US Tech analysis: the index is poised to continue the uptrend after rebounding from the support level

The US Tech stock index is poised to continue growing after a correction towards the support level; it is likely to have enough potential to reach a new all-time high. The forecast for US Tech for next week is moderately optimistic.

US Tech forecast: key trading points

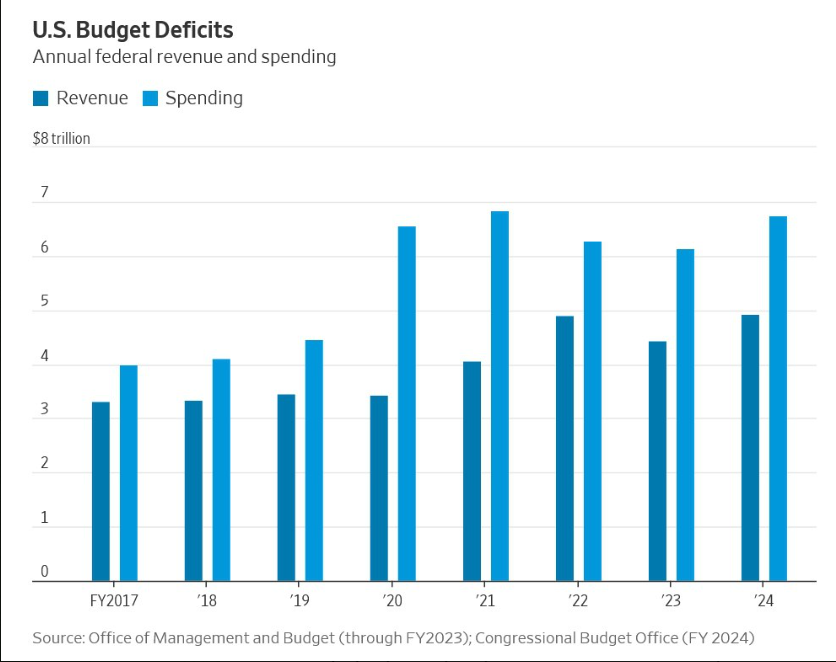

- Recent data: the US federal budget deficit reached 1.8 trillion USD

- Economic indicators: the size of the federal budget deficit directly impacts the government debt market and the US Federal Reserve interest rate

- Market impact: with the increasing federal budget deficit, the government debt market may adversely affect the stock market in the technology and financial sectors

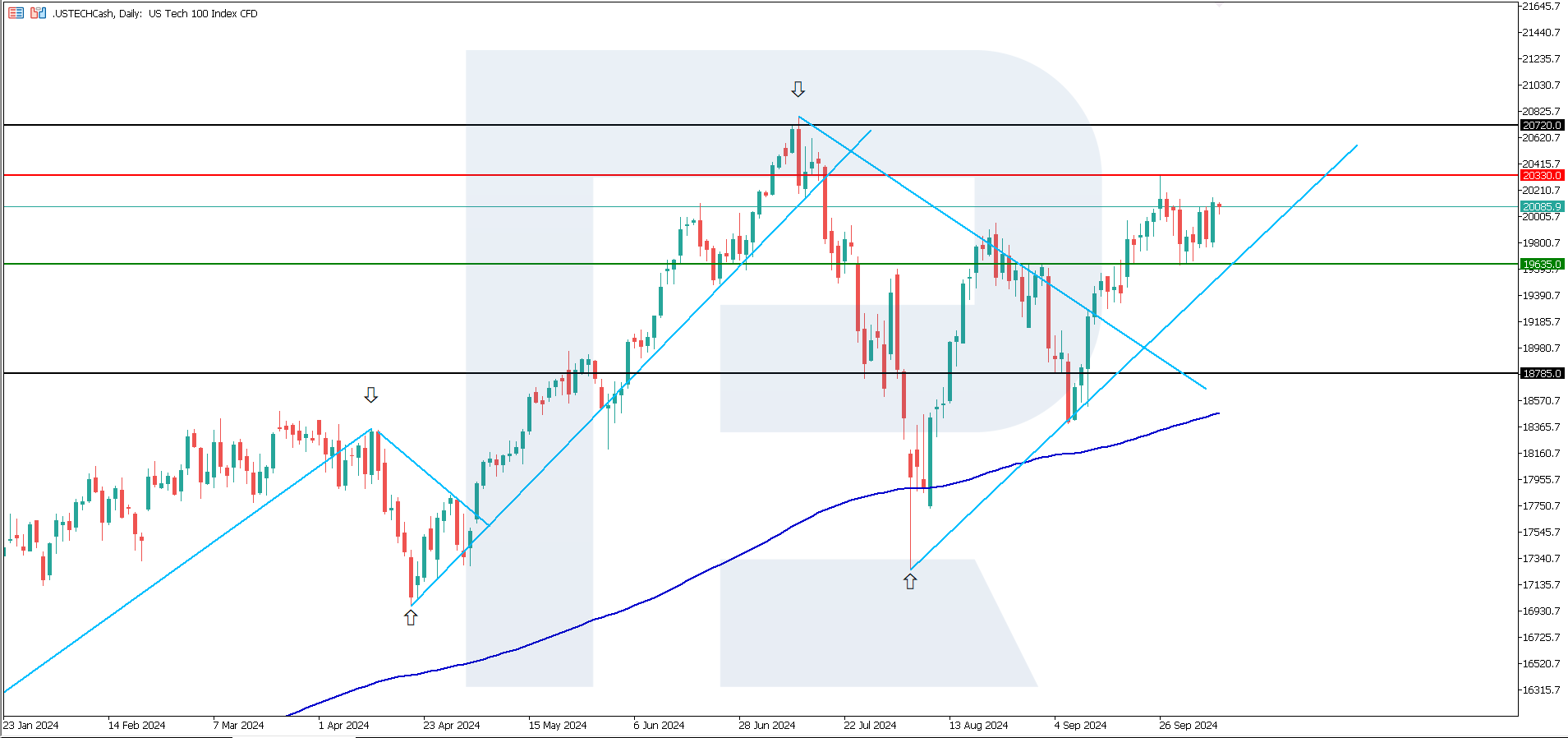

- Resistance: 20,330.0, Support: 19,635.0

- US Tech price forecast: 20,720.0

Fundamental analysis

The US federal budget deficit exceeded 1.8 trillion USD over the last fiscal year. This was due to increased spending on interest payments and programs for elderly Americans, as the government faces an ongoing gap between federal spending and tax proceeds.

Source: https://www.wsj.com/politics/policy/budget-deficit-national-debt-2024-079d8d13

New data emerged when Republican presidential nominee Donald Trump and Democratic nominee Kamala Harris proposed new tax and spending plans estimated to add trillions of dollars to the deficit over the next decade.

The increase in the deficit means that the government is forced to borrow more funds, which increases the total national debt. This may, in turn, boost interest rates as investors require higher yields to compensate for higher risks and inflation. Elevated interest rates pressure stock prices, particularly for companies that depend on borrowings to ensure their growth and operations. The medium-term US Tech index forecast is moderately optimistic.

US Tech technical analysis

The US Tech stock index is in an uptrend. The recent correction ended with a rebound from the 19,635.0 support level. According to technical analysis, the US Tech index still has the potential to reach an all-time high. A breakout above the 20,330.0 resistance level will signal a continuation of the uptrend.

The following scenarios are considered for the US Tech price outlook:

- Pessimistic US Tech forecast: a breakout below the 19,635.0 support level could send the price down to 18,785.0

- Optimistic US Tech forecast: a breakout above the 20,330.0 resistance level could boost the index to 20,720.0

Summary

The US federal budget deficit exceeded 1.8 trillion USD over the last fiscal year. The increase forces the government to borrow more funds, which increases the total national debt. This may, in turn, boost interest rates as investors require higher yields to compensate for high risks and inflation. Nevertheless, the US Tech index has the potential for growth to a new all-time high in the short term.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.