US Tech analysis: uptrend continues, but historical high not yet renewed

The US Tech stock index is in an uptrend and will likely renew its historical high. The US Tech forecast for next week is moderately positive.

US Tech forecast: key trading points

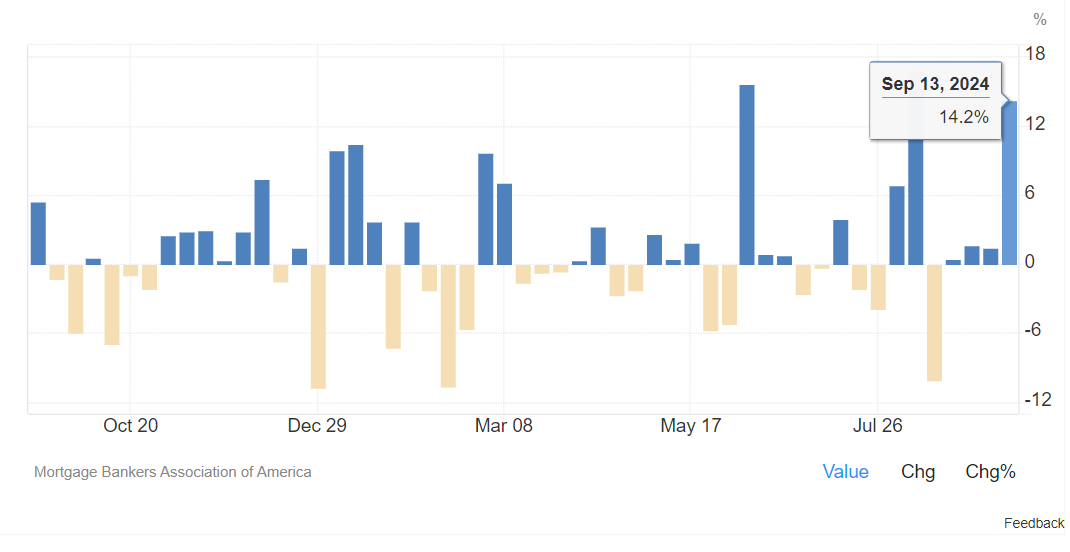

- Recent data: mortgage applications registered in the US last week increased by 14.20%

- Economic indicators: mortgage demand indicators have an indirect impact on inflation and the overall economy

- Market impact: lower mortgage rates and higher applications indicate increased demand in the property market

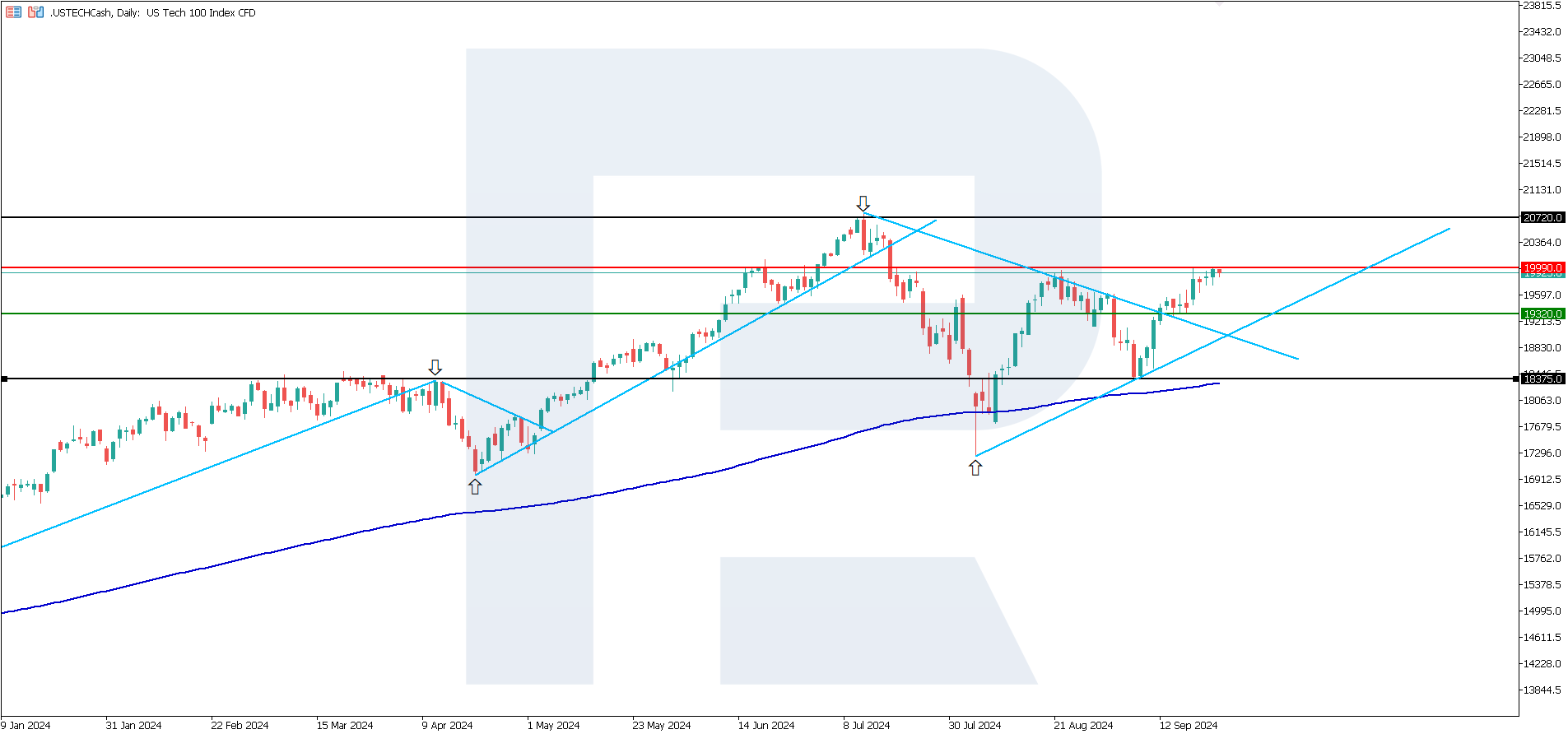

- Resistance: 19,990.0, Support: 19,320.0

- US Tech price forecast: 20,720.0

Fundamental analysis

The number of mortgage applications in the US continues to grow. Last week, registrations increased by 14.20% on a seasonally adjusted basis from the previous week, as the Mortgage Bankers Association (MBA) reported on 18 September. The refinance index rose 24.20%. The average rate on a 30-year mortgage fell to 6.15% from 6.29%.

Source: https://tradingeconomics.com/united-states/mortgage-applications

Representatives of the US Federal Reserve System acknowledge the possibility of another significant interest rate cut. Policymakers noted that the current value still places considerable pressure on the US economy, and a further reduction may be required to achieve a ‘neutral’ rate. The President of the Federal Reserve Bank of Chicago, Austan Goolsbee, expressed a similar view.

Thus, further reductions in the US Fed’s key rate by 0.50% rather than 0.25% cannot be ruled out. This would have a favourable impact on the stock market and stimulate price growth. For this reason, the forecast for the US Tech index is moderately positive.

US Tech technical analysis

The US Tech stock index is in an uptrend, consistently surpassing each newly formed resistance level. Although the growth rate is somewhat slower than other US stock indices, from a technical analysis perspective, US Tech may renew its historical maximum in the short term.

The following scenarios are identified for the US Tech price outlook:

- Pessimistic forecast for US Tech: if the support level at 19,320.0 is breached, the downside target could be 18,375.0

- Optimistic forecast for US Tech: if resistance at 19,990.0 is breached, the upside target will be 20,720.0.

Summary

Representatives of the US Federal Reserve leave room for another significant interest rate cut, which could give the stock market an additional growth impulse. The US Tech stock index is in an uptrend and aiming for an all-time high. A break above the resistance level at 19,990.0 will serve as a signal for further growth.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.