US 500 analysis: correction slows but has not concluded

The US 500 stock index has returned to a growth trajectory following a correction. However, it is unlikely that the index has ceased its decline or that the quotes are poised to reach new all-time highs.

US 500 trading key points

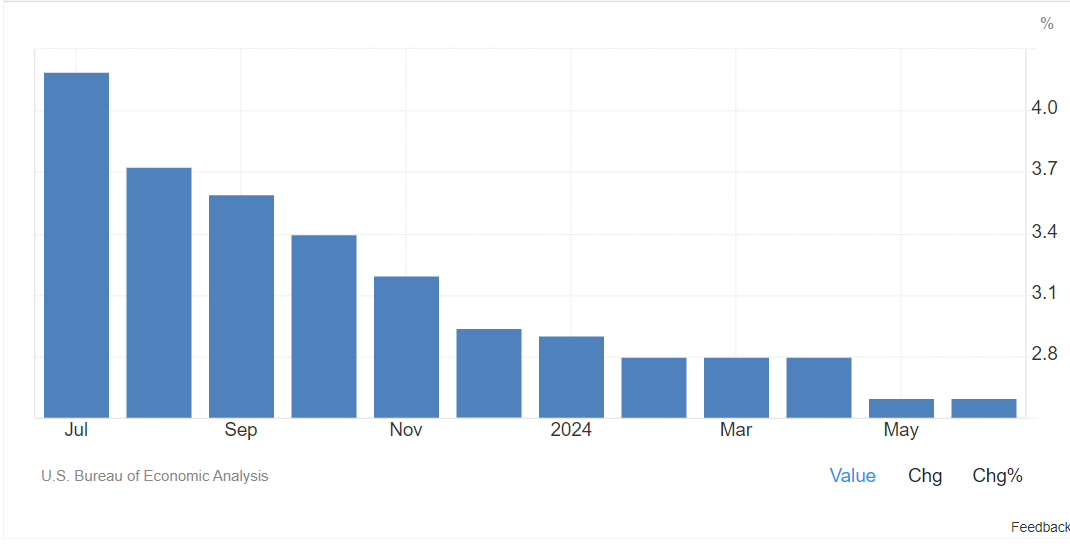

- Recent data: the annual PCE inflation gauge decreased to 2.5% from 2.6% last month

- Economic indicators: the US Federal Reserve closely monitors this indicator for its monetary policy

- Market impact: slowing PCE inflation gives more reasons for two rate cuts by the Fed

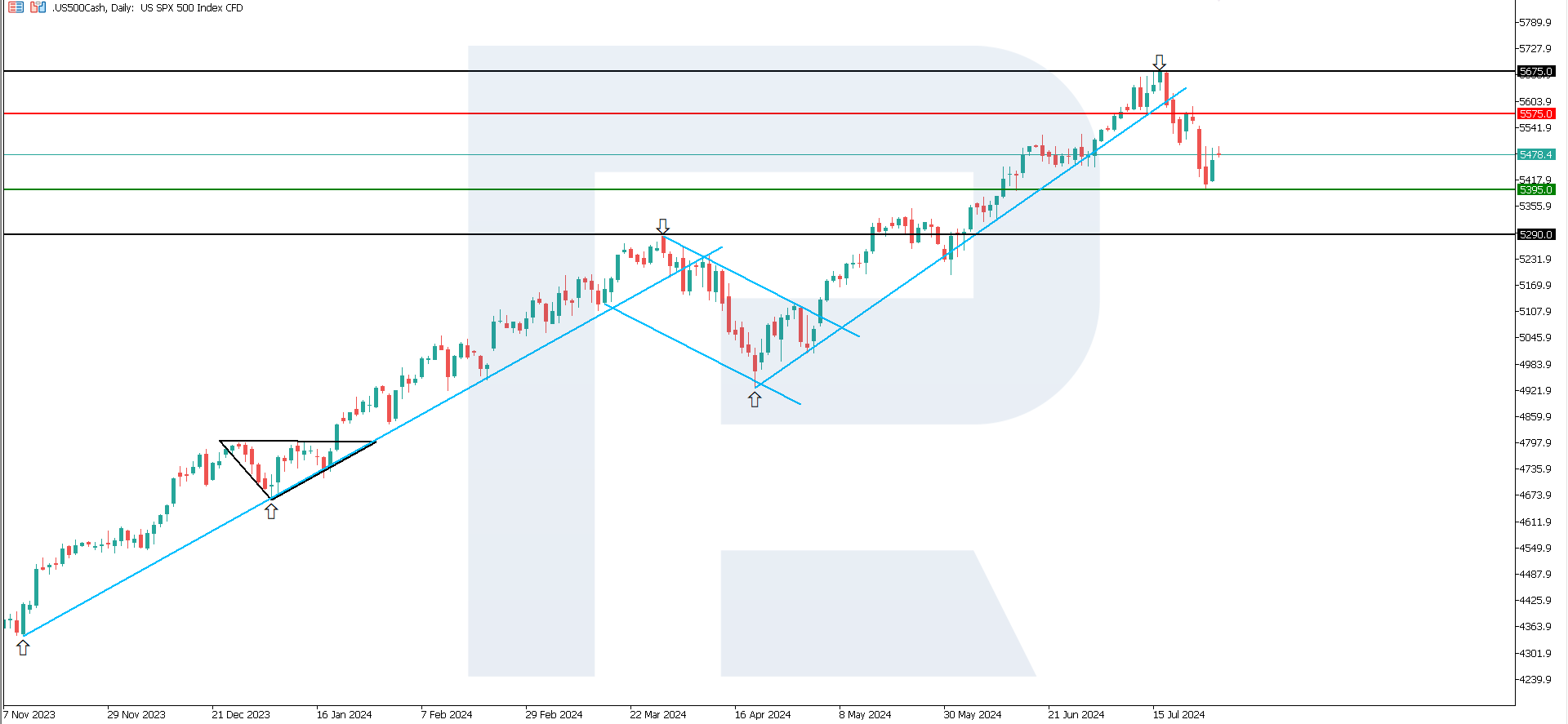

- Resistance: 5,575.0, Support: 5,395.0

- US 500 price forecast: 5,290.0

Fundamental analysis

The PCE inflation index rose by 0.1% in June, according to data released by the US Department of Commerce on 16 July. The indicator was expected to be 0.1%. The annual PCE inflation rate decreased to 2.5% from 2.6% last month.

Source: https://tradingeconomics.com/united-states/core-pce-price-index-annual-change

Based on the core PCE index, the Federal Reserve’s favourite indicator, the annual inflation rate remained at 2.6%. US consumer income increased by 0.2% in June, falling short of the expected 0.4% increase, while spending rose by 0.3%, aligning with expectations.

As a result, the US Federal Reserve is unlikely to limit itself to just one interest rate cut. The regulator will likely lower the key rate twice. The question is whether this news has already been factored into asset prices.

US 500 technical analysis

The US 500 stock index rose by 1.85% at the end of last week following a protracted decline. However, the uptrend’s support line has been breached, and no signs of a trend reversal have been observed. The quotes will highly likely tumble further this week.

Key US 500 levels to watch this week include:

- Resistance level: 5,575.0 – if the price breaks above this level, it could target 5,675.0

- Support level: 5,395.0 – if the price breaks below the support level, it might aim for 5,290.0

Summary

Although the US 500 stock index halted its decline, it is too early to talk about a trend reversal. The target for a decline could be the 5,290.0 level. Based on the Federal Reserve’s favourite gauge, the core PCE index, annual inflation rate remained at 2.6%, increasing the likelihood of two key rate cuts by the end of the year.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.