Gold (XAUUSD) is rising for the third consecutive day

Gold prices are rising, with investors awaiting inflation data to understand the timing of the first Federal Reserve interest rate cut.

XAUUSD trading key points

- Current trend: gold prices are increasing for the third consecutive day

- Market focus: the market awaits signals following yesterday’s release of the US CPI data

- XAUUSD price targets: 2417.00 and 2425.25

Fundamental analysis

Gold prices are rising for the third consecutive day, with the cost of a troy ounce of gold reaching 2,380.00 USD.

Market participants eagerly await US inflation data for June, scheduled for release on Thursday afternoon. This data is crucial for understanding the Federal Reserve’s future actions on interest rates.

The US annual consumer price index is expected to have decreased to 3.1% in June, while core inflation may remain unchanged at 3.4% y/y.

US Federal Reserve Chair Jerome Powell emphasised yesterday that the regulator would lower rates when ready. The market currently estimates the likelihood of a reduction in borrowing costs in September at 73%, with another cut projected in December.

A Federal Reserve interest rate cut will lead to a decrease in yields on US government bonds, which will also exert downward pressure on the US dollar. There is an inverse correlation between gold and the USD.

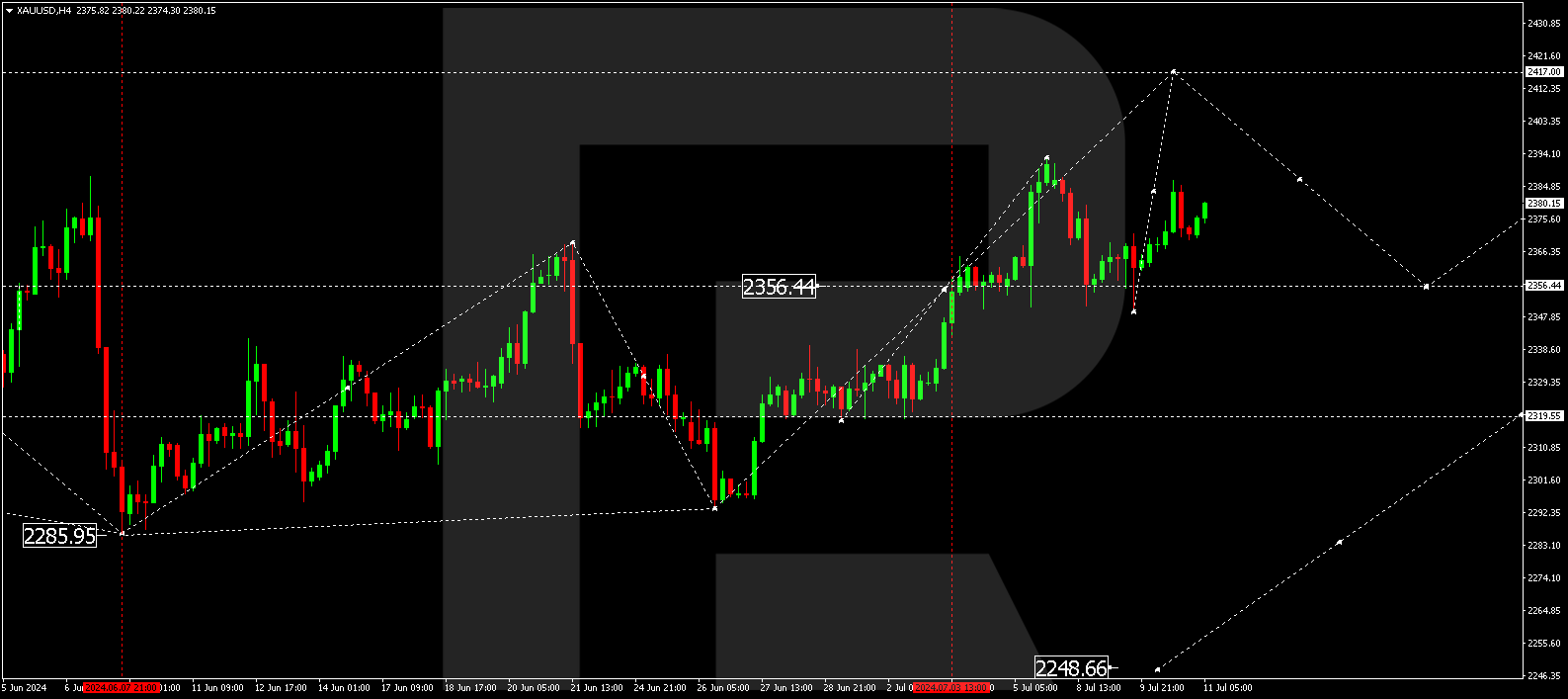

XAUUSD technical analysis

On the XAUUSD H4 chart, a consolidation range continues to develop above 2,355.95. Today, 11 July 2024, the wave could continue towards 2,417.00. Subsequently, the price could fall to 2,355.95 (testing from above). A downward breakout of the range will open the potential for a decline wave to 2,248.66. With an upward breakout, growth might continue to 2,425.25.

Summary

Gold maintains upward momentum amid expectations of an imminent Federal Reserve interest rate cut. Technical indicators point to a potential correction to the 2,417.00 and 2,425.25 targets.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.