USDJPY remains at a two-month high: everyone needs a pause

The USDJPY pair is stuck in a consolidation phase, and the market is following the news. Find out more in our analysis for 11 October 2024.

USDJPY forecast: key trading points

- The USDJPY pair continues to consolidate

- The yen is under pressure due to a strong US dollar and general uncertainty about further BoJ interest rate hikes

- USDJPY forecast for 11 October 2024: 145.95 and 144.44

Fundamental analysis

The USDJPY rate is hovering around 148.67 on Friday. The pair has hardly changed its position and maintains a consolidation scenario.

The US dollar continues to exert pressure on the Japanese yen due to increased expectations regarding future US Federal Reserve actions. The baseline scenario suggests that the Fed will cautiously lower interest rates without sharp moves. These expectations arose after the US published strong employment figures for September and confidently reported on inflation.

Japan’s Prime Minister Shigeru Ishiba has previously stated that the current economic conditions may be inconsistent with further rate hike plans. The USDJPY forecast is neutral.

USDJPY technical analysis

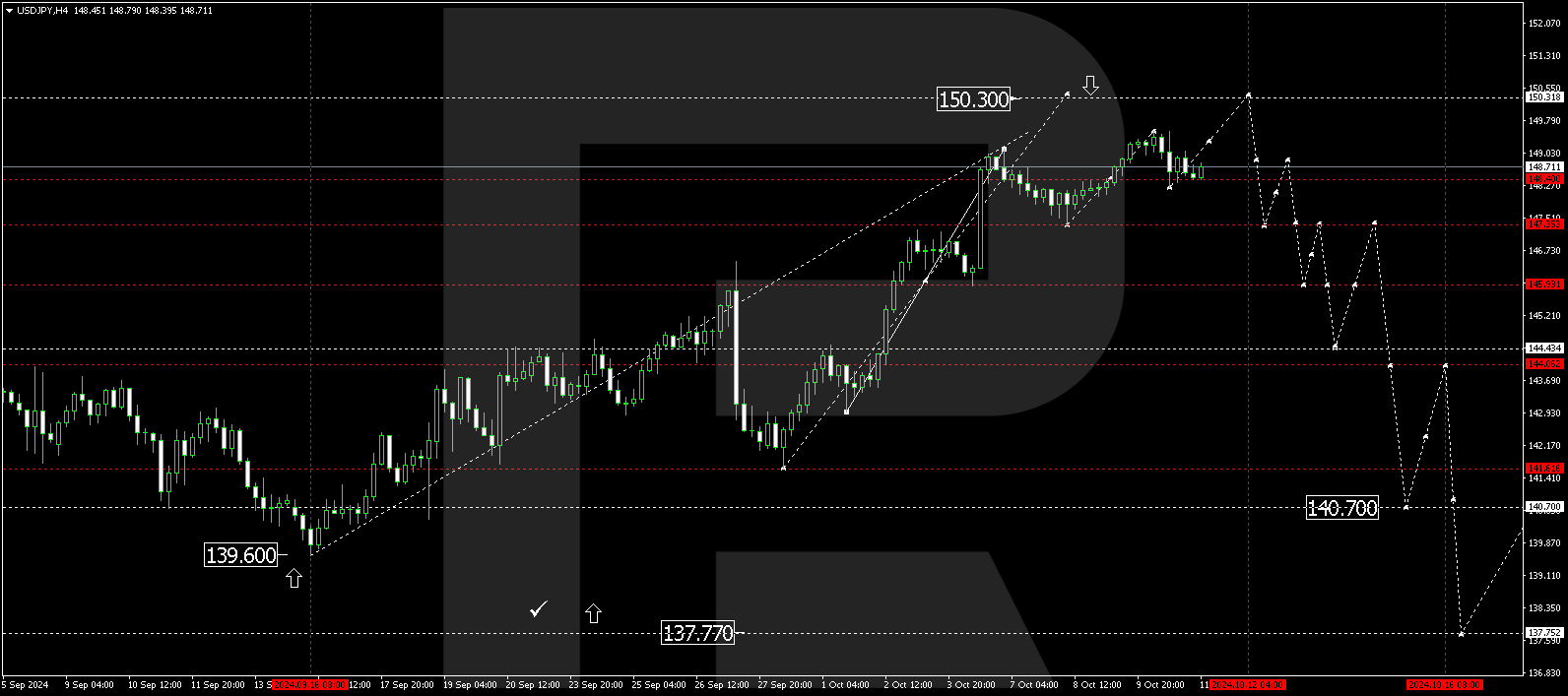

The USDJPY H4 chart shows that the market continues to develop a consolidation range around 148.40. It is worth considering the possibility of the USDJPY rate breaking above the consolidation range today, 11 October 2024. The range is expected to extend to 150.30. A downward wave could start after the price reaches this level, targeting the range’s lower boundary at 147.35, where a correction might occur. If the price breaks below this level, it could trigger a decline to 145.95, with the correction potentially extending towards 144.44.

Summary

The USDJPY pair remains in a consolidation phase until new information becomes available. Technical indicators in today’s USDJPY forecast suggest a potential correction towards the 145.95 and 144.44 levels.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.