US 500 analysis: technology sector impact exceeds March 2020 levels

The US 500 stock index is poised to break the resistance level. A slowdown in underlying inflation may drive growth until the end of next week. However, the technology sector’s weight has reached critical levels, reminiscent of the March 2000 crisis.

US 500 trading key points

- Recent data: the annual inflation gauge PCE decreased to 2.6% from 2.7% last month

- Economic indicators: the data shows easing inflation, which might impact the US Federal Reserve’s decision to lower the interest rate ahead of time. The regulator primarily focuses on the PCE figures

- Market impact: the US technology sector has outperformed all others by growth rates over the last decade, rising by 706% compared to a 237% increase in the S&P 500 index. Its relative strength compared to the broad market reached a new record level in June, exceeding the previous high set in March 2000

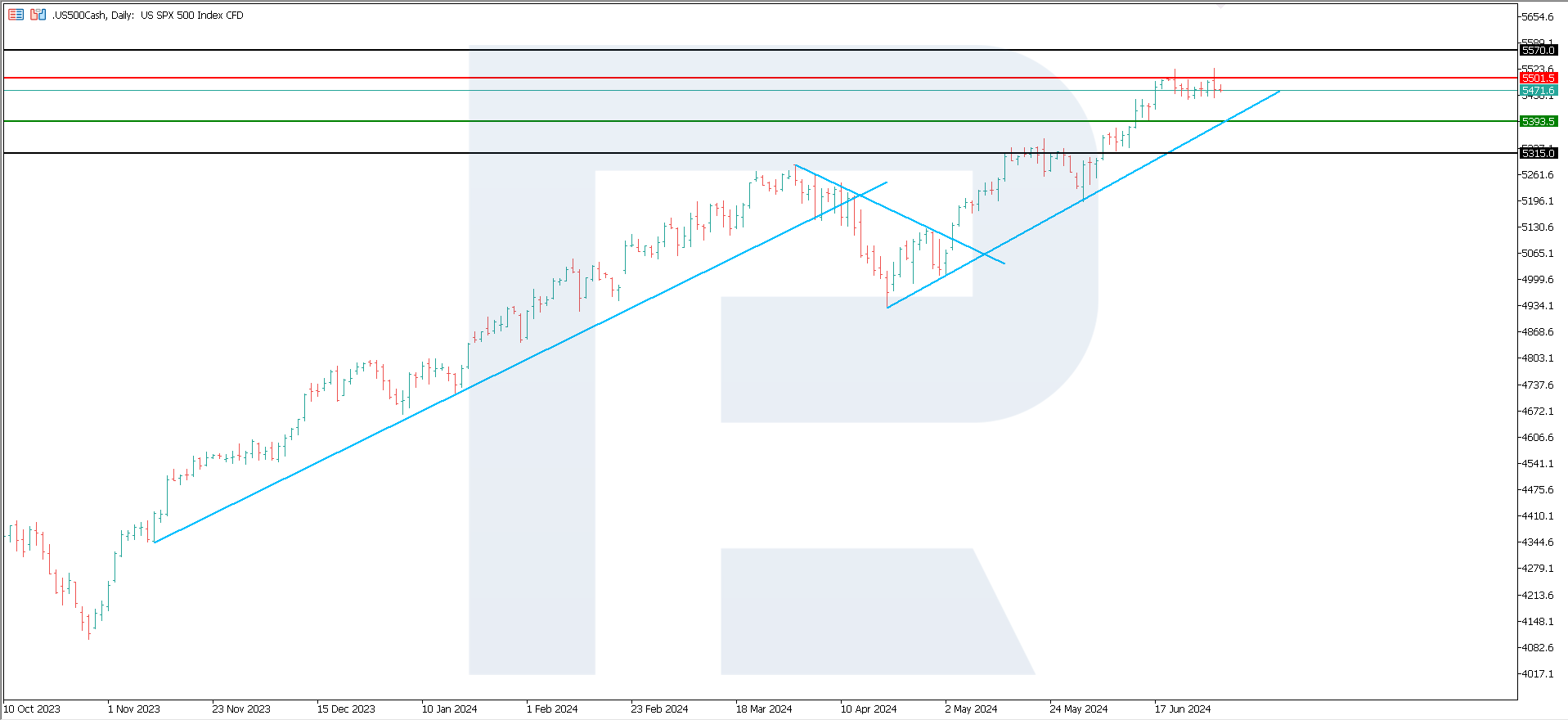

- Resistance: 5,501.5, Support: 5,393.5

- US 500 price target: 5,570.0

US 500 fundamental analysis

The PCE price index, the US Federal Reserve’s preferred inflation gauge, decreased to 2.6% from 2.7% last month, which aligns with analysts’ forecasts. The primary concern is the Federal Reserve’s future interest rate policy. Of the world’s 23 top central banks included in Bloomberg’s quarterly guide, the Bank of Japan is the only one not expected to lower borrowing costs in the next 18 months. Even the Federal Reserve is anticipated to ease monetary policy in September, which should positively affect the stock market across all industries, not just the technology sector.

US 500 technical analysis

On the daily timeframe, the US 500 index maintains an uptrend that started in late April 2024, with the technology sector as the primary growth driver. The potential for further index growth and a new all-time high persists. Key levels to watch include:

Resistance level: 5,501.5. A breakout above this level may push the index price up to 5,570.0

Support level: 5,393.5. A breakout below this level may cause the index price to decline to 5,315.0

Summary

As long as inflation continues to fall, the likelihood of the US Federal Reserve easing monetary policy remains, serving as a growth driver for the US 500 index. From a technical analysis perspective, the index maintains its upward momentum, with a target of 5,570.0.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.