USDJPY: Japan’s producer prices rising for 43 months

The USDJPY rate is slightly strengthening in its attempt to break above the key resistance level. Find out more in our analysis for 10 October 2024.

USDJPY forecast: key trading points

- The yen is weakened due to the cautious stance of the Japanese authorities against interest rate hikes

- Japan’s producer prices rose by 2.8% year-on-year for September

- Lending activity in Tokyo has slowed for the second consecutive month, reaching its lowest level in a year

- USDJPY forecast for 10 October 2024: 150.30 and 147.35

Fundamental analysis

The USDJPY rate is testing a crucial resistance level at 149.45. The yen remains under pressure due to Prime Minister Shigeru Ishiba and Economy Minister Ryosei Akazawa’s cautious stance. They are against hasty interest rate hikes amid a challenging economic situation in Japan.

The Federal Reserve’s September meeting minutes showed that policymakers were divided on the pace of rate cuts. Ultimately, they decided to reduce interest rates by 50 basis points to balance inflation targets with increasing labour market risks. However, following last week’s release of the strong US employment data, traders lowered their expectations of an aggressive monetary policy easing by the regulator.

Markets currently estimate the likelihood of a more moderate 25-basis-point rate cut in November at about 84.7%, virtually ruling out the possibility of a more significant half-percentage-point rate cut. As part of today’s USDJPY forecast, such expectations support the US dollar.

According to the latest data, Japan’s producer prices rose by 2.8% year-on-year in September, exceeding forecasts and marking the 43rd consecutive month of inflation growth in this sector. However, lending activity in the country slowed for the second consecutive month, reaching its lowest level in almost a year. The value of loans increased by 2.7% year-on-year in September, becoming one of the reasons behind the current developments.

Investors now await the upcoming US inflation data, which may significantly impact the November Federal Reserve interest rate decision.

USDJPY technical analysis

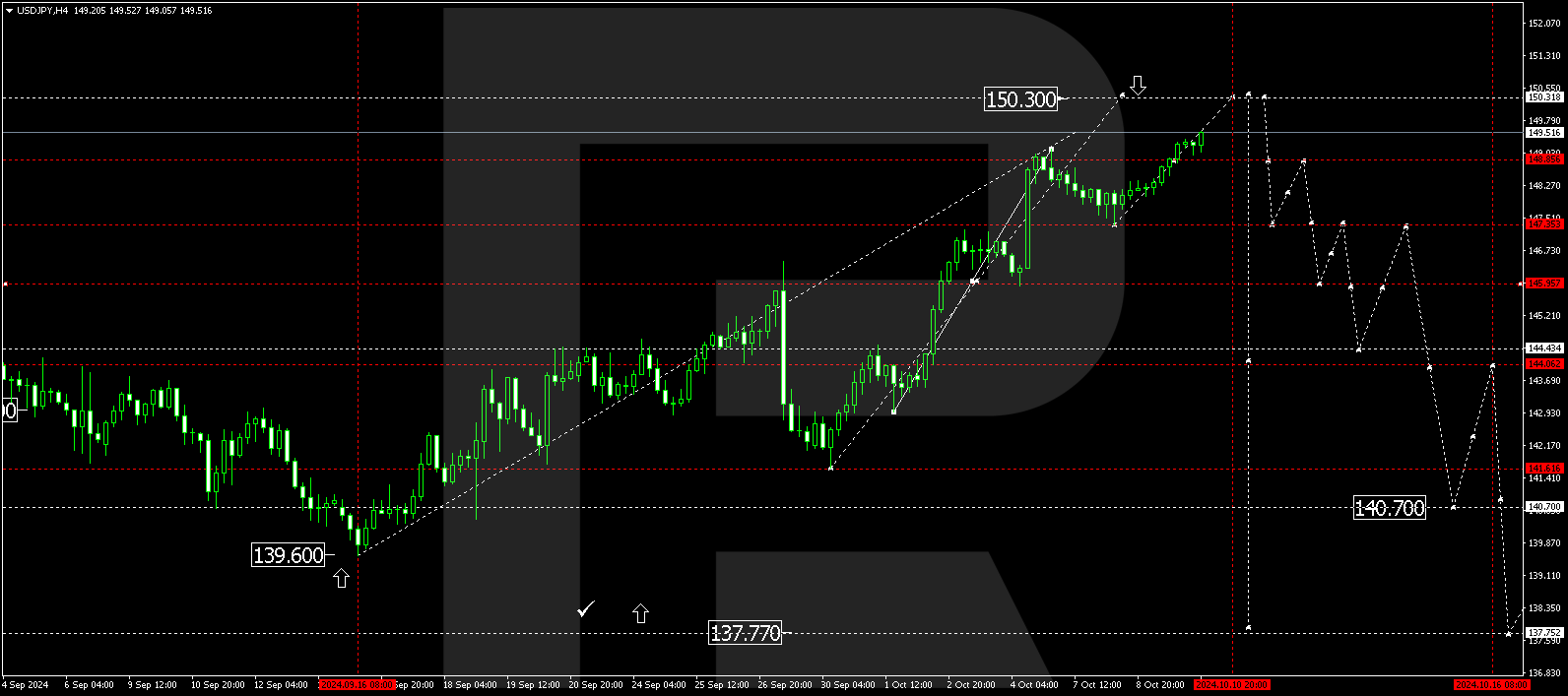

The USDJPY H4 chart shows that the market has formed a narrow consolidation range around 148.85. The USDJPY rate has broken above the range today, 10 October 2024, and is expected to extend it towards 150.30. A downward wave could begin once the price hits this level, aiming for the range’s lower boundary at 147.35. A breakout below this level will open the potential for a decline to 145.95 and potentially further to 144.44, the first target.

Summary

Given the current economic conditions, the USDJPY rate remains under pressure amid the Japanese government’s cautious stance against sharp interest rate hikes. At the same time, markets are pricing in a high likelihood of a more moderate Federal Reserve interest rate cut in November, which bolsters the current US dollar growth. Technical indicators in today’s USDJPY forecast suggest a potential growth wave towards the 150.30 level and a decline to the 147.35 level.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.