Disney – negocio resiliente con un enfoque en el crecimiento de beneficios y los retornos de capital en 2026

Disney presentó resultados estables y mejoró los márgenes de streaming, mientras que su perspectiva para 2026 apunta a mayores ganancias y un programa activo de recompra de acciones. Una ruptura por encima del nivel de 122 USD podría señalar una continuación de la tendencia alcista en 2026.

The Walt Disney Company (NYSE: DIS) ha publicado los resultados del 3T del ejercicio fiscal 2025. Los ingresos alcanzaron 23.65 mil millones de USD (+2% interanual), ligeramente por debajo de las expectativas del mercado, mientras que el beneficio por acción (BPA) ajustado fue de 1.61 USD, superando las previsiones de los analistas. Las ganancias GAAP subieron a 2.92 USD, impulsadas por un beneficio fiscal único vinculado a Hulu.

Por primera vez, el segmento de streaming de Disney reportó rentabilidad consistente: la división Direct-to-Consumer (DTC) generó 346 millones de USD de beneficio, mientras que su base de suscriptores se amplió a 183 millones. En contraste, la televisión lineal continuó en declive, mientras que la división de Experiences fortaleció su posición, entregando 2.52 mil millones de USD en beneficio operativo (+13% interanual). El brazo deportivo (ESPN) también mejoró su desempeño, con el beneficio operativo subiendo a alrededor de 1.04 mil millones de USD (+29% interanual).

La dirección elevó su previsión de BPA ajustado en el ejercicio 2025 a 5.85 USD y espera un beneficio operativo de streaming de aproximadamente 1.3 mil millones de USD para fin de año. La compañía también confirmó el lanzamiento de ESPN-DTC el 21 de agosto y anunció varias alianzas importantes, incluido un acuerdo con WWE por más de 1.6 mil millones de USD y planes para ampliar la cooperación con la NFL.

Tras la publicación de resultados, las acciones de Disney cayeron más de un 2%, ya que los inversores reaccionaron con cautela al menor crecimiento de ingresos y al deterioro del rendimiento de la TV lineal, a pesar de la sólida rentabilidad y la mejora de las previsiones para el año completo. Al día siguiente, la presión vendedora continuó, llevando las acciones hasta 112 USD y ampliando el descenso general a aproximadamente un 5% respecto al nivel previo a los resultados. Los comentarios de los analistas añadieron presión, destacando los riesgos asociados a los costosos derechos deportivos y la continua caída estructural de la televisión lineal.

Sin embargo, para el 22 de agosto, las acciones se habían recuperado por completo, cerrando en 119 USD. El repunte estuvo respaldado por el sentimiento positivo en torno al lanzamiento DTC de ESPN el 21 de agosto, junto con un rally más amplio del mercado después de que Jerome Powell señalara la posibilidad de recortes de tipos de interés.

Este artículo examina The Walt Disney Company y su modelo de negocio, proporciona un análisis fundamental de los resultados financieros de Disney y ofrece un análisis técnico de las acciones de Walt Disney, evaluando su desempeño actual como base para una previsión de DIS para 2025.

Acerca de The Walt Disney Company

The Walt Disney Company es una de las mayores corporaciones de medios y entretenimiento del mundo, fundada el 16 de octubre de 1923 por los hermanos Walter y Roy Disney. La empresa es reconocida por sus películas de acción real y dibujos animados, incluyendo creaciones icónicas como ‘Blancanieves y los siete enanitos’. Su portafolio incluye Lucasfilm, Marvel Studios, Pixar y 20th Century Studios.

Además de la producción cinematográfica, Disney opera parques temáticos y resorts en todo el mundo – Disney World y Disneyland – y transmite contenido televisivo a través de ABC, ESPN y National Geographic. En 2019, la empresa lanzó su servicio de streaming Disney+.

Otra área clave del negocio es la producción y licencia de productos relacionados con sus franquicias populares. Disney salió a bolsa en la Bolsa de Nueva York el 12 de noviembre de 1957, cotizando bajo el ticker DIS.

Imagen del nombre de la empresa The Walt Disney CompanyPrincipales flujos financieros de The Walt Disney Company

Los ingresos de Walt Disney provienen de varias fuentes clave, que abarcan una amplia gama de operaciones de entretenimiento y medios. A continuación se describen los segmentos principales generadores de ingresos:

- Redes de medios: canales de televisión y redes de cable (ABC, Disney Channel, ESPN, FX, National Geographic, entre otros). Las fuentes de ingresos incluyen publicidad, tarifas de licencia, suscripciones pagadas y venta de derechos de transmisión.

- Suscripciones y operaciones internacionales: servicios de streaming (Disney+, ESPN+ y Hulu) y comercio internacional. Las fuentes principales de ingresos son las suscripciones a plataformas de streaming y la venta de contenido y licencias en mercados extranjeros.

- Parques, experiencias y productos de consumo: parques temáticos, resorts, cruceros y hoteles. Los ingresos se generan a través de venta de entradas, paquetes vacacionales, souvenirs, juguetes licenciados y otros bienes y servicios.

- Entretenimiento de estudio: producción y distribución de películas, ventas de videos para el hogar y publicación de música. Los ingresos provienen de la distribución cinematográfica, venta de contenido digital y físico, y ganancias de bandas sonoras musicales y licencias.

En sus informes financieros, Disney clasifica todos los ingresos en tres segmentos clave:

1. Entretenimiento: producción cinematográfica, programación televisiva, distribución cinematográfica, ventas y licencias de contenido, lanzamientos de bandas sonoras y producciones de Broadway.

2. Deportes: operaciones relacionadas con la marca ESPN, incluyendo transmisiones deportivas por cable y digitales, derechos de transmisión de eventos deportivos, la plataforma de streaming ESPN+, publicidad, licencias de contenido y programas/eventos deportivos analíticos.

3. Experiencias: parques temáticos (Disneyland, Disney World y parques internacionales), cruceros (Disney Cruise Line), resorts y hoteles, atracciones, así como eventos y actividades de participación del cliente relacionados con la marca Disney (espectáculos interactivos y tours VIP).

4. Eliminaciones: refleja los pagos realizados por Hulu a ESPN y al negocio de televisión lineal del segmento de Entretenimiento por los derechos de transmisión de sus canales en la plataforma Hulu Live, así como los pagos realizados por ABC y Disney+ a ESPN por la transmisión de ciertos contenidos deportivos en el canal ABC y Disney+.

Informe del Q4 2024 de The Walt Disney Company

El 14 de noviembre, The Walt Disney Company publicó su informe del Q4 del año fiscal 2024, que finalizó el 28 de septiembre. A continuación, se presentan los principales datos del informe:

- Ingresos: 22.57 mil millones de USD (+6%)

- Ingresos netos: 0.95 mil millones de USD (-6%)

- Ganancias por acción: 1.14 USD (+39%)

- Beneficio operativo: 3.65 mil millones de USD (+23%)

Ingresos por segmento:

- Entretenimiento: 10.83 mil millones de USD (+14%)

- Deportes: 3.91 mil millones de USD (sin cambios)

- Experiencias: 8.24 mil millones de USD (+1%)

Ingresos operativos por segmento:

- Entretenimiento: 1.07 mil millones de USD (+353%)

- Deportes: 0.92 mil millones de USD (-5%)

- Experiencias: 1.66 mil millones de USD (+6%)

Todos los indicadores (excepto los ingresos netos) mostraron crecimiento. La administración de la compañía atribuyó la disminución del ingreso neto a un aumento en el gasto en producción de contenido y marketing, así como mayores costos para el desarrollo de sus servicios de streaming (Disney+, Hulu).

La empresa proyectó un crecimiento continuo en sus principales indicadores financieros en 2025, aunque prevé una posible disminución en el número de nuevos suscriptores de Disney+ en el Q1 2025 en comparación con el Q4 2024.

Disney anunció un programa de recompra de acciones por 3.00 mil millones de USD y el pago de dividendos este año. Los dividendos aumentarán un 33%, alcanzando 0.50 USD por acción, y se pagarán en dos cuotas en enero y julio de 2025.

Para 2026, Walt Disney anticipó un crecimiento más lento en su segmento de deportes, un crecimiento de un solo dígito en el segmento de experiencias y un crecimiento de dos dígitos en el sector de entretenimiento.

Basándose en las previsiones de la compañía para 2025-2026, se espera que los indicadores financieros clave sigan aumentando, lo que debería impactar positivamente en los pagos de dividendos y el programa de recompra de acciones, impulsando el precio de las acciones.

Informe del Q1 2025 de The Walt Disney Company

El 5 de febrero, The Walt Disney Company publicó su informe correspondiente al primer trimestre del año fiscal 2025, finalizado el 28 de diciembre de 2024. A continuación se presentan los principales datos:

- Ingresos: 24.690 millones USD (+6%)

- Ingreso neto: 3.660 millones USD (+27%)

- Beneficio por acción: 1.76 USD (+44%)

- Ganancia operativa: 5.060 millones USD (+31%)

Ingresos por segmento:

- Entretenimiento: 10.870 millones USD (+9%)

- Deportes: 4.850 millones USD (sin cambios)

- Experiencias: 9.410 millones USD (+3%)

Ganancia operativa por segmento:

- Entretenimiento: 1.700 millones USD (+95%)

- Deportes: 247 millones USD (en comparación con una pérdida de 103 millones USD)

- Experiencias: 3.110 millones USD (+31%)

El CEO Robert Alan Iger destacó el sólido inicio del nuevo ejercicio fiscal y expresó confianza en la estrategia de crecimiento de la compañía. Subrayó los éxitos importantes en los servicios de streaming, incluida la integración de ESPN en Disney+, así como el desempeño constantemente fuerte del segmento de parques temáticos y resorts.

Con miras al futuro, Disney proyectó un crecimiento del beneficio por acción ajustado de un solo dígito alto con respecto a 2024. También se esperaba que los ingresos operativos del segmento de streaming (Disney+, Hulu, ESPN+) aumentaran en aproximadamente 875 millones USD. Como ya se había anunciado, Disney planeaba destinar 3.000 millones USD a recompras de acciones en 2025.

Aunque The Walt Disney Company superó las previsiones de ingresos y beneficios en el primer trimestre de 2025, el precio de sus acciones bajó ligeramente al cierre de la sesión bursátil del día del anuncio. Esto se debió principalmente a una disminución de 700.000 suscriptores de Disney+, lo que generó preocupación entre los inversores sobre el crecimiento futuro en el segmento de streaming. Además, la compañía advirtió que las suscripciones podrían seguir cayendo en el segundo trimestre debido al reciente aumento de precios, reforzando así el sentimiento negativo en el mercado.

Informe del Q2 2025 de The Walt Disney Company

El 7 de mayo, The Walt Disney Company publicó su informe financiero del 2T de 2025 para el trimestre finalizado el 29 de marzo de 2025. Las cifras clave son las siguientes:

- Ingresos: 23.62 mil millones de USD (+7%)

- Ingreso neto: 3.09 mil millones de USD (+369%)

- Beneficio por acción: 1.45 USD (+20%)

- Beneficio operativo: 4.43 mil millones de USD (+15%)

Ingresos por segmento:

- Entertainment: 10.68 mil millones de USD (+9%)

- Sports: 4.53 mil millones de USD (+5%)

- Experiences: 8.89 mil millones de USD (+6%)

- Eliminations: (484) millones de USD (en comparación con una pérdida de 418 millones de USD en el año anterior)

Ingreso operativo por segmento:

- Entertainment: 1.26 mil millones de USD (+61%)

- Sports: 0.69 mil millones de USD (-12%)

- Experiences: 2.49 mil millones de USD (+9%)

El informe financiero del 2T de 2025 de Walt Disney proporcionó evidencia clara de que la compañía estaba recuperando impulso con éxito. El beneficio por acción aumentó un 20% interanual, superando las expectativas de los analistas, mientras que los ingresos avanzaron un 7%. Tras la publicación, el precio de la acción subió un 11%. Sin embargo, lo más significativo no fue solo la mejora en las métricas financieras, sino también la firme confirmación de que la estrategia de relanzamiento de Disney comenzaba a dar resultados.

Uno de los anuncios más notables fue la construcción planificada de un nuevo parque temático en Abu Dabi. Es importante destacar que Disney no está invirtiendo en el proyecto en sí: Miral cubre todos los costos, mientras que Disney proporciona el aporte creativo y cobrará regalías. Esta estrategia ligera en activos, con un gasto de capital mínimo, permite a Disney expandir su huella internacional sin añadir carga a su deuda.

Pese a la perspectiva negativa expresada en el informe del 1T de 2025, las plataformas de streaming de Disney – en particular Disney+ y Hulu – añadieron 2.5 millones de suscriptores, llevando el total a 180.7 millones. Este crecimiento contribuyó significativamente a un aumento del ingreso operativo. Los éxitos en cines como Moana 2 y Thunderbolts de Marvel no solo impulsaron la taquilla, sino que también aumentaron el compromiso en streaming y la asistencia a los parques temáticos.

Al 29 de marzo de 2025, el efectivo y equivalentes de la compañía ascendían a 5.85 mil millones de USD, frente a 5.48 mil millones de USD el 28 de diciembre de 2024. El aumento de los activos líquidos pone de relieve un flujo de caja consistentemente positivo y una gestión eficaz del capital de trabajo.

El endeudamiento total, incluidas las obligaciones a corto plazo, disminuyó a 42.9 mil millones de USD al final del 2T, desde 45.3 mil millones de USD tres meses antes.

El flujo de caja libre del trimestre informado ascendió a 4.89 mil millones de USD, subrayando la sólida eficiencia operativa de la compañía y su capacidad para generar una liquidez sustancial para financiar inversiones, atender la deuda y devolver efectivo a los accionistas mediante dividendos.

Para el 3T de 2025, la dirección orientó hacia un mayor crecimiento de suscriptores y fortalecimiento en todos los segmentos clave. La previsión de BPA para todo 2025 se elevó a 5.75 USD, lo que representa un aumento del 16% respecto a 2024. Se espera que el beneficio operativo crezca a doble dígito en Entertainment, alrededor de un 18% en Sports y entre un 6–8% en Experiences.

Informe del Q3 2025 de The Walt Disney Company

El 7 de agosto, The Walt Disney Company publicó su informe del tercer trimestre del ejercicio fiscal 2025, que finalizó el 28 de junio de 2025. Las cifras clave son las siguientes:

- Ingresos: 23,65 mil millones de USD (+2%)

- Ingreso neto: 3,21 mil millones de USD (+4%)

- Ganancias por acción: 1,61 USD (+16%)

- Beneficio operativo: 4,57 mil millones de USD (+8%)

Ingresos por segmento:

- Entertainment: 10,70 mil millones de USD (+1%)

- Sports: 4,30 mil millones de USD (-5%)

- Experiences: 9,08 mil millones de USD (+8%)

- Eliminations: (448) millones de USD (frente a una pérdida de 369 millones de USD en el año anterior)

Beneficio operativo por segmento:

- Entertainment: 1,02 mil millones de USD (-15%)

- Sports: 1,03 mil millones de USD (+29%)

- Experiences: 2,51 mil millones de USD (+13%)

En Q3 FY2025, Disney entregó un crecimiento modesto, con ingresos +2% frente a Q3 FY2024 y prácticamente planos en comparación con el trimestre anterior. El EPS ajustado subió hasta 1.61 USD, superando las expectativas de los analistas. En base GAAP, el EPS alcanzó 2.92 USD, aunque esto estuvo inflado por un beneficio fiscal puntual vinculado a Hulu. El beneficio operativo total por segmentos subió un 8% hasta 4.58 mil millones USD, indicando márgenes mejorados.

El segmento Disney Entertainment informó ingresos de 10.70 mil millones USD (+1% interanual), pero el beneficio operativo cayó un 15% hasta 1.02 mil millones USD. La presión principal vino del descenso de la TV tradicional y la debilidad en ventas y licencias de contenido, que no igualaron el éxito del año anterior de Inside Out 2, así como mayores amortizaciones de películas. El streaming fue el motor clave de crecimiento: Disney+ y Hulu, junto con ESPN+, elevaron los ingresos hasta 6.18 mil millones USD (+6% interanual) y aportaron su primer beneficio de 346 millones USD frente a una pérdida un año antes. La base de suscriptores continuó expandiéndose: Disney+ alcanzó 127.8 millones (+1.8 millones en el trimestre), Hulu 55.5 millones (+0.8 millones), mientras que ESPN+ se mantuvo estable en 24.1 millones.

El segmento Sports, liderado por ESPN, generó 4.31 mil millones USD de ingresos (-5% interanual debido a la retirada de Star India), pero el beneficio operativo subió un 29% hasta 1.04 mil millones USD. En EE. UU., ESPN se vio afectado por mayores costes de derechos de emisión de la NBA, pero los resultados generales mejoraron gracias a la ausencia de pérdidas de Star India y a mayores ingresos publicitarios.

El segmento Experiences, que abarca parques, resorts y cruceros, volvió a demostrar ser el principal generador de caja. Los ingresos subieron hasta 9.09 mil millones USD (+8% interanual), mientras que el beneficio aumentó hasta 2.52 mil millones USD (+13% interanual). Los parques de EE. UU. y los cruceros mostraron un crecimiento particularmente fuerte, impulsado por mayor gasto por visitante y expansión de la flota. Los parques internacionales registraron un crecimiento moderado de ingresos, aunque los beneficios se redujeron ligeramente. Los ingresos de Consumer Products aumentaron un 3% hasta 0.99 mil millones USD, con un beneficio de 444 millones USD (+1% interanual).

Para Q4, Disney proyectó un crecimiento de suscriptores de más de 10 millones en Disney+ y Hulu y esperó un EPS ajustado para el año completo 2025 de alrededor de 5.85 USD (+18% interanual). Se esperaba crecimiento del beneficio operativo en todos los segmentos: Entertainment en doble dígito, Sports alrededor de 18% y Experiences alrededor de 8%. A más largo plazo, la compañía apuesta por ampliar sus parques (incluido un nuevo proyecto en Abu Dhabi), hacer crecer su negocio de cruceros y aprovechar franquicias fuertes como Star Wars, Marvel y Pixar. Para ESPN, el énfasis se ha desplazado hacia servicios digitales y asociaciones, aunque la dirección no planea actualmente escindir la división como una empresa cotizada independiente.

Resultados financieros de The Walt Disney Company Q4 2025

El 13 de noviembre, The Walt Disney Company publicó sus resultados financieros del Q4 del año fiscal 2025, que finalizó el 27 de septiembre de 2025. Las cifras clave son las siguientes (https://thewaltdisneycompany.com/investor-relations/#reports):

- Ingresos: 22.46 mil millones USD (0%)

- Ingreso neto: 2.04 mil millones USD (+115%)

- Ganancias por acción (no-GAAP): 1.11 USD (–3%)

- Beneficio operativo (no-GAAP): 3.48 mil millones USD (–5%)

Ingresos por segmento:

- Entertainment: 10.21 mil millones USD (+1%)

- Sports: 3.98 mil millones USD (+2%)

- Experiences: 8.77 mil millones USD (+6%)

- Eliminations: (490) millones USD (vs una pérdida de 409 millones USD un año antes)

Ingreso operativo por segmento:

- Entertainment: 0.69 mil millones USD (–15%)

- Sports: 0.91 mil millones USD (–2%)

- Experiences: 1.88 mil millones USD (+13%)

El informe Q4 2025 de Disney fue mixto: la compañía superó las expectativas de beneficio, pero falló ligeramente en las previsiones de ingresos. Las ganancias por acción ajustadas se situaron en 1.11 USD, por encima del consenso del mercado de 1.03–1.07 USD, resultando en una ligera superación. Los ingresos alcanzaron 22.5 mil millones USD, justo por debajo de las expectativas de los analistas de 22.7–23.0 mil millones USD, manteniéndose prácticamente sin cambios frente al año anterior.

El ingreso operativo total por segmentos (no-GAAP) disminuyó un 5% interanual hasta 3.48 mil millones USD, principalmente debido a la debilidad del segmento Entertainment, que incluye cine, televisión lineal y ventas de contenido. La división Sports se mantuvo prácticamente plana, mientras que Experiences (parques, cruceros y productos de consumo) registró un aumento del 13% en el ingreso operativo hasta 1.88 mil millones USD con ingresos 6% más altos de 8.77 mil millones USD.

El segmento Direct-to-Consumer (streaming) funcionó notablemente mejor: los ingresos subieron un 8% hasta 6.25 mil millones USD, mientras que el beneficio operativo se disparó un 39% hasta 352 millones USD – evidencia de que el streaming ahora es consistentemente rentable.

La dirección emitió una perspectiva optimista para el próximo año fiscal. En FY 2026, Disney espera un crecimiento de doble dígito en las ganancias por acción ajustadas frente a 2025, un flujo de caja operativo de alrededor de 19 mil millones USD, gastos de capital de alrededor de 9 mil millones USD, y planes para duplicar su programa de recompra de acciones hasta 7 mil millones USD (desde 3.5 mil millones USD en 2025). El dividendo anual también aumentará un 50% hasta 1.50 USD por acción.

La compañía también pretende sostener un crecimiento de doble dígito del EPS en FY 2027, implementar un plan de inversión a 10 años por un total de 60 mil millones USD para expandir sus parques y negocio de cruceros, y lograr márgenes de beneficio de alrededor del 10% en streaming para 2026.

Sin embargo, la dirección también advirtió sobre riesgos. Los ingresos de la TV tradicional y el cine siguen disminuyendo, hay una disputa de distribución en curso con YouTube TV, y se espera un coste adicional de 400 millones USD – principalmente marketing para grandes estrenos –. Además, las comparaciones serán difíciles debido a un fuerte catálogo de contenido en 2024.

En general, el trimestre fue moderadamente positivo: el beneficio y el desempeño del streaming superaron las expectativas, mientras que los ingresos se mantuvieron planos y el ingreso operativo siguió bajo presión por resultados más débiles en cine y TV. La perspectiva para 2026 es alentadora, con la compañía apuntando al crecimiento de beneficios, mayor eficiencia, dividendos más altos y retornos de capital sustanciales para los accionistas.

Análisis fundamental de The Walt Disney Company

A continuación se presenta el análisis fundamental de The Walt Disney Company basado en los resultados del Q4 2025

- Liquidez y balance: al final del Q4 2025, Disney mantenía alrededor de 5.7 mil millones USD en efectivo y equivalentes. Los activos corrientes totalizaron 24.3 mil millones USD, mientras que los pasivos corrientes se situaron en 34.2 mil millones USD, dando un ratio corriente de aproximadamente 0.7×. Aunque formalmente bajo, este es un nivel típico para una gran compañía de medios y entretenimiento con flujos de caja futuros estables (de suscripciones, venta de entradas y reservas).

El endeudamiento total (a corto y largo plazo) ascendió a 42.0 mil millones USD, mientras que los activos totales se situaron en 197.5 mil millones USD y el patrimonio de los accionistas en 109.9 mil millones USD. Esto indica una carga de deuda moderada pero manejable, una estructura de balance estable y crecimiento del patrimonio en comparación con el año anterior.

- Flujo de caja: para el año fiscal 2025, Disney generó 18.1 mil millones USD en flujo de caja operativo y alrededor de 10.1 mil millones USD en free cash flow (tras un gasto de capital de 8.0 mil millones USD en parques, cruceros y otros activos). Ambas cifras aumentaron interanualmente, impulsadas por un mayor beneficio operativo en el segmento Experiences, menores deterioros y cierto beneficio de pagos de impuestos diferidos.

El free cash flow se mantiene consistentemente positivo – ahora acercándose al 10–11% de los ingresos anuales – lo que indica que la compañía puede financiar internamente su nivel elevado de gasto de capital sin aumentar la deuda.

- Diversificación de ganancias: en el Q4 2025, el ingreso operativo total por segmentos (no-GAAP) se situó en 3.48 mil millones USD (–5 % interanual). La mezcla de beneficios estuvo bien equilibrada: Entertainment aportó 691 millones USD (–35 % interanual, reflejando un trimestre débil para cine y TV lineal), Sports 911 millones USD (–2 % interanual) y Experiences 1.88 mil millones USD (+13 % interanual – un trimestre récord para parques, cruceros y productos de consumo).

Dentro de Entertainment, el segmento Direct-to-Consumer registró un aumento del 8% en ingresos y una subida del 39% en el beneficio operativo hasta 352 millones USD, confirmando que el streaming ahora es un negocio rentable en lugar de uno con pérdidas. En general, las ganancias de Disney están bien diversificadas: el desempeño más débil en cine y TV se compensa parcialmente con beneficios fuertes y estables de parques y cruceros y con una mejora de la economía del streaming.

- Retornos de capital: en FY 2025, Disney devolvió alrededor de 5.3 mil millones USD a los accionistas – incluidos 1.8 mil millones USD en dividendos y 3.5 mil millones USD en recompras de acciones. Al mismo tiempo, la compañía redujo la deuda total (de 45.8 mil millones USD a 42.0 mil millones USD) mientras mantenía un free cash flow positivo.

La dirección ha fijado como objetivo aumentar las recompras anuales de acciones a 7 mil millones USD y un dividendo anual más alto de 1.50 USD por acción en FY 2026, señalando su disposición a elevar los retornos de capital a medida que se fortalezcan los flujos de caja.

Análisis fundamental de Disney (DIS) – conclusión

A fecha de Q4 2025, Disney parece financieramente sólida. El balance no está excesivamente apalancado, la deuda neta se mantiene moderada en relación con el patrimonio y los activos, y tanto el flujo de caja operativo como el free cash flow cubren holgadamente el gasto de capital, los dividendos y las recompras.

Las ganancias están bien diversificadas: mientras los segmentos heredados (cine y TV lineal) están bajo presión, el streaming ya es rentable, y la división de parques y cruceros continúa entregando crecimiento de doble dígito en el beneficio operativo, manteniéndose como el principal generador de caja de la compañía.

Desde la perspectiva de estabilidad financiera, los riesgos son moderados y provienen más de las condiciones del negocio que de restricciones de liquidez o de balance.

Análisis de múltiplos clave de valoración para The Walt Disney Company

A continuación se presentan los principales múltiplos de valoración para Walt Disney basados en los resultados financieros del Q4 2025, calculados a un precio de la acción de 105 USD.

| Multiplicador | Qué muestra | Valor | Comentario |

|---|---|---|---|

| P/E (TTM) | El precio de 1 USD de beneficios de los últimos 12 meses | 15.3 | ⬤ Nivel típico – la acción no parece ni barata ni cara. Para Disney, esto representa una valoración media |

| P/S (TTM) | El precio de 1 USD de ingresos anuales | 2.0 | ⬤ Normal – los inversores están pagando aproximadamente el doble de los ingresos anuales de la compañía; este nivel no parece particularmente barato ni sobrevalorado |

| EV/Sales (TTM) | Valor de empresa frente a ingresos, incluyendo la deuda | 2.4 | ⬤ Ligeramente superior a P/S debido a la deuda, pero aún dentro de un rango razonable para un gran grupo de medios con parques |

| P/FCF (TTM) | El precio de 1 USD de flujo de caja libre | 18.9 | ⬤ Alrededor de 19 veces el FCF anual, lo cual es aceptable para una compañía grande y estable con generación de caja en mejora |

| FCF Yield (TTM) | Rentabilidad del flujo de caja libre para los accionistas | 5.3% | ⬤ Un nivel atractivo para inversión a largo plazo |

| EV/EBITDA (TTM) | Valor de empresa frente a EBITDA | 12.0 | ⬤ Límite – no es barato, pero tampoco extremo. Un múltiplo normal para un negocio de calidad con crecimiento moderado |

| EV/EBIT (TTM) | Valor de empresa frente a beneficio operativo | 16.6 | ⬤ Ligeramente por encima de la zona de confort pero razonable para una compañía con márgenes al alza y crecimiento de beneficios |

| P/B | Precio frente al valor contable | 1.66 | ⬤ Un nivel moderado – los inversores pagan alrededor de 1.7 USD por cada 1 USD de patrimonio. Para Disney, esta es una ratio saludable, no excesiva |

| Net Debt/EBITDA | Carga de deuda en relación con el EBITDA | 2.1 | ⬤ Deuda notable, pero dentro de un rango normal |

| Interest Coverage (TTM) | Relación entre beneficio operativo y gasto por intereses | 10.6 | ⬤ Los intereses están holgadamente cubiertos – el servicio de deuda sigue en una zona muy segura |

Análisis de valoración de The Walt Disney Company – conclusión

La posición financiera de Disney se mantiene estable: el beneficio y el EBITDA están creciendo, el free cash flow se ha recuperado y los niveles de deuda son moderados y se atienden fácilmente.

Desde una perspectiva de valoración, la acción parece tener un precio justo en torno a 105 USD. Los múltiplos clave de valoración están dentro del rango medio, mientras que una rentabilidad de free cash flow de alrededor del 5% hace que las acciones sean atractivas para inversión a largo plazo.

Considerando la debilidad continua en cine y televisión, pero el sólido desempeño de parques y streaming, un precio cercano a 105 USD parece un punto de entrada razonable para quienes creen en un mayor crecimiento de beneficios y flujo de caja en 2026–2027.

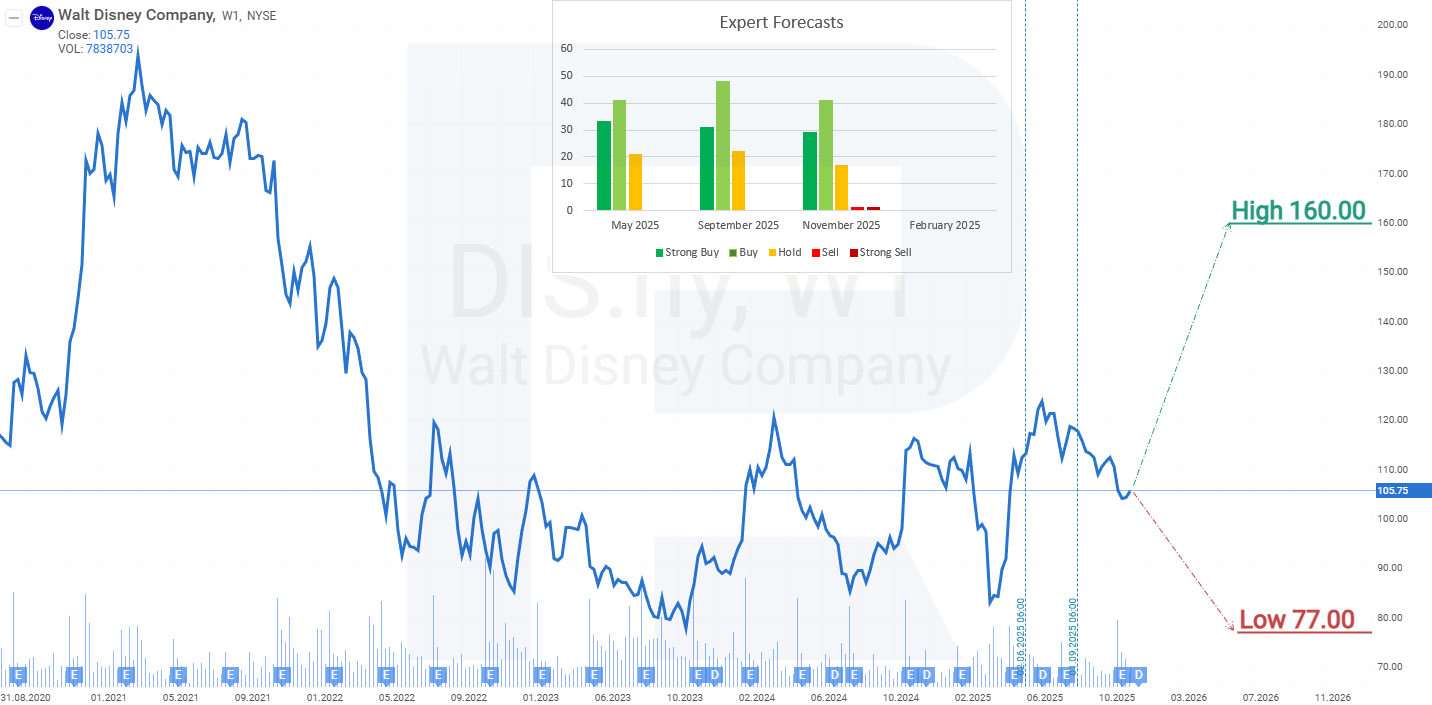

Pronósticos de expertos sobre las acciones de The Walt Disney Company para 2026

- Barchart: 21 de 30 analistas calificaron las acciones de Walt Disney como Strong Buy, 3 como Moderate Buy, 5 como Hold y 1 como Strong Sell. La previsión del extremo superior es 160 USD, y la previsión del extremo inferior es 77 USD.

- MarketBeat: 18 de 27 analistas dieron a la acción una calificación Buy, 8 recomendaron Hold y 1 aconsejó Sell. La previsión del extremo superior es 152 USD, y la previsión del extremo inferior es 110 USD.

- TipRanks: 14 de 17 analistas calificaron las acciones como Buy y 3 como Hold. La previsión del extremo superior es 152 USD, y la previsión del extremo inferior es 123 USD.

- Stock Analysis: 8 de 15 expertos calificaron las acciones de Walt Disney como Strong Buy, 6 como Buy y 1 como Hold. La previsión del extremo superior es 152 USD, y la previsión del extremo inferior es 110 USD.

Pronóstico del precio de las acciones de The Walt Disney Company para 2026

El descenso del precio de las acciones de Disney, que comenzó en marzo de 2021 desde alrededor de 200 USD, terminó solo en octubre de 2023 cerca de 80 USD. Anteriormente, la acción había caído hasta este mismo nivel de soporte desde 150 USD durante el punto álgido de la pandemia de COVID-19, cuando los gobiernos impusieron confinamientos y cerraron fronteras, reduciendo drásticamente la asistencia a los parques temáticos de Disney. Claramente, este nivel representa una zona de soporte clave donde los inversores tienden a entrar como compradores.

A fecha de diciembre de 2025, las acciones de Walt Disney continúan cotizando dentro de un amplio rango entre 80 USD y 122 USD. En junio, hubo un intento de romper por encima del límite superior de este rango, pero la demanda de la acción resultó insuficiente para sostener una ruptura. La publicación del informe Q3 FY2025 se percibió negativamente por los inversores y condujo a una caída en las acciones DIS, aunque el descenso no fue pronunciado: durante el trimestre, la acción cayó temporalmente alrededor de un 8%, pero para cuando se publicaron los resultados del Q4, la caída se había reducido a aproximadamente un 1%. Esto indica que la demanda de los inversores por la acción se mantiene resiliente a pesar de los desafíos continuos de la compañía.

Tras el informe Q4 FY2025, el precio de la acción volvió a bajar, pero al acercarse al nivel de 100 USD, la caída se desaceleró y luego se revirtió en un movimiento alcista. Basándose en el desempeño actual de las acciones de Walt Disney Company, los movimientos potenciales de precio para 2026 son los siguientes.

La previsión del escenario base para las acciones de Disney asume un avance desde los niveles actuales hacia la resistencia en 122 USD. Una ruptura por encima de esta resistencia podría actuar como catalizador para mayores ganancias, potencialmente impulsando el precio hasta 165 USD. Respaldan este escenario la estimación de valor razonable de la compañía de alrededor de 105 USD por acción, su rentabilidad por dividendo relativamente alta dada su fortaleza financiera y el programa planificado de recompra de acciones de 7 mil millones USD para 2026.

La previsión alternativa para la acción de Disney contempla que continúe cotizando dentro del rango establecido – una caída hacia el soporte en 80 USD, seguida de un rebote desde ese nivel y una posterior subida hacia el límite superior del rango en 122 USD.

Análisis y pronóstico de las acciones de The Walt Disney Company para 2026Aviso legal: Este artículo ha sido traducido con la ayuda de herramientas de IA. Si bien se ha hecho todo lo posible para preservar su significado original, pueden existir algunas inexactitudes u omisiones. En caso de duda, consulte la fuente original en inglés.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.