EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD technical analysis and forecast for 16-20 December 2024

Here is a detailed weekly technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD for 16-20 December 2024.

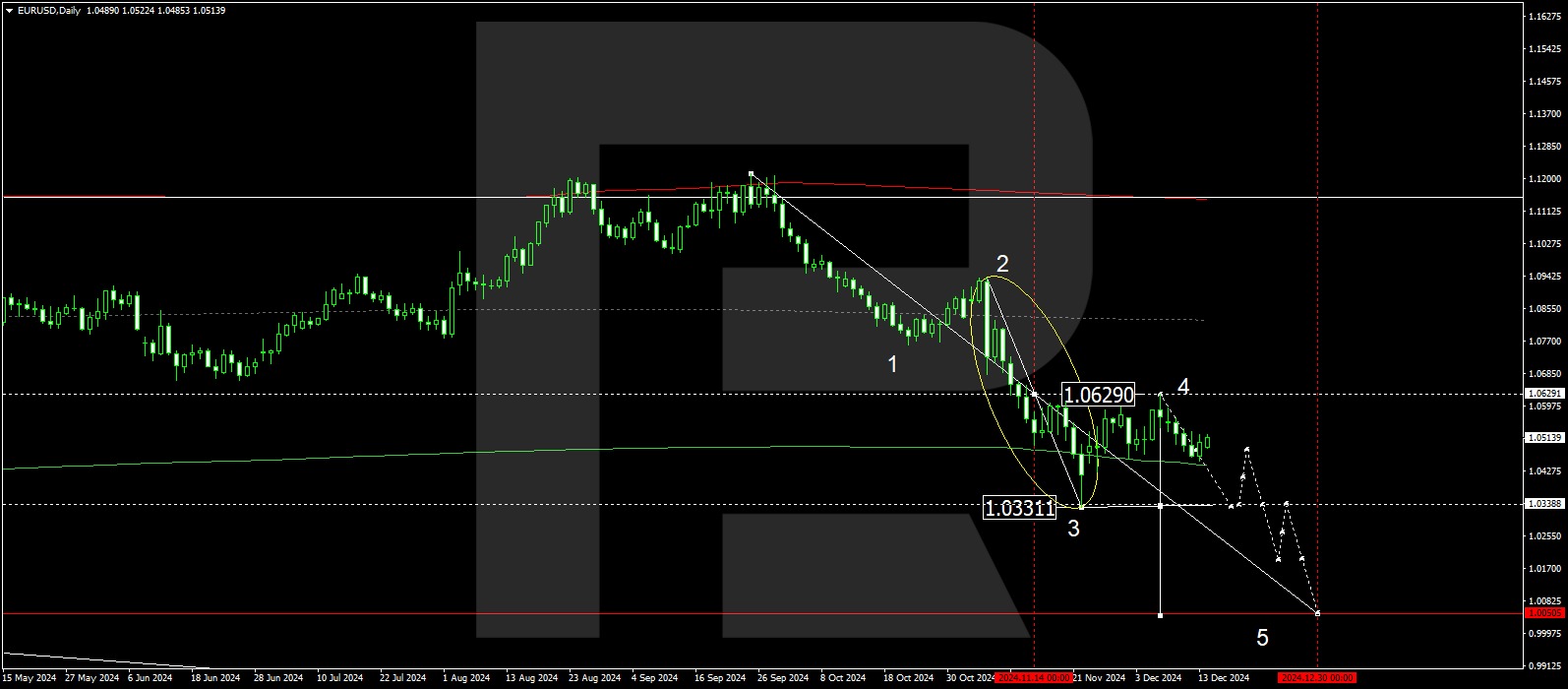

EURUSD forecast

The EURUSD pair has rebounded downward from the 1.0629 level and declined to 1.0452. A consolidation range is anticipated to form around this level, with a downward breakout potentially extending the wave to 1.0338, the first target. After reaching this level, the EURUSD pair might undergo a correction towards 1.0480 (testing from below). Subsequently, it could decline to 1.0200, potentially continuing towards 1.0050.

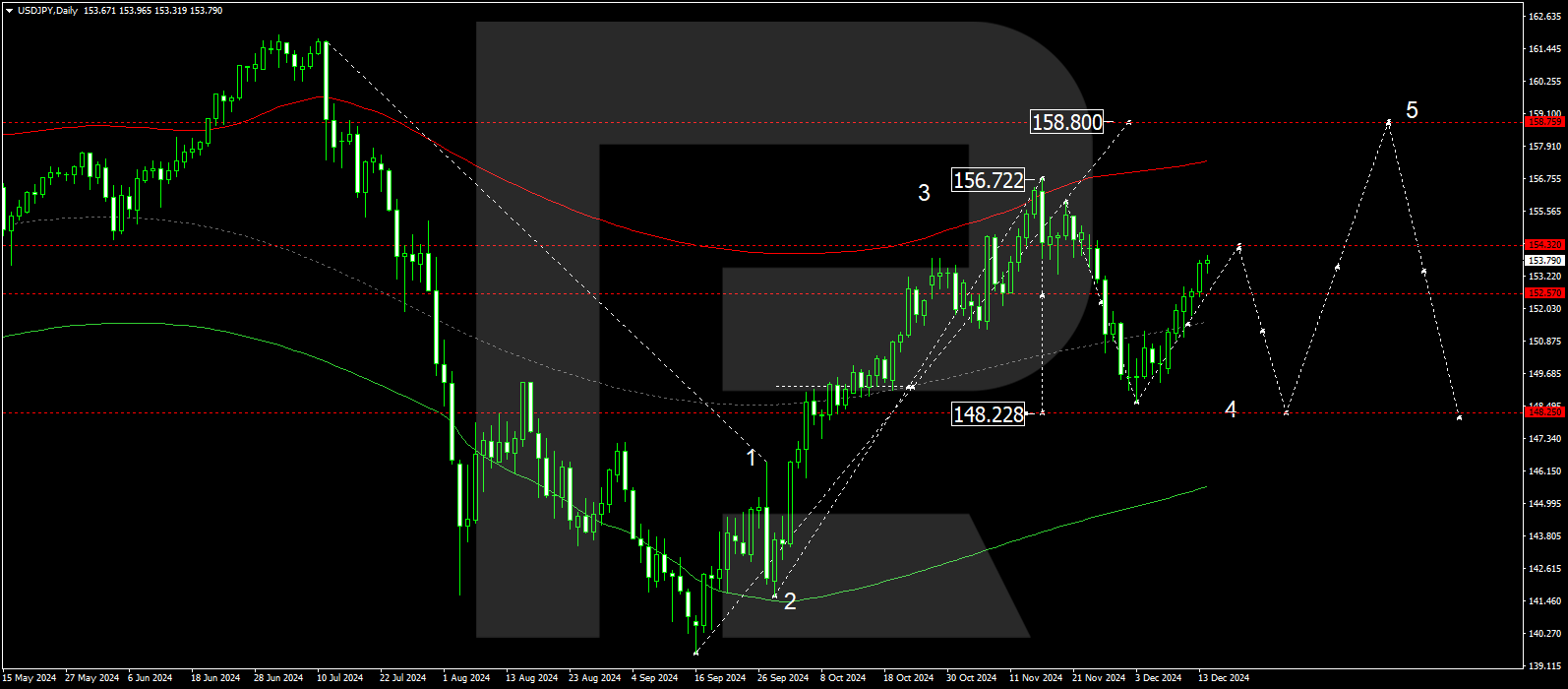

USDJPY forecast

The USDJPY pair maintains its upward momentum towards 154.40, having reached the local target of this wave at 153.93. The price is expected to decline to 151.51 (testing from above) before rising to the main target of 154.40. Subsequently, a corrective wave in the USDJPY pair might follow, aiming for 148.25. Once the correction is complete, a new growth wave towards 158.75 will likely begin.

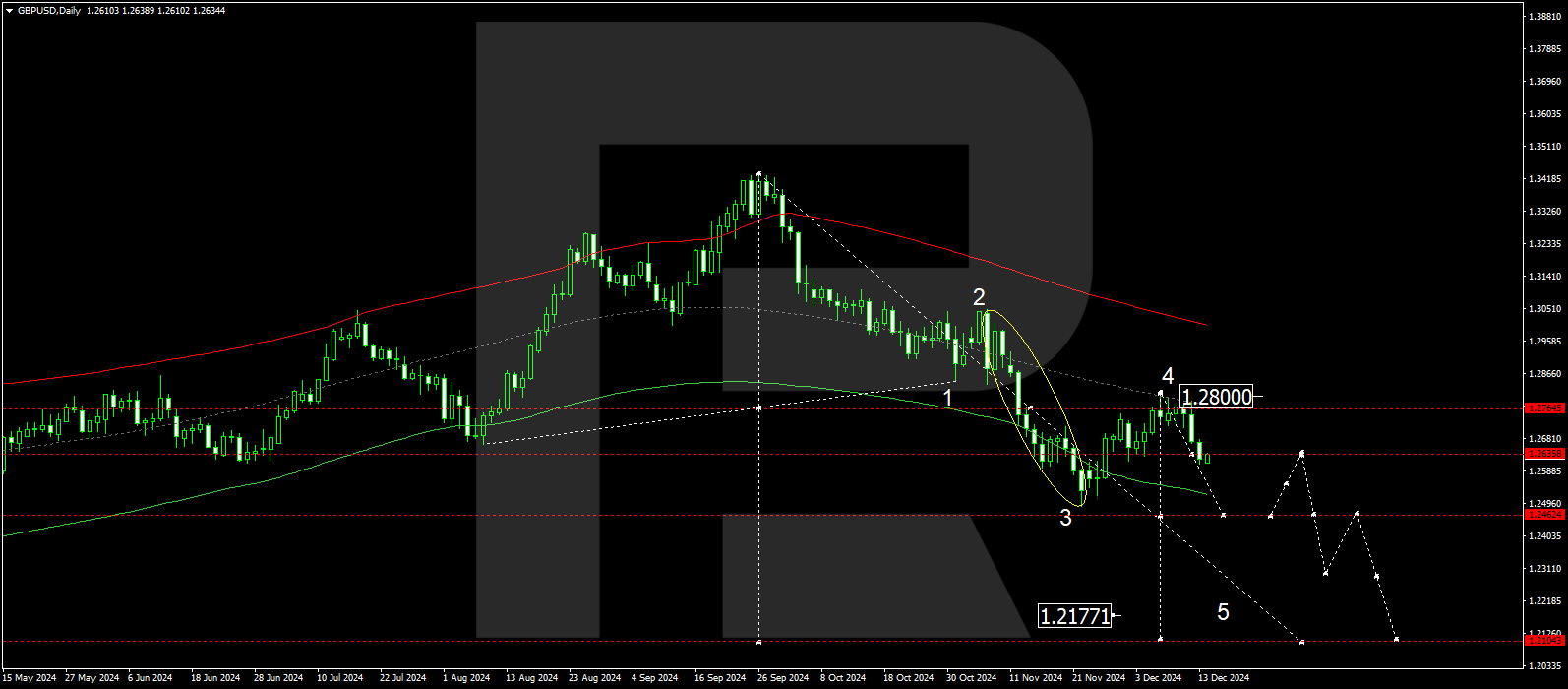

GBPUSD forecast

The GBPUSD pair has completed a downward wave towards 1.2608. The market is now forming a consolidation range, having reached this level. The price is expected to break below the range, continuing the trend towards 1.2464, the first target. Once the GBPUSD pair achieves the target, it might correct upwards to 1.2640 (testing from below). Subsequently, a new downward wave might start, targeting 1.2300, potentially continuing towards 1.2100.

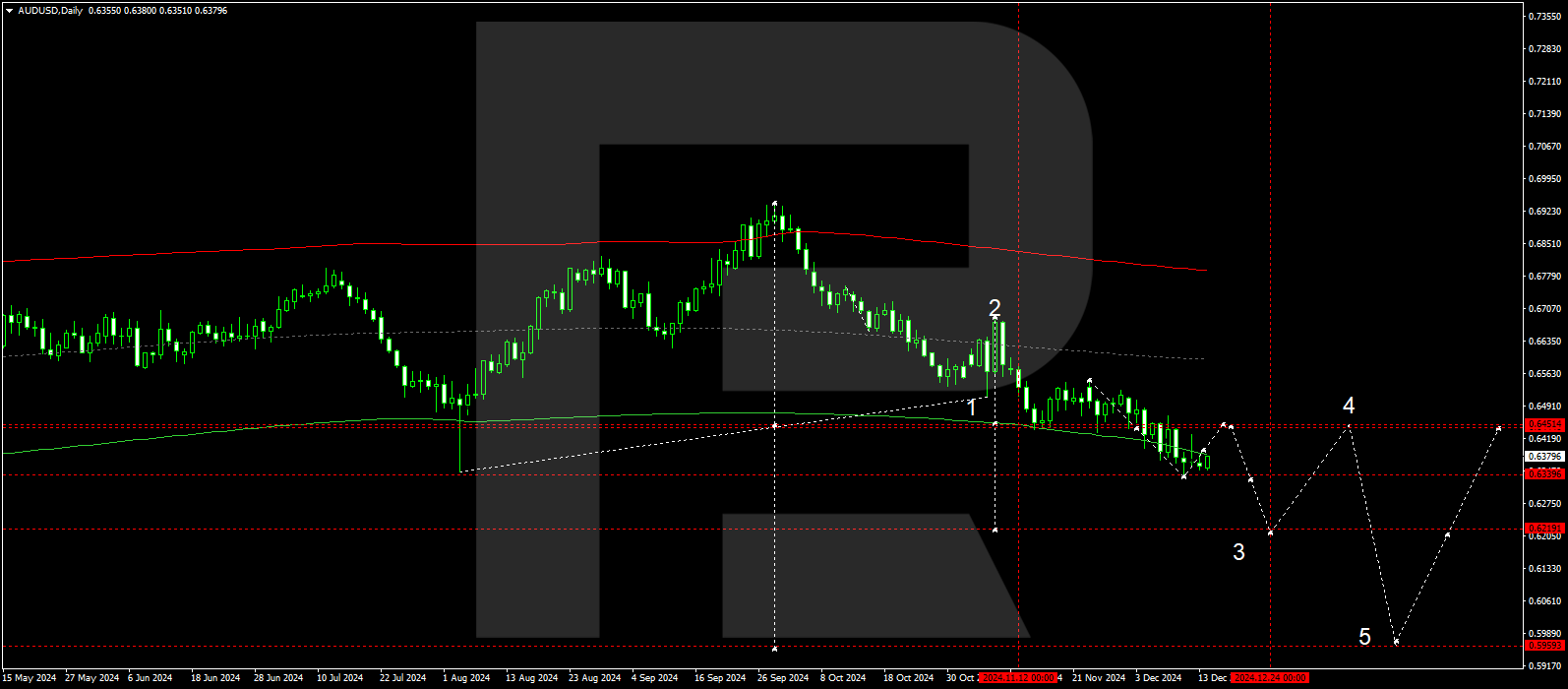

AUDUSD forecast

The AUDUSD pair has completed a downward wave, reaching 0.6333. A consolidation range is currently forming above this level. A breakout above the range could lead to a correction towards 0.6450 (testing from below), followed by a decline to the local target of 0.6220. After reaching this target, the AUDUSD pair might correct to 0.6400. Subsequently, a new downward wave might start, aiming for 0.5959, the main target.

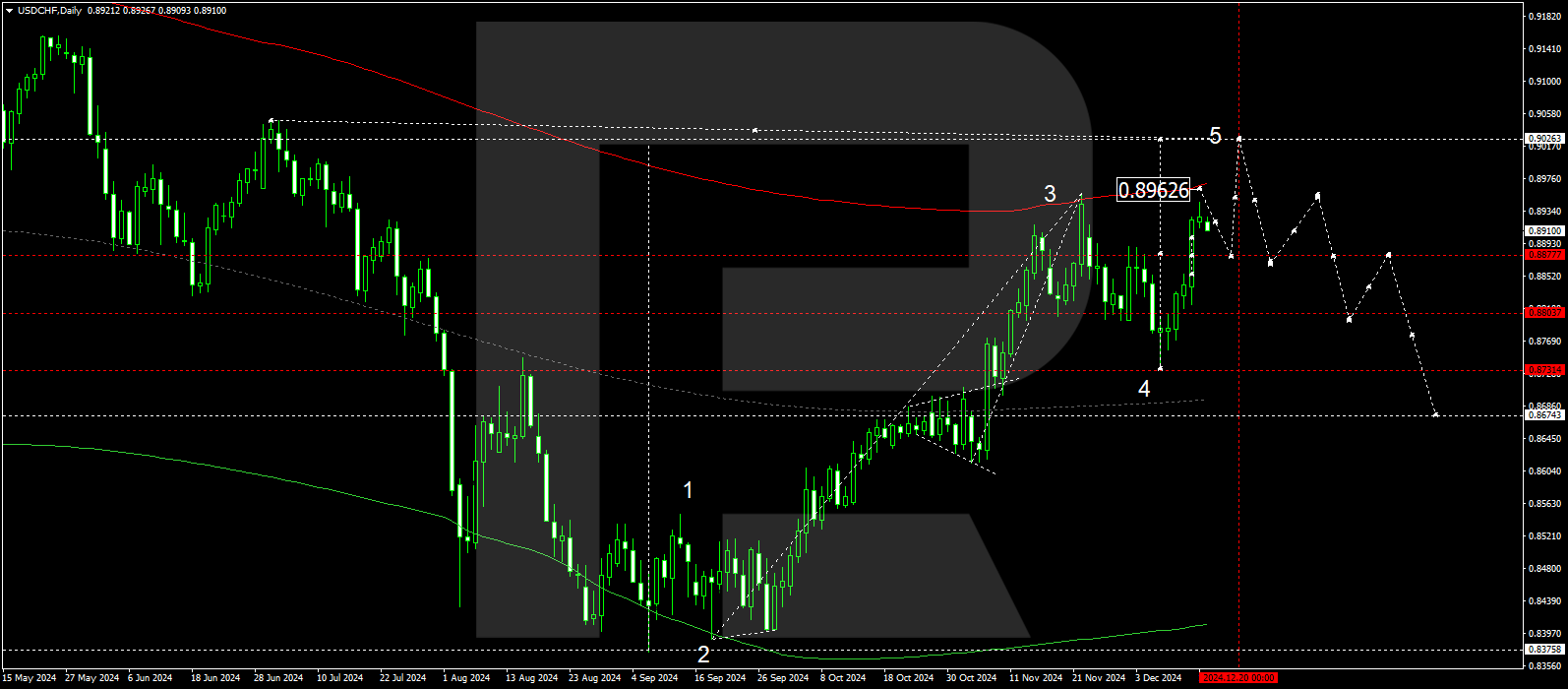

USDCHF forecast

The USDCHF pair has formed a consolidation range around 0.8877 and, after breaking above it, is maintaining its upward trajectory towards 0.8962. After hitting this level, the USDCHF pair might correct downwards to 0.8877 (testing from above). Subsequently, a new growth wave is likely to begin, aiming for 0.9026, the first target.

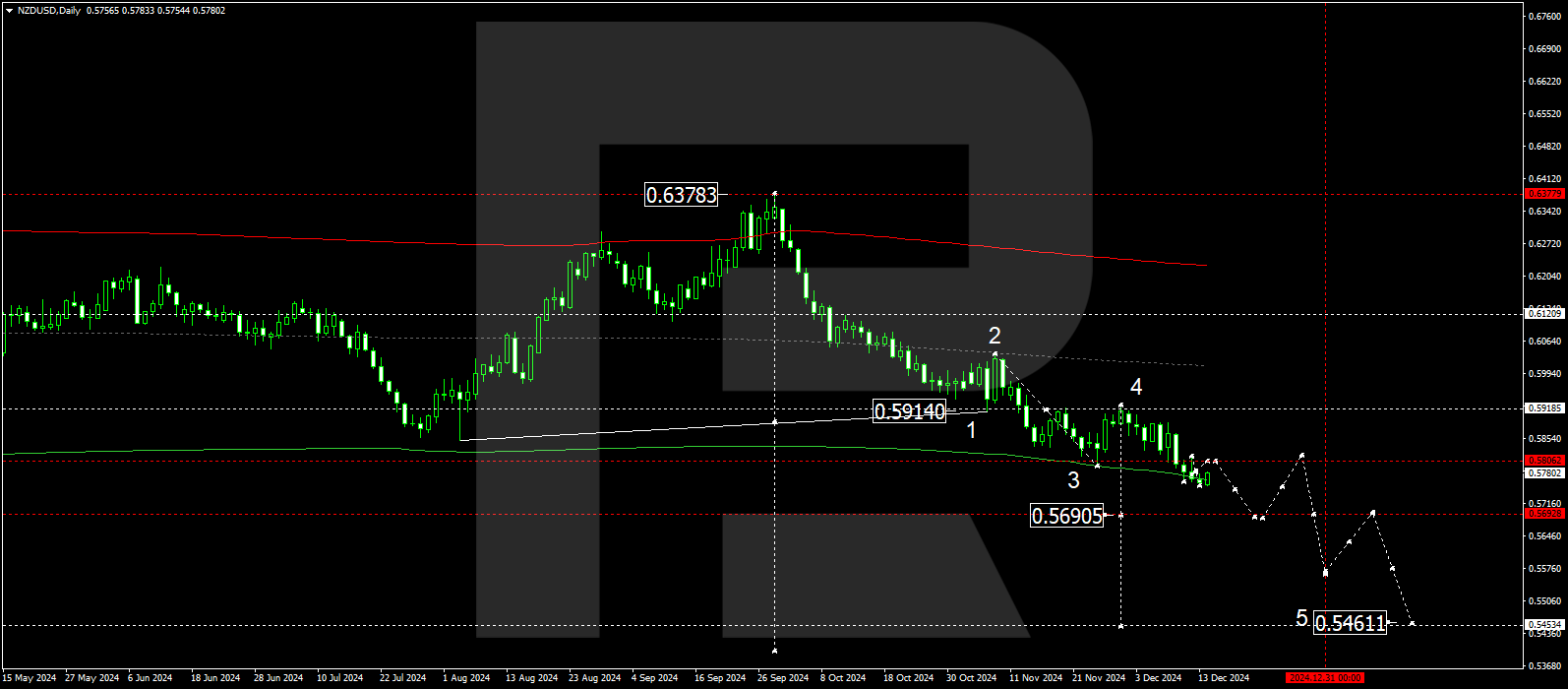

NZDUSD forecast

The NZDUSD pair has broken below the 0.5800 level, continuing its downward momentum towards 0.5690. After reaching this level, a corrective wave might follow, rising towards 0.5777 (testing from below). Subsequently, a downward wave in the NZDUSD pair is expected, aiming for 0.5570 and potentially extending to 0.5460, the main target.

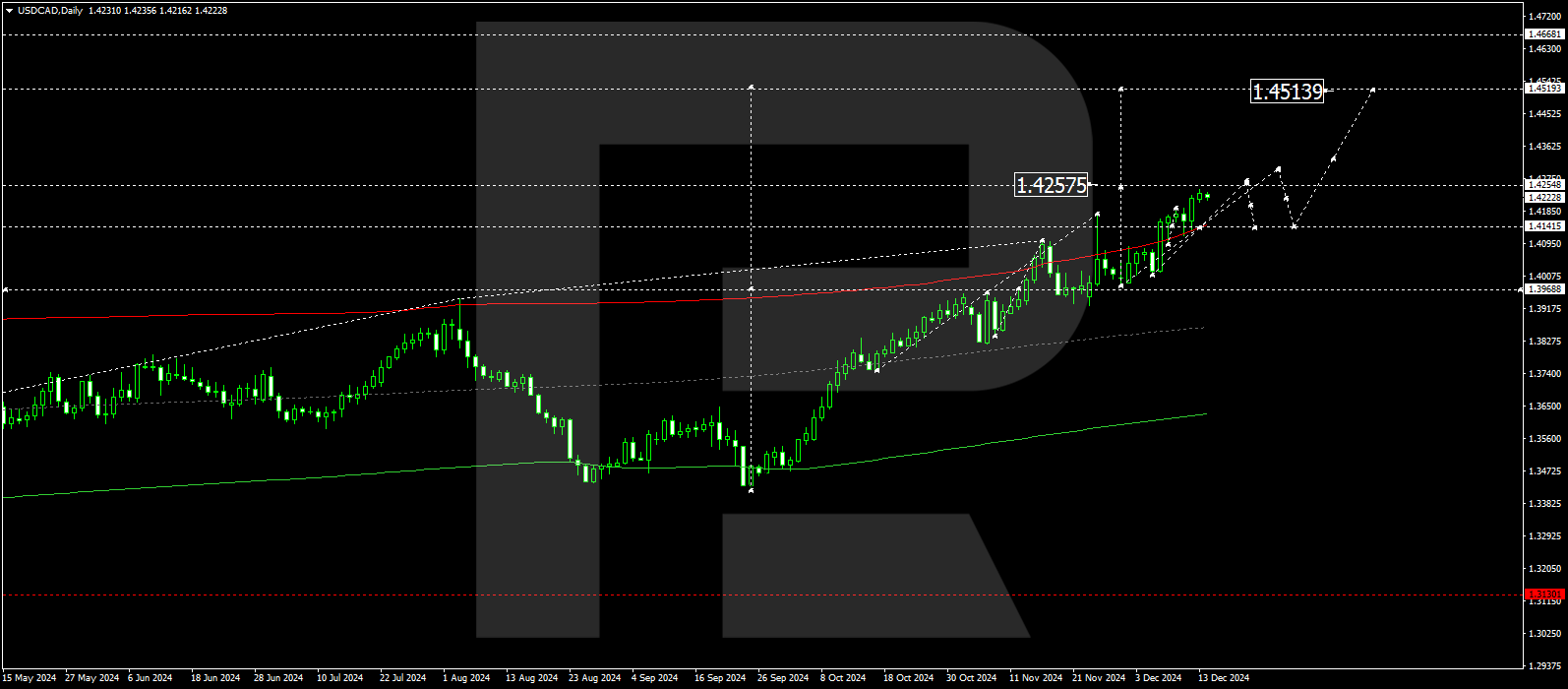

USDCAD forecast

The USDCAD pair has formed a consolidation range around 1.4141 and, after breaking above it, continues its upward trajectory towards 1.4292. After reaching this level, the USDCAD pair might correct downwards to 1.4141 (testing from above). Subsequently, a new growth wave might begin, aiming for 1.4514, the main target.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.