Brent declines moderately following a surge to 81.00 USD

Brent prices surged to 81.00 USD amid increasing tensions in the Middle East. Growth may continue after a minor correction. Find out more in our Brent analysis for today, 8 October 2024.

Brent forecast: key trading points

- US data: the market awaits the API crude oil stock report today

- Current trend: correcting as part of the uptrend

- Brent forecast for 8 October 2024: 81.00 and 77.00

Fundamental analysis

Brent quotes are experiencing a strong upward rally (rising by about 10% in a week) following escalating geopolitical tensions in the Middle East. The American Petroleum Institute (API) is set to release US crude oil stock data today. A decline in inventories may support Brent prices, while an increase may conversely push the asset price down.

The market is also awaiting US inflation statistics this week, with the Consumer Price Index (CPI) and the Producer Price Index (PPI) due on Thursday and Friday. Oil will likely react to the US stock market’s response to inflation data. A rise will propel Brent’s price, while a decrease will push it down.

Brent technical analysis

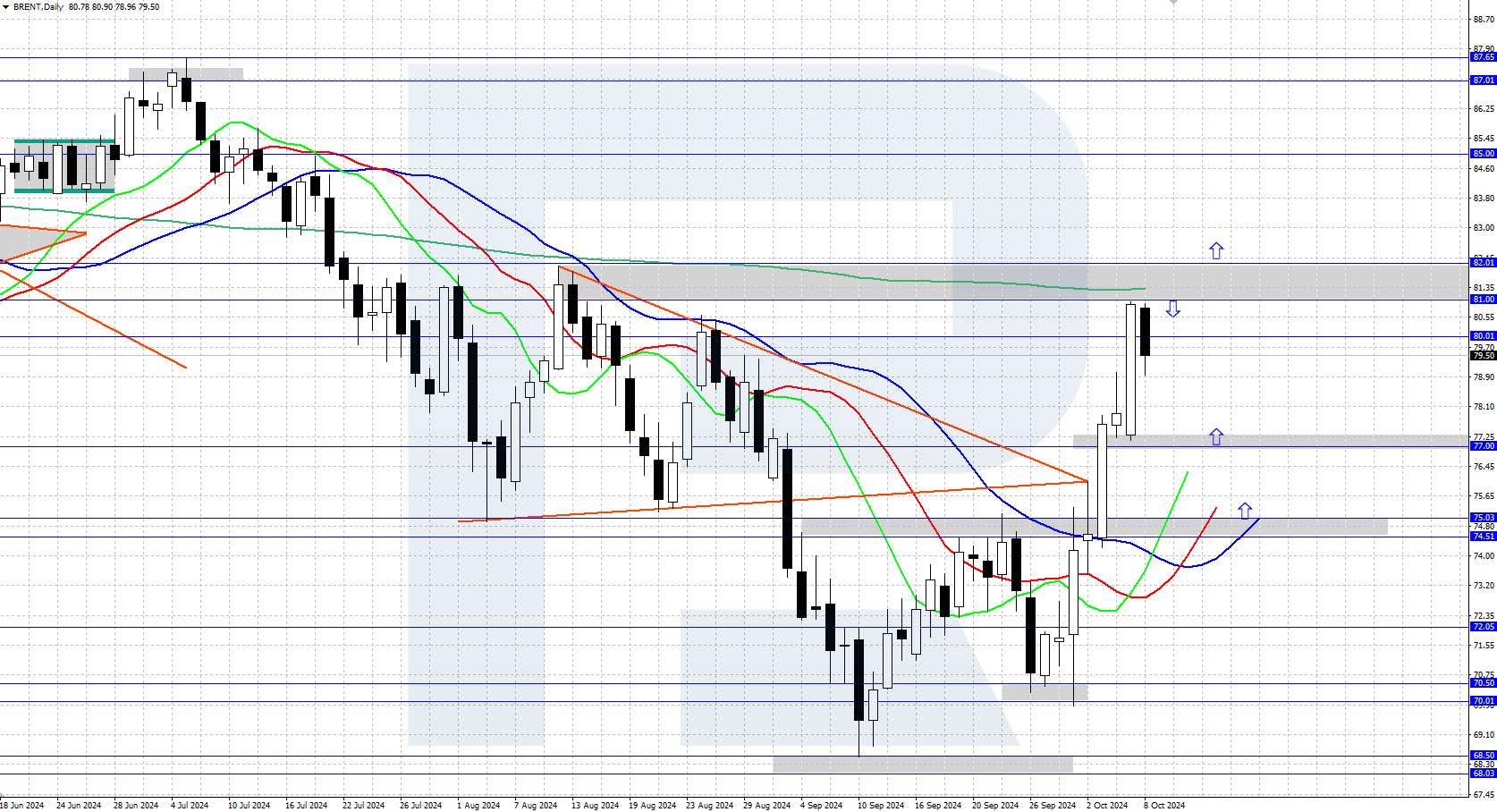

Brent prices have completed the daily downtrend, and the quotes have reversed upwards from 70.00 USD, shifting to an uptrend. The commodity is trading around 79.50 USD, correcting downwards from the local high of 81.00 USD. Once the correction is over, growth may continue.

The short-term Brent price forecast suggests that the quotes may retrace to the 77.00 USD or even 75.00 USD support levels as part of the downward correction, from where they could resume growth. If bulls advance their attack from the current price level and gain a foothold above 81.00-82.00 USD, the price will likely rise to 85.00 USD.

Summary

Brent prices surged to 81.00 USD amid escalating tensions in the Middle East. Today’s US crude oil stock data from the American Petroleum Institute (API) may further impact oil price movements.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.