Palantir combina un crecimiento rápido con márgenes récord, pero el mercado ya ha descontado un escenario perfecto

Palantir Technologies continúa demostrando un fuerte crecimiento y una rentabilidad excepcionalmente alta, respaldada por una sólida demanda de sus soluciones de inteligencia artificial. Sin embargo, los múltiplos de valoración elevados sugieren que podría producirse una corrección antes de la siguiente etapa de la tendencia alcista.

Palantir Technologies Inc. (NASDAQ: PLTR) presentó un informe de Q3 2025 excepcionalmente sólido, superando significativamente las expectativas del mercado: los ingresos se situaron en 1.18 mil millones de USD (+63% interanual) frente a una estimación de consenso de 1.09 mil millones de USD, y las ganancias ajustadas por acción (EPS no-GAAP) alcanzaron 0.21 USD, por encima de las previsiones de 0.17 USD. La empresa superó las expectativas tanto en ingresos como en beneficios.

En base no-GAAP, Palantir logró una rentabilidad impresionante: el ingreso operativo ajustado alcanzó 601 millones de USD (un margen del 51%), el beneficio neto ajustado se situó en 529 millones de USD, y el flujo de caja libre ajustado totalizó 540 millones de USD, con un margen de FCF de alrededor del 46%. El mayor crecimiento provino del negocio US Commercial, donde los ingresos se más que duplicaron interanualmente. Tanto el segmento comercial total como los contratos gubernamentales también registraron una expansión sólida, lo que indica una demanda amplia de las soluciones de la compañía.

La dirección elevó sus previsiones para Q4 2025 y para el año completo. Para el cuarto trimestre, Palantir espera ingresos de aproximadamente 1.33 mil millones de USD y un mayor crecimiento del beneficio operativo ajustado. La previsión de ingresos para el año completo se elevó a 4.4 mil millones de USD (alrededor de +50% interanual), con un margen ajustado sólido. La empresa subrayó que el principal motor de crecimiento sigue siendo su plataforma AIP y la fuerte demanda de soluciones de IA y analítica tanto por parte de clientes comerciales como gubernamentales.

En general, el informe destaca que Palantir se encuentra en una fase de rápida expansión, con una rentabilidad ya alta y una fuerte generación de caja. La dirección espera que estas sólidas tendencias de crecimiento continúen el próximo año, aunque la empresa aún no ha proporcionado una previsión cuantitativa precisa para 2026.

Este artículo examina Palantir Technologies Inc., describe sus principales fuentes de ingresos, revisa los informes trimestrales de la compañía y ofrece un análisis fundamental de PLTR. También presenta previsiones de expertos para las acciones de Palantir en 2026 y analiza el rendimiento bursátil de PLTR, formando la base para la previsión del precio de las acciones de Palantir Technologies Inc. para 2026.

Acerca de Palantir Technologies Inc.

Palantir Technologies fue fundada en 2003 por Peter Thiel, Alexander Karp, Joseph Lonsdale, Stephen Cohen y Nathan Gettings. La empresa salió a bolsa el 30 de septiembre de 2020 bajo el símbolo PLTR en la Bolsa de Nueva York.

Palantir se especializa en el desarrollo de software para el análisis de macrodatos, incluyendo Gotham, diseñado para agencias de seguridad nacional e inteligencia; Foundry, para el sector corporativo; y Apollo, para el despliegue de versiones de software. Estos productos están disponibles tanto para clientes gubernamentales como privados, y ofrecen soluciones de software para la gestión y análisis de datos, con un fuerte enfoque en privacidad y seguridad.

Imagen del nombre de la empresa Palantir Technologies Inc.Flujos financieros principales de Palantir Technologies Inc.

Los ingresos de Palantir provienen principalmente de la venta de licencias para sus productos de software y de la prestación de servicios relacionados. A continuación, se detallan las principales fuentes de ingresos:

- Tarifas de licencia: empresas y agencias gubernamentales compran licencias para usar las plataformas de Palantir (Gotham, Foundry)

- Suscripciones y servicios: además de las licencias iniciales, Palantir ofrece suscripciones para soporte técnico y actualizaciones, así como servicios para la implementación del programa, personalización y capacitación del personal

- Servicios profesionales: prestación de servicios altamente especializados como análisis de datos, desarrollo de soluciones personalizadas y asistencia en la integración de sistemas

- Contratos gubernamentales: una parte significativa de los ingresos proviene de acuerdos con agencias gubernamentales, que utilizan las tecnologías adquiridas para análisis de datos en áreas de seguridad, inteligencia y otros dominios gubernamentales

- Sector corporativo: en los últimos años, la empresa ha estado expandiendo activamente su presencia en el mercado comercial, donde ofrece sus soluciones analíticas a grandes corporaciones para optimizar procesos empresariales, gestionar riesgos y procesar datos estadísticos

Como resultado, los ingresos totales de Palantir se generan mediante una combinación de ventas de software con licencia, suscripciones, servicios profesionales y contratos a largo plazo con clientes tanto gubernamentales como privados.

Informe del Q3 2024 de Palantir Technologies Inc.

Palantir Technologies publicó sus datos del tercer trimestre de 2024 el 4 de noviembre de 2024. A continuación, se destacan los puntos clave del informe:

- Ingresos: 726.5 millones USD (+30%)

- Ingreso neto: 149.3 millones USD (+103%)

- Ganancias por acción: 0.06 USD (+100%)

Ingresos por segmento y región:

- EE. UU.: 498.9 millones USD (+45%)

- Reino Unido: 69.5 millones USD (+10%)

- Otros países: 157.0 millones USD (+21%)

- Gobierno: 408.3 millones USD (+33%)

- Ingresos comerciales: 317.5 millones USD (+27%)

- Ingresos del gobierno de EE. UU.: 319.8 millones USD (+39%)

- Ingresos comerciales de EE. UU.: 179.1 millones USD (+34%)

El informe muestra que el gobierno de EE. UU. sigue siendo la principal fuente de ingresos de Palantir Technologies, aportando casi la mitad del total. Palantir pronosticó ingresos de entre 767.0 y 771.0 millones USD en el cuarto trimestre de 2024, lo que representa un aumento del 5-6% en comparación con el trimestre anterior.

Informe del Q4 2024 de Palantir Technologies Inc.

Palantir Technologies publicó sus resultados del cuarto trimestre de 2024 el 3 de febrero de 2025. A continuación se destacan los puntos clave del informe:

- Ingresos: 827.5 millones USD (+36%)

- Ingreso neto: 76.9 millones USD (-21%)

- Ganancias por acción: 0.03 USD (-25%)

Ingresos por segmento:

- Ingresos comerciales: 372.5 millones USD (+31%)

- Ingresos del gobierno de EE. UU.: 343.0 millones USD (+45%)

- Ingresos comerciales de EE. UU.: 214.0 millones USD (+64%)

El CEO de Palantir, Alexander Karp, señaló que los resultados del cuarto trimestre continuaban siendo impresionantes, destacando que las primeras suposiciones de la empresa sobre la adopción generalizada y accesibilidad de los modelos de lenguaje grande se habían confirmado y habían contribuido a un crecimiento sustancial. También describió los resultados como parte de una visión a largo plazo, afirmando que Palantir se encuentra en las primeras etapas de una revolución de varios años para la que la compañía se ha estado preparando durante más de dos décadas.

Para 2025, Palantir presentó un pronóstico optimista, esperando ingresos en el rango de 3.74–3.76 mil millones USD, lo que equivale a un crecimiento interanual de aproximadamente el 31%. Esta previsión superó significativamente las estimaciones de consenso de los analistas, reflejando la confianza en la demanda constante de sus plataformas y software de inteligencia artificial.

Se proyectó que los ingresos comerciales en EE. UU. alcanzarían los 1.07 mil millones USD, lo que representa un incremento del 54% con respecto a 2024. Además, la gerencia pronosticó un beneficio operativo ajustado en el rango de 1.55–1.57 mil millones USD y un flujo de caja libre ajustado de entre 1.05 y 1.70 mil millones USD. También anticiparon mantener beneficios operativos y ganancias netas bajo las normas GAAP en cada trimestre de 2025.

Para el Q1 2025, se proyectaron ingresos en el rango de 858–862 millones USD, con una utilidad operativa ajustada entre 354 y 358 millones USD, estableciendo nuevos objetivos para el año.

A pesar del panorama positivo, los recientes informes sobre posibles recortes al presupuesto de defensa de EE. UU. generaron inquietud entre los inversores, ya que más del 40% de los ingresos del Q4 de Palantir provinieron de contratos gubernamentales con EE. UU.

Informe del Q1 2025 de Palantir Technologies Inc.

El 5 de mayo de 2025, Palantir Technologies publicó sus resultados financieros del 1T de 2025, correspondientes al trimestre finalizado el 31 de marzo. Las cifras clave son las siguientes:

- Ingresos: 883.9 millones USD (+39%)

- Ingreso neto: 214.0 millones USD (+24%)

- Beneficio por acción (no GAAP): 0.13 USD (+62%)

Ingresos por segmento:

- Ingresos comerciales: 396.8 millones USD (+33%)

- Ingresos gubernamentales: 486.9 millones USD (+45%)

- Ingresos del gobierno de EE. UU.: 373.0 millones USD (+45%)

- Ingresos comerciales de EE. UU.: 255.0 millones USD (+71%)

El informe de ganancias del 1T de 2025 reflejó el crecimiento continuo de Palantir y el fortalecimiento de su posición en el mercado de soluciones de IA. Los ingresos aumentaron un 39% interanual y estuvieron en línea con las estimaciones de consenso de los analistas, subrayando el fuerte impulso del negocio de la compañía. Un motor importante del crecimiento fue el segmento comercial de EE. UU., donde los ingresos aumentaron un 71%.

Los datos trimestrales señalaron avances en la diversificación de las fuentes de ingresos. Palantir continúa reduciendo su dependencia de los contratos gubernamentales al aumentar la proporción de clientes comerciales. La base de clientes también se expande, con el número de clientes aumentando un 39% interanual y un 8% trimestral.

Durante el período del informe, Palantir cerró 139 acuerdos, cada uno por un valor de al menos 1 millón USD, incluidos 51 por encima de 5 millones USD y 31 que superaron 10 millones USD. Estas cifras subrayan la creciente demanda de los productos de Palantir entre los grandes clientes corporativos.

Los indicadores de rentabilidad también fueron impresionantes. El ingreso operativo totalizó 176 millones USD, con un margen del 20%, y el flujo de caja libre ascendió a 370 millones USD. La Regla del 40, que es la suma del crecimiento de ingresos y el margen operativo, se situó en 83%, lo que demuestra un equilibrio saludable entre crecimiento y eficiencia.

Palantir mantiene una perspectiva confiada. Su previsión de ingresos para todo 2025 ha sido elevada a un rango de 3.89-3.90 mil millones USD, reflejando expectativas de un desempeño sólido continuo impulsado por su plataforma AIP y alianzas en expansión en el sector comercial. La previsión para el 2T de 2025 incluye ingresos en el rango de 934-938 millones USD e ingreso operativo de 401-405 millones USD.

A pesar del informe de ganancias positivo, las acciones de Palantir cayeron un 11% tras la publicación debido a preocupaciones sobre múltiplos de valoración altos – específicamente, un PER de 536 en comparación con el promedio de la industria de software de 42. Sin embargo, el precio de PLTR rebotó al día siguiente, lo que sugiere que los inversores siguen dispuestos a asumir riesgo en anticipación de resultados sobresalientes de Palantir Technologies.

Resultados del Q2 de 2025 de Palantir Technologies Inc.

El 4 de agosto de 2025, Palantir Technologies publicó sus resultados financieros del 2T de 2025 para el trimestre que finalizó el 30 de junio. Los aspectos clave son los siguientes:

- Ingresos: 1.00 mil millones USD (+48%)

- Ingreso neto: 326.72 millones USD (+33%)

- Beneficio por acción (no GAAP): 0.16 USD (+100%)

Ingresos por segmento:

- Ingresos comerciales: 450.7 millones USD (+47%)

- Ingresos gubernamentales: 552.9 millones USD (+49%)

- Ingresos del gobierno de EE. UU.: 426.1 millones USD (+53%)

- Ingresos comerciales de EE. UU.: 306.5 millones USD (+93%)

Palantir demostró un fuerte crecimiento en Q2 2025. Los ingresos alcanzaron 1.00 mil millones de USD, un 48% más interanual y un 14% más trimestre a trimestre. El crecimiento fue impulsado principalmente por dos segmentos: el segmento Gobierno aportó 553 millones de USD (+49% interanual), mientras que el negocio Comercial generó 451 millones de USD (+47% interanual). Geográficamente, EE. UU. siguió siendo el principal motor de crecimiento, generando ingresos de 733 millones de USD (+68% interanual y +17% trimestral). Fuera de EE. UU., los ingresos totalizaron 271 millones de USD (+12% interanual).

La rentabilidad mejoró en el 2T. El margen bruto se situó aproximadamente en 80.8% – representando la porción de ingresos retenida tras los costos directos de servicio del producto. El margen operativo GAAP alcanzó 27%, mientras que el margen neto fue 32.6%, reflejando una ganancia neta sustancial relativa a los ingresos. En base no GAAP, que excluye ciertos elementos no operativos, el margen operativo fue 46%. La expansión de márgenes fue respaldada por el apalancamiento operativo, con gastos creciendo más lentamente que los ingresos.

El beneficio por acción fue de 0.13 USD en base GAAP y 0.16 USD en base no GAAP. La diferencia se atribuye a la compensación basada en acciones (SBC) y los impuestos del empleador relacionados.

La dirección aumentó la guía para el 3T de 2025, esperando ingresos de 1.083–1.087 mil millones USD e ingreso operativo ajustado de 493–497 millones USD. Para todo 2025, la compañía pronostica ingresos de 4.142–4.150 mil millones USD (alrededor de +45% interanual), ingreso operativo ajustado de 1.912–1.920 mil millones USD y flujo de caja libre ajustado de 1.8–2.0 mil millones USD. La compañía también destacó la aceleración del segmento comercial de EE. UU., que se proyecta supere 1.302 mil millones USD en el año.

Resultados de Palantir Technologies Inc. Q3 2025

El 3 de noviembre de 2025, Palantir Technologies publicó sus resultados de Q3 del año fiscal 2025, que finalizó el 30 de septiembre. Las cifras clave son las siguientes:

- Ingresos: 1.18 mil millones de USD (+63%)

- Beneficio neto (no-GAAP): 528.71 millones de USD (+119%)

- Ganancias por acción (no-GAAP): 0.21 USD (+110%)

Ingresos por segmento:

- Ingresos comerciales: 548.42 millones de USD (+73%)

- Ingresos gubernamentales: 632.68 millones de USD (+55%)

- Ingresos del gobierno de EE. UU.: 485.90 millones de USD (+52%)

- Ingresos comerciales de EE. UU.: 396.70 millones de USD (+121%)

Palantir presentó resultados de Q3 2025 excepcionalmente sólidos, superando significativamente las expectativas del mercado. Los ingresos crecieron un 63% interanual, alrededor de un 8% por encima del consenso, mientras que las ganancias ajustadas por acción (EPS no-GAAP) alcanzaron 0.21 USD frente a previsiones de alrededor de 0.17 USD.

En base no-GAAP, la empresa ahora opera como un negocio de software maduro y de alto margen. El beneficio operativo ajustado se situó en 601 millones de USD con un margen del 51%, el beneficio neto ajustado en 529 millones de USD y el flujo de caja libre ajustado en 540 millones de USD (un margen del 46%) – lo que significa que más de la mitad de los ingresos se convierte en efectivo.

El crecimiento está siendo impulsado no solo por nuevos clientes, sino también por la ampliación de contratos existentes: la tasa de retención neta en dólares alcanzó 134%, lo que significa que los clientes existentes están aumentando su gasto con Palantir en aproximadamente un 34% por año. El valor total de contratos aumentó un 151% hasta 2.8 mil millones de USD.

La mezcla del negocio también se ha desplazado a favor del segmento comercial. Los ingresos comerciales aumentaron un 73% interanual, mientras que los ingresos comerciales de EE. UU. se dispararon un 121% hasta 397 millones de USD. Los ingresos gubernamentales aumentaron un 55% interanual. El mercado de EE. UU. ahora representa alrededor del 75% de los ingresos totales, con el número de grandes acuerdos continuando en aumento – 204 contratos por encima de 1 millón de USD durante el trimestre, incluyendo 53 que superaron los 10 millones de USD.

La dirección elevó su guía para el año completo 2025: los ingresos esperados ahora son 4.396–4.400 mil millones de USD (+53% interanual), el beneficio operativo ajustado se proyecta en 2.151–2.155 mil millones de USD, y el flujo de caja libre ajustado en 1.9–2.1 mil millones de USD. Para Q4 2025, la empresa espera ingresos de alrededor de 1.33 mil millones de USD y una mayor expansión de márgenes.

En esta configuración, Palantir está entregando simultáneamente un rápido crecimiento de ingresos y una rentabilidad no-GAAP muy alta, ampliando su base de clientes corporativos y su cartera de contratos, y financiando su expansión mediante generación interna de caja en lugar de deuda. Sin embargo, la acción cotiza con múltiplos de valoración elevados, manteniendo vivo el debate en torno a ella. Fundamentalmente, el negocio sigue siendo fuerte y financieramente sólido. No obstante, muchos analistas creen que una parte significativa del crecimiento futuro ya está incorporada en la valoración de la acción.

Análisis fundamental de Palantir Technologies Inc.

A continuación se presenta el análisis fundamental de PLTR basado en los resultados de Q3 2025:

- Liquidez y balance: al final de Q3 2025, Palantir mantenía alrededor de 1.6 mil millones de USD en efectivo y 4.8 mil millones de USD en valores del Tesoro y otros instrumentos líquidos – un total de 6.4 mil millones de USD en activos altamente líquidos. Los activos totales ascendieron a 8.1 mil millones de USD, los pasivos a 1.4 mil millones de USD, y el patrimonio de los accionistas a 6.7 mil millones de USD, lo que indica que más del 80% del balance está financiado por capital. La deuda total (a corto y largo plazo) se situó en 235 millones de USD, dejando una posición de caja neta de alrededor de 6.2 mil millones de USD, con deuda sobre activos de solo 3%. El gasto por intereses de la deuda a largo plazo durante los últimos 12 meses fue insignificante, por lo que el servicio de la deuda no genera ninguna presión. En general, el balance es altamente conservador – bajo apalancamiento, una gran reserva de efectivo y valores, y un riesgo de solvencia muy bajo.

- Rentabilidad y calidad de ganancias: los ingresos de Q3 2025 totalizaron 1.181 mil millones de USD (+63% interanual), con el crecimiento también acelerándose respecto al trimestre anterior. El beneficio operativo ajustado (no-GAAP) fue 601 millones de USD, con un margen del 51%; el beneficio neto ajustado fue 529 millones de USD, lo que se traduce en un margen neto de alrededor del 45%. El margen bruto se mantiene cerca del 80%, típico de un modelo de software con bajo coste de ventas.

La estructura de ingresos es sólida: los ingresos comerciales alcanzaron 548 millones de USD (+73% interanual), los ingresos gubernamentales 633 millones de USD (+55% interanual), y los ingresos en EE. UU. en total alrededor de 883 millones de USD (+77% interanual), con US Commercial +121% interanual. La base de clientes se amplió a 911 clientes (+45% interanual). Esto indica que el crecimiento de ingresos proviene no de acuerdos puntuales, sino de la expansión de contratos y entradas constantes de nuevos clientes. Al mismo tiempo, el negocio se mantiene consistentemente rentable tanto en base GAAP como no-GAAP.

- Flujos de caja: el flujo de caja operativo de Q3 2025 fue de alrededor de 508 millones de USD, aproximadamente el 43% de los ingresos trimestrales. El flujo de caja libre ajustado alcanzó 540 millones de USD (margen ≈ 46%), mientras que en los últimos 12 meses, el FCF ajustado totalizó alrededor de 2.0 mil millones de USD, con un margen de alrededor del 51%. Durante los primeros nueve meses de 2025, Palantir generó más de 1.35 mil millones de USD en caja operativa, con bajo gasto de capital y un modelo de negocio ligero en activos. La compañía depende muy poco del endeudamiento, y el flujo de caja interno supera cómodamente todas las obligaciones de intereses. El programa de recompra de acciones sigue siendo limitado (alrededor de 0.1 millones de acciones recompradas durante el trimestre por 19 millones de USD, con aproximadamente 880 millones de USD restantes bajo el plan aprobado), lo que significa que la mayor parte del efectivo se retiene dentro de la empresa para reinversión.

Análisis fundamental de PLTR – conclusión:

Palantir parece financieramente muy fuerte a Q3 2025. La empresa mantiene un efectivo y activos líquidos sustanciales, conserva una posición de caja neta, tiene una deuda mínima y no enfrenta una carga de intereses significativa. Ofrece una rentabilidad no-GAAP alta, con un margen operativo de casi el 50% y un margen neto de alrededor del 45%. El crecimiento de ingresos por encima del 60% está respaldado por fuertes métricas de retención de clientes y expansión de contratos, en lugar de eventos puntuales.

El flujo de caja libre es consistentemente positivo y significativo en relación con los ingresos, lo que permite a Palantir financiar el crecimiento completamente a través de recursos internos. Desde la perspectiva de estabilidad financiera, los riesgos siguen siendo bajos. Incluso en el caso de una desaceleración del crecimiento o una corrección en los múltiplos de valoración, el balance y la liquidez de la compañía proporcionan un colchón de seguridad significativo. La pregunta clave para los inversores ya no es sobre la solvencia, sino si Palantir puede sostener el ritmo de expansión de ingresos y márgenes que actualmente está implícito en su valoración de mercado.

Análisis de los múltiplos de valoración clave para Palantir Technologies Inc.

A continuación se presentan los principales múltiplos de valoración para Palantir Technologies Inc. para Q3 del año fiscal 2026, calculados a un precio de acción de 178 USD:

| Multiplicador | Qué muestra | Valor | Comentario |

|---|---|---|---|

| P/E (TTM) | El precio de 1 USD de beneficios de los últimos 12 meses | 416 | ⬤ Extremadamente caro: los inversores están pagando más de 400 veces las ganancias anuales al nivel actual de rentabilidad. |

| P/S (TTM) | El precio de 1 USD de ingresos anuales | 108 | ⬤ Ratio precio/ventas excepcionalmente alto – incluso para una empresa de software de rápido crecimiento, esto refleja una euforia clara del mercado. |

| EV/Sales (TTM) | Valor de empresa frente a ingresos, incluyendo la deuda | 107 | ⬤ El negocio está valorado en más de 100 veces los ingresos anuales – un nivel extremadamente elevado. |

| P/FCF (TTM) | El precio de 1 USD de flujo de caja libre | 236 | ⬤ Incluso en base a flujo de caja, la empresa parece altamente sobrevalorada, cotizando a más de 200 veces el flujo de caja libre anual. |

| FCF Yield (TTM) | Rentabilidad del flujo de caja libre para los accionistas | 0.42% | ⬤ El flujo de caja libre rinde menos del 1% en relación con la capitalización bursátil – una apuesta pura a un crecimiento rápido continuo. |

| EV/EBITDA (TTM) | Valor de empresa frente a EBITDA | 477 | ⬤ Un múltiplo muy alto: el mercado está pagando cientos de veces el EBITDA anual – una señal clara de sobreextensión y expectativas excesivas. |

| EV/EBIT (TTM) | Valor de empresa frente a beneficio operativo | 496 | ⬤ El mercado está pagando casi 500 veces el beneficio operativo anual – cualquier desaceleración del crecimiento sería duramente castigada en el precio de la acción de PLTR. |

| P/B | Precio frente al valor contable | 64 | ⬤ Una prima extrema sobre el valor contable, reflejando expectativas altamente elevadas. |

| Net Debt/EBITDA | Carga de deuda en relación con el EBITDA | –7.4 | ⬤ Fuerte posición de liquidez – la empresa mantiene un efectivo neto significativo. |

| Interest Coverage (TTM) | Relación entre beneficio operativo y gasto por intereses | n/a | ⬤ Los gastos por intereses son prácticamente inexistentes. |

Análisis de valoración de Palantir Technologies Inc. – conclusión

Palantir ya es una empresa rentable y de rápido crecimiento con alto flujo de caja libre y una gran reserva de efectivo, sin cargar con deuda. Financieramente, el negocio parece muy fuerte.

Sin embargo, a 178 USD, la acción parece extremadamente cara: todos los múltiplos de valoración clave (P/E, P/S, EV/Sales, P/FCF, EV/EBITDA, EV/EBIT) están en niveles que solo pueden justificarse si un crecimiento impecable continuara durante varios años más. En resumen, Palantir es un negocio excelente, pero a este precio, representa una apuesta por un futuro perfecto más que una inversión con un margen de seguridad.

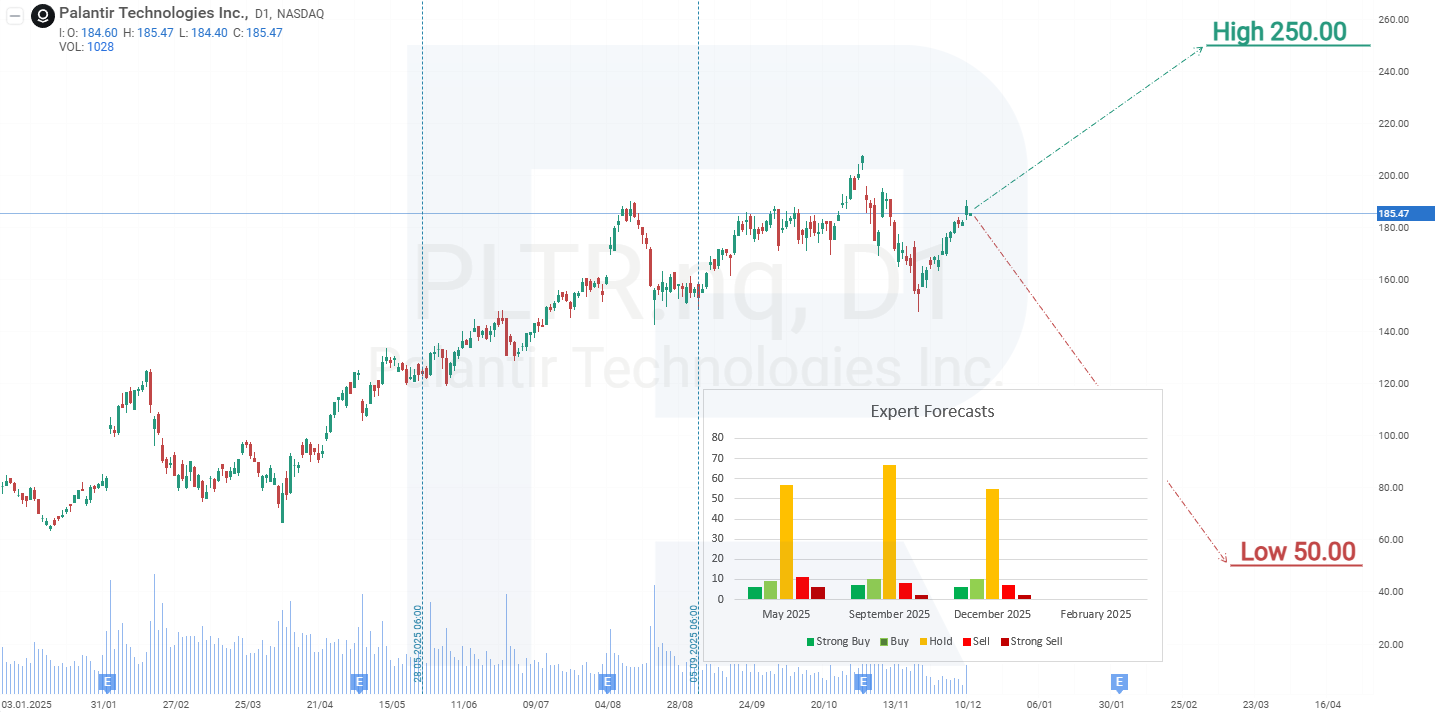

Previsiones de expertos para las acciones de Palantir Technologies Inc.

- Barchart: 4 de 21 analistas calificaron las acciones de Palantir Technologies como Strong Buy, 14 como Hold, 1 como Sell y 2 como Strong Sell. La previsión superior es 255 USD, mientras que la previsión inferior es 50 USD.

- MarketBeat: 4 de 24 analistas asignaron a la acción una calificación Buy, 18 recomendaron Hold y 2 aconsejaron Sell. La previsión superior es 255 USD, mientras que la inferior es 18 USD.

- TipRanks: 3 de 16 analistas calificaron la acción como Buy, 11 como Hold y 2 como Sell. La previsión superior es 255 USD, mientras que la previsión inferior es 50 USD.

- Stock Analysis: 2 de 19 expertos calificaron la acción como Strong Buy, 3 como Buy, 12 como Hold y 2 como Sell. La previsión superior es 255 USD, mientras que la previsión inferior es 50 USD.

Previsión del precio de las acciones de Palantir Technologies Inc. para 2026

En el gráfico diario, las acciones de Palantir se están negociando dentro de un canal alcista. La publicación de un sólido informe trimestral no logró provocar un mayor interés comprador debido a los múltiplos de valoración elevados de la acción; de hecho, los buenos resultados impulsaron la toma de beneficios. Como resultado, el precio de la acción cayó bruscamente, descendiendo alrededor de un 27% hasta el 20 de noviembre. En el nivel de 150 USD, el interés de los inversores por las acciones de Palantir regresó, y el precio comenzó a recuperarse, alcanzando resistencia alrededor de 190 USD.

En base al desempeño actual del precio de la acción de Palantir Technologies, los posibles escenarios para 2026 son los siguientes.

La previsión del escenario base para las acciones de Palantir Technologies anticipa otra corrección hacia la línea de tendencia en 160 USD. En este nivel, se espera un interés comprador renovado por parte de los inversores, lo que podría desencadenar una nueva ola alcista, potencialmente empujando el precio hacia el límite superior del canal en 250 USD.

La previsión alternativa para las acciones de Palantir Technologies debería considerarse si las acciones rompen por encima de la resistencia en 190 USD. En este escenario, el precio podría subir rápidamente hacia el límite superior del canal alrededor de 230 USD, lo que representa un fuerte nivel de resistencia. Sin embargo, un rally tan rápido podría agravar la sobrevaloración de la acción y llevar a los inversores a tomar beneficios, lo que a su vez podría desencadenar una corrección más profunda, llevando PLTR de vuelta hacia la línea de tendencia cerca de 160 USD.

Análisis y previsión de las acciones de Palantir Technologies Inc. para 2026Riesgos de invertir en acciones de Palantir Technologies Inc.

Invertir en las acciones de Palantir en 2026 implica ciertos riesgos que pueden afectar las ganancias de la empresa. A continuación se enumeran riesgos potenciales y factores que podrían afectar negativamente sus ingresos:

- Presión por alta valoración: a diciembre de 2025, las acciones de Palantir se negocian a múltiplos extremadamente altos – por ejemplo, el ratio Price-to-Sales (P/S) supera 108 según los ingresos esperados, mientras que el ratio Price-to-Earnings (P/E) supera 400 según las ganancias esperadas. Si la empresa no logra ofrecer un crecimiento suficiente para justificar estas valoraciones, el sentimiento de los inversores podría cambiar, llevando a una fuerte caída del precio de la acción. Podría producirse una corrección si el crecimiento de ingresos queda por debajo de la tasa esperada de crecimiento anual del 25–30%.

- Dependencia de contratos gubernamentales: una parte considerable de los ingresos de Palantir proviene de clientes gubernamentales, particularmente agencias de defensa e inteligencia de EE. UU. Reducciones en presupuestos federales, cambios de política bajo una nueva administración o la no renovación de contratos clave podrían impactar sustancialmente los ingresos. La inestabilidad política o recortes del gasto en defensa aumentarían este riesgo.

- Desafíos en el sector comercial: aunque los ingresos comerciales de Palantir están creciendo, todavía constituyen una parte menor de los ingresos totales. La compañía tiene dificultades para escalar debido a costes elevados, lo que la hace menos atractiva para pequeñas y medianas empresas. Si el crecimiento del sector comercial se desacelera o no logra compensar posibles caídas en los ingresos gubernamentales, los ingresos totales podrían verse afectados.

- Aumento de la competencia: Palantir enfrenta competencia de gigantes tecnológicos como Microsoft (NASDAQ: MSFT), que podrían integrar IA y analítica en ofertas más amplias, así como de empresas especializadas. Si los competidores ofrecen soluciones alternativas más baratas o más asequibles, Palantir corre el riesgo de perder cuota de mercado (especialmente en el sector comercial), lo que afectaría negativamente la posición financiera de la empresa.

- Riesgos regulatorios y de IA: una regulación más estricta de la IA y la analítica de datos, especialmente en EE. UU. y a nivel global, podría limitar las capacidades de Palantir o incrementar los costes de cumplimiento. Las preocupaciones sobre privacidad o el uso indebido de sus herramientas (por ejemplo, en vigilancia) podrían dañar la reputación de la empresa, therefy disuadiendo a clientes y reduciendo los ingresos.

- Dilución del capital por compensación en acciones: Palantir utiliza activamente acciones de la empresa como compensación, reduciendo su valor para los accionistas. Si esta práctica continúa sin un crecimiento de ingresos correspondiente, podría socavar la confianza de los inversores y presionar el precio de la acción, generando dudas sobre la estabilidad de los ingresos futuros.

- Ventas de acciones por insiders: en 2024, los insiders de la empresa, incluido el CEO Alex Karp y el cofundador Peter Thiel, vendieron activamente porciones significativas de sus participaciones personales, con Thiel desinvirtiendo un tercio de su participación durante este período. En febrero de 2025, se anunció que Karp había solicitado vender un adicional de 1.00 mil millones en acciones. Tal actividad de insiders puede afectar negativamente el precio de mercado de las acciones y el sentimiento de los inversores.

Todos estos factores reducen la confianza en la capacidad de Palantir para mantener su trayectoria proyectada de crecimiento y flujos de ingresos en 2025, haciendo que la inversión en sus acciones sea altamente arriesgada.

Aviso legal: Este artículo ha sido traducido con la ayuda de herramientas de IA. Si bien se ha hecho todo lo posible para preservar su significado original, pueden existir algunas inexactitudes u omisiones. En caso de duda, consulte la fuente original en inglés.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.