DE 40 analysis: reaching another all-time high may result in a large-scale correction

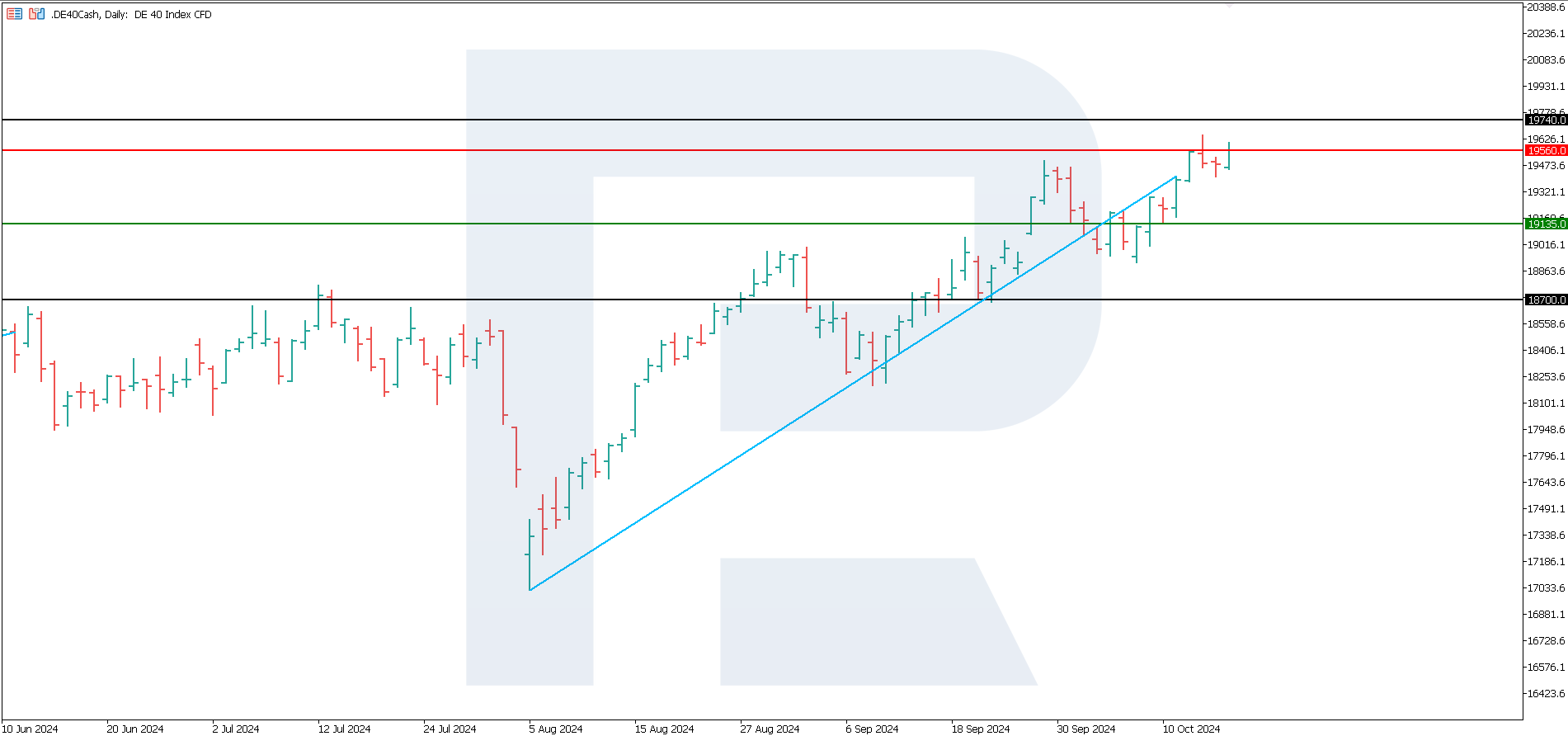

Following a minor correction, the DE 40 stock index is again attempting to reach a new all-time high and surpass the 19,560.0 resistance level. However, any subsequent decline could be even more substantial. The DE 40 forecast for next week is moderately positive.

DE 40 forecast: key trading points

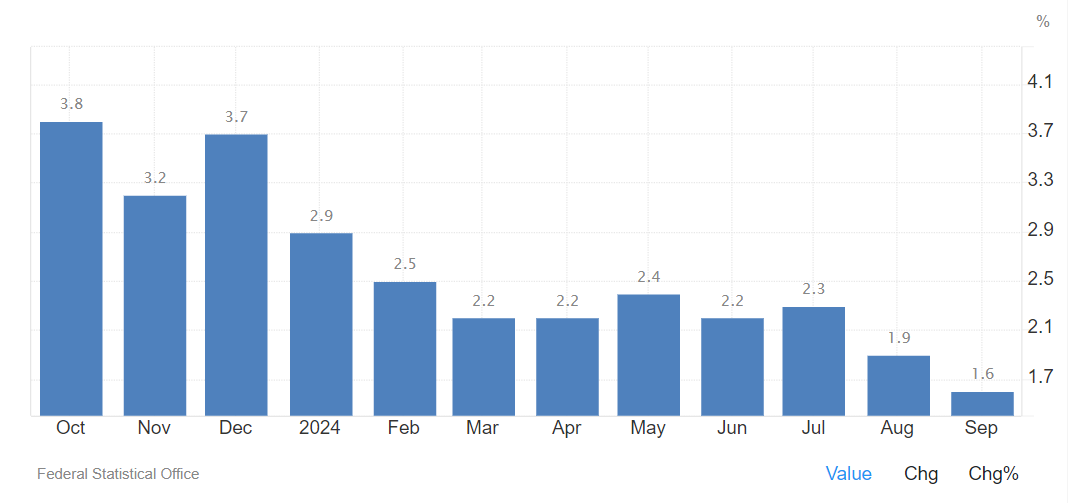

- Recent data: Germany’s Consumer Price Index (CPI) came in at 1.6% year-on-year in September

- Economic indicators: the Consumer Price Index measures the change in the prices for goods and services typically purchased by households

- Market impact: the decline in annual inflation rates could positively impact the stock market if the ECB makes a more decisive interest rate cut

- Resistance: 19,560.0, Support: 19,135.0

- DE 40 price forecast: 19,740.0

Fundamental analysis

The CPI data shows that prices were 1.6% higher in September 2024 than in September 2023, aligning with forecasts. However, the inflation rate decreased from 1.9% in August 2024. This may signal controlled inflation, easing concerns about potential economic overheating. Nevertheless, this was not the case for the German economy, considering the downturn in the manufacturing industry.

Source: https://tradingeconomics.com/germany/inflation-cpi

Low inflation is highly likely a sign of weaker economic demand, which may raise concerns among market participants. Lower inflation is often linked to slower economic growth. Investors will closely follow macroeconomic data to assess the overall state of the economy.

Last Friday, Volkswagen Group reported a 7% drop in global deliveries in Q3 2024, highlighting the challenges faced by the European automotive industry, including sluggish demand in China and high production costs in Europe. European automakers must also deal with the consequences of a potential trade war between Beijing and the European Union as the EU imposes import duties on Chinese electric vehicles in response to alleged subsidies. The DE 40 index forecast is moderately optimistic.

DE 40 technical analysis

The DE 40 stock index is in an uptrend and is poised to reach an all-time high. However, the upward momentum is weakening as each subsequent breakout above a resistance level requires a correction to the support. The likelihood of more massive sell-offs in the stock market is growing. According to the DE 40 analysis, a breakout below the 19,135.0 support level will signal the beginning of a downtrend.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: a breakout below the 19,135.0 support level could send the index down to 18,700.0

- Optimistic DE 40 forecast: a breakout above the 19,560.0 resistance level may propel the price up to 19,740.0

Summary

Germany’s consumer inflation data shows that prices were 1.6% higher in September 2024 than in September 2023, aligning with forecasts. In this case, the low CPI level is highly likely an indication of weakening economic demand, which may raise concerns among stock market participants. They will closely watch macroeconomic data to assess the overall state of the economy.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.