Gold (XAUUSD) attempts to rise; the market awaits US data

The XAUUSD price is attempting to break out of a descending price channel as market participants await the Federal Reserve’s decision and US employment market statistics this week. Find out more in our XAUUSD analysis for today, 30 July 2024.

XAUUSD trading key points

- Market focus: market participants await the Federal Reserve’s decision and US employment market statistics this week

- Current trend: the price is experiencing a downward correction after reaching an all-time high of 2,483 USD

- XAUUSD forecast for 30 July 2024: 2,400 and 2,370

Fundamental analysis

XAUUSD quotes continue to trade within a downward correction following an all-time high of 2,483 USD per troy ounce. The strengthening of the US dollar against major currencies exerts pressure on gold. This week, the market will focus on the Federal Reserve’s interest rate decision and US employment market statistics.

The interest rate will unlikely change at this meeting; market participants await comments on the Federal Reserve’s future actions in the accompanying statement. However, the employment data may impact the XAUUSD price: a decrease in the statistics will drive gold prices up, while an increase will exert pressure on the quotes.

XAUUSD technical analysis

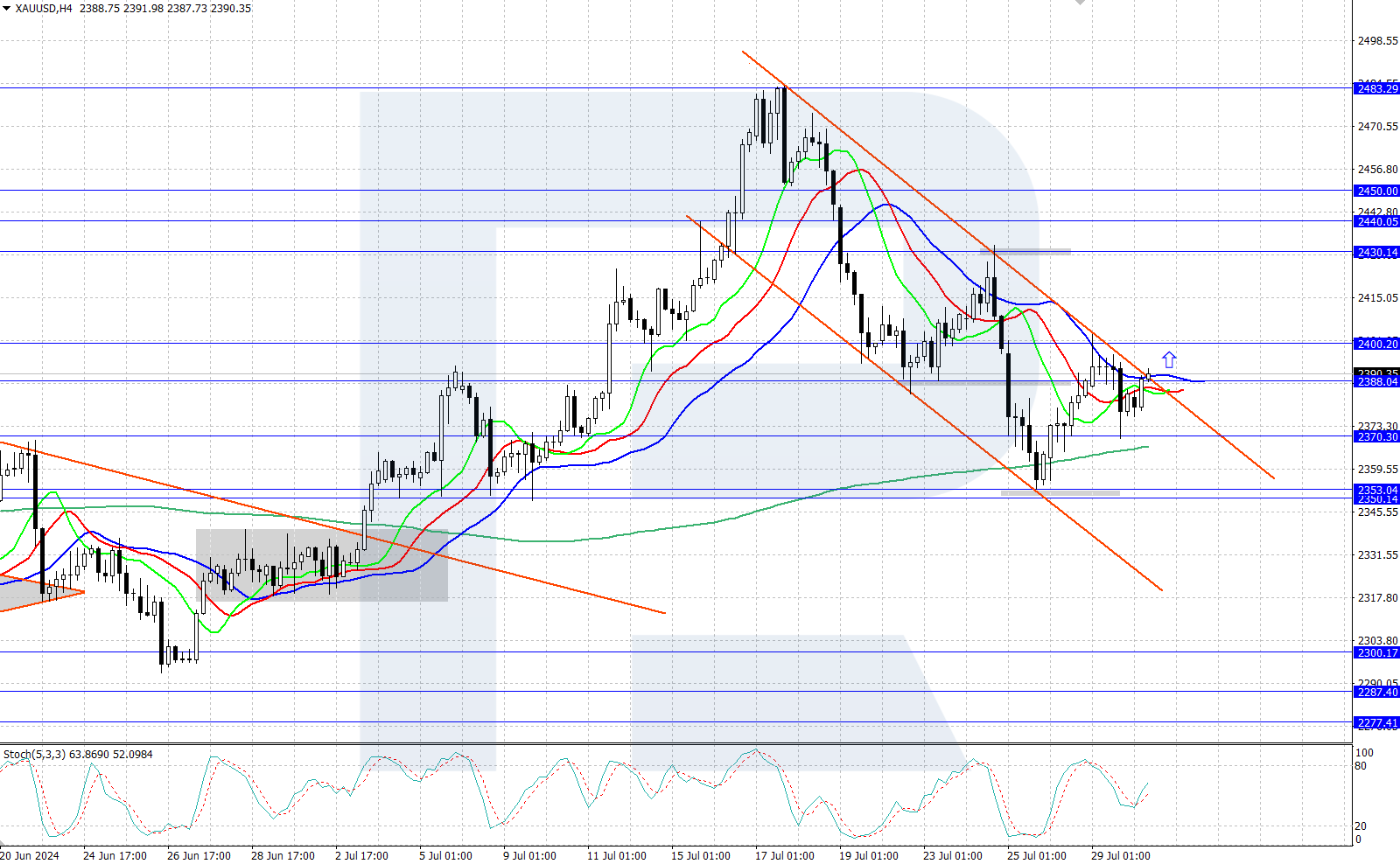

On the H4 chart, XAUUSD quotes remain within a descending price channel. At the end of last week, they found support in the 2,353 area, close to the 61.8% Fibonacci retracement level. Bulls are now attempting to seize the initiative and reverse the price upwards in an effort to secure above the 2,388 resistance level.

Gold is trading at the 2,389 level next to the upper boundary of the descending price channel. The short-term XAUUSD price forecast suggests that if bulls surpass the channel’s resistance line and secure above it, the price is expected to rise to 2,400 and then to 2,430. If bears repel the bulls and hold the channel’s boundary, the price could decline to 2,370, falling further to 2,353.

Summary

Although XAUUSD quotes continue to trade within a downward correction, bulls are now actively attempting to reverse the trend upwards. This week, the future direction of XAUUSD quotes will depend on the Federal Reserve meeting and US employment market data.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.