Brent prices fall below 80.00 USD; focus on the Federal Reserve’s decision and the EIA data today

According to the API data, Brent prices have fallen below 80.00 USD despite decreasing oil inventories. Today, the market awaits the outcome of the Federal Reserve’s meeting. Find out more in the Brent analysis dated 31 July 2024.

Brent trading key points

- API data: US crude oil stocks decreased by 4.49 million barrels

- Market focus: market participants await the Federal Reserve’s decision and crude oil stock data from the EIA

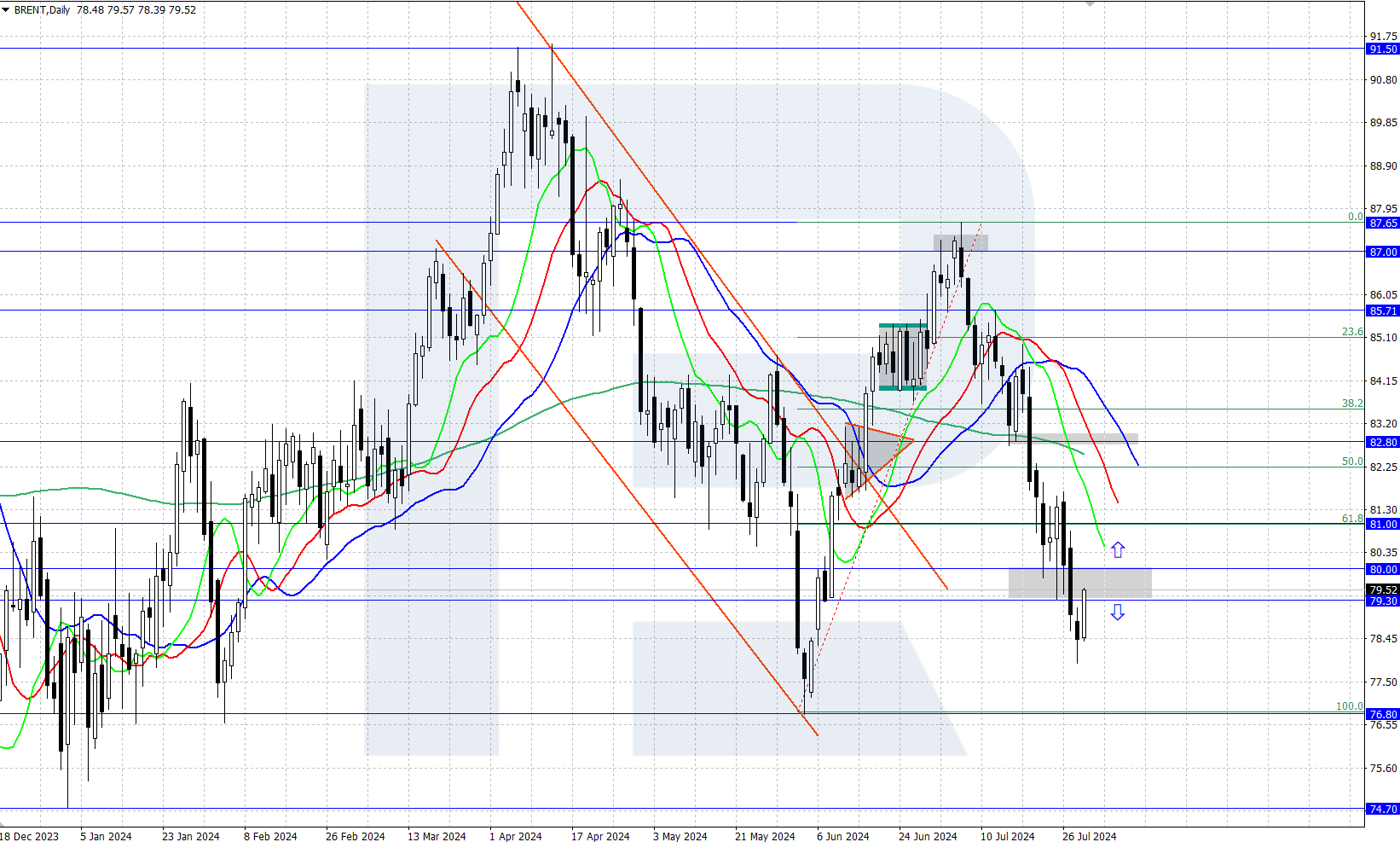

- Brent forecast for 31 July 2024: 82.80 and 76.80

Fundamental analysis

Brent prices declined further, dropping to the 78.00 USD level yesterday. Today, Brent quotes are experiencing a moderate rise; data from the American Petroleum Institute (API) released yesterday evening, indicating a decrease of 4.49 million barrels in US crude oil inventories, might have influenced the market.

Today, market participants are awaiting the release of US crude oil inventories data from the Energy Information Administration (EIA) during the American session and the US Federal Reserve’s decision on interest rates. The rate will unlikely change at this meeting; market participants are more interested in the Federal Reserve’s future actions provided in the accompanying statement.

Brent technical analysis

Brent quotes are now trading around 79.30. On the daily chart, bears have pushed the price below the 79.30-80.00 support area despite active resistance from bulls. This area now serves as resistance, preventing attempts by bulls to reverse the market upwards.

The short-term Brent price forecast suggests a further decline in oil prices to a daily low of 76.80. This downward movement could be invalidated if the price secures above the 79.30-80.00 range, which might boost price growth to 82.80.

Summary

Brent prices continued to decline, briefly falling to 78.00. The Fed’s meeting, US employment market data, and oil inventory statistics from the EIA may influence future asset movements.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.