USDJPY: the yen continues to lose ground

The US presidential election has put pressure on the yen, which continues to lose ground against the US dollar. More details in our analysis for 6 November 2024.

USDJPY forecast: key trading points

- The Bank of Japan monetary policy meeting minutes

- Japan’s services PMI: previously at 53.1, currently at 49.7

- US presidential election

- USDJPY forecast for 6 November 2024: 155.38

Fundamental analysis

The Bank of Japan’s monetary policy meeting minutes are released a month after the meeting. The report typically has minimal impact on the market unless BoJ Policy Board members make bold statements.

Japan’s services PMI covers various industries, including transport and communication, financial intermediation, business and consumer services, information technology, and the hotel and restaurant sectors.

The forecast for 6 November 2024 does not appear overly optimistic for the Japanese yen as the PMI decreased to 49.7 from the previous period. The indicator is currently below 50.0, which adds to positive sentiment towards the US dollar.

Votes are being counted following the US presidential election. At this stage, this provides additional support for the markets and strengthens the US dollar. The USDJPY rate continues its upward momentum, hitting previous months’ highs.

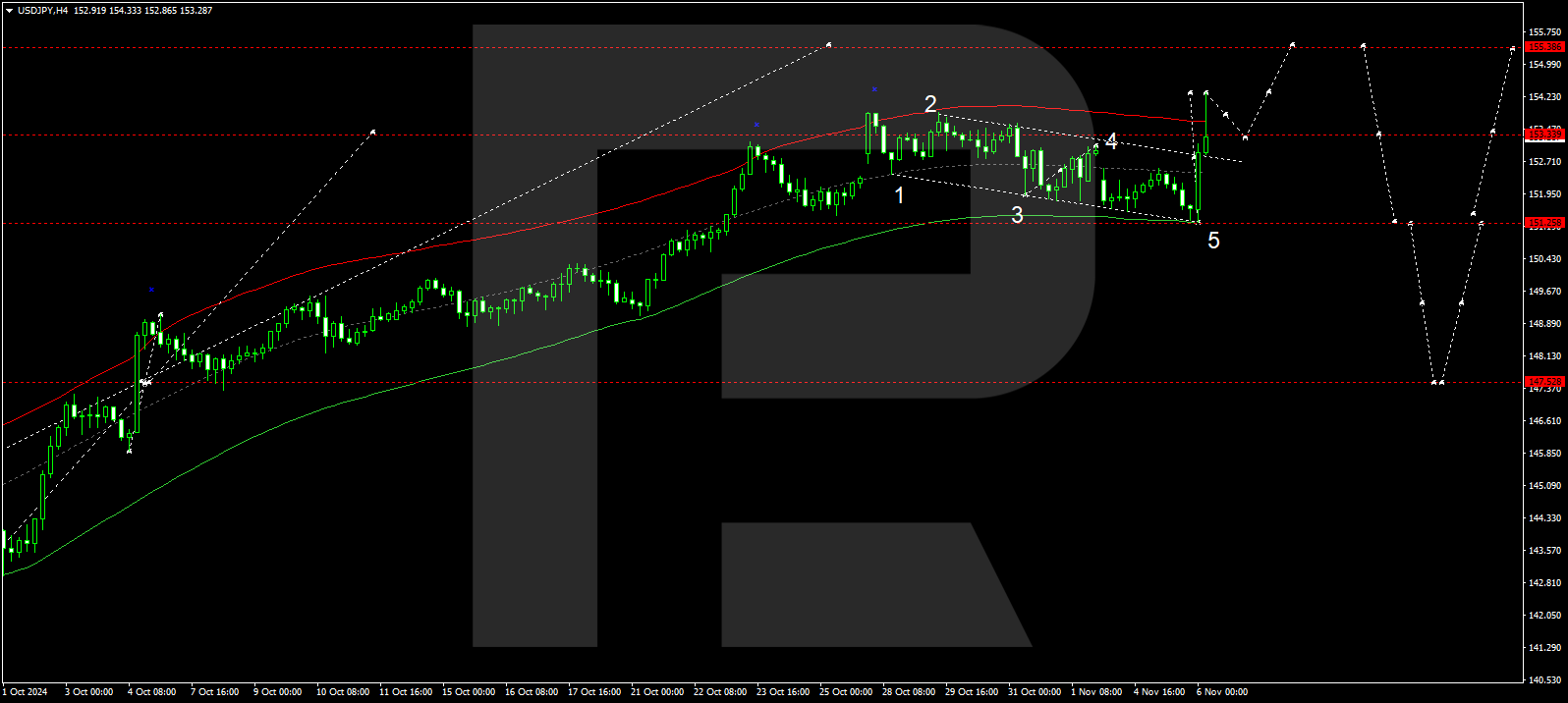

USDJPY technical analysis

The USDJPY H4 chart shows that the market has completed a correction, reaching 151.28. A growth wave structure is forming today, 6 November 2024, aiming for 155.38 as a local target. A corrective wave could start once the price hits this level, targeting 151.00. Subsequently, another growth structure towards 152.42 could develop before a further correction towards 150.80.

The Elliott Wave structure and corrective wave matrix, with a pivot point at 152.66, technically confirm this scenario for the USDJPY rate. The market has rebounded from the lower boundary of a price envelope. After reaching its upper boundary at 154.25, the price could decline to the envelope’s central line at 152.50. Subsequently, the growth wave could continue towards the upper boundary of the price envelope, with the target at 155.38.

Summary

Together with the technical analysis for today’s USDJPY forecast, the decline in Japan’s PMI and the strengthening of the US dollar suggest that the growth wave could develop towards the 155.38 level.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.