US 30 forecast next week: uptrend persists despite correction

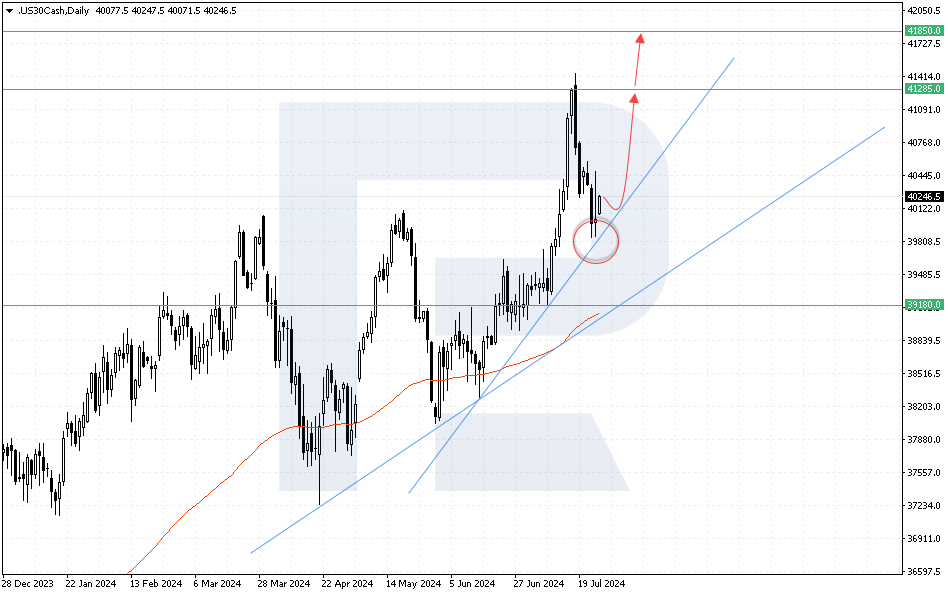

The US 30 stock index corrected by 3.85% after reaching a new all-time high, although the potential for further growth remains. However, market participants have likely already factored in a potential interest rate cut by the US Federal Reserve.

US 30 trading key points

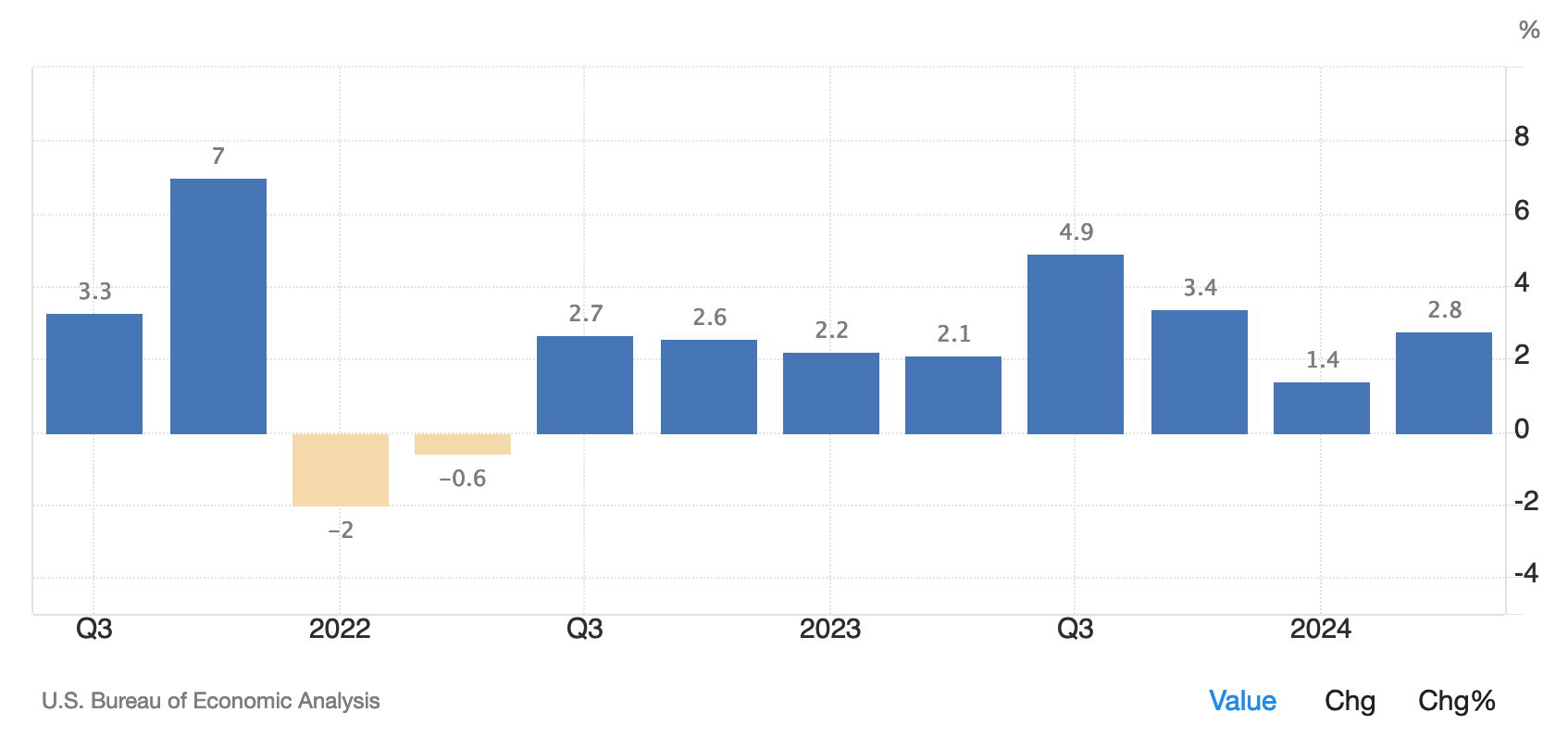

- Recent data: US Q2 GDP rose by 2.8% year-over-year, while analysts expected a 2.1% increase

- Economic indicators: although this surge was quite unexpected for analysts, it is unlikely to affect the Federal Reserve’s interest rate decision

- Market impact: such robust results of the US economy reduce the likelihood of a recession and bolster bullish sentiment among market participants

- Resistance: 41,285.0, Support: 39,180.0

- US 30 price forecast: 41,850.0

Fundamental analysis

US GDP growth in Q2 2024 exceeded forecasts. According to Department of Treasury data dated 25 July, the US economy grew at an annual rate of 2.80% over this period.

Source: https://tradingeconomics.com/united-states/gdp-growth

The US gross domestic product growth rate surpassed Wall Street expectations of a 2.10% increase. The core PCE inflation gauge slowed to 2.90% from 3.70% in the previous quarter. Personal consumption expenditures rose by 2.30%.

The US Federal Reserve will highly likely lower the key rate in September this year. The regulator’s more detailed comments, due next week, will set the price trend in the near term.

US 30 technical analysis

Following a correction of 3.85%, the US 30 stock index failed to reach the support level of the uptrend. The US 30 index forecast suggests the price will highly likely rise further towards the current resistance level, with the potential for reaching a new all-time high remaining.

Key US 30 levels to watch next week include:

- Resistance level: 41,285.0 – a breakout above this level could drive the price to 41,850.0

- Support level: 39,180.0 – if the price breaks below the support level, it will highly likely fall to 37,265.0

Summary

Despite the correction, the US 30 stock index remains in an uptrend with the potential for growth to new all-time highs. The US economy grew at an annual rate of 2.80% in Q2 2024, while analysts had expected a more modest growth of 2.10%. The US economy has proven strong enough to avoid a recession.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.