DE 40 analysis: the index hits a three-month high; risk appetite rises

The DE 40 index has reached a three-month peak. Investors continue to assess the economic situation as positive. Find out more in our DE 40 forecast for next week.

DE 40 forecast: key trading points

- The DE 40 index is developing a rally

- Stable economic signals drive positivity

- Resistance: 19,420.0, Support: 18,318.0

- DE 40 price forecast: 19,600.0

Fundamental analysis

The European stock market appears confident and continues to rally. August was productive for the DE 40 index, with purchases starting on 5 August and continuing with minimal pauses for consolidation.

The DE 40 forecast suggests growth may continue next week as the index’s fundamental environment remains favourable.

Investors rely on positive signals confirming a stable economic situation, with sentiment confident ahead of the global release of NVIDIA’s financial report. This data will affect the risk appetite of most high-tech companies worldwide.

Allianz and Munich Re stocks performed well in the DE 40 index yesterday, rising by 1.5% and boosting the securities of other insurance companies. Stocks of healthcare companies, led by Merck and Siemens Healthineers, remained positive. In contrast, automakers’ shares came under pressure, with Mercedes, Porsche, and VW stocks losing an average of 0.5% and BMW shares tumbling by 1.5%.

DE 40 technical analysis

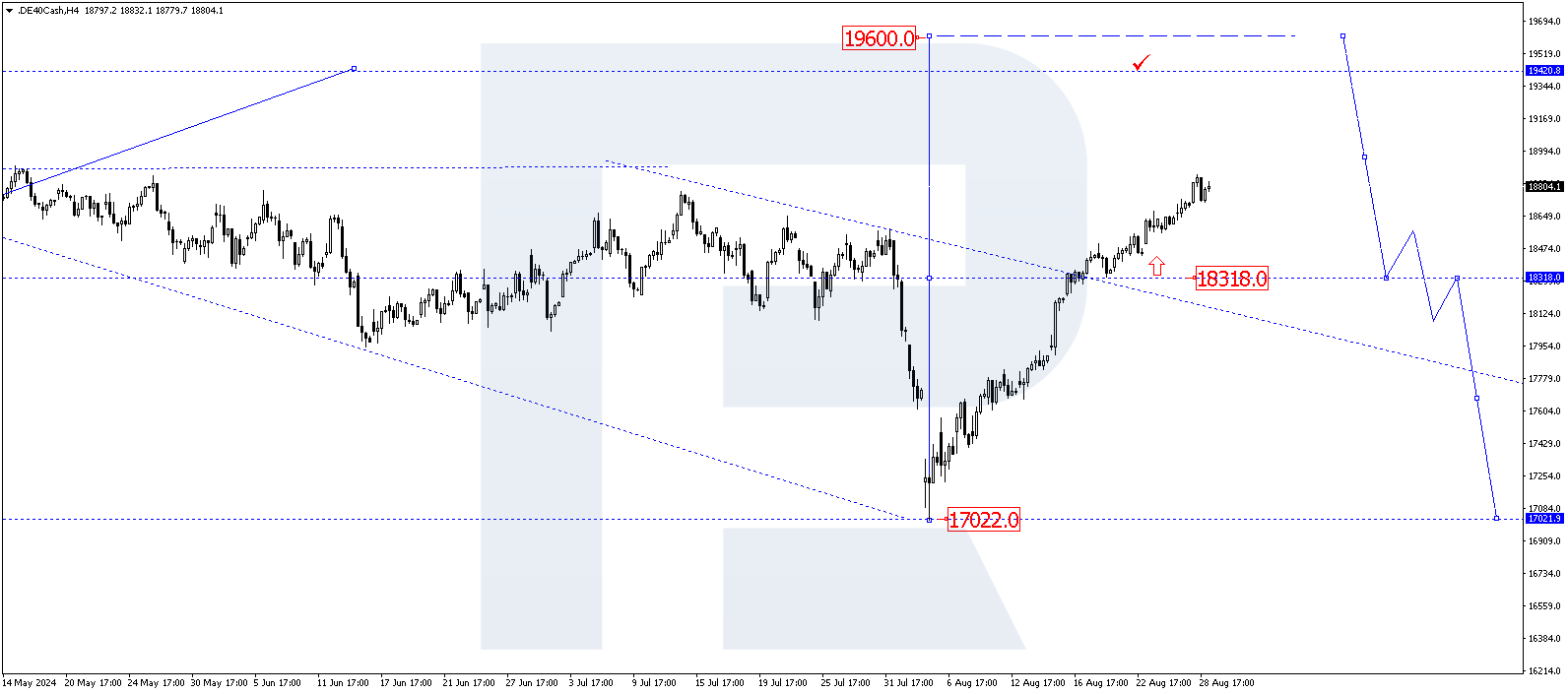

The DE 40 H4 chart shows the market has broken above the 18,318.0 level and maintains its upward momentum. A breakout of this level is considered a signal for continuing the trend towards at least 19,420.0. The wave could extend to 19,600.0. This target is seen as a measured move of the DE 40 index through the breakout of the 18,318.0 level from the wave’s low of 17,022. After the price reaches this level, a downward wave could develop, aiming for 18,994.0.

Key DE 40 levels to watch include:

- Resistance level: 19,420.0 – if the price breaks above this level, it could reach 19,600.0

- Support level: 18,318.0 – a breakout below this level would signal a movement to 17,022.0

Summary

The DE 40 index has reached a three-month high and may rise higher amid favourable economic signals. Technical indicators suggest that the index could increase to 19,420.0 and 19,600.0.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.