US 30 analysis: Donald Trump’s victory and the US Fed interest rate cut spark market euphoria

The US 30 stock index has reached a new all-time high and is rising steadily following the US Federal Reserve’s key rate cut. Find out more in our US 30 analysis and forecast for next week, 11-17 November 2024.

US 30 forecast: key trading points

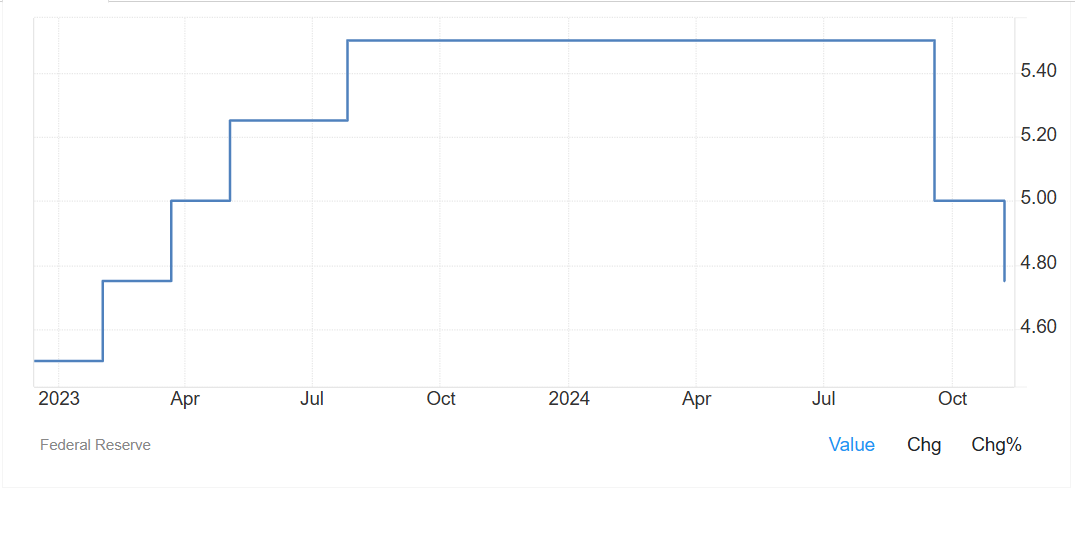

- Recent data: the US Federal Reserve lowered the interest rate to 4.75%

- Economic indicators: the interest rate determines the cost of money in the economy

- Market impact: a rate cut positively impacts the stock market and drives economic growth

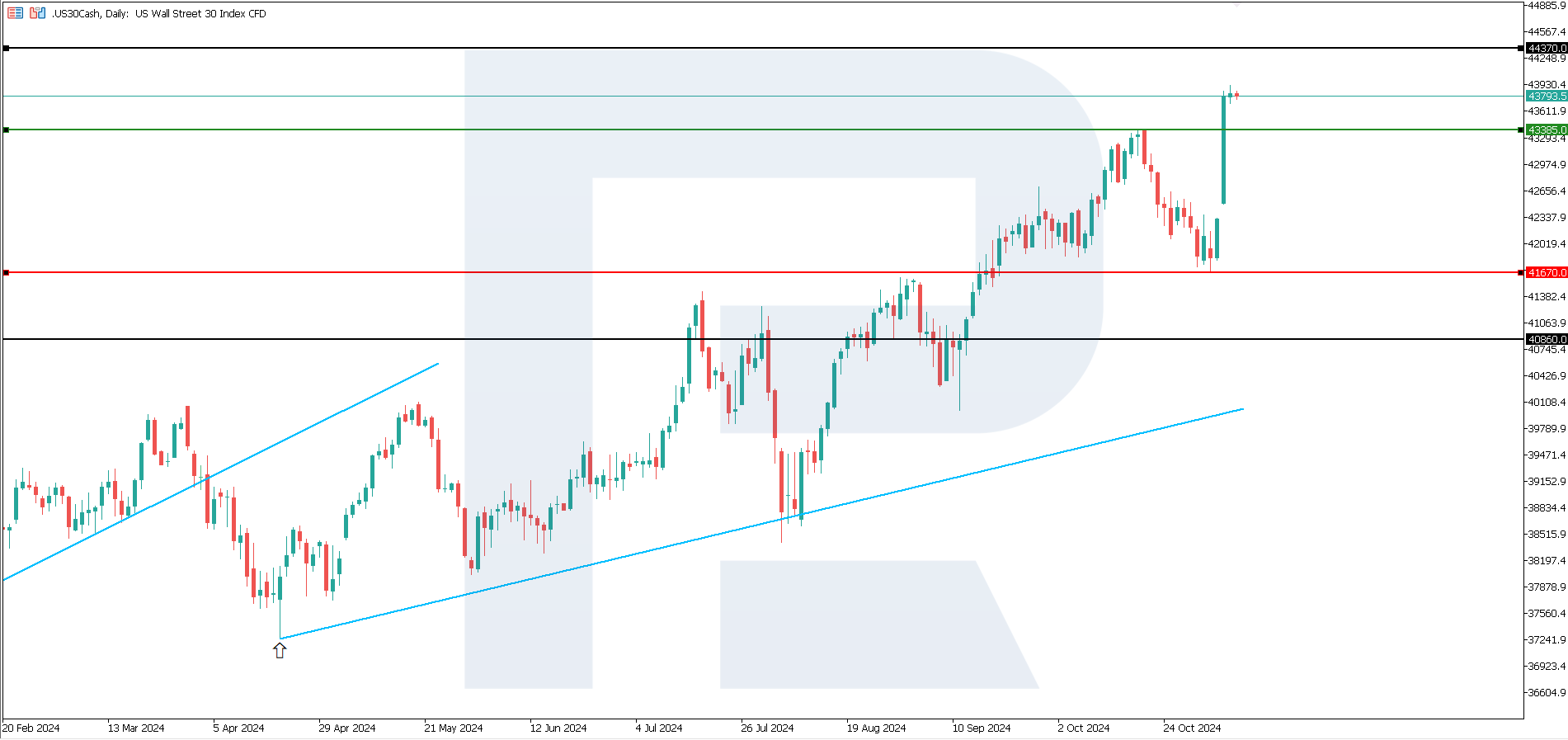

- Resistance: 43,385.0, Support: 41,670.0

- US 30 price forecast: 44,370.0

Fundamental analysis

The Fed’s press office reported that the US Federal Reserve trimmed interest rates by 25 basis points to 4.50-4.75%. The last instance of two consecutive rate cuts within a single cycle occurred in March 2020. Reducing the key rate makes loans cheaper for businesses and consumers, stimulating economic activity in the US.

Source: https://tradingeconomics.com/united-states/interest-rate

The latest data from the Federal Reserve indicate that economic activity continues to grow steadily. The 0.25% Federal Reserve rate cut may positively impact the stock market, especially for companies focused on domestic demand and consumption. Lower borrowing costs typically encourage increased spending by businesses and consumers, which may improve the earnings of retail trade, consumer services, and technology companies.

Lower rates also reduce corporations’ borrowing costs, enabling increased investments in business development and process improvement. Investors typically respond to such measures from the Federal Reserve with growing optimism, which can boost stock prices. With sustained economic growth, as noted in the regulator’s announcement, the market may anticipate a further increase in companies’ earnings, supporting the stock market. The US 30 index forecast is optimistic.

US 30 technical analysis

The US 30 stock index has reached a new all-time high and remains in a strong uptrend. According to the US 30 technical analysis, the next growth target could be the 44,370.0 level if the quotes hold above the previously breached resistance level at 43,385.0. There are no signs of a trend reversal in the medium term.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 41,670.0 support level could push the index down to 40,860.0

- Optimistic US 30 forecast: if the price holds above the previously breached 43,385.0 resistance level, it could rise to 44,370.0

Summary

The US Federal Reserve lowered interest rates by 25 basis points to 4.50-4.75%. The regulator believes that the latest data show steady economic growth. The US 30 stock index has reached a new all-time high and is in a stable uptrend, with the next growth target at 44,370.0.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.