DE 40 analysis: after reaching a new all-time high, the index trend may turn downward

The DE 40 stock index hit a new all-time high despite weak economic indicators in Germany. The primary reason for such investor reaction is the expectation of an ECB key rate cut, which cannot be a long-term factor.

DE 40 forecast: key trading points

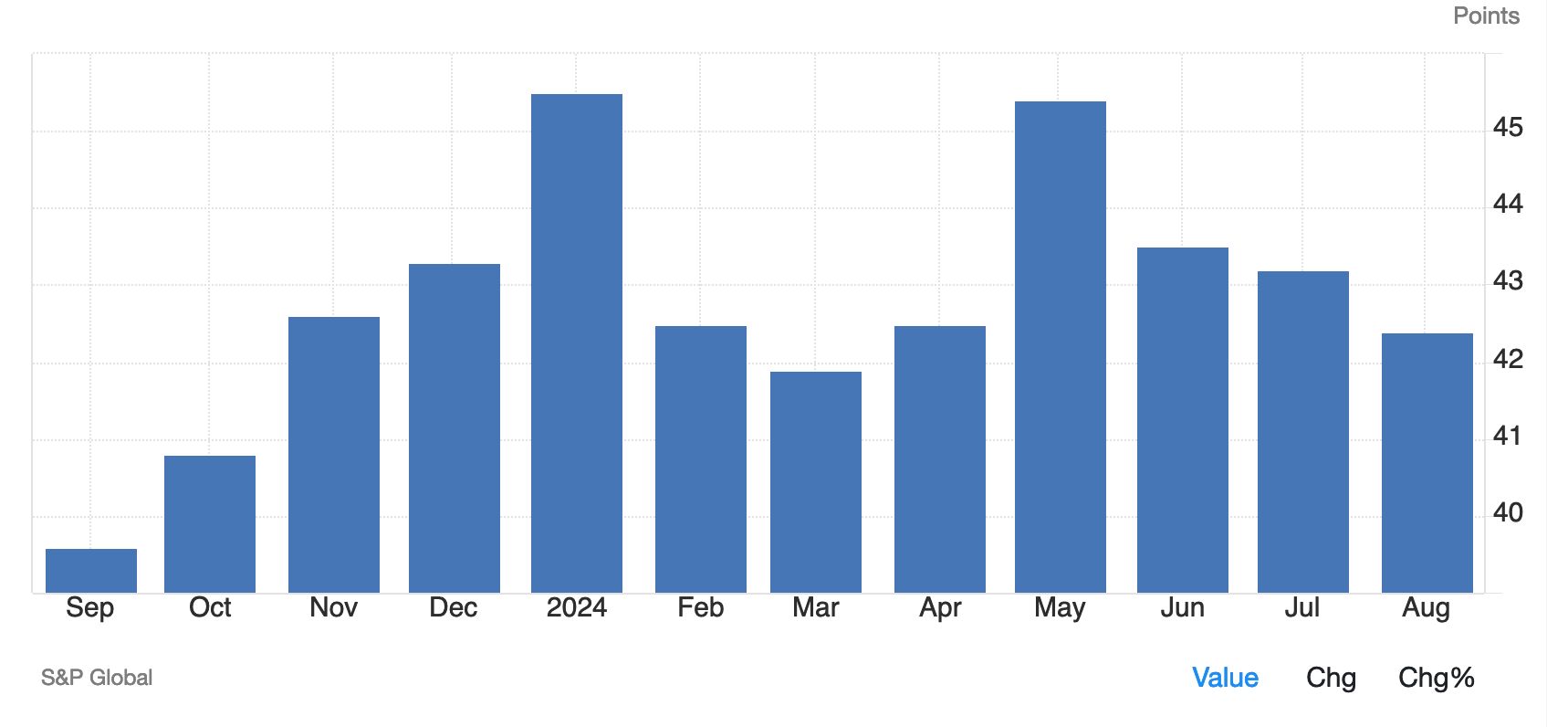

- Recent data: the manufacturing PMI reached 42.4 points in August

- Economic indicators: the real sector has a significant share in the German GDP, but the current indicators signal its stagnation

- Market impact: market participants currently ignore this indicator. However, a negative cumulative effect may adversely affect the quotes in the mid-term

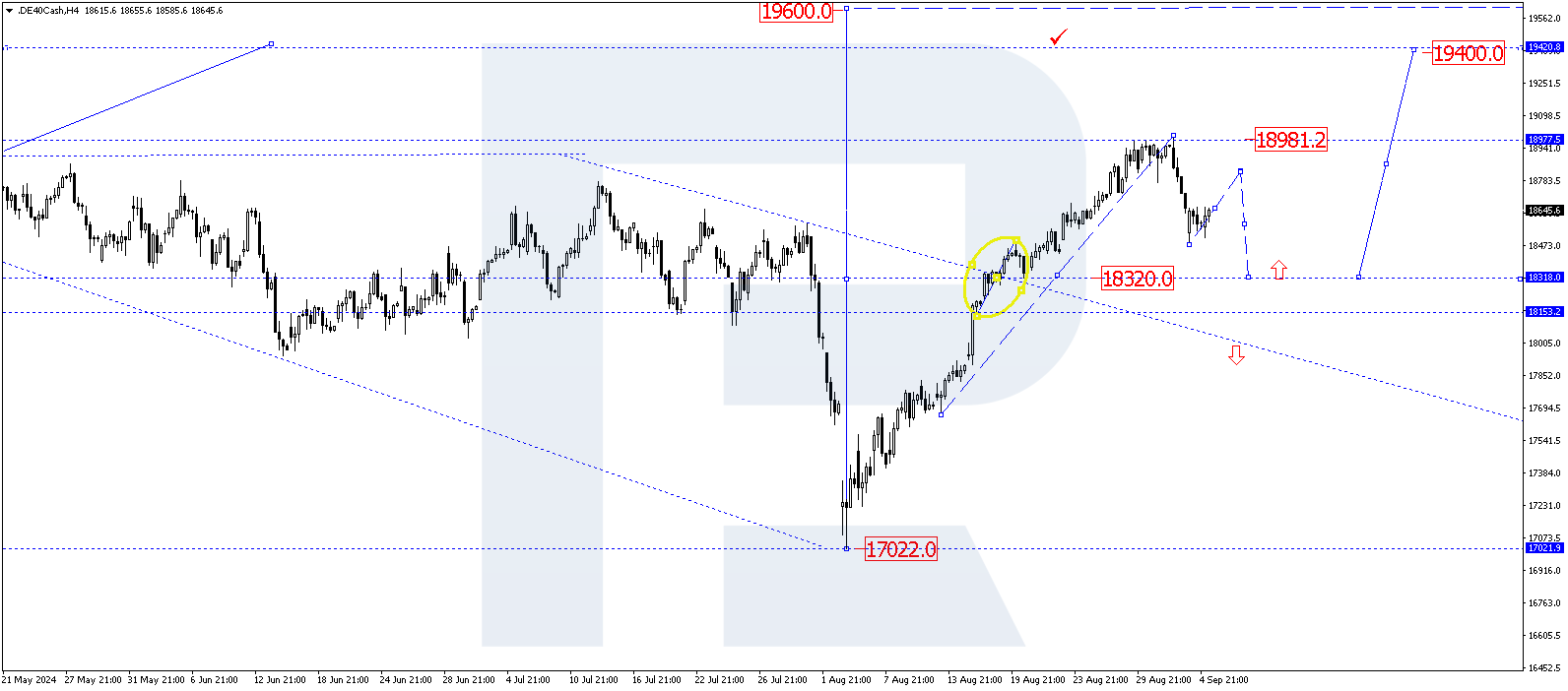

- Resistance: 18,980.0, Support: 18,430.0

- DE 40 price forecast: 17,935.0

Fundamental analysis

The manufacturing PMI came in at 42.4 points in August, exceeding analysts’ expectations of 42.1. The general trend remains downward, showing no signs of a slowdown. Germany’s GDP will likely decline or show no growth at the year-end, so the DE 40 forecast for next week is negative.

Source: https://tradingeconomics.com/germany/manufacturing-pmi

Volkswagen AG is considering German factory closures for the first time in its 87-year history, breaking tradition and provoking a conflict with trade unions. This move reflects serious challenges shaking the European automotive industry, leading to a moderately negative DE 40 index forecast.

After many years of ignoring the problem of excessive capacity and decreased competitiveness, the German auto giant's steps will likely spark a broader rethinking in the industry. The reasons are clear: European efforts to compete with Chinese companies and Tesla Inc. in the electric vehicle market have failed. The automaking industry employs 900,000 Germans, with 130,000 of them working at Volkswagen.

DE 40 technical analysis

The DE 40 stock index fell from its all-time high by 2.72%, with minor corrective growth underway. The price has not yet breached the current 18.430.0 support level, but this scenario is highly likely. There is no clear trend at the moment. From the DE 40 technical analysis perspective, a steady downtrend will emerge only after a breakout below the support level.

Key levels to watch in the DE 40 price forecast include:

- Resistance level: 18,980.0 – if the price breaks above this level, the growth target could be at 19,100.0

- Support level: 18,430.0 – a breakout below the support level may send the price down to 17,935.0

Summary

Despite weak German economic indicators, the DE 40 index hit a new all-time high before declining by 2.72%. The current 18,430.0 support level will likely be breached to reach 17,935.0. The mid-term DE 40 forecast is negative, with growth only possible in the case of an ultra-loose ECB monetary policy.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.