USDJPY: uncertainty about the BoJ policy curbs yen’s growth

The USDJPY rate declines, remaining close to local highs. Discover more in our analysis for 21 November 2024.

USDJPY forecast: key trading points

- Bank of Japan Governor Kazuo Ueda emphasised that any interest rate changes will be gradual

- US Federal Reserve officials expressed mixed opinions on the regulator’s monetary policy

- Japan’s exports rose by 3.1% in October, exceeding forecasts, and offsetting September’s decline

- Investors are awaiting Japan’s inflation data release scheduled for Friday

- USDJPY forecast for 21 November 2024: 156.17

Fundamental analysis

The USDJPY rate is declining on Thursday after rising for three days. The Japanese yen remains under pressure due to uncertainty about future Bank of Japan rate hikes. The regulator’s chief, Kazuo Ueda, noted that any monetary policy changes will be gradual and depend on the economic situation. However, he did not specify the timing of decisions.

Mixed signals are coming from US Federal Reserve officials. On Wednesday, Michelle Bowman, known for her tough stance, called for caution with further rate cuts, emphasising persistent inflation risks and a strong labour market. At the same time, Lisa Cook noted that a gradual transition to a more neutral monetary policy may be appropriate.

Amid these statements, the Japanese economy is showing positive signals. Exports grew by 3.1% in October, exceeding analysts’ forecasts and offsetting a 1.7% decrease in September. Although expected to drop, imports also increased by 0.4%. According to today’s USDJPY forecast, these data may support the yen’s recent strengthening.

Investors are awaiting Japan’s October inflation data release, due on Friday, as it may provide insight into the economic outlook and further BoJ policy. Analysts forecast a minor increase in the CPI.

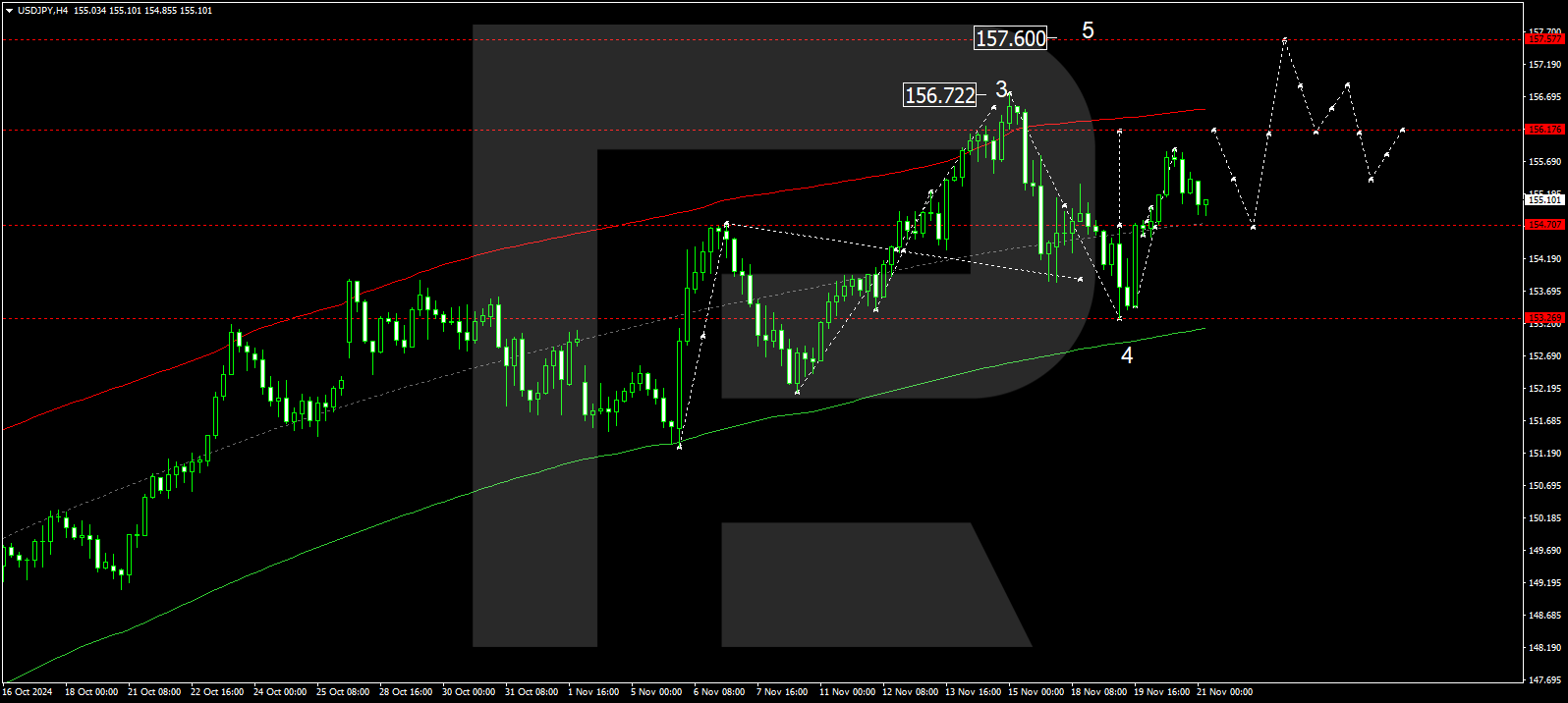

USDJPY technical analysis

The USDJPY H4 chart shows that the market has formed a narrow consolidation range around 154.70 and, breaking above it, reached a local target of 155.75. A correction towards 154.70 (testing from above) is possible today, 21 November 2024. Once the correction is complete, the price could rise to 156.17 and reach 157.60, the first target.

The Elliott Wave structure and growth wave matrix, with a pivot point at 153.30, technically support this scenario for the USDJPY rate. The market is forming a consolidation range around the central line of a price envelope at 154.70. A downward breakout may extend the downward wave to the envelope’s lower boundary at 153.00. Conversely, an upward breakout could drive a growth wave targeting the envelope’s upper boundary at 157.60.

Summary

The USDJPY rate declines amid mixed signals from US Federal Reserve officials but is still impacted by uncertainty around the BoJ policy. Japan’s inflation data, due on Friday, may be crucial for further currency pair movements. Technical indicators for today’s USDJPY forecast suggest that the growth wave could continue towards the 156.17 level.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.