US Tech analysis: the index continues steady growth

The US Tech stock index is in an uptrend and is expected to reach new all-time highs. The forecast for US Tech next week is positive.

US Tech forecast: key trading points

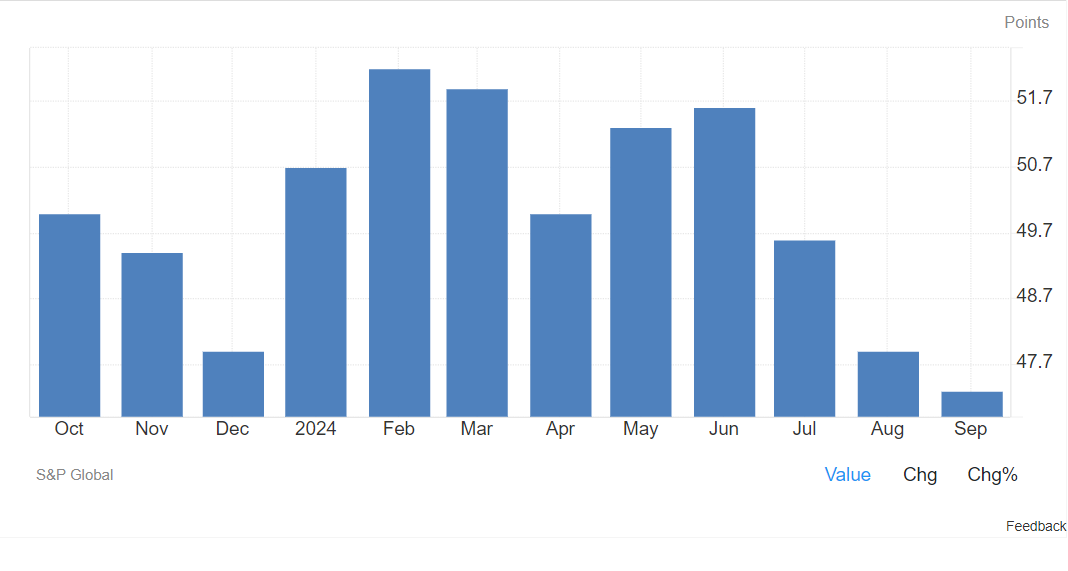

- Recent data: ISM Manufacturing PMI was 47.2% in September

- Economic indicators: the ISM Manufacturing PMI is an indicator of the manufacturing sector’s economic health, as it reflects changes in demand, output, and employment levels

- Market impact: in a declining PMI environment, defensive sectors (healthcare and utilities) may become more attractive

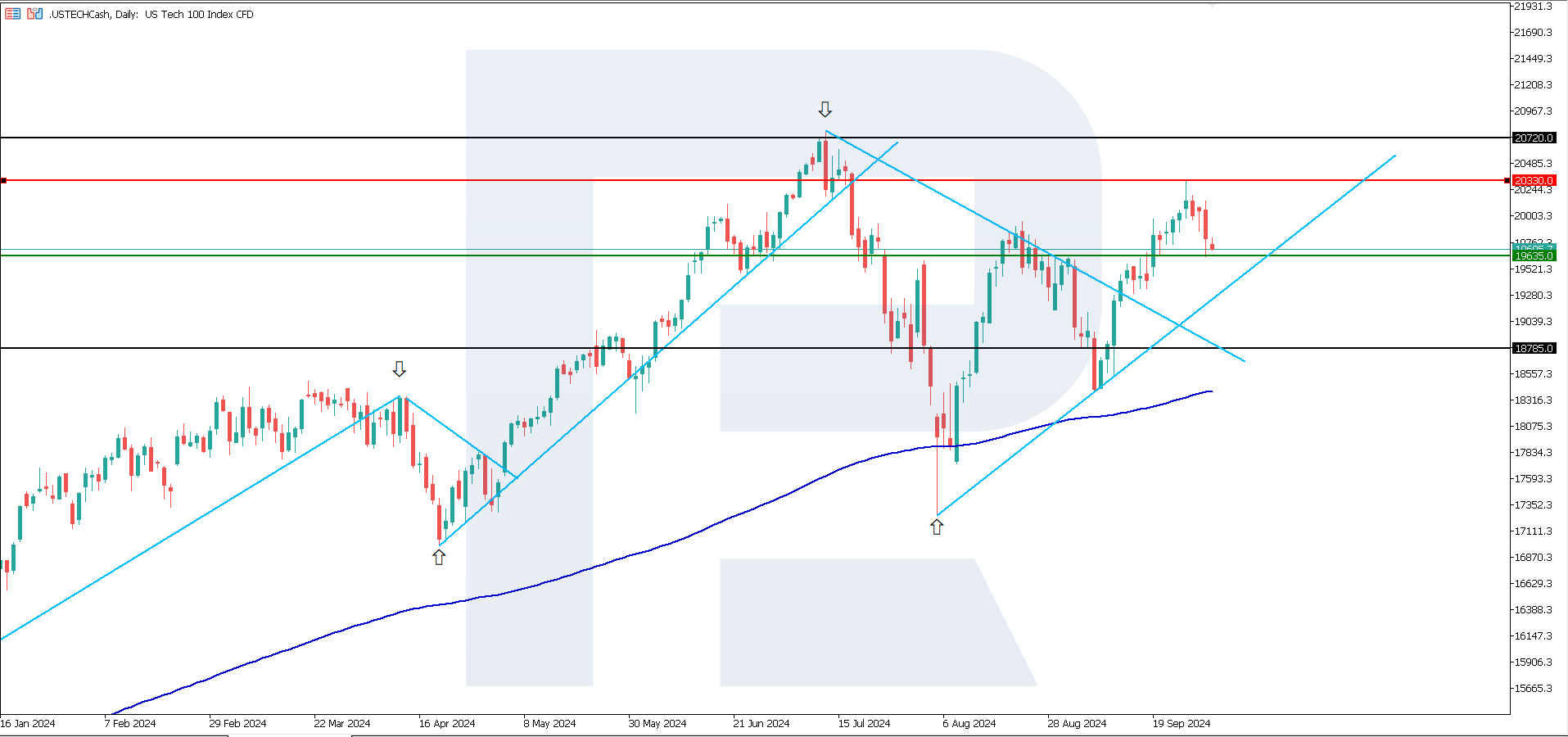

- Resistance: 20,330.0, Support: 19,635.0

- US Tech price forecast: 20,720.0

Fundamental analysis

The contraction in US manufacturing activity, as reflected in the ISM PMI (ISM PMI), which remains at 47.2%, indicates a continued downturn in the manufacturing sector. A value below 50.0% signals a contraction in manufacturing activity, which may suggest weaker product demand, slower economic growth, and increased uncertainty among businesses.

Source: https://tradingeconomics.com/united-states/manufacturing-pmi

US manufacturing activity has contracted for the sixth consecutive month. In response, the US Fed may consider more aggressive monetary policy easing, potentially reducing interest rates to stimulate the economy and support demand. The labour market data to be released this Friday will be particularly important.

If unemployment in the US rises again, rumours of a 0.50% cut in the Fed Funds rate could materialise. Such a move would benefit the stock market and accelerate the stock indices’ growth rate. The medium-term forecast for US Tech remains positive.

US Tech technical analysis

US Tech is in an uptrend and is set to reach new all-time highs. It has been recovering for longer than other indices after the decline in early August this year. A break above the current resistance level at 20,330.0 will signal further growth. The nearest target for the upward trend could be 20,720.0.

Within the US Tech price outlook, the following scenarios are identified:

- Pessimistic forecast on US Tech: if the support level at 19,635.0 is breached, prices could fall to 18,785.0

- Optimistic forecast for US Tech: if resistance at 20,330.0 is breached, the index may rise to 20,720.0

Summary

US manufacturing activity has contracted for the sixth consecutive month. The ISM Manufacturing PMI remains at 47.2%, indicating an ongoing deterioration in the manufacturing sector. A reading below 50.0% signals a decline in manufacturing activity, which may suggest weaker product demand. This trend could prompt the US Federal Reserve to lower the key rate more aggressively, supporting the stock market.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.