DE 40 forecast: after the current correction, the index may regain its historical highs

After setting an all-time high, the DE 40 stock index has corrected by 2.66% but still retains upside potential. As market conditions suggest further gains, the DE 40 forecast for next week remains positive.

DE 40 forecast: key trading points

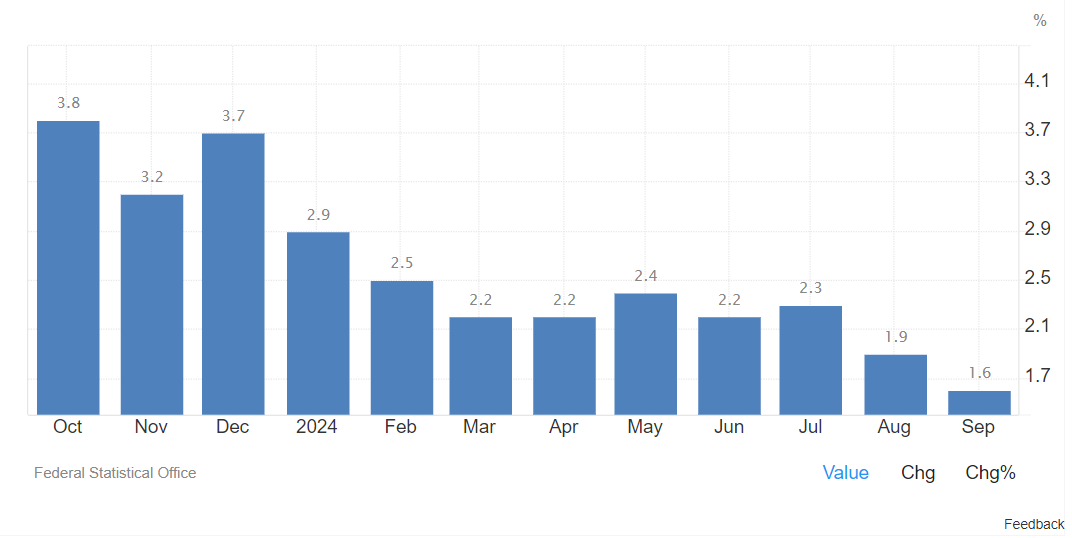

- Recent news: German CPI was 1.6% year-on-year in September, slightly below the expected 1.9%, which signals softer inflationary pressures in the economy

- Economic indicators: the CPI data reflects inflation and is critical to assessing the economy’s health. Lower-than-expected inflation can serve as a signal that the ECB may hold off on additional rate hikes

- Market impact: softer inflation news suggests the European Central Bank (ECB) may adopt a more dovish stance, which is generally positive for stock markets

- Resistance: 19,505.0, Support: 18,840.0

- DE 40 price forecast: 19,720.0

Fundamental analysis

The recent CPI slowdown (1.6% compared to 1.9% last month) is a crucial signal of weak inflationary pressure, indicating that economic activity may be contracting. This adds to the uncertainty surrounding the growth outlook.

The following scenarios are identified within the DE 40 price outlook:

- Pessimistic forecast for DE 40: in case the support level at 18,840.0 is breached, prices may fall to 18,475.0

- Optimistic forecast for DE 40: if resistance at 19,505.0 is breached, the index may rise to 19,720.0

Summary

Germany’s CPI slowed to 1.6% in September, below the expected 1.9%, signalling declining consumer activity. This slowdown adds to the risks of economic growth contraction, creating expectations of an ECB rate cut at the next meeting. Under these conditions, the short-term forecast for the DE 40 is moderately positive, with the potential for further gains in the coming weeks.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.