US 30 analysis: index fails to reach new all-time high

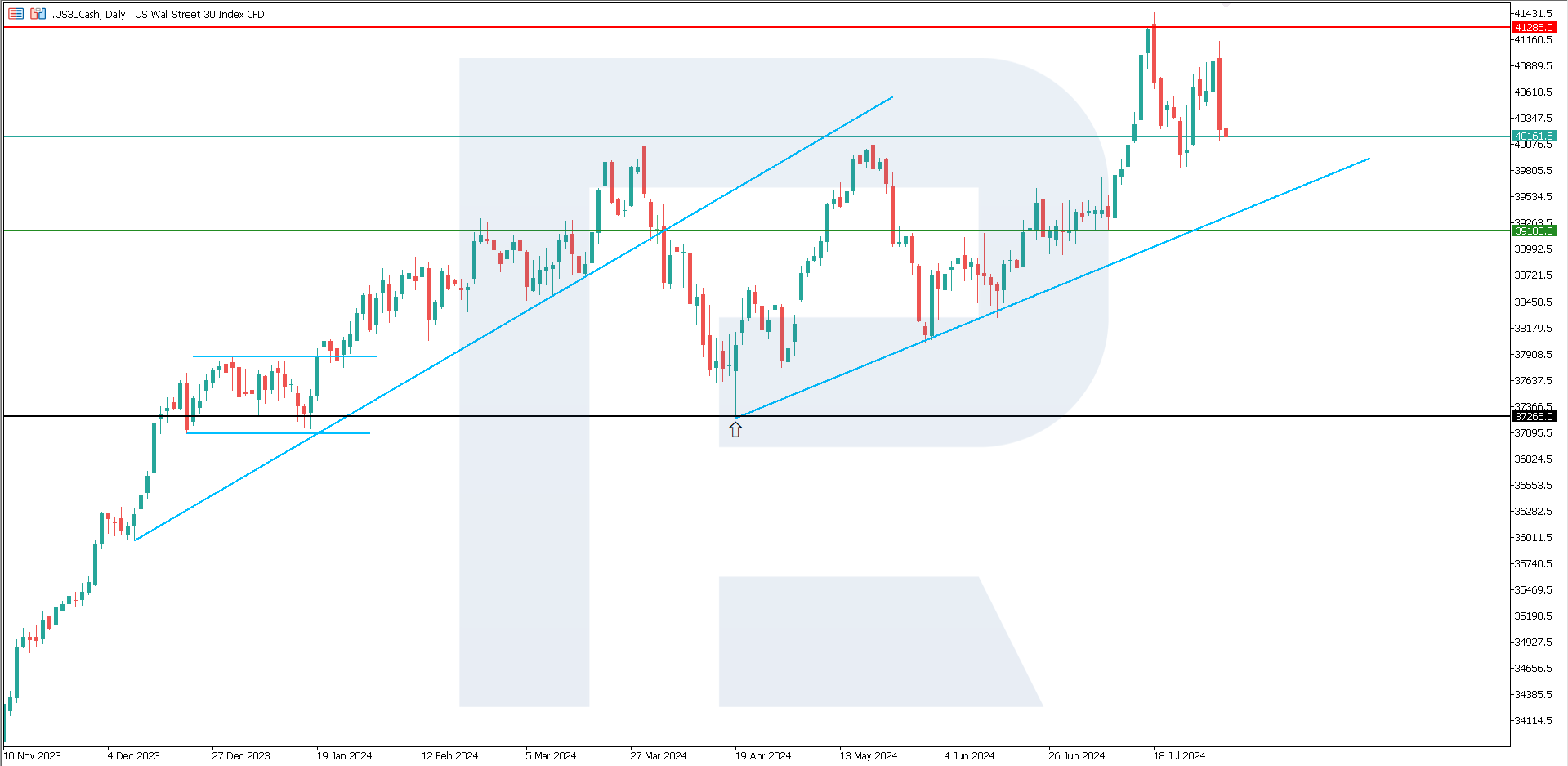

The US 30 stock index failed to hit a new all-time high, pulling back from the current resistance level. The US 30 index forecast shows that it may form a sideways channel in the mid-term.

US 30 trading key points

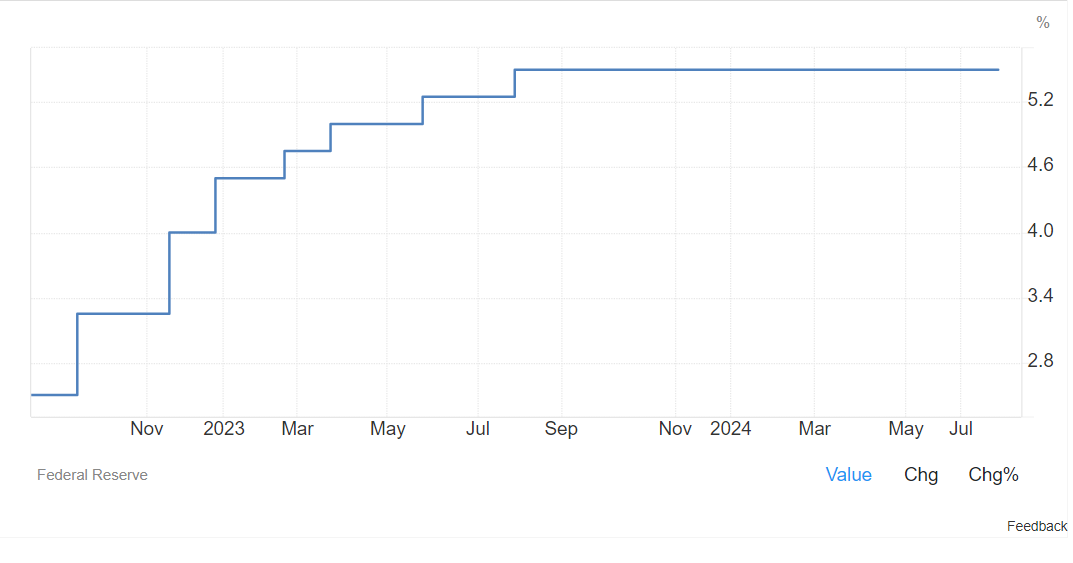

- Recent data: the Federal Reserve maintained interest rates within the 5.25-5.50% range

- Economic indicators: the key rate determines the value of money in the economy; a high rate typically hurts the stock market

- Market impact: although the key rate remained unchanged, a speech by Federal Reserve Chair Jerome Powell encouraged investors

- Resistance: 41,285.0, Support: 39,180.0

- US 30 price forecast: 41,850.0

Fundamental analysis

As anticipated by investors, the Federal Reserve left the key rate in the 5.25-5.50% range. This is the highest in 23 years and has remained unchanged for eight consecutive meetings. The decision was unanimous among the 12 FOMC members, and the market expected this move.

Source: https://tradingeconomics.com/united-states/interest-rate

The Federal Reserve will continue to reduce its balance sheet. In May, the regulator announced the forthcoming start of monetary policy tightening. The Fed lowered the maximum volume of US government bonds, the returns from which are not reinvested upon repayment, from 60 billion USD to 25 billion USD per month, with the limit for mortgage securities remaining at 35 billion USD.

The Federal Reserve’s long-term targets are maximum employment and a 2% inflation rate. The Federal Open Market Committee noted that risks associated with the Fed’s dual mandate have become more balanced. The regulator reported uncertainty in the economic forecast, which is why it remains cautious.

US 30 technical analysis

From the US 30 technical analysis perspective, the quotes remain in an uptrend as the channel’s lower boundary and the support level have not been breached. This supports a moderately optimistic view for the US 30 price forecast. Although the price is likely to reach a new all-time high, a sideways channel is possible in the mid-term.

Key levels to watch in the US 30 forecast for next week include:

- Resistance level: 41,285.0 – if the price breaks above this level, it could target 41,850.0

- Support level: 39,180.0 – if the price breaks below this support, the decline could continue to 37,265.0

Summary

The US 30 stock index has failed to reach a new all-time high but remains in an uptrend. The US 30 forecast for next week indicates that the likelihood of growth to 41,850.0 persists. The US Federal Reserve’s interest rate remained within 5.25-5.50%. The Federal Open Market Committee noted that risks associated with the Fed’s dual mandate have become more balanced.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.