JP 225 analysis: the index holds steadily above 39,000.0

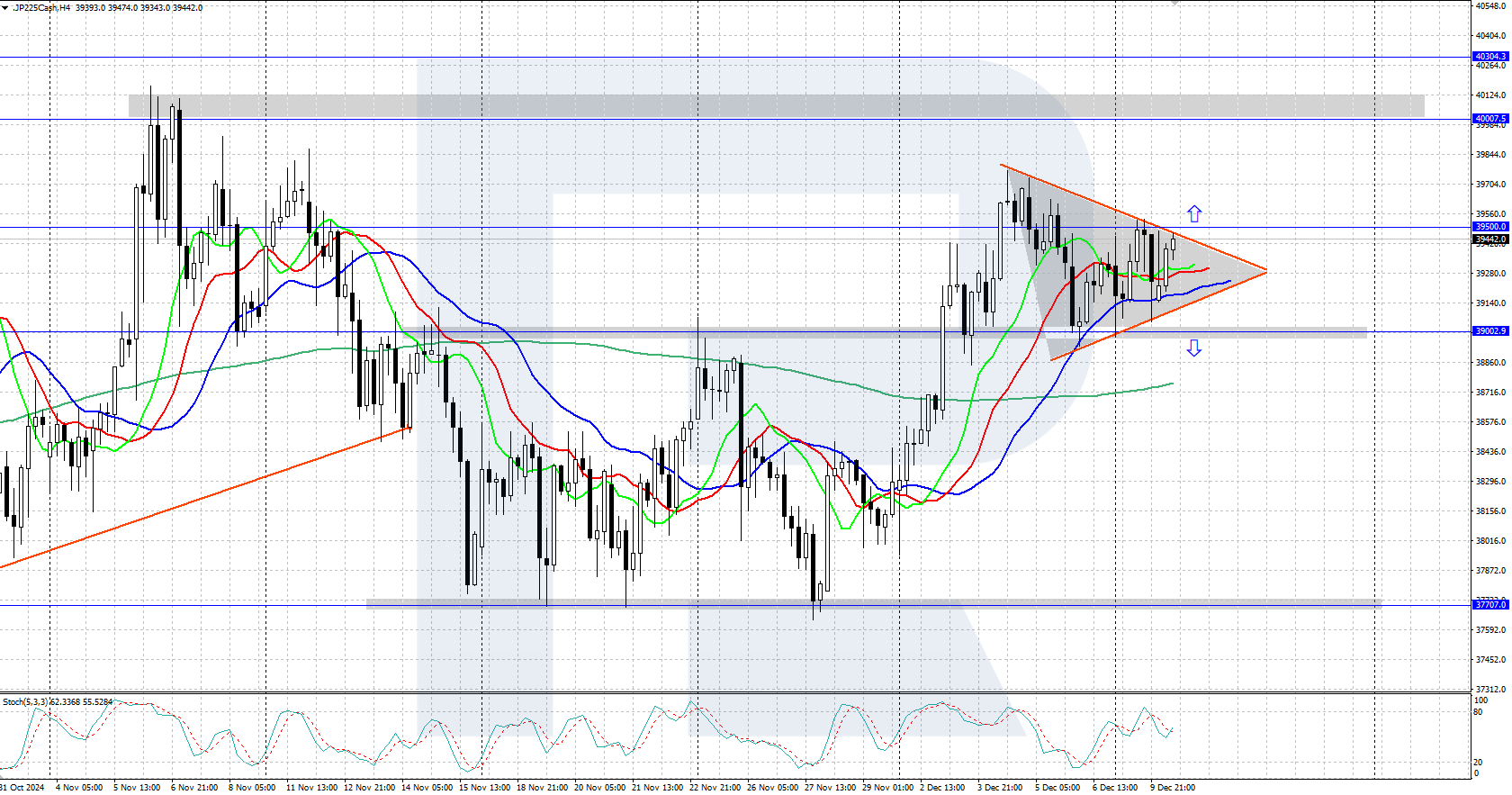

The JP 225 stock index shows upward momentum on the chart, securing above 39,000.0. The JP 225 forecast for next week is positive.

JP 225 forecast: key trading points

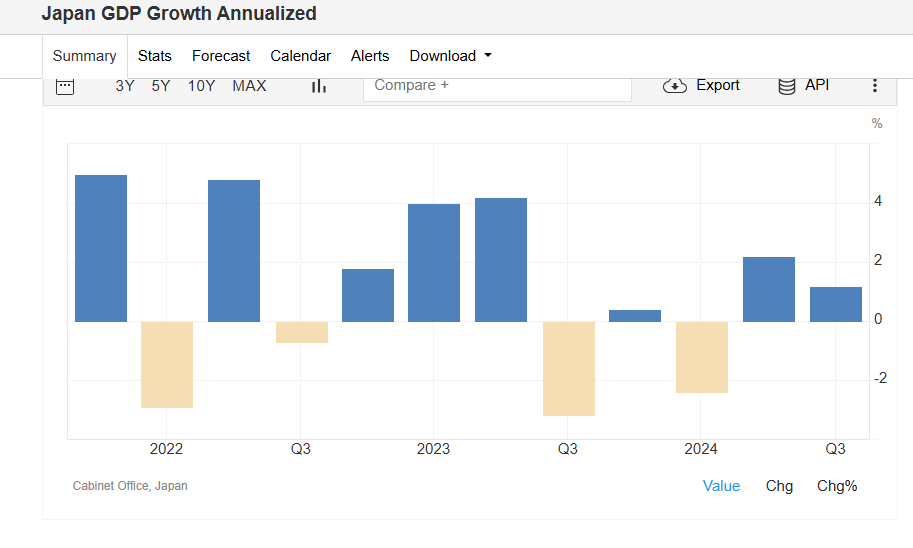

- Recent data: Japan’s GDP rose by 1.2% year-on-year in Q3 2024

- Economic indicators: GDP is the key measure of the country’s economic growth

- Market impact: an increase in the figure indicates a positive trend in Japan’s economy, while a decline signals a negative trend

- Resistance: 40,000.0, Support: 39,000.0

- JP 225 price forecast: 39,900.0

Fundamental analysis

Japan’s GDP rose by 1.2% year-on-year in Q3 2024, exceeding preliminary forecasts of 0.9% but falling short of the Q2 results (2.2%). Government spending decreased markedly in the country amid interest rate hikes.

Source: https://tradingeconomics.com/japan/gdp-growth-annualized

Bank of Japan Governor Kazuo Ueda recently stated that an interest rate hike is possible shortly as economic performance aligns with expectations. However, some Policy Board members have voiced concerns about the sustainability of economic and wage growth.

Japanese stocks rose at the start of the week amid China’s announcement of a moderately loose monetary policy, which improved market sentiment in the entire region. The biggest gainers in the JP 225 index were Sony Group (+2.7%), Kawasaki Heavy Industries (+2.3%), and Toyota Motor (+1.5%).

JP 225 technical analysis

The JP 225 stock index experiences upward momentum on the chart, firmly securing a position above the 39,000.0 level. The index now has the potential for growth to the psychologically important resistance level of 40,000.0.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: if the price falls below the 39,000.0 support level, the index could drop to 37,700.0

- Optimistic JP 225 forecast: if the price steadily rises above 39,500.0, the index could continue its ascent to 40,000.0

Summary

The JP 225 stock index shows moderate growth at the start of the week, securing above the 39,000 level. The index forecast for next week is positive.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.