EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD technical analysis and forecast for 30 September - 4 October 2024

Here is a detailed weekly technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD for 30 September - 4 October 2024.

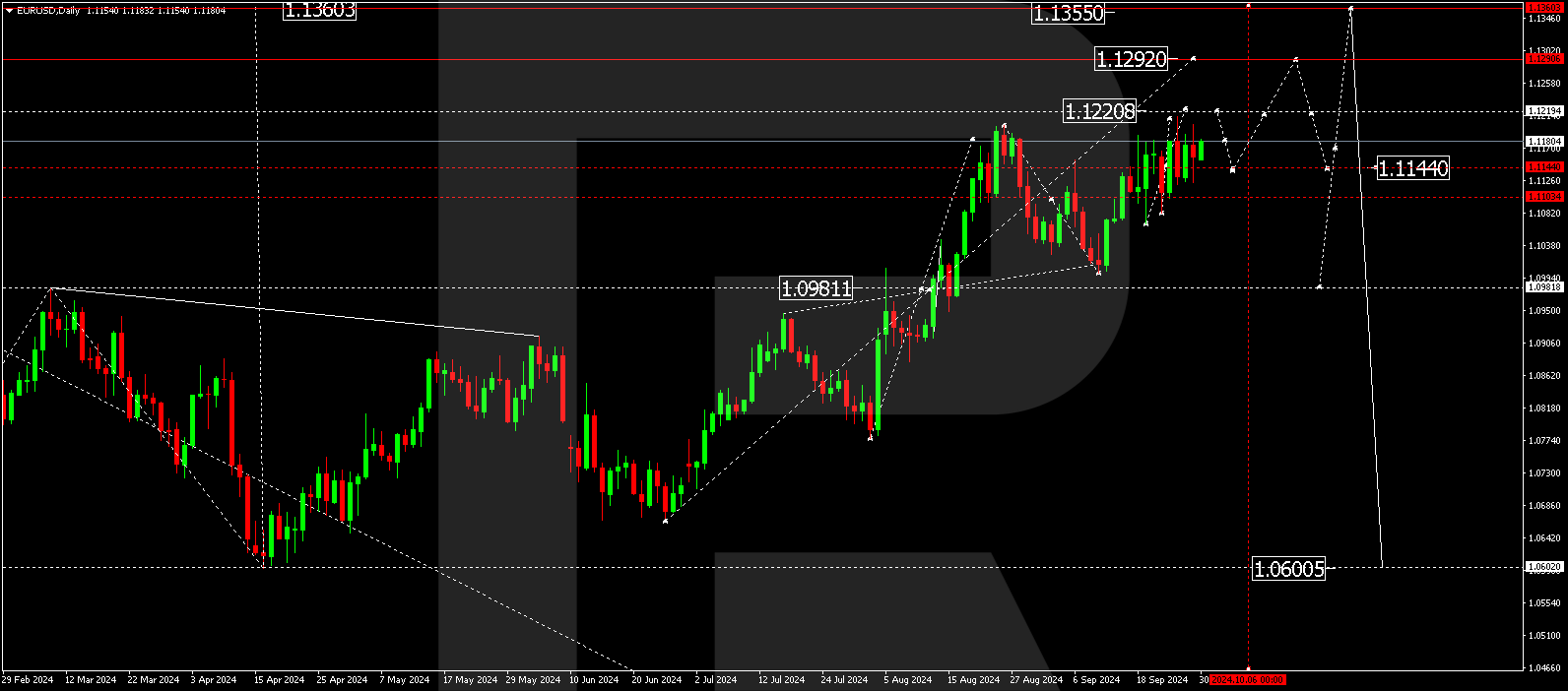

EURUSD forecast

The EURUSD pair is forming a broad consolidation range around the level of 1.1144, with expected growth to 1.1222. After reaching this level, a decline to 1.1144 (test from above) is not excluded. Growth is likely after the 1.1222 level is breached, opening the potential for a growth wave to 1.1290. Should there be a decline and a breakout below 1.1103, the potential for a correction wave to 1.0990 will be established.

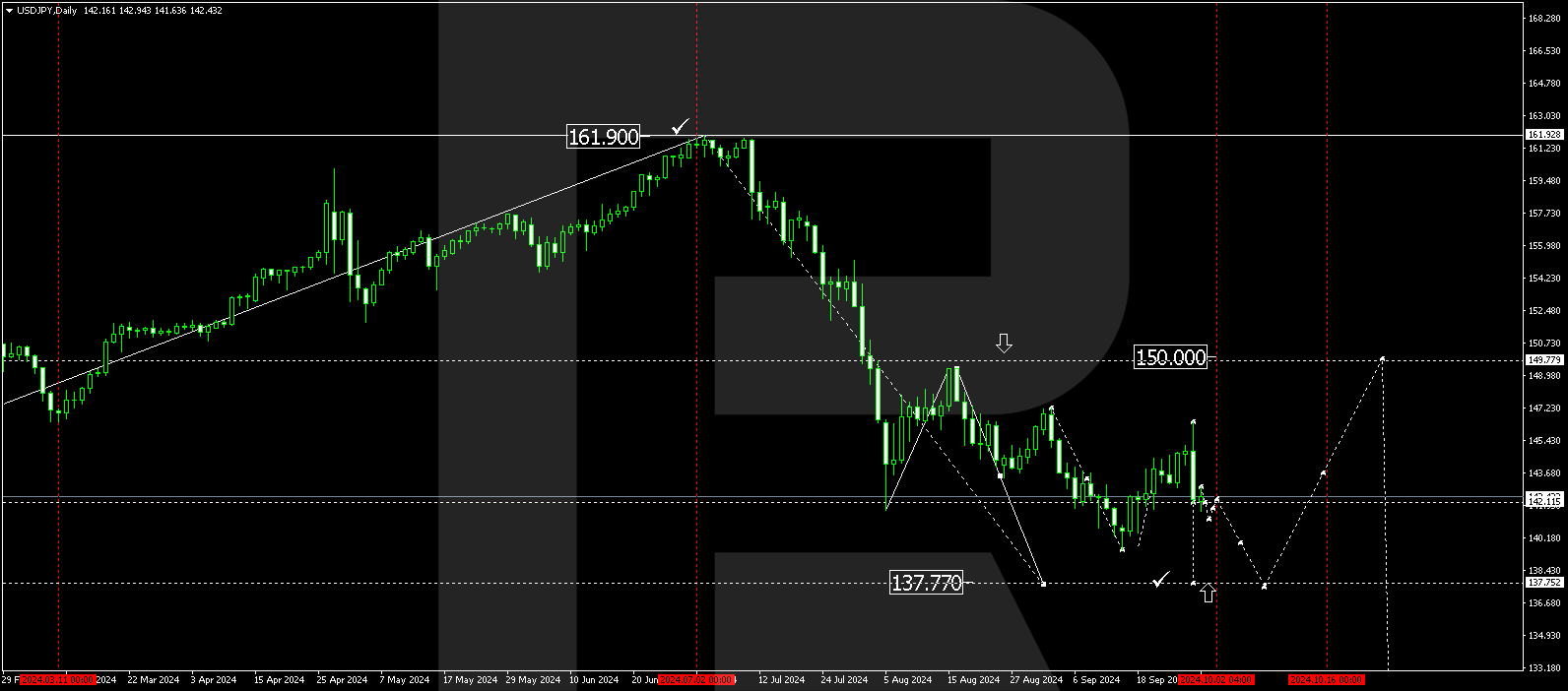

USDJPY forecast

The USDJPY pair has completed a growth wave to the level of 146.48 and a downward impulse to the level of 142.10. At the moment, a narrow consolidation range is forming around this level. A downward exit from the range could open the potential for a downward wave to 137.77. Conversely, another growth link to 146.66 is not excluded if there is an upward exit. After reaching this level, we will consider the trend continuing down to the level of 137.77. The target for the downward wave is the primary one.

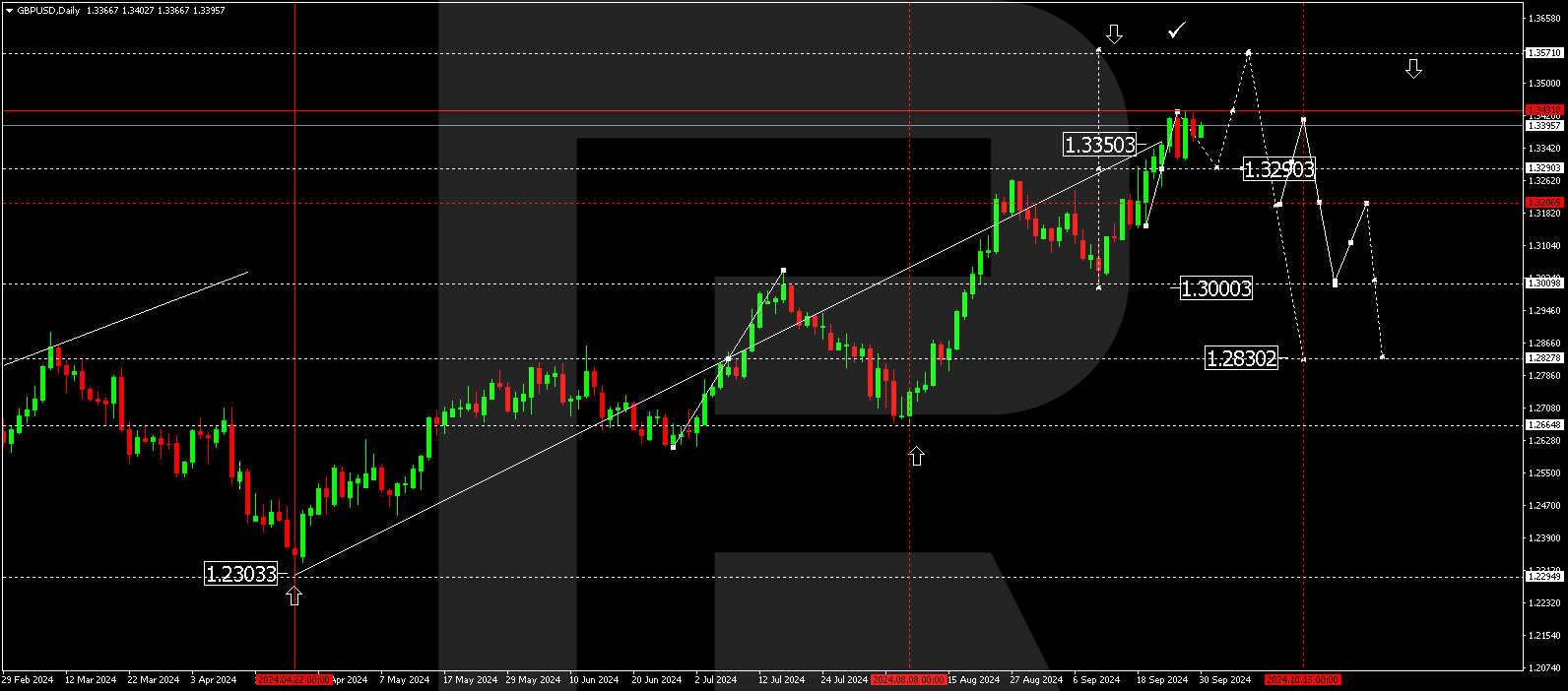

GBPUSD forecast

The GBPUSD pair has fulfilled the target of the growth wave. At the moment, a consolidation range has been formed at 1.3434. In the event of an upward exit from this range, the wave could extend to 1.3575. Conversely, if there is a downward exit, we expect the beginning of a decline to the level of 1.3200, with the prospect of the downward trend continuing to the level of 1.3000 (test from above). Additionally, we will consider the probability of the beginning of a new wave of growth to the level of 1.3333.

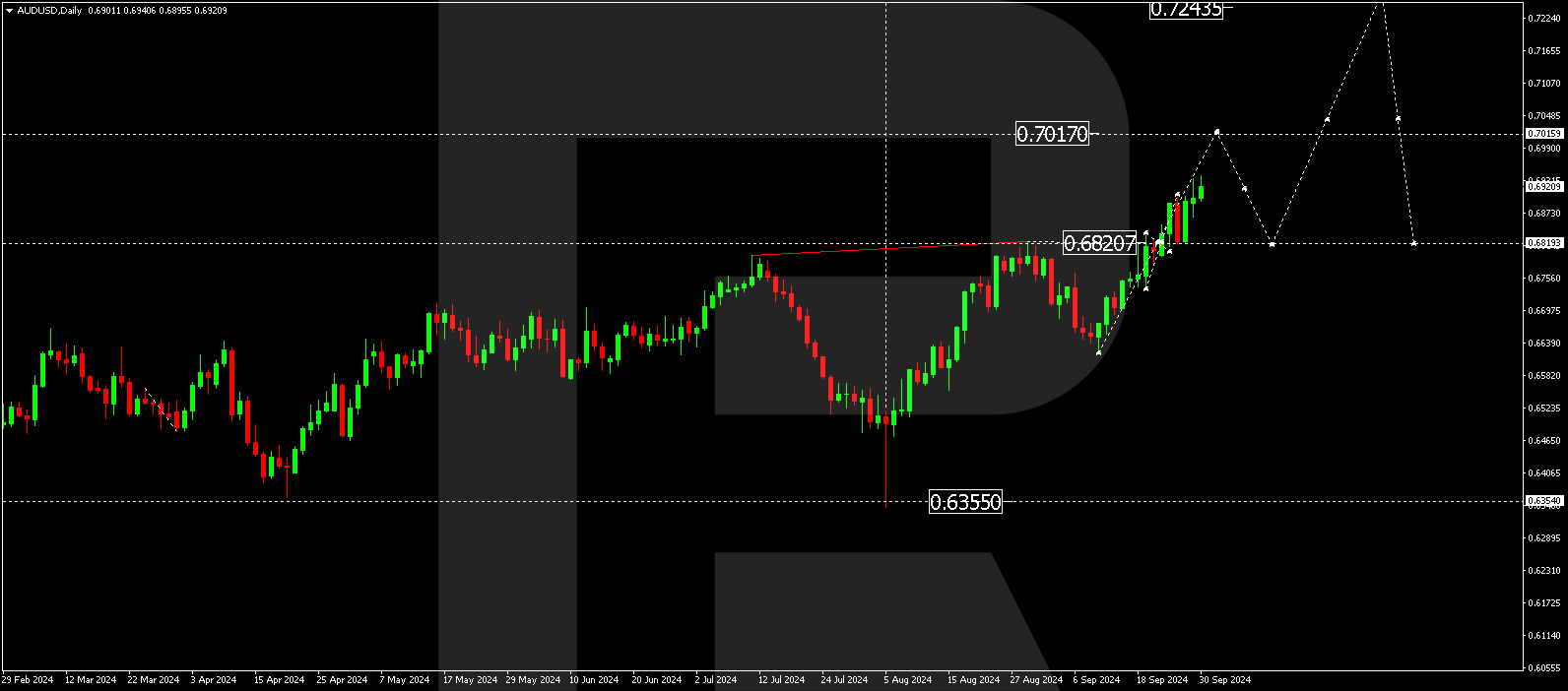

AUDUSD forecast

The AUDUSD pair has formed a consolidation range around the 0.6820 level. Today, the market suggests considering the likelihood of a breakout of the upper boundary of this range. If the level of 0.6920 is breached upwards, it will open the potential for a growth wave to 0.7017. The target is local. Subsequently, we expect a decline to 0.6800 (test from above), possibly followed by a growth wave to 0.7244.

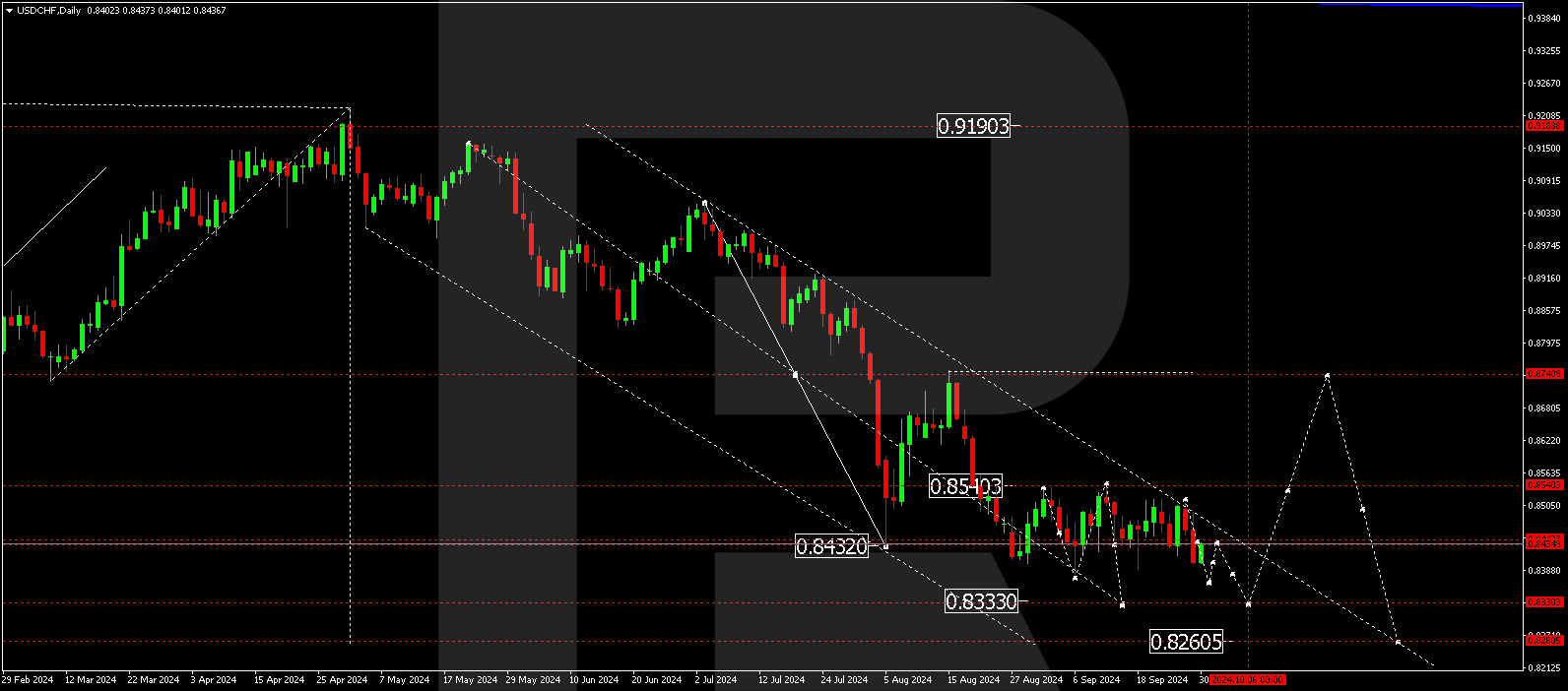

USDCHF forecast

The USDCHF pair continues to develop a broad consolidation range around the 0.8433 level. It is relevant to consider the probability of a decline to the 0.8333 level. The target is local. After its fulfilment, we expect the beginning of the growth wave to the level of 0.8540. If this level is breached upwards, the growth wave could extend to 0.8740.

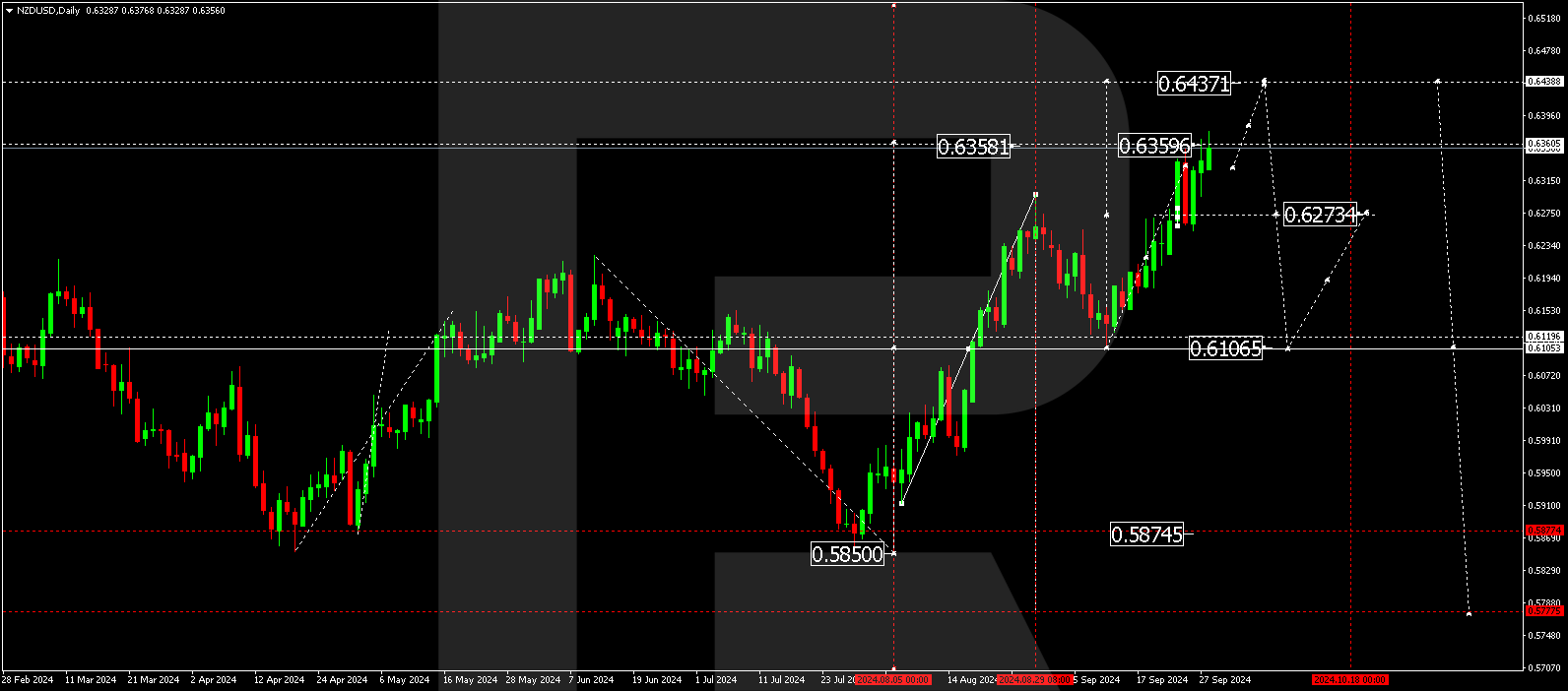

NZDUSD forecast

The NZDUSD pair executed a wave of growth to the level of 0.6360. At the moment, a consolidation range has been formed at this level. With its exit upwards, we will consider the probability of the wave continuing to the level of 0.6437. After reaching this level, we expect the beginning of the decline to the level of 0.6272. If this level is breached downwards, it will open the potential for a downward wave to 0.6106.

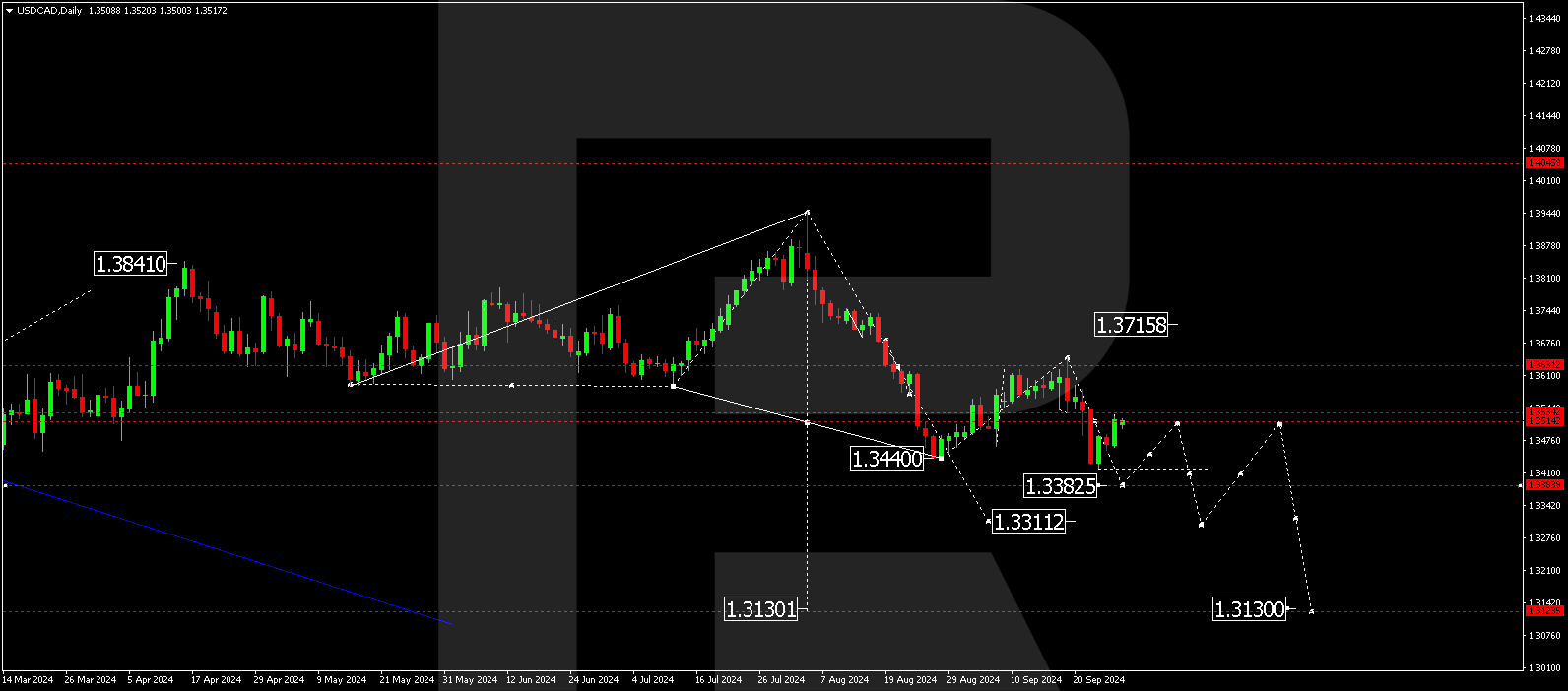

USDCAD forecast

The USDCAD pair continues to develop a consolidation range around 1.3515. If it exits upwards, it will open the potential for a growth wave to 1.3630, with the prospect of the upward trend continuing to 1.3715. Conversely, if it exits downwards, we expect a decline to 1.3311 with the prospect of continuing the downward trend to 1.3130.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.