JP 225 analysis: the uptrend’s support line is breached; the index is likely to decline further

The JP 225 stock index has fallen by over 12% from its all-time high. The JP 225 index forecast suggests a further decline in line with the downtrend.

JP 225 trading key points

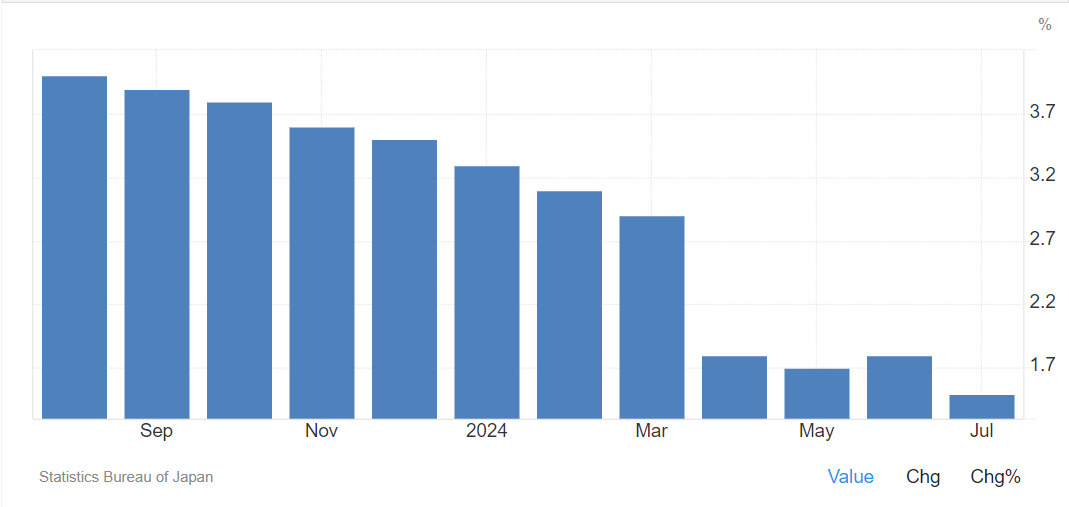

- Recent data: Japan’s inflation (excluding food and energy prices) fell to 1.5% in July

- Economic indicators: this is significantly below the Bank of Japan’s price stability target of 2.0%, allowing for more confidence in maintaining a tightening monetary policy

- Market impact: low inflation reduces the likelihood of a key rate hike, undermining demand for all Japanese assets from domestic investors

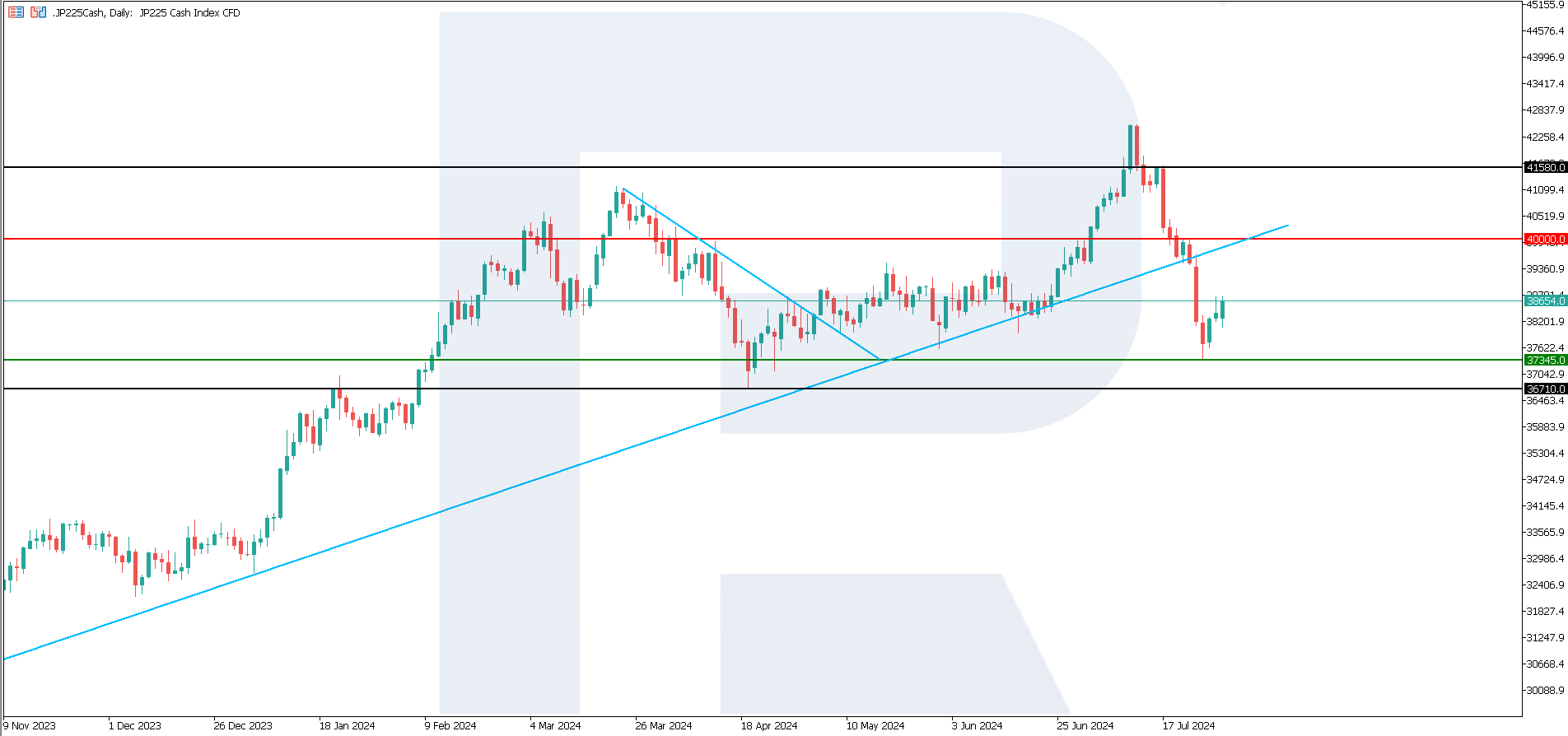

- Resistance: 40,000.0, Support: 37,345.0

- JP 225 price forecast: 36,710.0

Fundamental analysis

The Consumer Price Index (CPI), excluding fresh food and energy, decreased to 1.5% in July, markedly below the Bank of Japan’s price stability target of 2.0%. It is clear that, unlike their US counterparts, Japanese monetary authorities are grappling with low rather than high inflation rates.

Source: https://tradingeconomics.com/japan/tokyo-cpi-ex-food-and-energy

Tokyo’s Consumer Price Index (excluding fresh food and energy) averaged 0.3% over the past 20 years and stood at -0.1% between 2000 and 2020. These dynamics enabled the Bank of Japan to pursue an extremely soft monetary policy. Although the overall inflation rate has reached 2.8%, there is still room for manoeuvre.

If the regulator decides not to raise the key rate at tomorrow’s meeting, domestic investors will stop increasing their investments in Japanese assets. In this case, they will seek higher-yielding securities. External investors are already withdrawing capital from the Japanese stock market.

JP 225 technical analysis

The JP 225 stock index has breached the uptrend’s support line, thereby transitioning into a downtrend. A correction following a new all-time high is now unlikely. The downtrend will likely prevail in the short term.

Key levels to watch in the JP 225 analysis until the end of the week include:

- Resistance level: 40,000.0 – if the price breaks above this level, it could rise to 41,580.0

- Support level: 37,345.0 – if the price breaks below the support level, the index could reach 36,710.0

Summary

The JP 225 stock index is in a downtrend. Consequently, the JP 225 forecast for next week suggests a decline to 36,710.0. Low inflation rates are the fundamental reason for this, casting doubt on a potential key rate hike by the Bank of Japan.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.