Gold (XAUUSD) is trading near its annual peak amid weak US employment market statistics

XAUUSD price rose to an annual and all-time high of 2,483 USD following Friday’s release of US employment data. Find out more in the XAUUSD analysis for today, 5 August 2024.

XAUUSD trading key points

- Market focus: gold rose on weak US employment market statistics

- Current trend: gold is trading in an uptrend and could resume growth after a minor correction

- XAUUSD forecast for 5 August 2024: 2,477 and 2,400

Fundamental analysis

XAUUSD quotes experienced a surge after disappointing US employment data for July: nonfarm payrolls increased by only 114K, falling short of the expected 175K, and the unemployment rate rose to 4.3% instead of the projected 4.1%.

The market reacted to the poor statistics by selling the US dollar against major currencies and other assets, resulting in a decline in stock markets. Gold has sharply strengthened, reaching 2,477, slightly short of an all-time high of 2,483. Subsequently, a strong downward correction followed as buyers appeared to have decided to lock in profits.

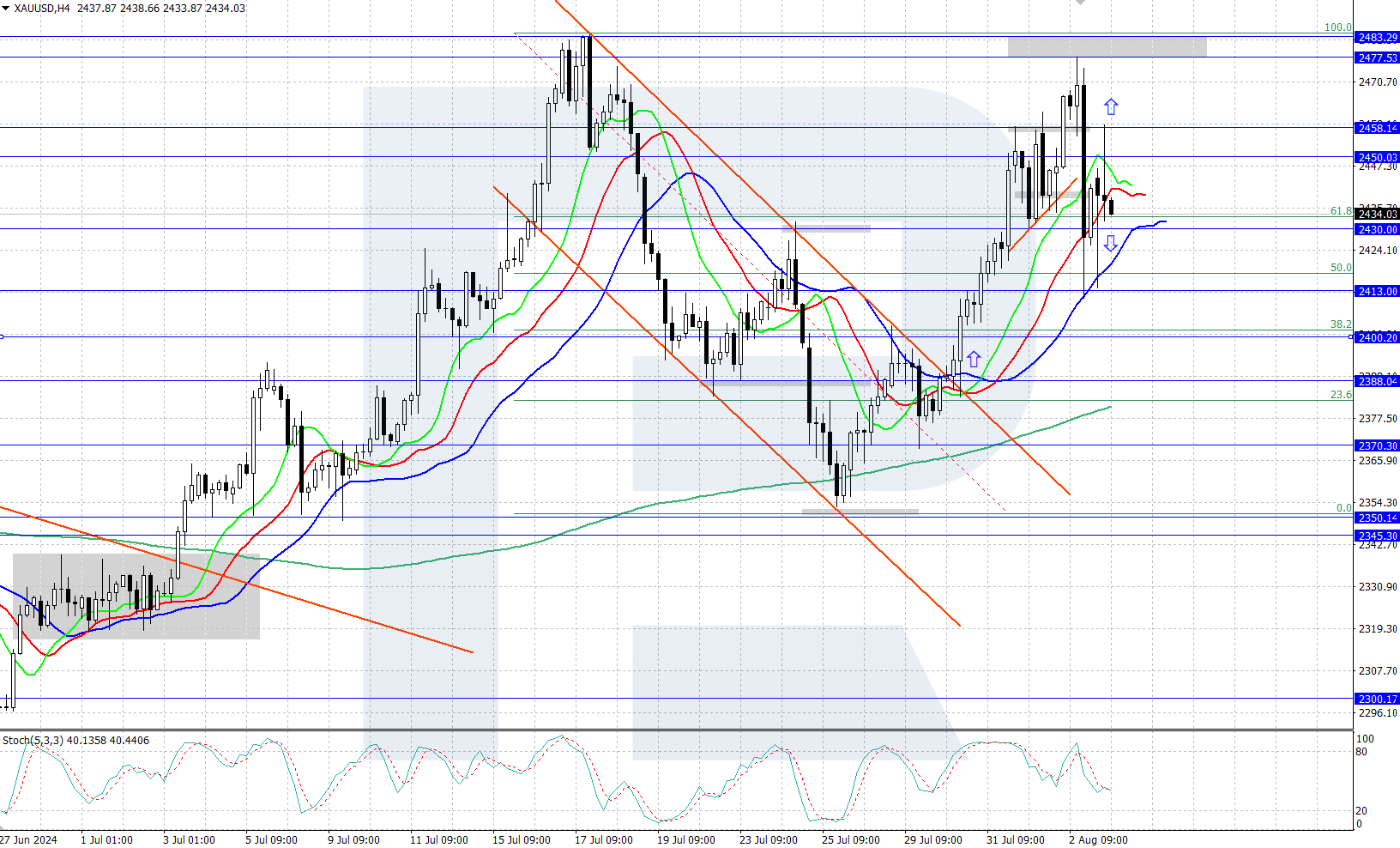

XAUUSD technical analysis

XAUUSD quotes are hovering slightly below 2,450, with bulls attempting to continue the upward momentum after a downward correction. The trend remains bullish. Given the US dollar’s pressure from weak employment statistics, gold could soon reach a new all-time high.

The short-term XAUUSD price forecast suggests that if bulls surpass the 2,477 resistance level, the quotes could reach a new record of 2,483. Conversely, if bears repel the bullish advance and push the quotes below the 2,430 support level, the XAUUSD price could decline to 2,413 and 2,400.

Summary

XAUUSD quotes stopped short of a record high at 2,477 afterf weak US employment market statistics were released. Although bulls have the potential to reach a high of 2,483, we will probably see some downward correction first.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.