USDJPY halts growth as the market pauses for further developments

USDJPY growth halted on Friday as the market paused and awaits further developments. More details and insights are available in our USDJPY analysis and forecast for today, 4 October 2024.

USDJPY forecast: key trading points

- The USDJPY pair is consolidating

- The market paused following a 3% decline in the yen over the past week

- USDJPY forecast for 4 October 2024: 145.22 and 143.2

Fundamental analysis

On Friday, the USDJPY rate reached a high of 146.27 before stabilising. The Japanese yen has slightly recovered after its sharp decline of over 3% against the US dollar, driven by a shift in the Bank of Japan’s monetary policy stance, which softened its outlook on interest rates.

Japanese Prime Minister Shigeru Ishiba reiterated that current economic conditions do not justify a rate hike. Meanwhile, the yen faced additional pressure from the strong appreciation of the US dollar. Recent US economic data signals that the Federal Reserve may not reduce interest rates as aggressively as initially expected.

The overall USDJPY forecast remains neutral as the market assesses these fundamental factors.

USDJPY technical analysis

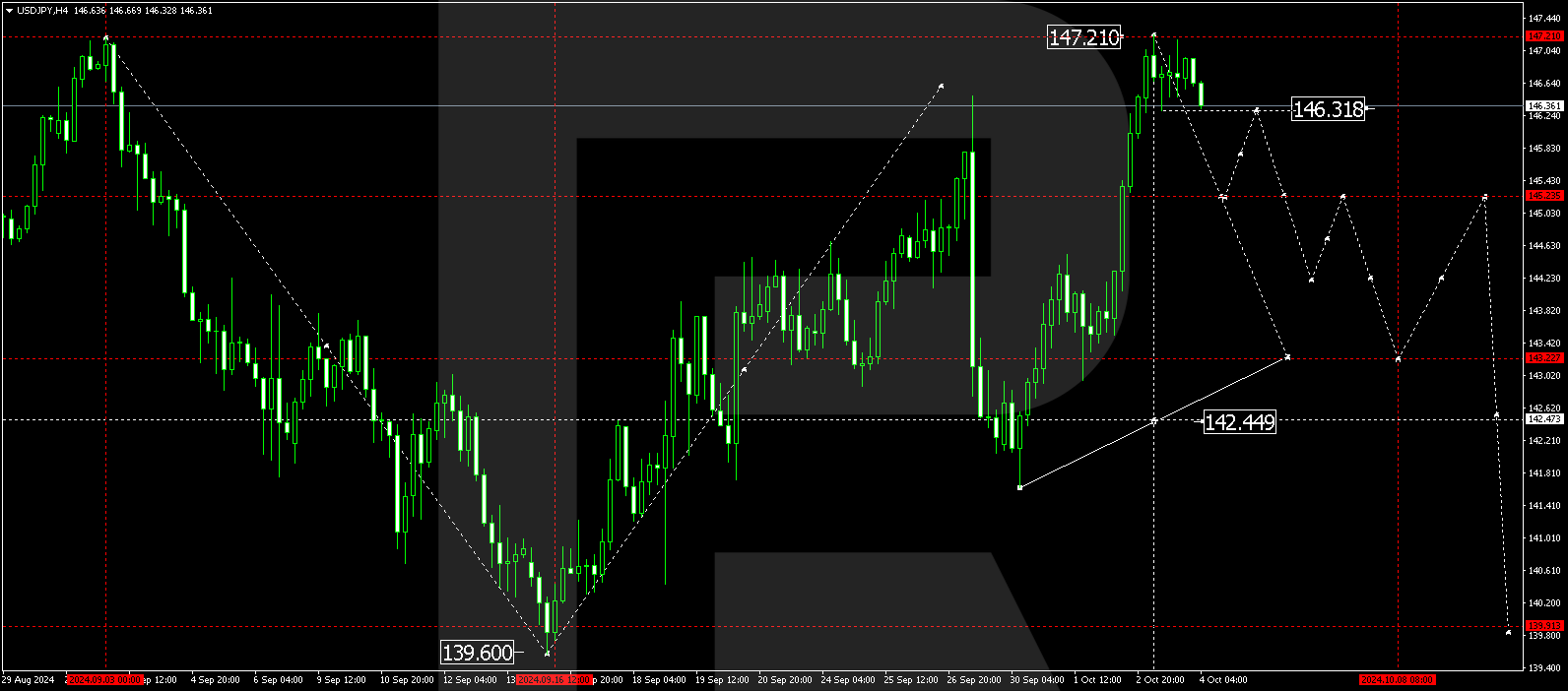

On the H4 chart, USDJPY has formed a consolidation range below 147.21. As of today, 4 October 2024, the lower boundary of this range at 146.31 has been breached, signalling the potential for further downside movement towards 145.22. Once this level is tested, a corrective move back to 146.31 could occur, with the possibility of a continued decline towards the 143.22 level.

Summary

The USDJPY pair experienced notable growth earlier in the week, but market activity slowed by Friday. Our technical analysis for today’s USDJPY forecast indicates a high probability of further downside, with key targets at 145.22 and 143.22. Keep an eye on market signals as the pair may continue its decline in the coming sessions.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.