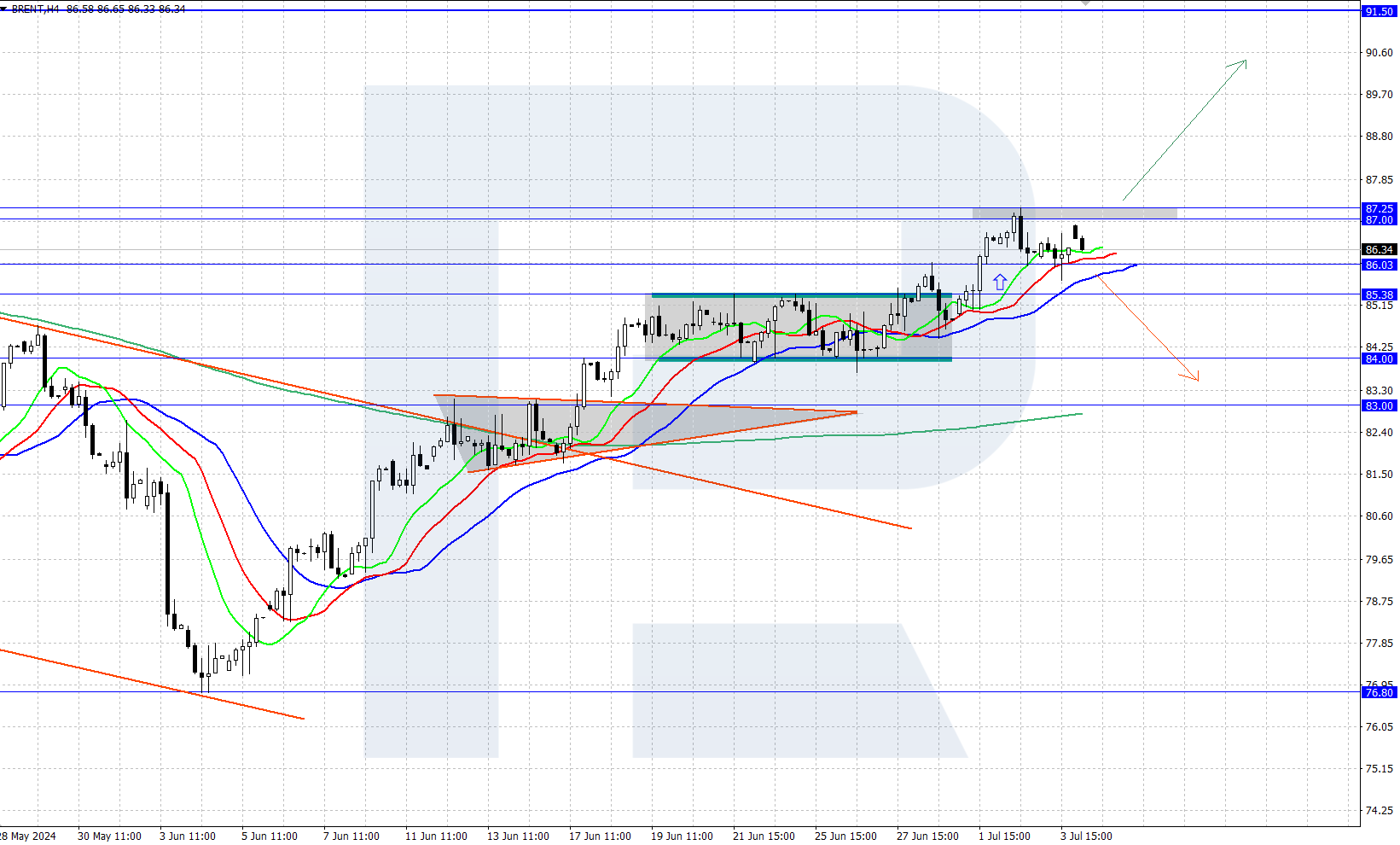

Brent halted its growth at 87.00

Rising oil prices failed to overcome the resistance at the 87.00 level on the fly; bears are attempting to seize the initiative and reverse the price.

Brent trading key points

- Current trend: Brent is experiencing strong upward momentum on the H4 chart

- Market focus: a sharp increase in Brent price volatility can be expected tomorrow following the release of US employment market statistics

- Price dynamics: the price is currently consolidating slightly below the 87.00 resistance level

- Brent price targets: 91.50, 84.00

Brent fundamental analysis

Brent crude oil price failed to surpass the 87.00 resistance level despite declining US crude oil stocks. According to the Energy Information Administration (EIA) data released on Wednesday, stocks decreased by 12.15 million barrels last week.

Brent is currently consolidating slightly below the 87.00 level, with bears attempting to seize the initiative and reverse the price. Today, US markets are closed for the US Independence Day holiday, but crucial employment market statistics will be released tomorrow, potentially leading to a surge in volatility.

Brent technical analysis

On the H4 chart, Brent crude oil is experiencing steady upward momentum. The price reached a daily strong resistance level at 87.00, which is a key reference point now – whether bulls can surpass it or not.

A short-term forecast suggests that if gold price gains a foothold above the area of 87.00-87.25, this will open the way for growth to the annual high of 91.50. If the quotes fail to rise above 87.00, a downward correction is expected, targeting the area of 83.00-84.00.

Summary

Brent crude oil price is experiencing steady upward momentum, reaching the 87.00 resistance level. The market focuses on Friday’s release of US employment market data, which may determine the direction of oil price movements.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.