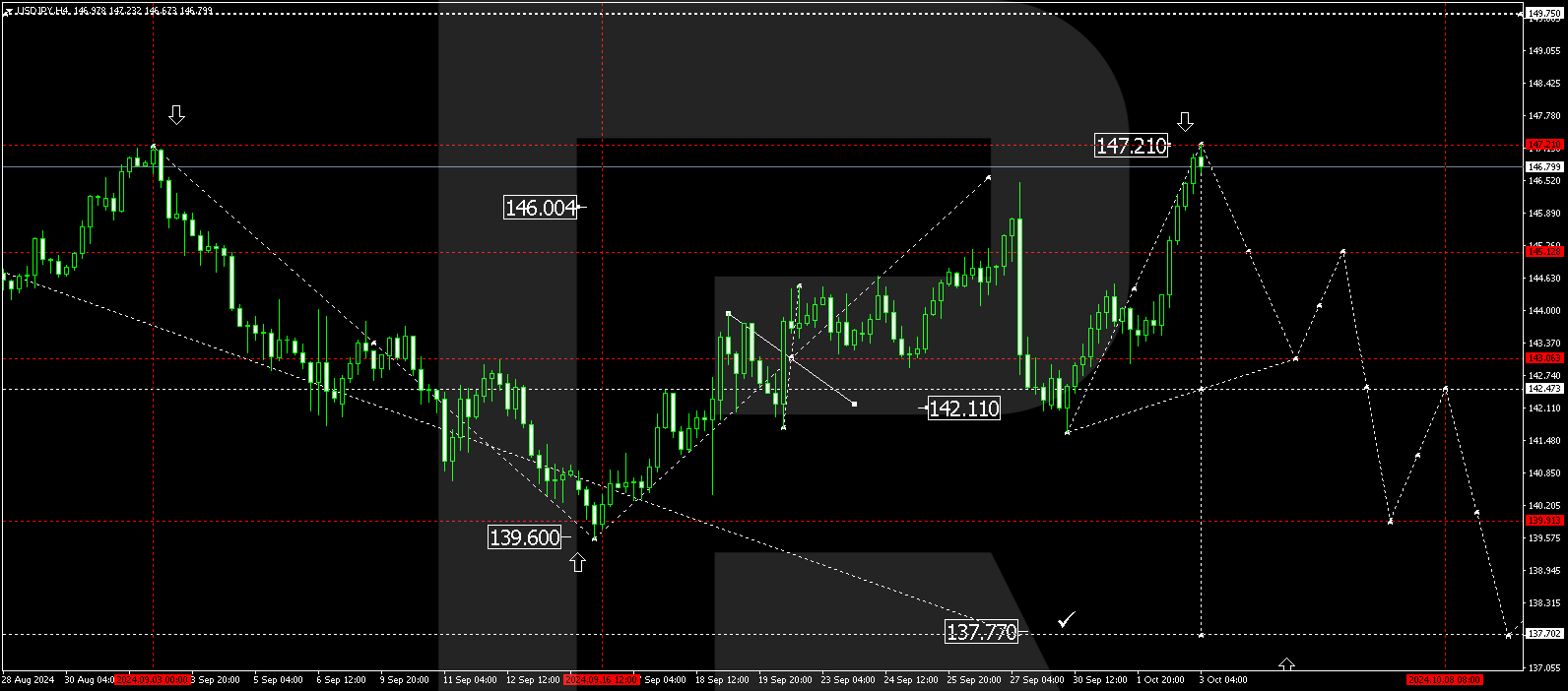

In today's USDJPY technical analysis, the H4 chart shows that the market moved towards 147.20. We expect a consolidation range under this level. An upward breakout could push USDJPY towards 149.70. Conversely, a downward breakout may signal the beginning of a new wave of decline towards 143.00. Breaking this level could signal further downside movement to 142.42, with the potential for a broader trend toward 137.77.

Summary

The decrease in US economic indicators, combined with rising unemployment claims and today's USDJPY analysis, suggests the possibility of continued downside movement in USDJPY. Today's USDJPY forecast targets 143.38 and 142.42, aligning with the broader bearish USDJPY outlook.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.