Pronóstico de las acciones de Micron para 2026: escenarios y niveles clave para MU

Micron está en el pico del ciclo de memoria y está ofreciendo resultados financieros récord. Este artículo analiza la resiliencia del negocio de Micron, la valoración de las acciones de MU y las perspectivas para 2026.

Micron Technology, Inc. (NASDAQ: MU) informó resultados para el Q1 del año fiscal 2026 que estuvieron muy por encima de las expectativas del mercado. Los ingresos non-GAAP alcanzaron 13.64 mil millones USD, el beneficio neto totalizó 5.48 mil millones USD y el beneficio por acción ascendió a 4.78 USD. La rentabilidad y la generación de caja mejoraron bruscamente. El flujo de caja operativo alcanzó 8.41 mil millones USD, y la compañía vinculó directamente el aumento de los resultados a la aceleración de la demanda de memoria utilizada en cargas de trabajo de IA, el aumento de los precios y una combinación de productos más favorable.

La guía de la dirección para el Q2 del año fiscal 2026 también estuvo significativamente por encima de las expectativas del mercado. La compañía prevé ingresos non-GAAP de alrededor de 18.7 mil millones USD, un margen bruto de aproximadamente 68% y un beneficio por acción de alrededor de 8.42 USD. Micron también anunció un plan de gasto de capital de alrededor de 20 mil millones USD para 2026, destinado a ampliar la capacidad de fabricación para satisfacer la fuerte demanda.

En la segunda mitad de 2025, el rally de las acciones de MU se aceleró y, a finales de 2025, las acciones de Micron habían subido aproximadamente un 230%, con ganancias de alrededor del 20% registradas solo en diciembre de 2025. El mercado ya había descontado una demanda sostenida y fuerte de memoria y un desempeño financiero sólido, y la guía posterior de la compañía para 2026 solo reforzó estas expectativas. Como resultado, el impulso alcista de MU continuó a principios de 2026.

Este artículo examina Micron Technology, Inc., describe las fuentes de sus ingresos, resume el desempeño trimestral de Micron y presenta expectativas para el año fiscal 2026. También incluye un análisis técnico de las acciones de MU, sobre cuya base se desarrol

Acerca de Micron Technology, Inc.

Fundada en 1978, Micron Technology Inc. es una empresa estadounidense que desarrolla y fabrica chips de memoria (DRAM, NAND) y proporciona soluciones tecnológicas para almacenamiento de datos. Micron es uno de los mayores fabricantes de memoria electrónica del mundo, con productos utilizados en automóviles, computadoras, dispositivos móviles, servidores y otros equipos electrónicos. La compañía salió a bolsa en la Bolsa de Nueva York en 1984 y cotiza bajo el símbolo MU.

Actualmente, Micron continúa desarrollando e implementando módulos de memoria avanzados y tecnologías de almacenamiento de datos para los mercados de inteligencia artificial, redes 5G, vehículos autónomos y computación en la nube.

Imagen del nombre de la empresa Micron Technology, Inc.Principales fuentes de ingresos de Micron Technology, Inc.

El modelo de negocio de Micron se centra en desarrollar, producir y vender módulos de memoria semiconductores y soluciones de almacenamiento de datos. Los segmentos de la empresa se categorizan según los mercados de productos enumerados a continuación:

- Computadoras personales y dispositivos: incluye ingresos por ventas de memoria utilizada en PC, laptops y estaciones de trabajo

- Dispositivos móviles: chips de memoria para smartphones y tablets, donde Micron compite con empresas que fabrican productos comparables para dispositivos de alto rendimiento

- Dispositivos de almacenamiento: productos y soluciones para almacenamiento de datos basados en memoria flash NAND

- Sistemas embebidos: componentes y módulos de memoria para integración en sistemas utilizados en los sectores automotriz, de salud y manufactura

La empresa presenta datos detallados para cada segmento y los agrupa en dos grandes sectores en sus informes. El primer sector es DRAM (memoria dinámica de acceso aleatorio), que representa una parte sustancial de los ingresos de la empresa (alrededor del 70%). DRAM se utiliza en computadoras personales, servidores, teléfonos inteligentes, tarjetas gráficas y otros dispositivos. El segundo sector, NAND (memoria flash), representa aproximadamente entre el 25% y 30% de los ingresos. Los productos NAND se utilizan en SSDs (unidades de estado sólido), dispositivos móviles, sistemas de almacenamiento de datos y otros productos que requieren acceso rápido y confiable a la información.

Informe del Q4 FY 2024 de Micron Technology Inc.

El 25 de septiembre de 2024, Micron publicó su informe del cuarto trimestre de 2024, correspondiente al período que finalizó el 25 de agosto. El desempeño financiero sorprendió a los inversores y superó las previsiones. A continuación, los datos reportados:

- Ingresos: 7.75 mil millones USD (+93%)

- Ingreso neto: 1.34 mil millones USD (comparado con una pérdida de 1.17 mil millones USD)

- Ganancias por acción: 1.18 USD (comparado con una pérdida de 1.07 USD)

- Beneficio operativo: 1.74 mil millones USD (comparado con una pérdida de 1.20 mil millones USD)

Ingresos por segmento:

- DRAM: 5.33 mil millones USD (+69%)

- NAND: 2.36 mil millones USD (+31%)

- Cómputo y redes: 3.01 mil millones USD (+152%)

- Móvil: 1.87 mil millones USD (+55%)

- Almacenamiento: 1.68 mil millones USD (+127%)

- Embebido: 1.17 mil millones USD (+36%)

Tras anunciar los resultados financieros del Q4 2024, la dirección de Micron destacó un impresionante crecimiento interanual del 93% en los ingresos, impulsado por la fuerte demanda de productos DRAM para centros de datos y ventas récord de NAND, que superaron por primera vez los 1 mil millones USD por trimestre.

El CEO de Micron, Sanjay Mehrotra, señaló que la compañía se encuentra en la mejor posición competitiva de su historia y pronosticó cifras récord de ingresos y rentabilidad para el Q1 2025. También subrayó la importancia de la demanda de soluciones de inteligencia artificial, que fortalece la posición de la empresa en el mercado.

Micron espera ingresos récord en el Q1 2025, con una previsión de 8.70 mil millones USD (más/menos 200 millones USD) y un margen bruto del 39.5%. Las ganancias por acción esperadas ascienden a 1.74 USD. Estas cifras son considerablemente más altas que las de trimestres anteriores, lo que indica un aumento de la demanda de productos de la empresa, particularmente en los segmentos de inteligencia artificial y computación en la nube.

Micron también señaló que sigue beneficiándose del aumento de precios en los mercados de memoria y almacenamiento de datos, debido al incremento de la demanda de servidores para IA.

Informe del Q1 FY 2025 de Micron Technology Inc.

El 18 de diciembre de 2024, Micron publicó su informe del primer trimestre del ejercicio fiscal 2025, correspondiente al período que finalizó el 28 de noviembre. A continuación se presentan los aspectos destacados del informe:

- Ingresos: 8.70 mil millones USD (+84%)

- Ingreso neto: 2.04 mil millones USD (versus una pérdida de 1.05 mil millones USD)

- Ganancias por acción: 1.79 USD (versus una pérdida de 0.95 USD)

- Beneficio operativo: 2.39 mil millones USD (versus una pérdida de 0.95 mil millones USD)

Ingresos por segmento:

- DRAM: 6.40 mil millones USD (+73%)

- NAND: 2.32 mil millones USD (+26%)

- Cómputo y redes: 4.40 mil millones USD (+153%)

- Móvil: 1.50 mil millones USD (+16%)

- Almacenamiento: 1.70 mil millones USD (+160%)

- Embebido: 1.10 mil millones USD (+6%)

Sanjay Mehrotra señaló que, por primera vez en la historia de la empresa, los centros de datos representaron más del 50% de los ingresos, impulsados por la fuerte demanda de chips de memoria para inteligencia artificial. También reconoció debilidad en los segmentos de consumo como PC y smartphones, pero expresó confianza en que el crecimiento se reanudará en la segunda mitad del año fiscal.

Para el Q2 del año fiscal 2025, Micron emitió una previsión por debajo de las expectativas de Wall Street, proyectando ingresos de 7.90 mil millones USD (± 200 millones USD) y BPA de 1.43 USD (± 0.10 USD). Esta previsión refleja una caída anticipada en los ingresos por DRAM y NAND debido al exceso de oferta y a la débil demanda del consumidor.

Los inversores reaccionaron negativamente a la perspectiva, y las acciones de Micron cayeron más del 13% tras la publicación del informe.

Informe del Q2 FY 2025 de Micron Technology Inc.

El 20 de marzo de 2025, Micron publicó su informe correspondiente al segundo trimestre del ejercicio fiscal 2025, que abarca el período finalizado el 27 de febrero. A continuación se destacan los resultados clave:

- Ingresos: 8.05 mil millones USD (+38%)

- Ingreso neto: 1.78 mil millones USD (+273%)

- Ganancias por acción: 1.56 USD (+323%)

- Beneficio operativo: 2.01 mil millones USD (+800%)

Ingresos por segmento:

- DRAM: 6.12 mil millones USD (+47%)

- NAND: 1.85 mil millones USD (+18%)

- Cómputo y redes: 4.60 mil millones USD (+153%)

- Móvil: 1.10 mil millones USD (+16%)

- Almacenamiento: 1.40 mil millones USD (+160%)

- Embebido: 1.00 mil millones USD (+6%)

Sanjay Mehrotra declaró que los ingresos por DRAM para centros de datos alcanzaron un nuevo récord, mientras que los ingresos por chips de memoria de alto ancho de banda (HBM) crecieron más del 50% respecto al trimestre anterior, superando los 1 mil millones USD. Enfatizó la sólida posición competitiva de Micron y su éxito en categorías de productos de alto margen, citando una estrategia eficaz y una creciente demanda de dispositivos de memoria para IA.

Para el Q3 del año fiscal 2025, Micron pronostica ingresos de entre 8.6 y 9.0 mil millones USD y BPA de entre 1.47 y 1.67 USD. Se espera que el margen bruto disminuya hasta el 36.5%, 1.5 puntos porcentuales menos que el trimestre anterior. Esta caída se debe al aumento de las ventas en productos de bajo margen dentro del segmento de consumo y al exceso de oferta en el mercado NAND, que sigue presionando los precios.

La reacción de los inversores fue mixta. Tras la publicación del informe, las acciones de Micron subieron más del 5% en operaciones posteriores al cierre, reflejando optimismo por el sólido desempeño. Sin embargo, las preocupaciones sobre el margen bruto y el aumento de inventarios posteriormente hicieron caer las acciones más del 8%, convirtiendo a Micron en una de las compañías con peor rendimiento del S&P 500 tras el informe.

Informe del Q3 FY 2025 de Micron Technology Inc.

El 25 de junio de 2025, Micron publicó sus resultados financieros para el tercer trimestre del año fiscal 2025, que cubre el período que finalizó el 29 de mayo. Las cifras reportadas, comparadas con el mismo período del año fiscal anterior, son las siguientes:

- Ingresos: 9.30 mil millones USD (+37%)

- Ingreso neto: 2.18 mil millones USD (+210%)

- Ganancias por acción: 1.91 USD (+208%)

- Beneficio operativo: 2.49 mil millones USD (+164%)

Ingresos por segmento:

- DRAM: 7.07 mil millones USD (+50%)

- NAND: 2.15 mil millones USD (+4%)

- Computación y redes: 5.06 mil millones USD (+97%)

- Móvil: 1.55 mil millones USD (-2%)

- Almacenamiento: 1.45 mil millones USD (+7%)

- Integrado: 1.22 mil millones USD (-5%)

Micron reportó sólidos resultados en el Q3 FY2025, superando significativamente las expectativas del mercado. Los ingresos alcanzaron 9.3 mil millones USD, un 37% más interanual, mientras que las ganancias por acción ajustadas subieron a 1.91 USD, frente a una estimación de consenso de 1.60 USD. El principal motor fue el crecimiento constante de la demanda de memoria utilizada en sistemas de IA. Los envíos de HBM aumentaron aproximadamente un 50% trimestre a trimestre, y los ingresos de centros de datos se duplicaron con creces.

Durante la conferencia de resultados, el CEO Sanjay Mehrotra señaló la adopción acelerada de soluciones tecnológicas avanzadas. La producción de DRAM 1-gamma usando litografía EUV comenzó antes de lo previsto, y se esperaban envíos masivos de HBM3E ya en el Q4. La compañía también informó del inicio de pruebas de HBM4, con planes de iniciar la producción en volumen en 2026. Estas iniciativas, junto con la expansión de la capacidad de fabricación en EE. UU. y el apoyo gubernamental bajo la Ley CHIPS, estaban configurando la ventaja estratégica de Micron en el segmento de memoria para IA.

La rentabilidad también mejoró, con el margen bruto alcanzando el 39%, superando el límite superior del guidance. Se esperaba un nuevo aumento hasta alrededor del 42% ±1% en el Q4. La compañía planeaba destinar aproximadamente 1.2 mil millones USD a gastos operativos en el trimestre siguiente, manteniendo la I+D en HBM y tecnologías de memoria de próxima generación como prioridad clave.

Las perspectivas para el Q4 reflejaron el optimismo de la dirección. Los ingresos esperados se situaron en 10.7 mil millones USD (+38% interanual), y las ganancias por acción se proyectaron en 2.50 USD (+111% interanual), ambas muy por encima de las estimaciones del consenso.

Informe del Q4 FY2025 de Micron Technology, Inc.

El 23 de septiembre de 2025, Micron publicó sus resultados del Q4 FY2025, que cubren el periodo que finalizó el 28 de agosto. Las cifras clave comparadas con el mismo periodo del año fiscal anterior son las siguientes:

- Ingresos: 11.31 mil millones USD (+46%)

- Ingreso neto: 3.47 mil millones USD (+158%)

- Ganancias por acción (EPS): 3.03 USD (+156%)

- Beneficio operativo: 3.96 mil millones USD (+126%)

Ingresos por segmento:

- Cloud Memory Business Unit: 4.54 mil millones USD (+213%)

- Core Data Center Business Unit: 1.58 mil millones USD (–23%)

- Mobile and Client Business Unit: 3.76 mil millones USD (+24%)

- Automotive and Embedded Business Unit: 1.43 mil millones USD (+17%)

Los resultados del Q4 FY2025 de Micron superaron las expectativas del mercado. La compañía informó ingresos récord de 11.32 mil millones de USD, mientras que el EPS ajustado se situó en 3.03 USD; ambas cifras superaron el consenso de los analistas de 11.2 mil millones de USD en ingresos y 2.86 USD en EPS. El crecimiento de los ingresos estuvo impulsado por una demanda excepcionalmente fuerte de los centros de datos enfocados en IA, que se convirtieron en la principal fuente de expansión y ahora son el núcleo del negocio de Micron. En el FY2025, los centros de datos representaron el 56% de los ingresos de la compañía con altos márgenes brutos, lo que confirma un cambio estructural hacia memoria para servidores y módulos HBM de mayor valor y mayor margen.

En el Q4 2025, Micron mejoró su mezcla de productos, con más envíos de DRAM para servidores y HBM para sistemas de IA y menos configuraciones de bajo coste. Este cambio elevó los precios medios de venta y empujó los márgenes al alza. El ciclo de precios de la memoria también se recuperó: hubo una escasez de suministro en DRAM, y los precios de NAND también aumentaron.

En el Q4, Micron generó un flujo de caja libre ajustado positivo de alrededor de 803 millones de USD a pesar de importantes gastos de capital. Para el ejercicio financiero 2025 en su conjunto, el FCF superó los 3.7 mil millones de USD. Al mismo tiempo, la dirección había advertido previamente que el CapEx aumentaría en el FY2026 a medida que la compañía expande la capacidad de DRAM y HBM para captar la creciente demanda impulsada por la IA.

Micron emitió una sólida guía para el próximo trimestre. Se esperaba que los ingresos se situaran en torno a 12.5 mil millones de USD (±300 millones de USD), el EPS ajustado alrededor de 3.75 USD (±0.15), y el margen bruto en el rango de 50.5–52.5%. Esta guía indicó que la dirección esperaba una fortaleza continua tanto en los ciclos de precios como de productos, particularmente en DRAM para servidores y HBM, con un mayor potencial para aumentar la rentabilidad a medida que la memoria para IA represente una proporción cada vez mayor de las ventas totales.

Resultados financieros de Micron Technology, Inc. Q1 2026

El 23 de septiembre de 2025, Micron publicó sus resultados del Q4 para el año fiscal 2025, que cubrieron el periodo que finalizó el 28 de agosto. Las cifras clave comparadas con el mismo periodo del año fiscal anterior son las siguientes:

- Ingresos: 11.31 mil millones USD (+46%)

- Beneficio neto: 3.47 mil millones USD (+158%)

- Beneficio por acción (EPS): 3.03 USD (+156%)

- Beneficio operativo: 3.96 mil millones USD (+126%)

Ingresos por segmento:

- Cloud Memory Business Unit: 4.54 mil millones USD (+213%)

- Core Data Center Business Unit: 1.58 mil millones USD (–23%)

- Mobile and Client Business Unit: 3.76 mil millones USD (+24%)

- Automotive and Embedded Business Unit: 1.43 mil millones USD (+17%)

Los resultados del Q4 FY2025 de Micron estuvieron por delante de las expectativas del mercado. La compañía reportó ingresos récord de 11.32 mil millones USD, mientras que el EPS ajustado se situó en 3.03 USD – ambas cifras superando el consenso de analistas de 11.2 mil millones USD en ingresos y 2.86 USD en EPS. El crecimiento de los ingresos estuvo impulsado por una demanda excepcionalmente fuerte de centros de datos enfocados en IA, que se convirtió en la principal fuente de expansión y ahora es el núcleo del negocio de Micron. Para FY2025, los centros de datos representaron el 56% de los ingresos de la compañía con altos márgenes brutos, confirmando un cambio estructural hacia memoria para servidores y módulos HBM de mayor valor y mayor margen.

En el Q4 2025, Micron mejoró su combinación de productos, con más envíos de DRAM para servidores y HBM para sistemas de IA y menos configuraciones de bajo costo. Este cambio elevó los precios de venta promedio y empujó los márgenes al alza. El ciclo de precios de la memoria también se recuperó: hubo una escasez de oferta en DRAM, y los precios de NAND también subieron.

En el Q4, Micron generó un flujo de caja libre ajustado positivo de alrededor de 803 millones USD a pesar de importantes gastos de capital. Para el año fiscal 2025 en conjunto, el FCF superó 3.7 mil millones USD. Al mismo tiempo, la dirección había advertido previamente que el CapEx aumentaría en FY2026 a medida que la empresa expande la capacidad de DRAM y HBM para capturar la creciente demanda impulsada por la IA.

Micron emitió una guía sólida para el próximo trimestre. Se esperaba que los ingresos fueran alrededor de 12.5 mil millones USD (±300 millones USD), el EPS ajustado alrededor de 3.75 USD (±0.15) y el margen bruto en el rango de 50.5–52.5%. Esta guía indicó que la dirección esperaba continuidad de fortaleza tanto en precios como en ciclos de producto, particularmente en DRAM para servidores y HBM, con un mayor potencial para incrementar la rentabilidad a medida que la memoria para IA represente una parte cada vez mayor de las ventas totales.

Impulsores del mercado de memoria y el papel de Micron en el ciclo actual

Un impulsor clave del crecimiento de la demanda de memoria en 2025–2026 será la construcción activa y expansión de centros de datos de IA. Los servidores modernos para entrenar y ejecutar modelos de IA requieren más memoria por servidor y tasas de transferencia de datos más rápidas, incrementando directamente la demanda de HBM, DRAM de servidor de próxima generación y SSDs para centros de datos. Micron Technology declara explícitamente que los planes de sus clientes para expandir la infraestructura de IA han elevado significativamente los pronósticos de demanda de memoria y sistemas de almacenamiento, con requisitos de capacidad y rendimiento del servidor que continúan creciendo con cada generación.

Otro factor es la oferta limitada. Micron espera que la escasez de memoria en la industria persista no solo en 2026 sino también más allá. El crecimiento en la producción de HBM reduce aún más la oferta de DRAM convencional para servidores, ya que parte de la capacidad de producción se está cambiando a soluciones más complejas y costosas. La empresa también señala que no es posible aumentar la producción debido a la necesidad de expansiones de salas limpias y los largos plazos de construcción y puesta en marcha de nuevas instalaciones.

La demanda también está respaldada por mercados más amplios. Micron destaca el ciclo de renovación de PCs ante el fin del soporte de Windows 10 y el crecimiento del segmento de AI-PC. En smartphones, la cantidad de memoria por dispositivo está aumentando, especialmente en modelos flagship. En el segmento automotriz, la demanda está creciendo a medida que los sistemas de asistencia al conductor en niveles L2+/L3 se vuelven más generalizados, y el volumen de memoria necesario para la electrónica dentro del coche aumenta.

Como resultado, Micron se ha convertido en un foco clave para los inversores, ya que es uno de los pocos fabricantes de HBM, junto con SK Hynix y Samsung Electronics, que es un componente clave para aceleradores modernos de IA. El mercado de HBM es efectivamente oligopolístico, con oferta limitada, y la demanda de centros de datos está creciendo más rápido de lo que la oferta puede alcanzar. Por lo tanto, los inversores están observando de cerca a cada proveedor capaz de escalar la producción. En este contexto, Micron destacó al proporcionar uno de los pronósticos más sólidos de ingresos, margen y demanda de HBM, lo que ha incrementado el interés en las acciones de la empresa.

Además, la empresa ha proporcionado al mercado una visibilidad rara sobre la demanda futura en el sector de memoria. Micron ha declarado que ha acordado precios y volúmenes de envíos de HBM para todo el año calendario 2026 y espera que condiciones ajustadas para DRAM y NAND persistan más allá de 2026. Esto alivia preocupaciones de que los precios de la memoria caigan rápidamente.

Análisis fundamental de Micron Technology, Inc.

A continuación se presenta un análisis fundamental de MU basado en los resultados del Q4 del ejercicio fiscal 2025:

- Liquidez y deuda: a fecha de 27 de noviembre de 2025, Micron Technology mantenía 9.73 mil millones de USD en efectivo y 2.28 mil millones de USD en valores negociables, sumando un total de 12.01 mil millones de USD en activos líquidos. Los activos corrientes totalizaban 29.67 mil millones de USD, mientras que los pasivos corrientes ascendían a 12.06 mil millones de USD, lo que proporciona a la empresa un sólido colchón de liquidez. La deuda total se situaba en 11.76 mil millones de USD, colocando a Micron en una posición neutral en términos de deuda neta, con una ligera posición de caja neta de alrededor de 0.26 mil millones de USD. Además, la compañía contaba con una línea de crédito no utilizada de 3.50 mil millones de USD, lo que refuerza aún más su resiliencia financiera.

- Flujos de caja y flujo de caja libre: en el último trimestre, Micron incrementó significativamente su generación de efectivo. El flujo de caja operativo totalizó 8.41 mil millones de USD, frente a 3.24 mil millones de USD en el mismo periodo del año anterior. El gasto de capital en equipos y construcción fue elevado, alcanzando los 5.39 mil millones de USD, pero las subvenciones gubernamentales de 0.88 mil millones de USD compensaron parte de estos costes. En consecuencia, el gasto de capital neto ascendió a 4.51 mil millones de USD. Con estas cifras, la empresa logró un flujo de caja libre ajustado de 3.90 mil millones de USD en el trimestre.

De cara al futuro, Micron planea una inversión significativa en el ejercicio fiscal 2026, con gastos de capital que se espera alcancen aproximadamente los 20 mil millones de USD, concentrados principalmente en la segunda mitad del año. Como resultado, el flujo de caja libre puede fluctuar considerablemente de un trimestre a otro.

- Rentabilidad y beneficios: en el Q1, Micron Technology presentó un trimestre sólido sobre una base no GAAP. El margen bruto se situó en el 56.8%, el margen operativo en el 47.0%, con un beneficio operativo de 6.42 mil millones de USD, un beneficio neto de 5.48 mil millones de USD y un beneficio por acción de 4.78 USD. Estas cifras supusieron una mejora sustancial tanto frente al trimestre anterior como frente al mismo periodo del año pasado. Esto es crucial para la estabilidad financiera, ya que estos márgenes permiten a la empresa financiar grandes inversiones manteniendo una estructura financiera equilibrada sin aumentar la deuda.

- Fortaleza del balance: el balance presenta una estructura sólida. Los activos totalizaron 85.97 mil millones de USD, los pasivos ascendieron a 27.17 mil millones de USD y el patrimonio neto de los accionistas fue de 58.81 mil millones de USD. El ratio de capital propio es elevado y la carga de deuda es moderada. Durante el trimestre, Micron redujo su deuda en 2.94 mil millones de USD, destinando parte del aumento de beneficios y flujos de caja a la reducción del riesgo financiero. Cabe destacar que parte del efectivo y las inversiones se mantienen en filiales extranjeras, lo que puede limitar el acceso operativo a estos fondos en determinados países. También existen compromisos futuros relacionados con el programa de inversiones, con un elevado gasto de capital previsto para el ejercicio fiscal 2026.

Análisis fundamental de MU – conclusión:

A fecha de Q1 2026, Micron parece financieramente sólida. La liquidez es elevada, la deuda neta es prácticamente inexistente, y tanto el beneficio como el flujo de caja operativo han aumentado con fuerza. El principal riesgo no está relacionado con el balance, sino con la naturaleza cíclica del mercado y la magnitud de la inversión, con alrededor de 20 mil millones de USD en gastos de capital previstos para el ejercicio fiscal 2026. Si las condiciones del mercado empeoran, el flujo de caja libre podría disminuir rápidamente, pero la reserva de liquidez actual y el acceso a la línea de crédito proporcionan a la empresa una fuerte flexibilidad financiera.

Análisis de los múltiplos de valoración clave de Micron Technology, Inc.

A continuación se presentan los principales múltiplos de valoración de Micron Technology basados en los resultados del Q1 del ejercicio fiscal 2026, calculados a un precio por acción de 340 USD.

| Multiplicador | Qué muestra | Valor | Comentario |

|---|---|---|---|

| P/E (TTM) | El precio de 1 USD de beneficios de los últimos 12 meses | 32 | ⬤ Una valoración excepcionalmente alta para un fabricante cíclico de memoria: el mercado está pagando más de 30 veces los beneficios anuales, confiando en la continuación del superciclo. |

| P/S (TTM) | El precio de 1 USD de ingresos anuales | 9.2 | ⬤ Un nivel agresivo para un negocio con márgenes históricamente volátiles. |

| EV/Sales (TTM) | Valor de empresa frente a ingresos, incluyendo la deuda | 9.2 | ⬤ Incluso considerando la deuda neta casi nula, la valoración basada en ingresos sigue siendo extremadamente alta. |

| P/FCF (TTM) | El precio de 1 USD de flujo de caja libre | 83 | ⬤ Micron parece muy cara en términos de flujo de caja libre, ya que el FCF va muy por detrás del beneficio reportado debido al elevado CapEx. |

| FCF Yield (TTM) | Rentabilidad del flujo de caja libre para los accionistas | 1.2% | ⬤ Una baja rentabilidad del flujo de caja libre, con la tesis de inversión basada en un fuerte crecimiento futuro del FCF. |

| EV/EBITDA (TTM) | Valor de empresa frente a EBITDA | 17.5 | ⬤ Un múltiplo elevado para memoria y NAND, incluso con márgenes récord impulsados por la demanda de IA. |

| EV/EBIT (TTM) | Valor de empresa frente a beneficio operativo | 28 | ⬤ Margen de seguridad mínimo basado en los beneficios. |

| P/B | Precio frente al valor contable | 6.6 | ⬤ El capital del balance se valora con una prima muy elevada, lo que indica una alta valoración para un negocio intensivo en capital y cíclico. |

| Net Debt/EBITDA | Carga de deuda en relación con el EBITDA | 0.0 | ⬤ La deuda neta es casi nula en relación con el EBITDA, lo que hace que el balance sea muy cómodo. |

| Interest Coverage (TTM) | Relación entre beneficio operativo y gasto por intereses | 32 | ⬤ Los gastos por intereses están ampliamente cubiertos. |

Análisis de los múltiplos de valoración de Micron – conclusión

Desde la perspectiva de la calidad del negocio y del ciclo actual, Micron se encuentra en su punto álgido: ingresos récord, rentabilidad muy elevada, fuerte EBITDA, deuda neta prácticamente inexistente y una demanda masiva de HBM y DRAM para centros de datos. Sin embargo, a la valoración actual, el mercado está valorando la compañía como si esta fase de superrentabilidad fuera a prolongarse durante mucho tiempo sin caídas significativas de los márgenes.

Casi todos los múltiplos de precio (P/E, P/S, EV/Sales, EV/EBIT, P/FCF) se encuentran en zona roja para un negocio cíclico de semiconductores. Si los ingresos y beneficios de Micron crecen más lentamente de lo que espera el mercado, la valoración de 340 USD podría resultar rápidamente demasiado alta, y las acciones podrían caer de forma significativa, incluso con informes de resultados sólidos.

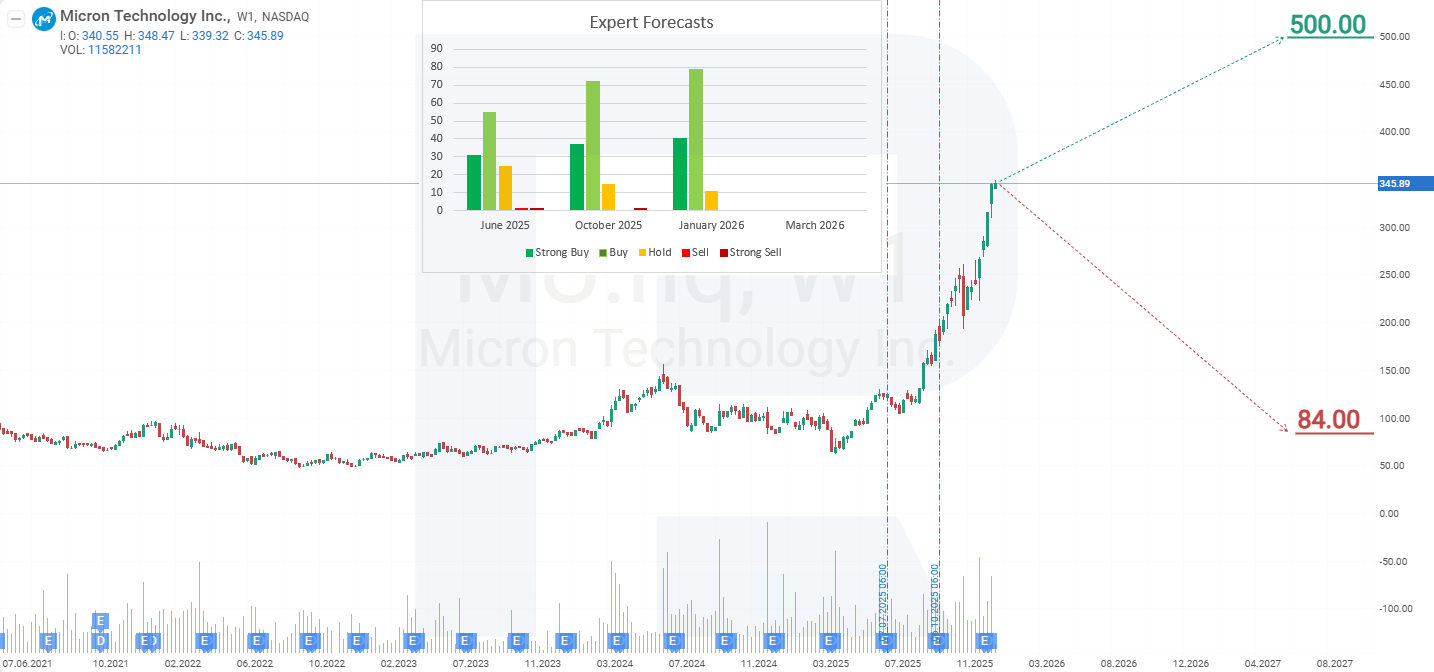

Pronósticos de expertos para Micron Technology, Inc.

- Barchart: 30 de 38 analistas calificaron las acciones de Micron Technology como Strong Buy, 5 como Moderate Buy y 3 como Hold. El precio objetivo superior es de 500 USD y el límite inferior es de 107 USD.

- MarketBeat: 34 de 37 analistas asignaron una calificación de Buy a las acciones, con 3 recomendaciones de Hold. El precio objetivo superior es de 400 USD y el límite inferior es de 84 USD.

- TipRanks: 24 de 26 analistas encuestados calificaron las acciones como Buy, con 2 recomendaciones de Hold. El precio objetivo superior es de 500 USD y el límite inferior es de 235 USD.

- Stock Analysis: 10 de 29 expertos calificaron las acciones como Strong Buy, 16 como Buy y 3 como Hold. El precio objetivo superior es de 500 USD y el límite inferior es de 84 USD.

Pronóstico del precio de las acciones de Micron Technology, Inc. para 2026

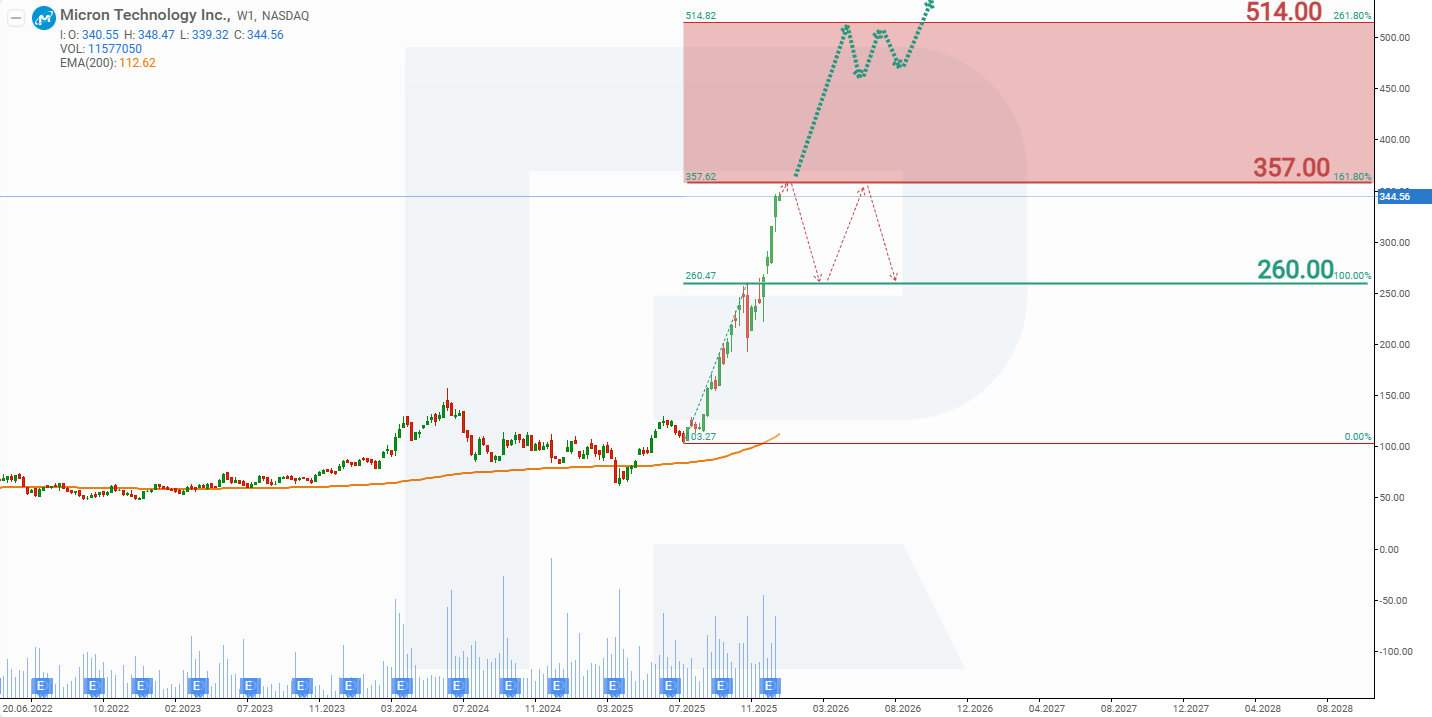

En la segunda mitad de 2025, en medio del aumento de la demanda de memoria, la atención de los inversores se desplazó hacia Micron Technology, impulsando el precio de sus acciones en más de un 230% y acercándolo a la resistencia en 357 USD. Basándose en el comportamiento actual de las acciones de Micron, los posibles escenarios de precios para 2026 son los siguientes:

El escenario base para las acciones de Micron implica una ruptura por encima de la resistencia en 357 USD, seguida de un movimiento al alza hacia 514 USD. Este escenario está respaldado por la sólida perspectiva de la empresa para 2026, que anticipa una demanda elevada y sostenida de memoria y una escasez de oferta debido a los largos plazos necesarios para ampliar la capacidad de producción. Como resultado, el interés de los inversores en las acciones de Micron podría mantenerse elevado, lo que permitiría alcanzar rápidamente el precio objetivo. Además, la demanda de las acciones de la compañía podría verse respaldada por flujos de capital que salgan de las acciones de NVIDIA, a medida que algunos inversores buscan una historia de crecimiento similar en el segmento de infraestructura de IA y memoria.

El escenario alternativo para las acciones de Micron sugiere un rechazo en el nivel de resistencia de 357 USD. En este caso, las acciones podrían caer hacia el soporte en 260 USD, tras lo cual podrían consolidarse entre 260 y 357 USD.

Análisis y pronóstico de acciones de Micron Technology, Inc. para 2026Riesgos de invertir en acciones de Micron Technology, Inc.

Invertir en acciones de Micron Technology conlleva varios riesgos que podrían impactar negativamente los ingresos y beneficios de la empresa:

- Ciclicidad del mercado de memoria: la industria de semiconductores, especialmente el segmento de memoria, es altamente cíclica, con fluctuaciones en la demanda y los precios. Una recesión prolongada en segmentos como NAND y DRAM podría provocar exceso de inventario, caída de precios y reducción de rentabilidad

- Alta competencia en la industria: Micron enfrenta una competencia intensa de actores como Samsung Electronics y SK Hynix. La inversión constante en tecnología e innovación es vital en este entorno competitivo. Si la empresa no mantiene el ritmo de los avances, podría perder cuota de mercado y reducir su rentabilidad

- Tensiones geopolíticas y restricciones comerciales: Micron opera a nivel global y genera ingresos significativos fuera de EE. UU. Las tensiones geopolíticas, disputas comerciales y controles regulatorios pueden limitar ventas y operaciones. Por ejemplo, los productos de Micron han sido objeto de escrutinio en China, lo que resalta los riesgos en los mercados internacionales

- Eficiencia operativa y control de costos: a pesar del crecimiento en ingresos, Micron enfrenta desafíos persistentes de eficiencia operativa. Los altos costos de producción indican oportunidades de reducción. Optimizar procesos y controlar gastos será clave para mejorar la rentabilidad

Los inversores deben considerar cuidadosamente estos riesgos al evaluar una inversión en Micron Technology, ya que podrían afectar significativamente el desempeño financiero y el precio de sus acciones.

Aviso legal: Este artículo ha sido traducido con la ayuda de herramientas de IA. Si bien se ha hecho todo lo posible para preservar su significado original, pueden existir algunas inexactitudes u omisiones. En caso de duda, consulte la fuente original en inglés.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.