US 500 analysis: the uptrend is likely to continue, with the index set to reach new all-time highs

The US 500 index is in an uptrend following the US Fed's decision to cut the key rate. The US 500 forecast for next week is cautiously optimistic.

US 500 forecast: key trading points

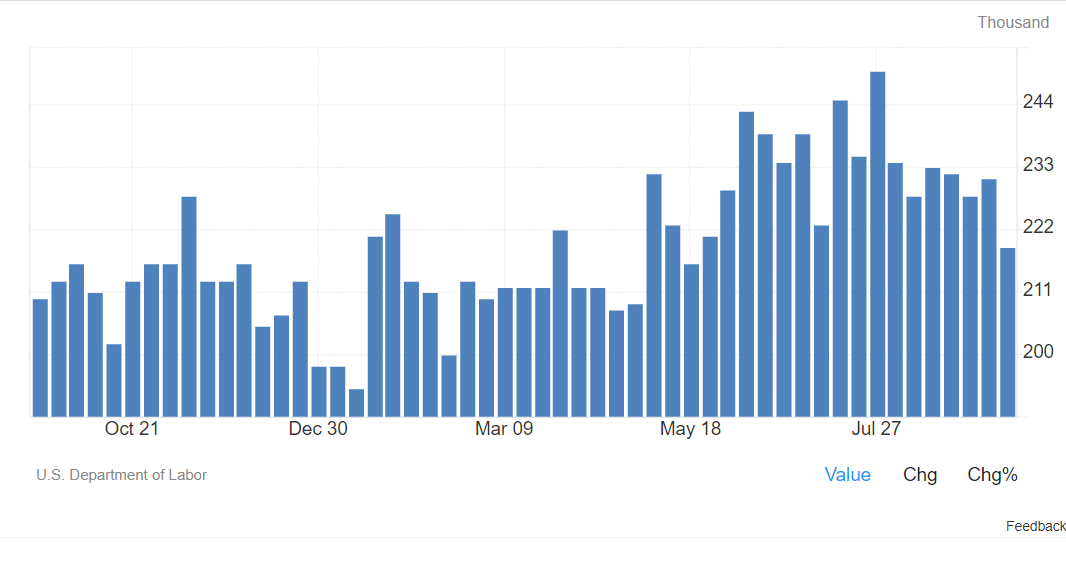

- Recent data: Initial Jobless Claims decreased by 12k to 219k in the previous week

- Economic indicators: the labour market is one of the two most important indicators for the US Fed in setting monetary policy parameters

- Market impact: strengthening of the labour market induces tightening of monetary policy, while weakness encourages easing

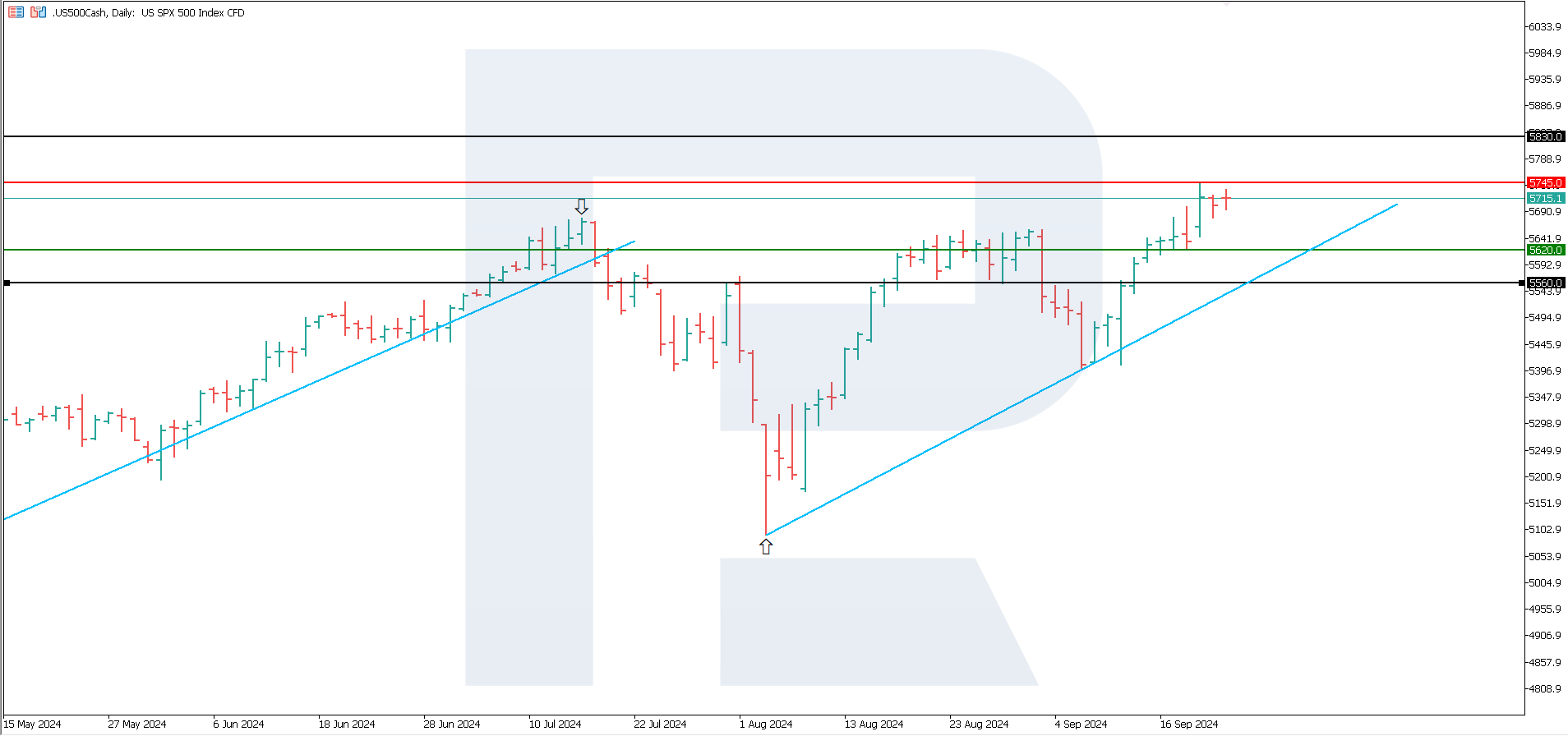

- Resistance: 5,745.0, Support: 5,620.0

- US 500 price forecast: 5,830.0

Fundamental analysis

The US Department of Labour reported on 19 September that the previous week's initial claims for unemployment benefits decreased by 12,000 to 219,000. The number of applications was expected to fall to 229,000. The previous figure was revised to 231,000 from 230,000.

Source: https://tradingeconomics.com/united-states/jobless-claims

The indicator's average value over four weeks decreased by 3,500 to 227,500. The total number of applications decreased by 14,000 to 1.829 million. The previous figure was revised to 1.843 million from 1.850 million.

The Federal Open Market Committee (FOMC) cut the benchmark interest rate by 50 basis points to 4.75-5.00%, marking the first rate cut in more than four years. The Federal Reserve's forecast projects the US economy to grow at 2.00% in 2024 and remain at that level for the following three years. The Fed slightly lowered its estimate for gross domestic product (GDP) growth this year to 2.00% from 2.10% in its June forecast. The unemployment rate forecast was raised to 4.40% for the end of this year, up from the previous forecast of 4.00% made just three months ago. The forecast for the US 500 Index remains cautiously optimistic.

US 500 technical analysis

The US 500 stock index is in an uptrend with the potential to reach an all-time high. The most likely scenario for further development is a breakthrough of the current resistance level at 5,745.0. From the US 500 technical analysis perspective, even a corrective decline to 5,620.0 would not indicate a reversal, as the uptrend line is significantly lower.

There are two basic scenarios for the US 500 price forecast:

- Optimistic forecast for US 500: If the resistance level at 5745.0 is breached, 5830.0 may become the growth target.

- Pessimistic outlook for the US 500: If the 5620.0 support level is breached, the price may fall to 5560.0.

Summary

Labour market indicators were revised upwards: jobless claims fell by 14,000 to 1.829 million. However, such dynamics are unlikely to prompt a more decisive interest rate cut by the US Federal Reserve. The regulator deems the current rate of inflation decline satisfactory, so the US 500 will likely continue to reach new historical highs.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.